Washoe County Property Tax

In the heart of Nevada, where the iconic Sierra Nevada mountains meet the vast desert landscapes, lies Washoe County, a diverse and thriving region known for its vibrant cities, picturesque natural surroundings, and a unique blend of urban and rural lifestyles. At the heart of any property owner's relationship with this county is the annual obligation of property taxes, a necessary contribution that supports the region's infrastructure, education, and services. This article aims to provide a comprehensive guide to understanding and navigating the world of Washoe County property taxes, offering insights into how these taxes are assessed, calculated, and applied, and providing practical tips for property owners.

Understanding the Basics of Washoe County Property Taxes

Washoe County, much like any other county in the United States, relies heavily on property taxes to fund essential public services. These taxes are a vital revenue source for the county, enabling it to maintain and develop critical infrastructure, support schools, and provide various services to its residents.

The process of property tax assessment in Washoe County begins with an evaluation of each property's value. This value is then used to determine the tax liability for the property owner. The county employs a team of assessors who are responsible for appraising properties based on a variety of factors, including location, size, improvements, and market conditions.

The assessed value of a property is not a static number. It can fluctuate over time due to various factors such as renovations, market trends, and changes in the property's physical condition. These changes are taken into account during the annual assessment process, which ensures that property taxes remain fair and equitable across the county.

Tax Rates and Calculations

The tax rate, a critical component in determining the property tax liability, is set by the county and can vary from one area to another. This rate is applied to the assessed value of the property to calculate the annual tax bill. It’s important to note that the tax rate can change annually, reflecting the county’s budgetary needs and priorities.

The tax calculation process involves multiplying the assessed value by the tax rate, resulting in the property's annual tax obligation. This amount is then divided into installments, typically due twice a year, to make it more manageable for property owners.

| Year | Tax Rate | Assessed Value Example | Estimated Annual Tax |

|---|---|---|---|

| 2023 | 0.037775% | $300,000 | $1,133.25 |

| 2022 | 0.038050% | $280,000 | $1,065.40 |

The Assessment Process: A Step-by-Step Guide

Understanding how your property is assessed and valued is crucial in navigating the world of property taxes. Here’s a detailed look at the assessment process in Washoe County.

Initial Valuation

The journey begins with the county assessor’s office, where a team of professionals is tasked with evaluating each property within the county. This process, known as the initial valuation, involves a comprehensive assessment of the property’s features and characteristics.

The assessors consider factors such as the property's location, size, and any improvements or additions made. They also analyze recent sales data and market trends to ensure that the valuation is in line with the current real estate market conditions.

Notice of Value

Once the initial valuation is complete, the county assessor’s office sends a Notice of Value to the property owner. This notice outlines the assessed value of the property and provides an opportunity for the owner to review and verify the information.

It's important for property owners to carefully examine this notice, as it serves as a crucial step in the assessment process. If the owner has any concerns or believes that the assessed value is inaccurate, they can initiate a formal appeal process to address these issues.

Appeals and Dispute Resolution

Washoe County provides a structured process for property owners to appeal their assessed values if they believe they have been overvalued. This process ensures that property owners have a fair opportunity to present their case and have their concerns addressed.

The appeal process typically involves submitting a written request to the county assessor's office, outlining the reasons for the appeal and any supporting evidence. The office then reviews the appeal and may request additional information or schedule an informal hearing to discuss the matter further.

If the appeal is successful, the assessed value of the property may be adjusted, leading to a reduction in the property tax liability. It's a crucial step in ensuring that property taxes remain fair and equitable across the county.

Property Tax Payment Options and Due Dates

Knowing when and how to pay your property taxes is an essential part of property ownership. Washoe County offers several payment options and schedules to accommodate the diverse needs of its residents.

Payment Options

Property owners in Washoe County have the flexibility to choose from various payment methods, including online payments, which can be made through the county’s official website. This convenient option allows property owners to pay their taxes from the comfort of their homes, ensuring a secure and efficient transaction.

For those who prefer traditional methods, payment can also be made via mail, with the option to include a check or money order. Additionally, the county provides the convenience of paying in person at designated locations, offering a personal touch to the payment process.

Payment Due Dates

Property taxes in Washoe County are typically due in two installments. The first installment is due by the end of February, while the second installment is due by the end of August. These due dates are critical, as late payments may incur additional fees and penalties.

It's important for property owners to mark these dates on their calendars and ensure timely payments to avoid any unnecessary financial burdens. The county's website often provides reminders and updates regarding payment deadlines, helping property owners stay informed and organized.

Navigating Property Tax Exemptions and Reductions

Washoe County offers various exemptions and reductions to certain property owners, providing financial relief and support to eligible individuals and organizations. These initiatives are designed to promote community growth, support education, and assist vulnerable populations.

Exemptions for Nonprofit Organizations

Nonprofit organizations, such as churches, charities, and educational institutions, are eligible for property tax exemptions in Washoe County. These exemptions are granted to ensure that these organizations can continue their vital work without the burden of high property taxes.

To qualify for this exemption, organizations must meet specific criteria and provide documentation to the county assessor's office. The exemption process involves a thorough review of the organization's mission, activities, and financial records to ensure compliance with the county's guidelines.

Veteran and Senior Citizen Exemptions

Washoe County shows its appreciation for the service and dedication of veterans by offering property tax exemptions and reductions. Eligible veterans can apply for these benefits, which can significantly reduce their property tax obligations.

Similarly, the county also recognizes the contributions of senior citizens by providing partial exemptions from property taxes. These exemptions are designed to support older residents, ensuring that they can continue to live comfortably in their homes without the financial strain of high property taxes.

Property Tax Relief Programs and Assistance

In recognition of the diverse needs and circumstances of its residents, Washoe County has implemented several property tax relief programs and assistance initiatives. These programs are aimed at providing financial support to vulnerable populations and ensuring that property ownership remains accessible and sustainable.

Low-Income Senior Citizen Assistance

Washoe County understands the unique challenges faced by low-income senior citizens when it comes to property ownership. To address this, the county has established an assistance program specifically tailored to this demographic.

This program provides eligible senior citizens with financial support to help cover their property tax obligations. The assistance is designed to ensure that seniors can maintain their independence and continue to live in their homes without the fear of financial burden.

Hardship and Disability Relief

Recognizing that unexpected financial hardships and disabilities can significantly impact an individual’s ability to pay property taxes, Washoe County has implemented relief programs to provide support during these challenging times.

Eligible individuals can apply for hardship relief, which may result in a temporary reduction or deferment of their property tax obligations. This initiative ensures that individuals facing difficult circumstances are not further burdened by their property tax liabilities.

The Impact of Property Taxes on Local Communities

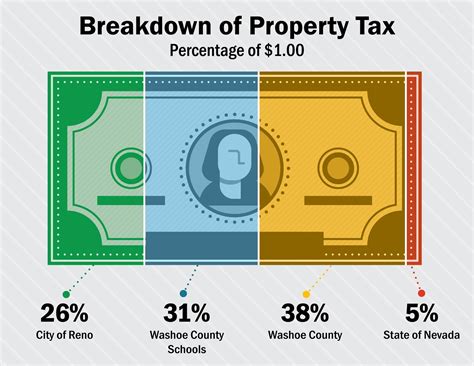

Property taxes play a pivotal role in the development and well-being of local communities. In Washoe County, these taxes are a primary source of revenue, funding essential services and infrastructure that directly impact the quality of life for residents.

Infrastructure Development

A significant portion of property tax revenue is dedicated to infrastructure development and maintenance. This includes projects such as road improvements, bridge repairs, and the expansion of public transportation networks.

By investing in infrastructure, Washoe County ensures that its residents have access to safe and efficient transportation systems, contributing to a higher quality of life and economic growth within the community.

Education and Community Services

Property taxes are a vital funding source for education in Washoe County. These taxes support local schools, ensuring that students have access to quality education and necessary resources.

Additionally, property tax revenue is allocated to various community services, such as parks and recreation, public safety, and social services. These investments enhance the overall well-being of the community and foster a sense of unity and support.

Future Outlook: Trends and Projections

As Washoe County continues to evolve and grow, the landscape of property taxes is also expected to change. Understanding these trends and projections can provide valuable insights into the future of property ownership and taxation within the county.

Population Growth and Development

With an increasing population and continued economic growth, Washoe County is likely to experience a rise in property values. This trend may lead to higher assessed values and, subsequently, increased property tax revenues for the county.

As the county develops and new infrastructure projects are implemented, the need for funding will likely grow, potentially resulting in changes to tax rates and assessment methodologies.

Technological Advancements and Assessment Processes

The integration of technology in the assessment process is expected to play a significant role in the future of property taxation. Advanced tools and data analytics may enhance the accuracy and efficiency of property valuations, leading to more equitable tax assessments.

Washoe County may also explore the use of remote sensing technologies and artificial intelligence to streamline the assessment process, ensuring that properties are valued accurately and fairly.

Conclusion: Empowering Property Owners with Knowledge

Understanding the intricacies of Washoe County property taxes is an essential step in becoming a responsible and informed property owner. By comprehending the assessment process, tax rates, payment options, and available exemptions, property owners can navigate their tax obligations with confidence and ensure that they are contributing fairly to the community’s growth and development.

As the county continues to evolve and adapt to changing circumstances, staying informed about property tax trends and initiatives will empower property owners to make informed decisions and actively participate in shaping the future of their community.

How often are property values reassessed in Washoe County?

+Property values in Washoe County are typically reassessed every two years. This process ensures that property taxes remain fair and aligned with current market conditions.

Are there any online tools available to estimate property tax obligations?

+Yes, Washoe County provides an online tax estimator tool on its official website. This tool allows property owners to estimate their annual tax obligations based on their property’s assessed value.

What happens if I miss a property tax payment deadline?

+Missing a property tax payment deadline can result in late fees and penalties. It’s important to mark these deadlines on your calendar and ensure timely payments to avoid additional financial burdens.

How can I stay informed about changes to property tax rates and assessment methodologies in Washoe County?

+Staying informed is crucial. You can subscribe to official county newsletters, follow their social media accounts, and regularly visit their website for updates. Additionally, attending local community meetings can provide valuable insights into these matters.

Are there any resources available to assist with the property tax appeal process?

+Yes, the county assessor’s office provides detailed guidelines and resources on their website to assist property owners with the appeal process. They also offer support and guidance throughout the process.