Lake County Illinois Property Tax

Welcome to a comprehensive guide on Lake County, Illinois' property tax landscape. This article will delve into the intricate details of property taxation in this vibrant region, offering insights into its workings and the factors that influence tax rates. From the basic mechanics of property tax calculation to the unique aspects of Lake County's system, we aim to provide a thorough understanding for residents, investors, and anyone interested in the real estate dynamics of this area.

Understanding Property Taxes in Lake County, Illinois

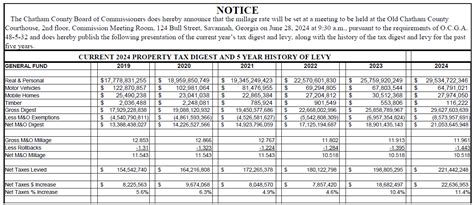

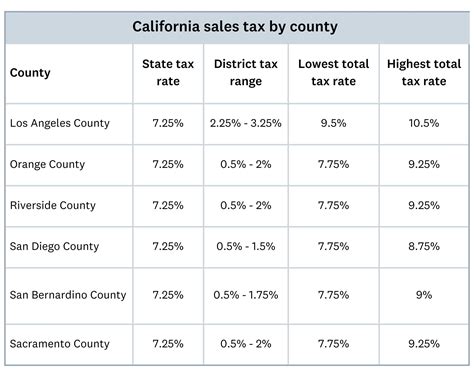

Property taxes in Lake County are a crucial aspect of local government funding, contributing significantly to the maintenance of infrastructure, education, and other essential services. These taxes are levied on both residential and commercial properties, with rates varying based on a property’s assessed value and the tax levy set by local taxing bodies.

The property tax system in Lake County is complex, influenced by a multitude of factors, including the county's diverse communities, varying property values, and the specific needs and demands of each district. Understanding this system is essential for property owners, as it directly impacts their financial obligations and the overall value of their investments.

How are Property Taxes Calculated in Lake County?

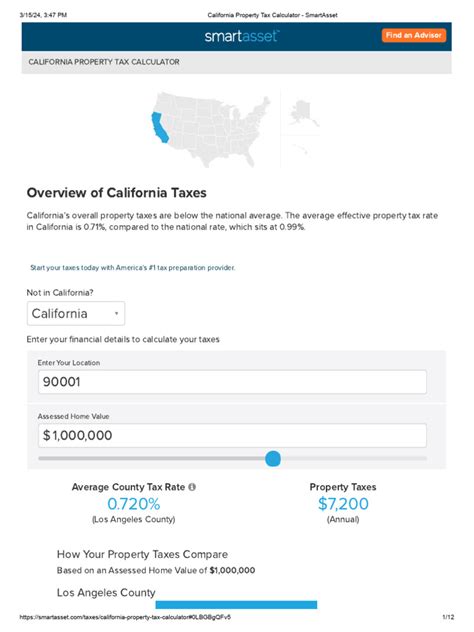

Property tax calculation in Lake County involves a three-step process: assessment, equalization, and taxation. Firstly, the Lake County Assessor’s Office conducts an assessment of each property’s market value. This value is then equalized by the Illinois Department of Revenue to ensure fairness across the state. Finally, the tax rate is applied to the equalized assessed value to determine the property tax amount.

| Step | Process |

|---|---|

| Assessment | Lake County Assessor determines property values. |

| Equalization | Illinois Department of Revenue ensures equalized assessment. |

| Taxation | Tax rate applied to equalized assessed value. |

The tax rate, often referred to as the tax levy, is determined by the local taxing bodies, which can include municipalities, school districts, park districts, and other special purpose districts. These entities decide on the amount of tax revenue they require to fund their operations and services, leading to varying tax rates across different areas of Lake County.

Factors Influencing Property Tax Rates

Several factors contribute to the variability of property tax rates in Lake County. These include:

- Property Value: Higher-valued properties generally attract higher taxes.

- Location: Tax rates can differ significantly between municipalities and districts.

- Taxing Body Needs: The financial requirements of different taxing bodies impact tax rates.

- Equalization Factor: The Illinois Department of Revenue adjusts property values to ensure state-wide fairness.

- Special Assessments: Certain improvements or projects may lead to additional assessments.

Lake County’s Property Tax Landscape: A Deep Dive

Lake County’s property tax system is renowned for its complexity, driven by the county’s diverse communities, varying property values, and the multitude of taxing bodies. This complexity, while challenging, ensures that the tax burden is distributed fairly and that essential services are adequately funded.

The Role of the Lake County Assessor

The Lake County Assessor’s Office plays a pivotal role in the property tax system. It is responsible for assessing the value of all properties within the county, ensuring that each property’s value is accurately reflected in the tax calculation process. This office employs a team of experts who regularly review property values, taking into account factors like recent sales, construction improvements, and general market trends.

The Assessor's Office is also tasked with maintaining fairness and transparency in the assessment process. They provide public access to assessment records, ensuring that property owners can understand the basis of their tax liability. Property owners can even dispute their assessments if they believe the value assigned to their property is inaccurate.

Equalization and State-Wide Fairness

To ensure fairness across the state, the Illinois Department of Revenue steps in with the equalization process. This department applies an equalization factor to the assessed values, adjusting them to reflect the true market value. This factor is based on a three-year rolling average of sales prices compared to assessed values in each county.

The equalization process is crucial as it prevents counties with higher property values from paying disproportionately higher taxes. It also ensures that counties with lower property values do not receive an unfair advantage in state funding.

Tax Rates and Levy Decisions

The tax rate, or levy, is the final piece of the property tax calculation puzzle. This rate is set by local taxing bodies, who determine the amount of tax revenue needed to fund their operations and services. These bodies include municipalities, school districts, park districts, and other special purpose districts.

The levy decision-making process is a crucial aspect of local governance. It involves careful consideration of budget requirements, projected revenues, and the impact on taxpayers. Taxing bodies must strike a balance between providing essential services and keeping tax burdens manageable.

Special Assessments and Additional Taxes

In addition to the standard property tax, Lake County property owners may also face special assessments or additional taxes. These assessments are typically levied to fund specific improvements or projects that benefit a particular area or community.

Special assessments can be used to fund a wide range of projects, from road improvements and sewer upgrades to the development of public parks or community centers. These assessments are often levied on a per-property basis, with the cost distributed among the properties that benefit from the improvement.

Navigating the Property Tax Process in Lake County

Understanding the property tax process in Lake County is crucial for property owners and investors. It empowers them to make informed decisions, manage their financial obligations, and actively participate in the local governance process.

Assessing Your Property

Property owners in Lake County have the right to know the assessed value of their property and how it was determined. The Lake County Assessor’s Office provides access to assessment records, allowing property owners to review their property’s value and understand the factors that influenced the assessment.

If a property owner believes their property's assessed value is inaccurate, they can file an appeal with the Lake County Board of Review. This board reviews assessment appeals and can adjust the value if it finds that the original assessment was incorrect.

Understanding Tax Bills

Lake County property tax bills are detailed documents that provide a breakdown of the tax calculation process. They include the assessed value of the property, the equalization factor applied, the tax rate, and the total tax amount due. Understanding these components can help property owners identify any discrepancies or changes from the previous year.

Property tax bills also indicate the due dates for tax payments. It's crucial for property owners to stay up-to-date with their tax payments to avoid late fees and potential legal consequences.

Exemptions and Tax Relief Programs

Lake County offers various exemptions and tax relief programs to eligible property owners. These programs aim to reduce the tax burden for specific groups, such as senior citizens, veterans, and low-income individuals. Some common exemptions include the Senior Citizens’ Homestead Exemption, the Senior Citizens’ Assessment Freeze Homestead Exemption, and the Homestead Exemption.

Property owners should explore these programs to see if they qualify for any tax relief. The Lake County Treasurer's Office provides information on these exemptions and can guide property owners through the application process.

Future Outlook and Potential Changes

The property tax landscape in Lake County is dynamic and subject to change. While the current system has served the county well, there are ongoing discussions and proposals for reforms aimed at improving fairness, transparency, and efficiency.

Proposed Reforms and Their Impact

Several proposals for property tax reform have been put forward in recent years. These include suggestions to simplify the assessment process, adjust the equalization factor methodology, and provide more relief to certain groups of taxpayers.

If these reforms are implemented, they could have a significant impact on property tax rates and the overall tax burden in Lake County. For instance, simplifying the assessment process could lead to more efficient and accurate assessments, potentially reducing the administrative costs associated with the current system.

The Role of Technology and Data Analytics

Advancements in technology and data analytics are also expected to play a significant role in shaping the future of property taxation in Lake County. These tools can enhance the accuracy and efficiency of the assessment process, allowing for more timely and precise property valuations.

Additionally, data analytics can help identify patterns and trends in property values, providing valuable insights for both property owners and taxing bodies. This data-driven approach can lead to more informed decision-making and potentially reduce the need for frequent reassessments.

Conclusion

In conclusion, the property tax system in Lake County, Illinois, is a complex yet essential mechanism for funding local services and infrastructure. It involves a meticulous process of assessment, equalization, and taxation, influenced by a multitude of factors. Understanding this system empowers property owners and investors to navigate their financial obligations effectively and participate actively in local governance.

As we look to the future, ongoing discussions and proposals for reform highlight the dynamic nature of this system. Embracing technological advancements and data analytics will be crucial in enhancing the fairness, efficiency, and transparency of Lake County's property tax landscape.

How often are property values assessed in Lake County, Illinois?

+

Property values in Lake County are assessed every three years. However, if there have been significant improvements or changes to a property, the Assessor’s Office may reassess it more frequently.

What happens if I disagree with my property’s assessed value in Lake County?

+

If you disagree with your property’s assessed value, you can file an appeal with the Lake County Board of Review. You’ll need to provide evidence to support your claim, such as recent sales of similar properties or an independent appraisal.

Are there any property tax exemptions available in Lake County, and how do I apply for them?

+

Yes, Lake County offers various property tax exemptions, including the Senior Citizens’ Homestead Exemption and the Homestead Exemption. To apply for these exemptions, you’ll need to complete the appropriate forms and submit them to the Lake County Treasurer’s Office by the deadline.

How can I stay updated on changes to property tax rates and assessments in Lake County?

+

You can stay informed by regularly checking the websites of the Lake County Assessor’s Office and the Lake County Treasurer’s Office. These offices often provide updates, news, and resources related to property tax assessments and rates.