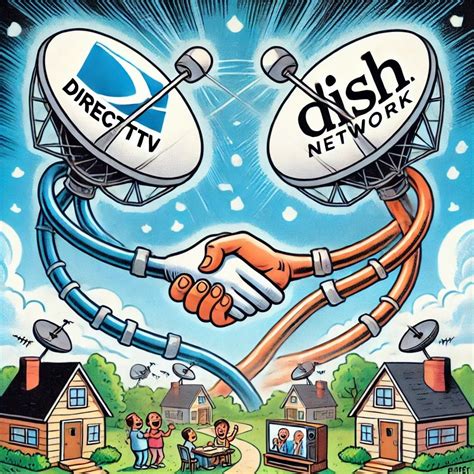

Origins Of The Dish Directv Merger: A Concise History

The Dish Directv Merger stands out as a defining moment in the evolution of pay-TV, signaling a strategic push toward scale, integration, and new distribution models. This concise history traces how the idea emerged, the players involved, and the regulatory and market forces that shaped its trajectory. By examining the origins of the Dish Directv Merger, readers gain a clearer view of how consolidation in the satellite space tests boundaries between content, technology, and consumer choice.

Key Points

- The merger concept arose from a drive for scale to compete with multi-platform bundles and streaming disruption.

- Asset combination would have expanded reach into wholesale agreements and cross-platform distribution.

- Regulatory scrutiny highlighted antitrust and market-concentration concerns in the pay-TV ecosystem.

- Impact on pricing, package diversity, and contract terms became central to public and stakeholder dialogue.

- The discussion influenced later M&A strategies in telecom and media, shaping how deals are framed and evaluated.

Origins and Timeline

The discourse around a potential Dish Directv Merger began as both satellite operators pursued stronger negotiating leverage and broader service footprints. Industry watchers noted that combining Dish Network’s customer base with DirecTV’s satellite assets could create a fused platform capable of offering more comprehensive bundles and joint hardware strategies. In the mid-2010s, leadership teams and advisors explored synergies in content rights, technology platforms, and wholesale arrangements, laying the groundwork for what many described as a landmark consolidation in the satellite arena.

Early discussions focused on leveraging existing infrastructures, reducing overlapping costs, and accelerating time-to-market for next‑generation viewing options. The strategic narrative emphasized scale as a means to improve pricing flexibility, invest in advanced receivers, and broaden the mix of services offered to households seeking integrated entertainment and broadband solutions.

Regulatory Context and Market Pressures

As talks progressed, regulators and industry analysts scrutinized the potential Dish Directv Merger for its potential to reshape competition. Analysts weighed the deal against the broader trend of convergence between traditional pay-TV, broadband, and streaming platforms. The regulatory lens highlighted questions about market concentration, control over distribution rights, and the impact on independent content creators and smaller distributors. This scrutiny helped frame a cautious path forward, underscoring that any final arrangement would need to address consumer welfare, fair competition, and transparent pricing practices.

Industry Impact and Long-Term Implications

Even as the talks did not culminate in a completed merger, the Dish Directv Merger narrative influenced industry behavior. Competitors reassessed bundle offerings, pricing strategies, and the pace of technology upgrades, while regulators refined guidelines for evaluating large-scale consolidations. The broader takeaway centered on how a merger of two satellite players could accelerate convergence with broadband and streaming, nudging the market toward new models of distribution, content partnerships, and customer experience design.

Legacy and Lessons

Today, the origins of the Dish Directv Merger are often cited as a case study in strategic ambition meeting regulatory reality. The failed or stalled discussions demonstrated that scale alone may not guarantee seamless integration or favorable consumer outcomes. The history emphasizes the importance of clarity around asset synergies, clear commitments on pricing and service levels, and a credible plan for technology interoperability. For industry observers and future dealmakers, the core lesson is simple: growth strategies must align with competitive guarantees and tangible benefits for customers to endure beyond headlines.

What sparked talks about a potential Dish Directv Merger in the mid-2010s?

+

Whispers of a merger emerged from a shared interest in scale, cross-platform distribution, and stronger negotiating power in an increasingly competitive pay-TV market. Both Dish Network and DirecTV assets represented complementary footprints, prompting executives to explore whether combining could improve bundle options, content access, and technology strategies.

How might a Dish Directv Merger have affected pricing and consumer options?

+

Proponents argued that a larger, consolidated platform could unlock more flexible pricing, broader package offerings, and innovative bundling with broadband. Critics warned that reduced competition could lead to higher prices or fewer choices if the merged entity moved toward dominant-market behavior. The actual outcome would depend on regulatory concessions and how the integration was executed.

What regulatory concerns were associated with the Dish Directv Merger?

+

Regulators would likely examine market concentration in satellite distribution, potential effects on content rights markets, and impacts on consumer welfare. antitrust reviews would consider whether the merger would stifle competition among pay-TV providers, impede independent content access, or hinder new entrants attempting to compete on price and innovation.

Did the Dish Directv Merger ever materialize into a completed deal?

+No final, completed merger between Dish Network and DirecTV occurred. The discussions highlighted strategic ambitions and regulatory considerations, but shifting market dynamics and alternative deal options ultimately kept the two entities operating independently. The episode remains a notable example of how high-profile consolidation attempts unfold in practice.

What lessons can future telecom-media deals learn from the Dish Directv Merger discussions?

+Key lessons include the importance of aligning asset synergies with consumer benefits, anticipating regulatory scrutiny early, and crafting clear commitments on pricing, service interoperability, and contract terms. A successful consolidation often hinges on credible integration plans that deliver tangible value without compromising competition or choice.