Death Tax California

The concept of a "death tax" or inheritance tax is a sensitive and often misunderstood topic, particularly in the context of California, one of the most populous and economically significant states in the United States. This comprehensive article aims to demystify the death tax in California, shedding light on its history, current status, and its impact on individuals and families.

Understanding the Death Tax in California

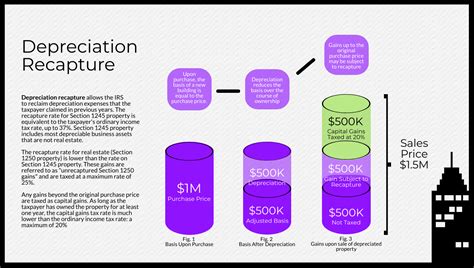

The death tax, formally known as the estate tax, is a levy imposed on the transfer of an individual's assets upon their death. It is a mechanism by which the government seeks to tax the value of an estate, which includes all the property, real estate, investments, and other assets owned by the deceased. In California, the estate tax is a complex and evolving subject, influenced by both federal and state regulations.

Federal Estate Tax Laws

The federal government in the United States has had an estate tax in place since 1916. This tax applies to estates with a value exceeding a certain threshold, currently set at $12.06 million for individuals and $24.12 million for married couples in 2022. The tax rate can reach as high as 40% for the largest estates.

However, it's important to note that not all states impose an additional estate tax on top of the federal one. As of my last update in January 2023, 12 states and the District of Columbia have their own estate tax laws, and California is one of them.

California's Estate Tax: A State-Level Perspective

California's estate tax is a decoupled tax, meaning it follows its own rules and thresholds, separate from the federal estate tax. Here are some key aspects of the estate tax in the Golden State:

- Exemption Thresholds: As of 2022, California's estate tax exemption is set at $5.89 million, which is lower than the federal threshold. This means that estates valued at $5.89 million or more are subject to the state's estate tax.

- Tax Rates: The California estate tax has a graduated rate structure. Estates valued between $5.89 million and $7.89 million are taxed at a rate of 8%. For estates valued between $7.89 million and $13.89 million, the rate increases to 10%. Estates valued above $13.89 million are taxed at a rate of 13%.

- Tax Collection: The California Franchise Tax Board (FTB) is responsible for administering and collecting the estate tax. Executors or personal representatives of the deceased's estate are required to file Form FTB 3520 and pay the estate tax within nine months of the date of death.

- Marital Deduction: Similar to the federal estate tax, California's estate tax allows an unlimited marital deduction. This means that assets transferred from a deceased spouse to a surviving spouse are not subject to the estate tax, providing an important planning opportunity for couples.

- Portability: California allows for portability of the estate tax exemption between spouses. This means that if one spouse passes away and does not use their entire exemption, the surviving spouse can utilize the remaining portion of the deceased spouse's exemption, effectively doubling the threshold at which the estate tax kicks in.

| California Estate Tax Thresholds and Rates |

|---|

| Exemption Threshold: $5.89 million (as of 2022) |

| Tax Rate: 8% for estates between $5.89 million and $7.89 million |

| Tax Rate: 10% for estates between $7.89 million and $13.89 million |

| Tax Rate: 13% for estates valued over $13.89 million |

Estate Planning Strategies to Mitigate Death Tax

Given the potentially substantial financial burden of the estate tax, many individuals and families seek strategies to minimize its impact. Here are some commonly employed estate planning techniques:

Gifts and Annual Exclusion

Individuals can gift assets during their lifetime to reduce the size of their taxable estate. The federal government allows an annual gift tax exclusion of $16,000 (as of 2022) per recipient. This means you can gift up to $16,000 to as many people as you like each year without triggering the gift tax. In California, the annual exclusion amount is the same.

Trusts

Trusts are legal entities that hold assets for the benefit of designated beneficiaries. There are various types of trusts, each with its own advantages and tax implications. Some common trusts used for estate planning include:

- Revocable Living Trusts: These trusts allow the grantor (the person creating the trust) to maintain control over the assets during their lifetime, but the assets transfer to beneficiaries outside of probate upon the grantor's death. These trusts can help avoid the estate tax, as they are not considered part of the taxable estate.

- Irrevocable Life Insurance Trusts (ILITs): By transferring ownership of a life insurance policy to an ILIT, the death benefit can be paid to beneficiaries outside of the taxable estate, effectively reducing the value of the estate for tax purposes.

- Charitable Trusts: Charitable trusts can be structured to provide income to a beneficiary for a specified period, after which the remaining assets go to a charity. These trusts offer both tax benefits and the opportunity to support a charitable cause.

Joint Ownership

Holding assets jointly with another person, such as a spouse or a child, can reduce the value of the taxable estate. Upon the death of one owner, the asset passes to the surviving joint owner without incurring estate taxes.

Retirement Accounts and Life Insurance

The proceeds from retirement accounts and life insurance policies are generally not subject to estate taxes if they are properly structured. Designating beneficiaries for these accounts can help ensure the funds pass outside of the taxable estate.

Charitable Contributions

Making charitable donations during one's lifetime or through a will can reduce the taxable value of an estate. These donations are typically tax-deductible and can also provide a sense of legacy by supporting causes close to the donor's heart.

The Impact of Death Tax on Families

The estate tax can have a significant impact on families, particularly those with substantial assets. Here's a closer look at how the death tax can affect different family situations:

Single Individuals

Single individuals with estates valued above the exemption threshold may face a substantial estate tax burden. Effective estate planning, such as utilizing trusts and making strategic gifts, can help mitigate this tax liability.

Married Couples

Married couples in California benefit from the unlimited marital deduction, which allows for the transfer of assets between spouses without incurring estate taxes. However, upon the death of the second spouse, the estate may be subject to the estate tax if it exceeds the exemption threshold. Portability of the exemption between spouses can help mitigate this risk.

Families with Heirs

For families with heirs, the estate tax can reduce the value of the inheritance. However, proper estate planning can help ensure that more of the estate is passed on to the heirs and less is lost to taxes. Techniques like gifting, trust creation, and charitable donations can be beneficial.

Business Owners

Business owners may face a unique challenge when it comes to the estate tax. The value of a business can be a significant portion of an estate, and if it exceeds the exemption threshold, it could trigger a substantial tax liability. Business owners often utilize techniques like buy-sell agreements, gifting business interests to family members, or establishing business trusts to address this issue.

Conclusion: Navigating the Complexities of Death Tax in California

The death tax in California is a complex topic, influenced by both federal and state regulations. While the estate tax can significantly impact the transfer of assets upon death, effective estate planning can help mitigate its financial burden. By understanding the thresholds, rates, and strategies outlined in this article, individuals and families can make informed decisions to protect their legacy and ensure a smoother transition of assets to their loved ones.

Frequently Asked Questions

What is the current exemption threshold for the California estate tax in 2023?

+As of my knowledge cutoff in January 2023, the exemption threshold for the California estate tax in 2023 is set at 5.89 million. This means that estates valued at 5.89 million or more are subject to the state’s estate tax. It’s important to stay updated with any changes in the tax laws as they may be subject to modifications.

Are there any ways to reduce the impact of the estate tax for married couples in California?

+Yes, married couples in California can take advantage of the unlimited marital deduction, which allows for the transfer of assets between spouses without incurring estate taxes. Additionally, the portability of the exemption between spouses can be utilized to effectively double the threshold at which the estate tax kicks in. Proper estate planning with the help of professionals can further optimize tax strategies for married couples.

Can you explain the difference between a revocable and an irrevocable trust in the context of estate planning?

+A revocable trust, also known as a living trust, allows the grantor to maintain control over the assets during their lifetime and can be modified or revoked at any time. Upon the grantor’s death, the assets transfer to beneficiaries outside of probate. An irrevocable trust, on the other hand, cannot be modified or revoked once it’s established. Assets placed in an irrevocable trust are typically beyond the reach of creditors and may have certain tax advantages. The choice between a revocable or irrevocable trust depends on individual circumstances and estate planning goals.

What happens if an estate exceeds the exemption threshold but the executor fails to pay the estate tax?

+If an estate exceeds the exemption threshold and the executor fails to pay the estate tax, the California Franchise Tax Board (FTB) may impose penalties and interest on the unpaid tax. Additionally, the FTB has the authority to pursue legal actions to collect the unpaid taxes, which could include placing a lien on the estate’s assets or even seizing assets to satisfy the tax debt. It’s crucial for executors to understand their responsibilities and file the necessary tax forms within the required timeframe.

Are there any estate planning strategies that can completely eliminate the estate tax burden in California?

+While it’s not possible to completely eliminate the estate tax burden in California for estates that exceed the exemption threshold, effective estate planning can significantly reduce its impact. Strategies such as gifting, utilizing trusts, taking advantage of the marital deduction, and making charitable contributions can all help minimize the estate tax liability. Consulting with an experienced estate planning professional is essential to develop a tailored plan that aligns with your specific goals and circumstances.