Auto Sales Tax Tn

In the state of Tennessee, understanding the intricacies of auto sales tax is crucial for both consumers and businesses alike. The sales tax system in TN, like in many other states, can be complex and often raises questions among car buyers and sellers. This article aims to provide a comprehensive guide, shedding light on the specific details and nuances of auto sales tax in Tennessee, offering clarity and insight to help navigate this essential aspect of vehicle transactions.

The Basics of Auto Sales Tax in Tennessee

Tennessee imposes a sales tax on the purchase of vehicles, which is a crucial revenue stream for the state. This tax is applicable to both new and used cars, ensuring that all vehicle transactions contribute to the state’s finances. The auto sales tax in TN is not a flat rate; instead, it varies based on several factors, making it a dynamic and often confusing element of car buying.

The Tennessee Department of Revenue plays a pivotal role in managing and regulating auto sales tax. They provide guidelines and resources to help taxpayers understand their obligations, ensuring compliance and transparency in the process.

Understanding the Tax Rate

The sales tax rate for vehicles in Tennessee is not uniform across the state. It varies depending on the county where the vehicle is registered. This means that the tax you pay can differ significantly based on your location, adding a layer of complexity to the purchasing process.

| County | Sales Tax Rate |

|---|---|

| Davidson County | 9.75% |

| Hamilton County | 9.25% |

| Shelby County | 9.25% |

| Knox County | 9.5% |

| ... | ... |

This table provides a glimpse of the varying sales tax rates across different counties in Tennessee. It's important to note that these rates are subject to change, and the most accurate information can be obtained from the Tennessee Department of Revenue's website.

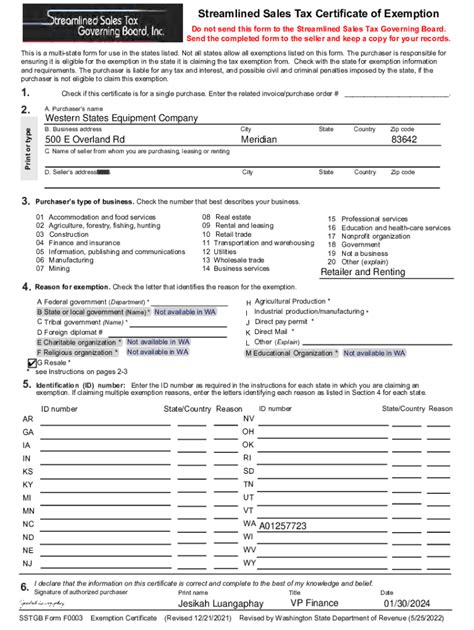

Exemptions and Special Considerations

While the auto sales tax is a standard practice, Tennessee offers certain exemptions and special provisions to specific groups or under particular circumstances. For instance, active-duty military personnel stationed in TN may be eligible for tax exemptions on vehicle purchases. Similarly, certain disabilities or medical conditions can qualify for tax relief, making the purchasing process more affordable for those in need.

Additionally, Tennessee participates in the Motor Vehicle Use Tax Agreement, which allows for the collection of tax on a vehicle purchased in another state and brought into Tennessee for use. This ensures that vehicles registered in TN are taxed appropriately, regardless of their point of purchase.

Calculating Auto Sales Tax: A Step-by-Step Guide

Calculating the sales tax on a vehicle purchase in Tennessee involves several steps. Let’s break down the process to provide a clear understanding of how this tax is determined and applied.

Step 1: Determine the Taxable Amount

The first step in calculating the auto sales tax is to determine the taxable amount. This is typically the purchase price of the vehicle, including any additional fees and charges, such as dealer preparation fees or transportation costs.

For instance, if you purchase a used car for $15,000 and the dealer charges an additional $500 for preparation and transportation, the taxable amount would be $15,500.

Step 2: Identify the Applicable Tax Rate

Once you have the taxable amount, the next step is to identify the applicable tax rate. As mentioned earlier, this rate varies depending on the county where the vehicle is registered. You can find the specific tax rate for your county by checking the Tennessee Department of Revenue’s website or contacting your local tax office.

Step 3: Apply the Tax Rate

With the taxable amount and the applicable tax rate in hand, you can now calculate the sales tax. This is a simple multiplication of the taxable amount by the tax rate. For example, if the taxable amount is 15,500 and the tax rate is 9.25%, the sales tax would be 1,436.75 (15,500 x 0.0925 = 1,436.75). This amount is added to the purchase price to determine the total cost of the vehicle.

Step 4: Consider Additional Fees and Taxes

It’s important to note that the sales tax is not the only fee or tax associated with purchasing a vehicle in Tennessee. There may be additional costs, such as registration fees, title fees, and emissions testing fees, which vary depending on the vehicle and the county. These fees are typically paid separately from the sales tax and can add a significant amount to the overall cost of the vehicle.

Auto Sales Tax: A Comparison with Other States

Tennessee’s auto sales tax system, with its varying rates across counties, is unique compared to other states. While some states have a uniform sales tax rate, others, like Tennessee, have a more complex system. This complexity can make it challenging to compare tax rates directly with other states.

For instance, while Tennessee's highest sales tax rate of 9.75% may seem high compared to some states, it's important to consider the overall tax burden, which includes not only the sales tax but also other fees and taxes. Additionally, the varying rates across counties can make it difficult to provide a straightforward comparison with other states.

The Impact of Varying Tax Rates

The varying tax rates across Tennessee counties can have a significant impact on the cost of purchasing a vehicle. For example, a car purchased in Davidson County would incur a sales tax of 9.75%, while the same car purchased in Hamilton County would have a tax rate of 9.25%. This difference of 0.5% may seem insignificant, but on a 20,000 car, it amounts to a difference of 100.

This variation can influence buying decisions, with consumers potentially opting to purchase vehicles in counties with lower tax rates to save money. However, it's essential to consider the overall cost of the vehicle, including registration fees and other associated expenses, when making such decisions.

Future Implications and Potential Changes

The auto sales tax landscape in Tennessee is subject to change, and there are several potential developments that could impact the system in the future.

Proposed Tax Reform

There have been discussions and proposals for tax reform in Tennessee, including changes to the auto sales tax system. These proposals aim to simplify the tax structure, potentially by implementing a uniform sales tax rate across the state. While these reforms are still in the planning stages, they could significantly impact the way vehicle sales are taxed in Tennessee.

Economic Impact and Revenue Generation

The auto sales tax is a significant source of revenue for Tennessee, contributing to the state’s budget and funding various public services and infrastructure projects. Any changes to the tax system, such as a uniform rate or other reforms, would need to consider the economic impact and ensure that the state’s revenue needs are met.

Technology and Online Sales

The rise of online car sales and the increasing use of technology in the automotive industry present unique challenges and opportunities for tax collection. Tennessee, like other states, will need to adapt its tax systems to accommodate these changes, ensuring that sales taxes are collected fairly and efficiently, regardless of the sales channel.

What documents are required for auto sales tax registration in Tennessee?

+

The required documents for auto sales tax registration in Tennessee include a completed Business Tax Application, proof of identity (such as a driver’s license or passport), and relevant business licenses or permits. Additionally, you may need to provide financial statements or other business-related documentation to support your application.

Are there any tax incentives for electric or hybrid vehicles in Tennessee?

+

Yes, Tennessee offers tax incentives for the purchase of electric and hybrid vehicles. These incentives can take the form of tax credits or rebates, reducing the overall cost of purchasing an environmentally friendly vehicle. It’s advisable to check with the Tennessee Department of Revenue for the latest information on these incentives, as they can change over time.

How often do auto sales tax rates change in Tennessee?

+

Auto sales tax rates in Tennessee can change annually or more frequently, depending on various factors, including legislative decisions and economic conditions. It’s crucial to stay updated with the latest tax rates to ensure compliance and accurate tax calculations. The Tennessee Department of Revenue provides regular updates on tax rate changes.