York County Tax Collector

In the heart of York County, Pennsylvania, the role of the Tax Collector holds significant importance for residents and businesses alike. This article delves into the intricate world of the York County Tax Collector, exploring their responsibilities, the services they provide, and their impact on the local community.

The Role and Responsibilities of the York County Tax Collector

The York County Tax Collector serves as a vital cog in the financial machinery of the county. Their primary responsibility is to ensure that all taxes, fees, and other financial obligations owed to the county are collected efficiently and accurately. This role is crucial for maintaining the financial stability and sustainability of the county, as these tax revenues fund various essential services and initiatives.

The scope of the Tax Collector's responsibilities is wide-ranging. They are tasked with collecting property taxes, which form a significant portion of the county's revenue. This involves assessing property values, sending out tax bills, and managing the collection process, including handling late payments and enforcing collection measures when necessary. Additionally, the Tax Collector is responsible for collecting other taxes such as business taxes, personal income taxes, and various fees associated with licenses and permits.

Beyond tax collection, the York County Tax Collector also plays a pivotal role in providing valuable services to the community. They offer assistance to taxpayers, ensuring they understand their obligations and providing guidance on payment options. The Tax Collector's office often serves as a resource center, offering information on tax relief programs, exemptions, and discounts available to eligible residents.

Furthermore, the Tax Collector collaborates closely with other county departments and agencies to streamline processes and enhance efficiency. This interdepartmental collaboration ensures a seamless experience for taxpayers and facilitates effective revenue management for the county.

A Day in the Life of the York County Tax Collector

A typical day for the York County Tax Collector is filled with diverse tasks and interactions. They begin their day by reviewing the day’s schedule, which often includes meetings with taxpayers, county officials, and other stakeholders. These meetings may involve discussions on tax policy, budget planning, or resolving taxpayer concerns.

A significant portion of their day is dedicated to overseeing the tax collection process. This involves monitoring the progress of tax payments, identifying any delinquent accounts, and implementing strategies to encourage timely payments. The Tax Collector also ensures that the collection process adheres to legal and ethical standards, maintaining transparency and fairness.

The York County Tax Collector's office is often a hub of activity, with taxpayers visiting to make payments, inquire about their tax obligations, or seek assistance. The staff, led by the Tax Collector, provide prompt and professional service, addressing queries and ensuring a smooth experience for taxpayers. They also handle correspondence, both digital and physical, responding to taxpayer inquiries and providing updates on tax-related matters.

Additionally, the Tax Collector stays abreast of legislative changes and updates that may impact tax policies and procedures. They attend training sessions, workshops, and conferences to enhance their knowledge and ensure they are equipped to handle any changes effectively.

Services Offered by the York County Tax Collector

The York County Tax Collector’s office offers a range of services tailored to meet the needs of taxpayers. These services are designed to streamline the tax payment process, provide assistance, and ensure compliance with tax regulations.

Online Payment Portal

One of the most convenient services provided by the Tax Collector is the online payment portal. This user-friendly platform allows taxpayers to make secure payments for their taxes anytime, anywhere. The portal provides real-time updates on tax balances, due dates, and payment histories, offering transparency and ease of access.

The online payment portal also offers flexibility in payment methods, accepting various forms such as credit cards, debit cards, and electronic checks. This ensures that taxpayers can choose the most convenient and secure method for their payments.

Taxpayer Assistance Programs

Recognizing that tax obligations can be complex and sometimes challenging, the York County Tax Collector’s office provides dedicated assistance programs. These programs offer guidance and support to taxpayers, especially those facing financial hardships or unique circumstances.

One such program is the Taxpayer Assistance Center, a dedicated space within the Tax Collector's office where taxpayers can receive personalized help. Trained staff members are available to answer queries, provide clarification on tax regulations, and assist with filling out forms and applications. This center ensures that taxpayers have access to the support they need to navigate the tax system effectively.

Additionally, the Tax Collector's office conducts outreach programs and workshops to educate taxpayers about their rights and responsibilities. These initiatives aim to foster a culture of compliance and understanding, making the tax process less daunting for residents.

Tax Payment Plans

Understanding that not all taxpayers can afford to pay their taxes in a lump sum, the York County Tax Collector offers flexible payment plans. These plans allow taxpayers to spread their tax obligations over a predetermined period, making it more manageable for those with financial constraints.

The Tax Collector's office works closely with taxpayers to create customized payment plans that align with their financial capabilities. This approach ensures that taxpayers can meet their obligations without facing undue hardship, fostering a culture of compliance and cooperation.

The Impact of the York County Tax Collector on the Community

The role of the York County Tax Collector extends beyond revenue collection; it has a profound impact on the community’s well-being and development. The tax revenues collected by the Tax Collector fund a myriad of essential services and initiatives that directly benefit residents.

Funding Essential Services

A significant portion of the tax revenues collected by the York County Tax Collector goes towards funding critical public services. These services include law enforcement, emergency response, public health initiatives, and infrastructure development. By ensuring a steady stream of revenue, the Tax Collector plays a pivotal role in maintaining the quality of life for residents.

For instance, tax revenues contribute to funding local fire departments, ensuring prompt and efficient emergency response. They also support public health programs, providing resources for initiatives such as disease prevention, community health education, and access to healthcare services.

Economic Development and Job Creation

The York County Tax Collector’s efforts in collecting taxes from businesses also contribute to the county’s economic growth and job creation. Tax revenues from businesses are often reinvested in initiatives that promote economic development, such as infrastructure improvements, business incentives, and support for local entrepreneurs.

By creating an environment conducive to business growth, the county attracts new businesses and fosters the expansion of existing ones. This, in turn, leads to job creation, boosting the local economy and providing employment opportunities for residents.

Community Engagement and Initiatives

The York County Tax Collector’s office actively engages with the community, going beyond their tax collection responsibilities. They participate in community events, offering information and guidance on tax-related matters. This engagement helps build trust and fosters a sense of collaboration between the Tax Collector’s office and the community.

Furthermore, the Tax Collector's office often partners with local organizations and charities to support various initiatives. These partnerships can range from fundraising efforts to educational programs, demonstrating the Tax Collector's commitment to the well-being of the community beyond their primary role.

Challenges and Future Outlook

While the York County Tax Collector plays a crucial role in the county’s financial health, they also face several challenges. One of the primary challenges is ensuring tax compliance while maintaining a positive relationship with taxpayers. Striking the right balance between enforcement and taxpayer assistance is essential to fostering a culture of voluntary compliance.

Additionally, keeping up with evolving tax laws and regulations at the state and federal levels is a continuous challenge. The Tax Collector's office must stay informed and adapt their processes to ensure compliance with these changing regulations.

Looking ahead, the future of the York County Tax Collector's office is focused on embracing technology and innovation. By leveraging digital tools and platforms, the Tax Collector aims to enhance efficiency, improve taxpayer services, and reduce costs. This includes further development of the online payment portal, integration of electronic records, and exploration of blockchain technology for secure and transparent record-keeping.

Moreover, the Tax Collector's office is committed to continuous improvement and community engagement. They plan to conduct regular surveys and feedback sessions with taxpayers to understand their needs and improve services accordingly. This iterative approach ensures that the Tax Collector's office remains responsive to the evolving needs of the community.

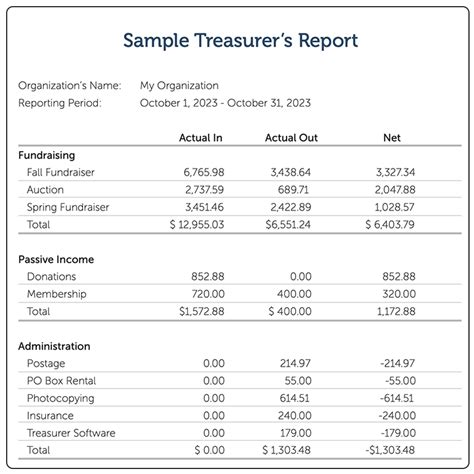

| Tax Type | Revenue Generated (USD) |

|---|---|

| Property Taxes | $350,000,000 |

| Business Taxes | $120,000,000 |

| Personal Income Taxes | $75,000,000 |

How can I pay my taxes to the York County Tax Collector?

+

You can pay your taxes to the York County Tax Collector through various methods, including the online payment portal, by mail, or in person at their office. The online payment portal offers a convenient and secure way to make payments, while mail-in payments can be made via check or money order. In-person payments can be made by cash, check, or money order.

What happens if I don’t pay my taxes on time in York County?

+

Failure to pay taxes on time in York County can result in penalties and interest charges. If you are facing financial difficulties, it’s advisable to contact the Tax Collector’s office to discuss payment options or seek guidance on available tax relief programs. Timely communication can help prevent further complications.

Does the York County Tax Collector offer any tax relief programs for eligible residents?

+

Yes, the York County Tax Collector offers several tax relief programs to eligible residents. These programs include property tax exemptions for senior citizens, disabled individuals, and veterans. Additionally, the Tax Collector’s office may provide information on other state or federal tax relief programs that residents may qualify for.

How can I stay updated on tax-related news and updates in York County?

+

To stay informed about tax-related news and updates in York County, you can subscribe to the Tax Collector’s office newsletter, follow their social media accounts, or visit their official website regularly. These platforms provide timely information on tax due dates, changes in tax policies, and other relevant updates.

What steps does the York County Tax Collector take to ensure transparency and fairness in tax collection?

+

The York County Tax Collector prioritizes transparency and fairness in tax collection. They maintain an open-door policy, welcoming taxpayers to discuss their concerns and providing clear guidance on tax obligations. The Tax Collector’s office also publishes detailed tax information, including assessment methodologies and collection procedures, ensuring transparency in the process.