Why Is My Tax Return So Low

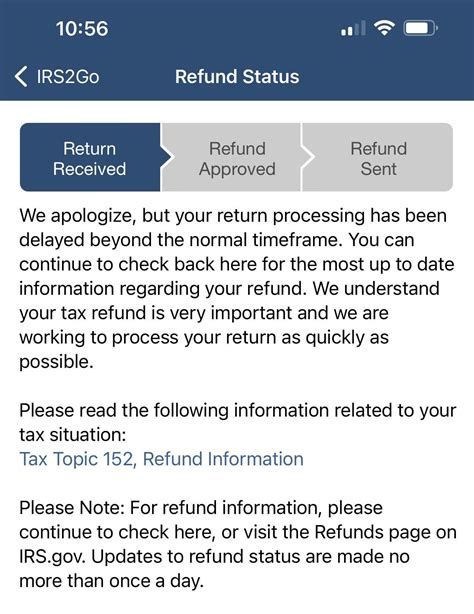

Many individuals and families eagerly anticipate the arrival of their tax refund each year, often relying on it as a financial boost or a means to catch up on expenses. However, it can be disheartening when the refund amount is lower than expected, leaving many taxpayers wondering, "Why is my tax return so low?" This comprehensive article aims to unravel the various factors that contribute to a reduced tax refund and provide insights into optimizing your financial strategies to maximize your returns.

Understanding the Dynamics of Tax Returns

Tax returns are a fundamental aspect of financial planning, and the amount you receive (or owe) is influenced by a multitude of factors. From personal circumstances to economic trends, there are numerous variables that can impact the size of your refund. Let’s delve into these factors to gain a clearer understanding.

1. Adjusted Tax Withholding

One of the primary reasons for a lower tax return is adjustments made to your tax withholding throughout the year. The Internal Revenue Service (IRS) encourages taxpayers to review their W-4 form annually to ensure their tax withholdings accurately reflect their current financial situation. Factors such as a change in marital status, the birth of a child, or a significant increase in income may require adjustments to your withholding allowances. If you claim fewer allowances, more tax is withheld from your paycheck, potentially resulting in a smaller refund.

| Year | Allowances Claimed | Withholding Amount |

|---|---|---|

| 2022 | 2 | $12,000 |

| 2023 | 0 | $15,000 |

For instance, let's consider a hypothetical scenario where an individual claimed two allowances on their W-4 in 2022, resulting in a withholding amount of $12,000. If they adjusted their allowances to zero in 2023, the withholding amount would increase to $15,000. While this strategy ensures a higher take-home pay throughout the year, it may result in a reduced tax return.

2. Economic Factors and Tax Policies

The economic landscape and tax policies implemented by the government play a pivotal role in determining the size of your tax return. During periods of economic growth, tax revenues may increase, leading to a higher tax burden for individuals. Conversely, economic downturns can result in tax cuts or incentives, potentially boosting your refund.

For example, during the COVID-19 pandemic, many governments introduced stimulus packages and tax relief measures to support individuals and businesses. These temporary policies may have resulted in higher refunds for taxpayers in those years. However, as economic conditions normalize, the impact of these measures on tax returns may diminish.

3. Deductions and Credits

The utilization of tax deductions and credits is a critical aspect of tax planning. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Understanding and claiming eligible deductions and credits can significantly impact your tax liability.

For instance, taxpayers who itemize deductions may claim expenses such as mortgage interest, charitable donations, or state and local taxes. These deductions can substantially reduce taxable income, resulting in a lower tax bill and potentially a higher refund. Similarly, credits like the Child Tax Credit or the Earned Income Tax Credit can provide substantial benefits for eligible taxpayers.

4. Income and Expense Fluctuations

Changes in income and expenses throughout the year can influence your tax return. If your income increases significantly, you may find yourself in a higher tax bracket, resulting in a higher tax liability. Conversely, a decrease in income or an increase in deductible expenses can lead to a lower tax bill and a potential refund.

Consider a self-employed individual who experiences a boom in business one year, resulting in a substantial increase in income. This may push them into a higher tax bracket, reducing their refund or even resulting in a tax liability.

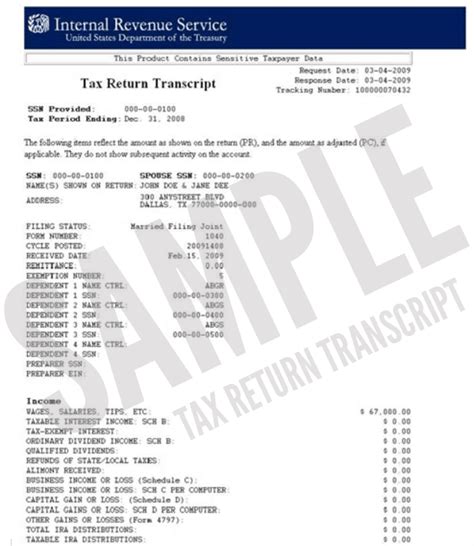

5. Tax Return Errors

Human error or unintentional mistakes on your tax return can lead to discrepancies and potentially reduce your refund. It’s essential to review your tax return carefully before submission to ensure accuracy. Common errors include incorrect Social Security numbers, misspelled names, or miscalculations in tax computations.

For instance, failing to report all sources of income or mistakenly claiming deductions for which you are not eligible can result in an audit and potential penalties. Therefore, it's crucial to seek professional assistance or utilize reliable tax preparation software to minimize the risk of errors.

Maximizing Your Tax Returns

While there are various factors beyond your control that influence your tax return, there are strategies you can implement to optimize your financial situation and potentially increase your refund.

1. Review Your Tax Withholdings

As mentioned earlier, adjusting your tax withholdings can be a strategic move. However, it’s essential to review your financial situation annually and make informed decisions. The IRS provides a Tax Withholding Estimator tool to help you determine the appropriate number of allowances to claim based on your circumstances.

Additionally, if you have multiple jobs or receive income from various sources, ensure that your withholdings are appropriately adjusted for each income stream. This can help prevent under-withholding, which may result in a smaller refund or even a tax liability.

2. Explore Tax Deductions and Credits

Familiarize yourself with the various tax deductions and credits available to you. Consult with a tax professional or utilize reputable online resources to identify deductions and credits for which you may be eligible. Some common deductions include:

- Student loan interest

- Medical and dental expenses

- Home office expenses (for eligible taxpayers)

- Moving expenses (if you meet the requirements)

- Educator expenses (for eligible educators)

Credits, such as the Child Tax Credit, American Opportunity Credit, or Lifetime Learning Credit, can provide substantial savings. Ensure you understand the eligibility criteria and requirements for claiming these credits.

3. Maximize Retirement Contributions

Contributing to tax-advantaged retirement accounts, such as a 401(k) or IRA, can reduce your taxable income and potentially increase your tax refund. These contributions are typically made with pre-tax dollars, meaning they lower your taxable income for the year. Consult with a financial advisor to determine the appropriate contribution strategy for your situation.

4. Plan for Major Life Events

Significant life events, such as marriage, the birth of a child, or buying a home, can have a substantial impact on your taxes. Plan ahead and consult with tax professionals to understand the tax implications of these events. For instance, marriage may allow you to combine incomes and potentially reduce your overall tax liability.

5. Keep Accurate Records

Maintaining organized financial records is crucial for accurate tax reporting. Keep track of all income, expenses, and deductions throughout the year. This practice not only simplifies the tax preparation process but also ensures you don’t miss out on any potential deductions or credits.

Conclusion

Understanding the factors that influence your tax return is essential for effective financial planning. While a lower tax return may be disappointing, it’s important to remember that it can be a result of various factors, many of which are beyond your control. By reviewing your tax withholdings, exploring deductions and credits, and planning for major life events, you can take proactive steps to optimize your financial situation and potentially increase your tax refund.

Frequently Asked Questions

Can I adjust my tax withholding throughout the year to increase my refund?

+Yes, you can adjust your tax withholding by submitting a new W-4 form to your employer. However, it’s important to strike a balance to avoid under-withholding, which may result in a smaller refund or a tax liability.

Are there any tax credits available for families with children?

+Yes, the Child Tax Credit is a significant credit available to eligible families with qualifying children. This credit can provide substantial savings and potentially increase your refund.

Can I claim deductions for my home office expenses?

+If you have a dedicated home office and meet the requirements, you may be eligible to claim deductions for home office expenses. Consult with a tax professional to understand the eligibility criteria and calculate your potential deductions.

What if I make a mistake on my tax return?

+If you discover a mistake on your tax return, it’s crucial to correct it promptly. The IRS provides guidance on how to amend your return. Consult with a tax professional for assistance in rectifying any errors.