Why Do I Owe Money On My Tax Return

The concept of owing money on a tax return can be perplexing, especially for those who have diligently filed their taxes annually. Understanding the reasons behind this scenario is crucial to ensure financial preparedness and compliance with tax regulations. This article aims to demystify the process, providing a comprehensive guide to the factors that may lead to a tax liability.

Uncovering the Reasons Behind a Tax Debt

There are several common scenarios that can result in individuals owing money on their tax returns. These factors often revolve around income, deductions, and tax obligations. Let's delve into these reasons to gain a clearer understanding.

Underpayment of Taxes During the Year

One of the primary reasons taxpayers may owe money is an underpayment of taxes throughout the year. Taxpayers in the United States are expected to pay taxes on their income as they earn it. This is often done through a system of payroll deductions, where employers withhold a portion of an employee's wages for federal income tax, state income tax (if applicable), and other deductions like Social Security and Medicare. However, if an individual's tax liability exceeds the amount withheld by their employer, they may owe money at the end of the year.

This can occur for various reasons, such as significant changes in income, the addition of a second job, or a substantial increase in investment income. For instance, if an individual experiences a sudden boost in their business income or has substantial capital gains from stock sales, their tax liability may surpass the standard payroll deductions.

Additionally, individuals who are self-employed or have income from multiple sources may need to make estimated tax payments throughout the year to cover their tax obligations. Failing to do so can result in a tax debt at the end of the year. The Internal Revenue Service (IRS) provides guidelines and tools to help taxpayers calculate their estimated tax payments accurately.

Inaccurate Tax Withholding

Taxpayers fill out a W-4 form when starting a new job to ensure the correct amount of tax is withheld from their paychecks. This form considers factors like marital status, number of dependents, and additional income sources. However, if the W-4 form is not filled out correctly or if an individual's circumstances change significantly during the year (e.g., marriage, birth of a child, or a new job), the tax withheld may not align with their actual tax liability.

For example, if a taxpayer claims too many allowances on their W-4, they may have less tax withheld than they owe, resulting in a tax debt when filing their return. Conversely, claiming fewer allowances can lead to overpayment, which may result in a refund.

It's essential for taxpayers to review their withholding regularly and adjust it as needed to avoid surprises at tax time. The IRS provides a Withholding Calculator to help individuals determine the appropriate amount of tax to have withheld from their paychecks.

Overclaiming Tax Credits and Deductions

Tax credits and deductions are valuable tools to reduce tax liability. However, claiming credits or deductions to which one is not entitled can lead to tax debt. The IRS audits tax returns with significant deductions or credits more frequently, especially if the deductions seem unusual for the taxpayer's income level or lifestyle.

For instance, claiming the Child Tax Credit for a child who does not meet the residency or age requirements, or overestimating medical expenses when claiming the Medical Expense Deduction, can result in a tax liability. It's crucial to keep accurate records and ensure that all credits and deductions claimed are legitimate and supported by documentation.

Unreported Income

Taxpayers are required to report all sources of income on their tax returns. Failure to do so can result in significant tax debt and potential legal consequences. Unreported income can come from various sources, including:

- Employment Income: This includes wages, salaries, tips, and other compensation earned from employment. If an individual receives a Form W-2 or 1099 from an employer, they must report this income on their tax return.

- Investment Income: Income from investments such as dividends, interest, and capital gains must be reported. Even if the income is from a small investment, it is still taxable and should be declared.

- Self-Employment Income: Individuals who are self-employed, freelancers, or have a side business must report their income. This includes income from gigs, online platforms, or any other self-employment activities.

- Gifts and Inheritances: While most gifts are not taxable, certain gifts or inheritances may trigger a tax liability. For instance, receiving a large sum of money as a gift or inheriting assets with a significant value may require reporting and potentially paying taxes.

The IRS has access to various information returns, such as Form 1099 and W-2, which report income paid to individuals. If the income reported on these forms does not match the income reported on a taxpayer's return, the IRS may audit the return and impose penalties and interest on the unpaid tax.

Tax Obligations for Specific Circumstances

Certain life events or financial situations can trigger additional tax obligations. For example, individuals who sell their homes may incur a capital gains tax if they profit from the sale. Similarly, those who inherit property may face estate taxes or capital gains taxes when they eventually sell the inherited assets.

Additionally, individuals who receive certain benefits, such as unemployment compensation or disability benefits, may need to pay taxes on those benefits. The rules surrounding the taxability of benefits can be complex, so it's essential to consult a tax professional or the IRS guidelines to understand one's specific obligations.

Tips for Managing Tax Obligations

Understanding the reasons behind a tax debt is the first step toward financial preparedness. Here are some tips to help manage tax obligations and avoid surprises at tax time:

- Stay Informed: Keep up-to-date with tax laws and regulations. The IRS provides extensive resources, including publications and forms, to help taxpayers understand their obligations. Additionally, consulting a tax professional can provide personalized guidance based on individual circumstances.

- Review Withholdings Regularly: Taxpayers should review their W-4 form and tax withholdings at least once a year, especially if their personal or financial situation changes. This ensures that the correct amount of tax is being withheld from their paychecks.

- Keep Accurate Records: Maintaining good records of income, expenses, and deductions is crucial. This not only helps with preparing tax returns but also provides documentation in case of an audit. Digital tools and software can make record-keeping more efficient and organized.

- Understand Tax Credits and Deductions: While tax credits and deductions can significantly reduce tax liability, it's essential to understand the eligibility criteria and requirements for each. Misusing or overclaiming these benefits can lead to tax debt and potential penalties.

- Consider Estimated Tax Payments: Individuals with significant income from self-employment or other sources not subject to withholding may need to make estimated tax payments throughout the year. The IRS provides guidance on calculating and paying these estimates to avoid penalties.

Conclusion

Owing money on a tax return can be a result of various factors, from underpayment of taxes to overclaiming deductions or credits. By understanding these reasons and taking proactive measures, taxpayers can manage their tax obligations effectively. Staying informed, keeping accurate records, and seeking professional guidance when needed are essential steps toward financial preparedness and compliance with tax regulations.

What should I do if I owe money on my tax return but cannot afford to pay the full amount?

+If you find yourself in a situation where you owe money on your tax return but cannot afford to pay the full amount, there are options available. The IRS offers various payment plans and installment agreements to help taxpayers manage their tax debt. You can apply for an IRS Online Payment Agreement through their website, which allows you to pay your tax debt in monthly installments. It’s important to note that interest and penalties may still accrue during the payment period.

Can I avoid owing money on my tax return by adjusting my W-4 form?

+Yes, adjusting your W-4 form can help you avoid owing money on your tax return. The W-4 form determines the amount of tax withheld from your paycheck, and by making adjustments, you can ensure that enough tax is withheld to cover your tax liability. The IRS provides a Withholding Calculator to help you determine the appropriate number of allowances to claim based on your personal and financial situation.

Are there any tax credits or deductions that can help reduce my tax liability?

+Yes, there are several tax credits and deductions that can help reduce your tax liability. Some common examples include the Child Tax Credit, Earned Income Tax Credit, Medical Expense Deduction, and Student Loan Interest Deduction. It’s important to understand the eligibility criteria and requirements for each credit or deduction to ensure you’re claiming them correctly and maximizing your tax savings.

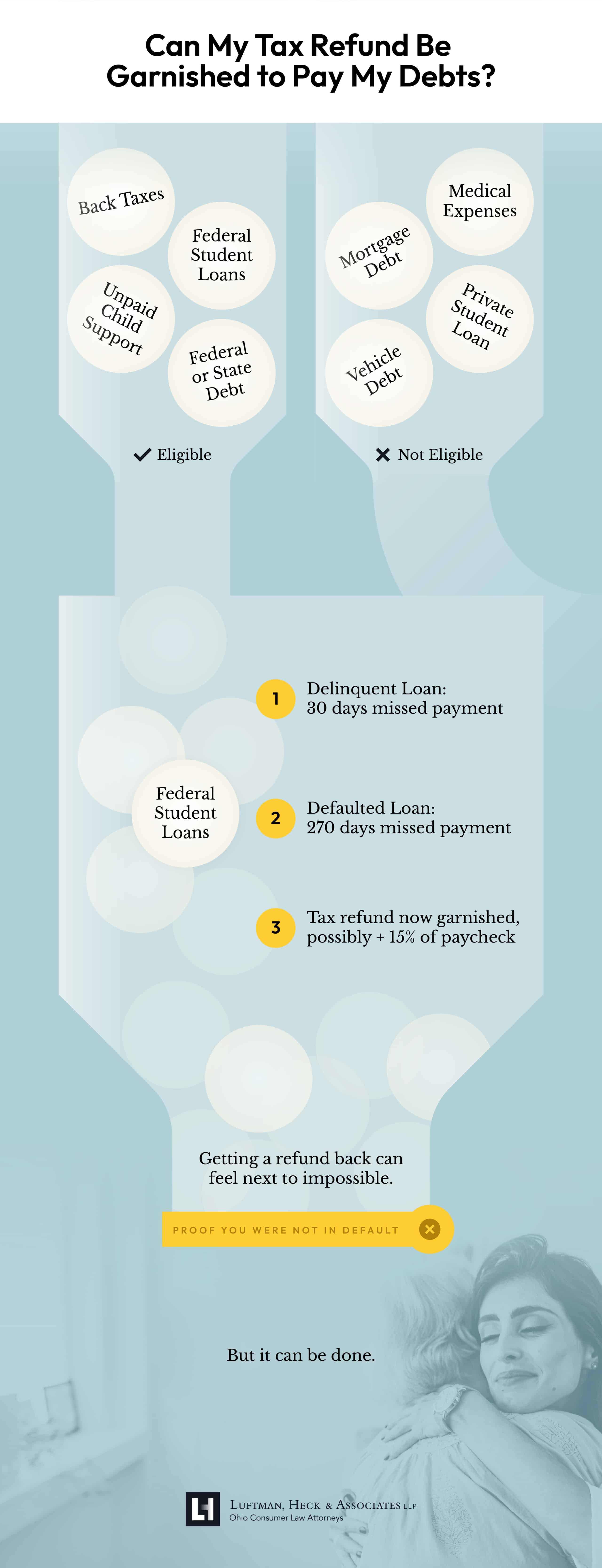

What happens if I don’t pay my tax debt on time?

+If you fail to pay your tax debt on time, the IRS may impose penalties and interest on the unpaid amount. These penalties can accumulate over time, increasing the total amount you owe. Additionally, the IRS has the authority to take enforcement actions, such as placing a federal tax lien on your property or garnishing your wages to collect the outstanding debt.