When Is Missouri Tax Free Weekend

Missouri's tax-free weekend, an annual event eagerly anticipated by many residents, offers a great opportunity to save on essential purchases. Officially known as the Sales Tax Holiday, this event provides a much-needed break from the state sales tax, encouraging shoppers to stock up on necessary items while enjoying significant savings.

While the concept of a tax-free weekend is straightforward, the dates and applicable items vary across states. In Missouri, the Sales Tax Holiday is carefully planned to benefit taxpayers, providing a strategic time to make tax-free purchases. The event typically occurs during a weekend in August, aligning with the back-to-school season, when many families are preparing for the upcoming academic year.

Understanding Missouri's Tax-Free Weekend

Missouri's tax-free weekend is a designated period when the state temporarily waives its sales tax, allowing consumers to purchase specific items without paying the usual sales tax. This initiative is designed to boost the local economy and provide a financial advantage to taxpayers, especially those with back-to-school shopping needs.

The tax-free weekend in Missouri is not just a simple sales event; it's a strategic economic initiative with a specific focus. By exempting certain items from sales tax, the state aims to stimulate spending, particularly on essential goods, during a critical period for retailers and consumers alike.

Dates and Duration

The exact dates for Missouri's tax-free weekend vary annually, usually falling within the first two weeks of August. This year, the Sales Tax Holiday is scheduled for August 5th to August 7th, 2023. This three-day event provides ample time for shoppers to take advantage of the tax exemption.

The duration of the tax-free weekend is strategically chosen to cater to the back-to-school shopping season. This period allows families to prepare for the upcoming academic year, purchasing necessary items like clothing, school supplies, and even computers, without the added burden of sales tax.

| Year | Tax-Free Weekend Dates |

|---|---|

| 2023 | August 5th - August 7th |

| 2022 | August 5th - August 7th |

| 2021 | August 6th - August 8th |

Applicable Items

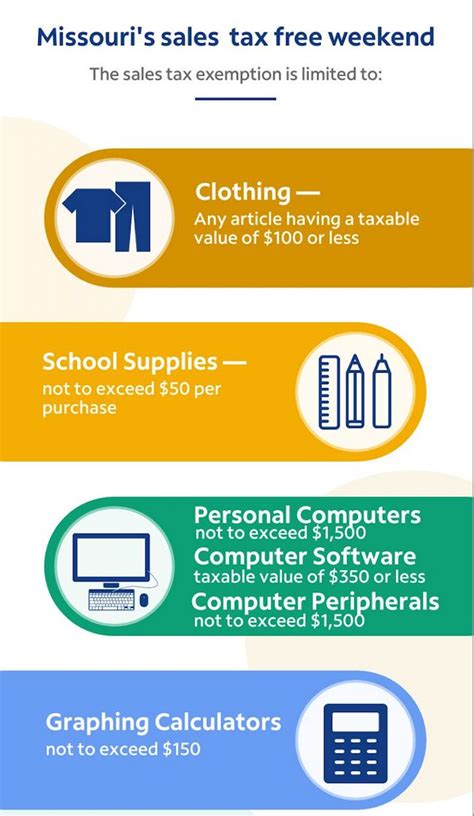

During Missouri's tax-free weekend, certain categories of items are exempt from sales tax. These categories typically include:

- Clothing: Apparel items, such as shirts, pants, dresses, and jackets, are tax-free if they cost $100 or less per item. This exemption covers a wide range of clothing, from everyday wear to formal attire.

- School Supplies: Essential school items like notebooks, pens, pencils, and backpacks are tax-free if they cost $50 or less per item. This category ensures that families can stock up on necessary school supplies without added tax costs.

- Computers and Software: Missouri also exempts computers and related software from sales tax during this weekend. This exemption applies to items costing $3,500 or less, making it an excellent time to upgrade technology.

- Other Exemptions: Additionally, certain sporting goods, safety equipment, and energy-efficient appliances are tax-free, subject to specific criteria.

Preparing for Missouri's Tax-Free Weekend

To make the most of Missouri's tax-free weekend, proper planning is essential. Here are some tips to ensure a successful and rewarding shopping experience:

Make a List

Create a comprehensive list of items you need to purchase during the tax-free weekend. This list should include clothing, school supplies, and any other applicable items. By planning ahead, you can ensure you don't miss out on any essential purchases.

Compare Prices

Before the tax-free weekend, research and compare prices from different retailers. This step will help you find the best deals and ensure you're getting the most value for your money. Many stores offer special promotions and discounts during this time, so keep an eye out for these opportunities.

Check Eligibility

Review the list of eligible items for the tax-free weekend. Ensure that the items you plan to purchase fall within the specified price limits and categories. This step is crucial to ensure you receive the full benefit of the tax exemption.

Set a Budget

Establish a realistic budget for your tax-free weekend shopping. With the savings from the tax exemption, you may be tempted to overspend. Setting a budget will help you stay focused and ensure you don't exceed your financial limits.

Shop Early

Consider shopping early in the tax-free weekend to avoid crowds and ensure you get the best selection of items. Many popular products may sell out quickly, so shopping early can be advantageous.

The Impact of Missouri's Tax-Free Weekend

Missouri's tax-free weekend has a significant impact on both consumers and businesses. For consumers, it provides a substantial savings opportunity, especially for those with back-to-school or technology needs. The tax exemption allows families to allocate their budgets more effectively, making essential purchases more affordable.

For businesses, the tax-free weekend can drive significant sales and revenue. Retailers often see an increase in foot traffic and sales during this period, leading to a boost in their bottom line. The event also encourages consumers to explore different stores and discover new products, creating a positive impact on the local economy.

Economic Benefits

The economic benefits of Missouri's tax-free weekend are far-reaching. By stimulating consumer spending, the event helps circulate money within the local economy. This increased spending benefits not only retailers but also other local businesses and service providers, creating a ripple effect that strengthens the community's economic foundation.

Community Engagement

The tax-free weekend also fosters a sense of community and engagement. Families and individuals come together to take advantage of the sales tax holiday, creating a festive atmosphere in shopping areas. This event brings people closer, creating a positive social impact beyond the economic benefits.

Future Implications

Missouri's tax-free weekend has become an integral part of the state's economic strategy, and its future looks promising. The event's success and popularity have led to increased participation from retailers and consumers alike. As a result, the state may consider expanding the categories of exempt items or extending the duration of the tax-free weekend to further boost its economic impact.

Furthermore, the success of Missouri's tax-free weekend could inspire other states to adopt similar initiatives, creating a broader trend of tax exemptions to support consumers and local economies. This trend could lead to a more comprehensive approach to tax relief, benefiting taxpayers across the country.

Expanding Exemptions

Missouri may explore expanding the categories of exempt items to include a wider range of essential goods. This could involve adding more sporting goods, household items, or even certain types of furniture to the tax-free list. By doing so, the state can provide relief to a broader spectrum of consumers and further stimulate the economy.

Long-Term Economic Strategy

The tax-free weekend can be seen as a key component of Missouri's long-term economic strategy. By providing periodic tax relief, the state can encourage consumer spending and support local businesses. This strategy, if successful, could lead to a more robust and resilient economy, benefiting all residents of the state.

Conclusion

Missouri's tax-free weekend is a well-planned and strategically timed event that provides substantial savings to taxpayers. By exempting specific items from sales tax, the state encourages consumer spending, especially during critical periods like the back-to-school season. The impact of this initiative extends beyond individual savings, fostering economic growth and community engagement.

As Missouri continues to refine and expand its tax-free weekend, the future looks bright for consumers and businesses alike. The potential for broader exemptions and an extended duration could make this event even more impactful, solidifying its place as a key economic driver for the state.

FAQ

What is Missouri’s Sales Tax Holiday?

+Missouri’s Sales Tax Holiday, also known as the tax-free weekend, is a designated period when the state waives its sales tax on specific items, providing consumers with tax-free shopping opportunities.

When is Missouri’s tax-free weekend in 2023?

+In 2023, Missouri’s tax-free weekend will be held from August 5th to August 7th.

What items are exempt during Missouri’s tax-free weekend?

+During Missouri’s tax-free weekend, clothing, school supplies, computers, and certain sporting goods and safety equipment are exempt from sales tax, subject to specific price limits.