Atlanta Property Tax

Property taxes are an essential component of local government funding, and in the city of Atlanta, Georgia, they play a significant role in supporting various public services and infrastructure. This article aims to delve into the intricacies of Atlanta's property tax system, providing a comprehensive guide for homeowners, investors, and anyone interested in understanding the financial obligations and opportunities associated with real estate in this vibrant city.

Understanding Atlanta’s Property Tax Landscape

The property tax system in Atlanta is a complex yet critical mechanism that funds essential services such as public schools, emergency response, road maintenance, and more. It is a key revenue source for both the city and the state, with tax rates and assessment processes that vary based on location and property characteristics.

Property taxes in Atlanta are primarily determined by the assessed value of a property and the applicable tax rate, which can differ significantly depending on the jurisdiction. The city is divided into various tax districts, each with its own tax authority, and properties may fall under multiple jurisdictions, making the tax landscape diverse and unique.

Let's explore the key aspects of Atlanta's property tax system, providing a detailed guide to help property owners navigate this crucial financial obligation.

Property Assessment Process

Property assessment is the first crucial step in determining the property tax liability. In Atlanta, the process involves the appraisal of properties to establish their fair market value. This value is then used as the basis for calculating the property tax owed.

The assessment process is typically conducted by the local tax assessor's office, which employs certified appraisers to evaluate properties. The appraisers consider various factors, including:

- Property size and improvements.

- Recent sales of similar properties.

- Market trends and conditions.

- Location and zoning regulations.

- Any unique features or amenities.

After the initial assessment, property owners receive a notice of assessment, detailing the appraised value of their property. This value serves as the foundation for calculating the property tax due.

| Assessment Year | Average Property Value |

|---|---|

| 2022 | $250,000 |

| 2023 (Projected) | $265,000 |

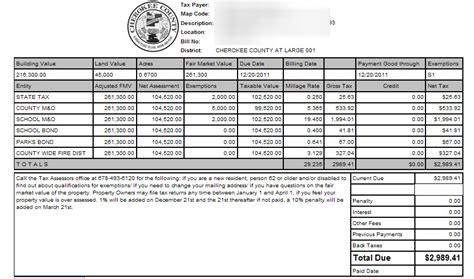

Tax Rates and Jurisdictions

Atlanta’s property tax rates are determined by the various tax authorities that have jurisdiction over the property. These include the city of Atlanta, Fulton County, and potentially other entities such as school districts or special-purpose districts.

Each jurisdiction sets its own tax rate, which is applied as a percentage of the assessed value of the property. These rates can vary significantly, and a property may fall under multiple jurisdictions, each with its own rate.

For instance, consider the following tax rates for a residential property located in Atlanta:

| Jurisdiction | Tax Rate (per $1,000 of Assessed Value) |

|---|---|

| City of Atlanta | $16.50 |

| Fulton County | $12.70 |

| Atlanta Public Schools | $8.70 |

| Total Effective Tax Rate | $38.90 |

In this example, the total effective tax rate is the sum of the individual rates, resulting in a total tax bill based on the assessed value of the property.

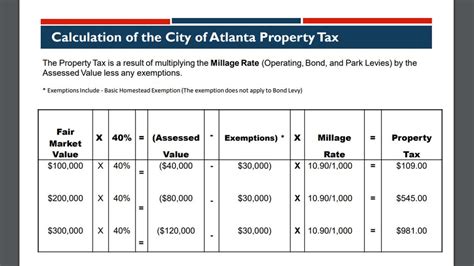

Property Tax Calculation

The calculation of property taxes in Atlanta involves a straightforward formula. The assessed value of the property is multiplied by the applicable tax rate for each jurisdiction, and the resulting amounts are summed up to determine the total tax liability.

For example, let's consider a residential property with an assessed value of $300,000, subject to the tax rates mentioned earlier. The calculation would be as follows:

| Jurisdiction | Tax Rate | Tax Calculation |

|---|---|---|

| City of Atlanta | $16.50 per $1,000 | $300,000 x $16.50 = $4,950 |

| Fulton County | $12.70 per $1,000 | $300,000 x $12.70 = $3,810 |

| Atlanta Public Schools | $8.70 per $1,000 | $300,000 x $8.70 = $2,580 |

| Total Tax Liability | $11,340 |

Thus, the total property tax liability for this example property would be $11,340 for the year.

Payment Options and Due Dates

Property tax payments in Atlanta are typically due in two installments, with the exact due dates varying depending on the jurisdiction. It’s important for property owners to be aware of these dates to avoid late fees and penalties.

The payment options and due dates for the city of Atlanta are as follows:

| Installment | Due Date |

|---|---|

| First Installment | January 1st - March 1st |

| Second Installment | July 1st - August 1st |

Payment methods accepted include check, money order, or online payment through the city's official website. Property owners are encouraged to explore these options to find the most convenient and secure method for their tax payments.

Exemptions and Abatements

Atlanta offers various property tax exemptions and abatements to eligible property owners. These incentives are designed to support specific groups and promote certain initiatives, providing a reduction in the tax liability.

Some common exemptions and abatements in Atlanta include:

- Homestead Exemption: Available to homeowners who use the property as their primary residence. This exemption reduces the assessed value of the property, resulting in lower taxes.

- Senior Citizen Exemption: Offered to homeowners aged 65 and older, providing a reduction in property taxes based on income and property value.

- Military Exemption: Active-duty military personnel and veterans may be eligible for a partial or full exemption, depending on their service status and the nature of their property ownership.

- Greenbelt Exemption: Properties designated as agricultural or timberland may qualify for a reduced assessment, encouraging land preservation and sustainable practices.

- Historic Property Abatement: Properties with historic significance may be eligible for an abatement, reducing the tax burden to promote the preservation of these valuable assets.

It's important for property owners to research and understand the eligibility criteria for these exemptions and abatements. Each jurisdiction may have specific requirements and application processes, so consulting with the relevant tax authorities is advisable.

Appealing Your Property Assessment

If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal the assessment. The appeal process in Atlanta involves a review by an independent board or a formal hearing, providing an opportunity to present your case and potentially lower your tax liability.

The steps for appealing your property assessment in Atlanta are as follows:

- Review your notice of assessment: Carefully examine the details of your property's assessed value, comparing it to recent sales of similar properties in your area.

- Gather evidence: Collect data and documentation to support your claim, such as recent appraisals, sales records of comparable properties, or expert opinions.

- File an appeal: Submit a formal appeal to the appropriate tax authority, typically within a specified timeframe. Include all relevant documentation and a clear explanation of your grounds for appeal.

- Attend the hearing: If your appeal is accepted, you may be invited to attend a hearing where you can present your case to an independent board or panel. Prepare thoroughly and bring any additional evidence or witnesses to support your argument.

- Await the decision: The board will review your appeal and make a decision, which may result in a change to your property's assessed value. You will receive notification of the outcome, and if successful, your property taxes will be adjusted accordingly.

Conclusion

Understanding and navigating Atlanta’s property tax system is crucial for property owners and investors. By familiarizing yourself with the assessment process, tax rates, payment options, and available exemptions, you can effectively manage your tax obligations and potentially reduce your tax liability.

Regularly reviewing your property's assessment, staying informed about tax rate changes, and taking advantage of available exemptions and abatements are key strategies for optimizing your property tax situation. Additionally, appealing an inaccurate assessment can provide an opportunity to lower your taxes and ensure fairness in the system.

In a city like Atlanta, where property values are on the rise and the tax landscape is diverse, staying proactive and informed is essential for financial planning and real estate success. Whether you're a homeowner or an investor, a solid understanding of property taxes will contribute to your overall financial strategy and help you make informed decisions about your real estate holdings.

How often are property assessments conducted in Atlanta?

+Property assessments in Atlanta are typically conducted every year, ensuring that the assessed value of properties remains up-to-date. This annual assessment process helps maintain fairness in the tax system by reflecting current market conditions and property improvements.

Are there any online resources to estimate my property tax in Atlanta?

+Yes, the city of Atlanta provides an online property tax estimator tool on its official website. This tool allows property owners to input their property details and receive an estimate of their annual tax liability. It’s a convenient way to get a rough idea of your tax obligations.

What happens if I miss the property tax payment deadline in Atlanta?

+Missing a property tax payment deadline can result in late fees and penalties. It’s important to stay aware of the payment due dates and consider setting reminders to avoid any financial consequences. If you’re facing financial difficulties, it’s advisable to contact the tax authority to explore potential payment arrangements.

Can I deduct my property taxes on my federal income tax return?

+Yes, property taxes paid in Atlanta can be deducted on your federal income tax return as an itemized deduction. However, there are certain limitations and restrictions based on your income and the amount of property taxes paid. It’s recommended to consult with a tax professional to ensure you’re taking full advantage of any applicable deductions.