Trump No Taxes

The revelation that former US President Donald Trump paid no federal income taxes in 10 out of 15 years, including paying just $750 in 2016 and 2017, sparked a storm of controversy and raised important questions about tax policy, presidential ethics, and the effectiveness of the US tax system.

In this comprehensive analysis, we delve into the details of Trump's tax returns, the legal and ethical implications of his tax strategies, and the broader impact on American politics and society. We will explore the complex web of business losses, tax credits, and deductions that allowed Trump to avoid paying taxes, and examine the potential consequences for future presidential candidates and the American public.

The Trump Tax Returns: A Closer Look

The New York Times’ explosive report in September 2020 detailed Trump’s tax records, revealing a pattern of tax avoidance through a series of aggressive accounting practices. Here are some key findings:

- In 10 of the 15 years examined, Trump reported more losses than income, allowing him to avoid paying federal income taxes.

- The largest tax benefit came from a $72.9 million refund in 2010, stemming from a 1995 tax case where Trump reported a $916 million loss.

- Trump's businesses incurred consistent losses, with $315 million in losses from his hotels and golf courses from 2000 to 2018.

- He took advantage of tax deductions for consulting fees paid to his daughter Ivanka and son Eric, and for expenses related to his Mar-a-Lago estate.

These findings sparked outrage among Trump's critics, who accused him of taking advantage of loopholes and exploiting the tax system for personal gain. But supporters argued that Trump's complex business empire and real estate holdings made his tax situation unique, and that he was simply taking advantage of the laws as they stood.

Legal and Ethical Implications

The legal implications of Trump’s tax strategies are complex. While Trump’s tax returns showed aggressive tax planning, they did not reveal any illegal activities. However, the ethics of his tax avoidance have been called into question.

One key issue is the potential conflict of interest between Trump's business interests and his role as president. Critics argue that Trump's tax strategies demonstrate a lack of financial transparency and a potential conflict between his personal financial interests and the public good. They point to his refusal to divest from his businesses during his presidency as a violation of ethical norms.

Additionally, Trump's tax avoidance raises questions about fairness and equality in the tax system. While most Americans pay taxes on their income, Trump's ability to use business losses and deductions to avoid paying federal income taxes for years has led to calls for tax reform to close loopholes and ensure a more equitable system.

Impact on American Politics and Society

The revelation of Trump’s tax records had a significant impact on American politics and society, influencing public perception and shaping policy debates.

Public Perception and Trust

The news that Trump paid little to no federal income taxes despite his immense wealth damaged his credibility and trust with the American people. Polls showed a decline in Trump’s approval ratings after the tax reports, with many Americans questioning his commitment to the nation’s well-being.

The perception that Trump was taking advantage of the tax system while ordinary Americans struggled to make ends meet further eroded public trust in government and the fairness of the tax system.

Policy Debates and Reform

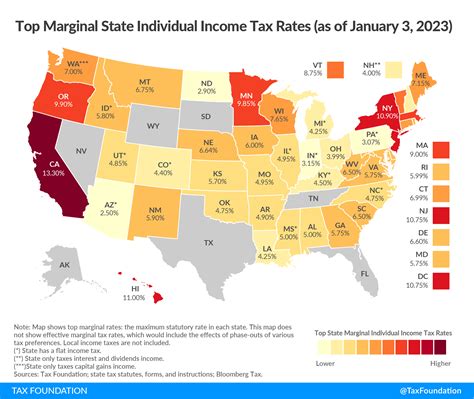

Trump’s tax records sparked debates about tax policy and reform. Democrats and progressives called for more stringent tax laws to prevent wealthy individuals and corporations from avoiding taxes through loopholes and deductions.

Proposals for tax reform included raising tax rates on the wealthy, limiting deductions and credits, and introducing a minimum tax for high-income earners. These debates continue to shape policy discussions, with proposals for a wealth tax and other measures to address income inequality gaining traction.

Political Strategy and Elections

Trump’s tax records also influenced political strategy and elections. The Democratic Party seized on the issue to attack Trump’s character and ethics, arguing that his tax avoidance demonstrated a lack of patriotism and commitment to the nation’s well-being.

The controversy over Trump's taxes became a key campaign issue in the 2020 presidential election, with Democrats using it to rally support and discredit Trump's economic policies. While Trump's tax strategies may have been legal, the political fallout highlighted the importance of financial transparency and ethics in American politics.

The Future of Presidential Tax Transparency

The controversy surrounding Trump’s taxes has raised important questions about the future of presidential tax transparency. Here are some key implications and potential reforms:

Mandatory Disclosure of Tax Returns

One proposed reform is to make it mandatory for presidential candidates and sitting presidents to disclose their tax returns. Currently, there is no legal requirement for presidents to release their tax records, but tradition and public expectation have led most candidates to do so voluntarily.

Making tax return disclosure mandatory would provide greater transparency and accountability, allowing the public to assess a candidate's financial interests and potential conflicts of interest. It would also help restore public trust in government and the fairness of the tax system.

Closing Loopholes and Simplifying the Tax Code

Trump’s tax strategies highlighted the complexity and inefficiencies of the US tax code. Simplifying the tax code and closing loopholes could help prevent wealthy individuals and corporations from avoiding taxes through aggressive accounting practices.

Reforms could include limiting deductions and credits, introducing a minimum tax for high-income earners, and simplifying tax brackets to make the system more progressive and equitable. These changes would help ensure that everyone pays their fair share and reduce the incentive for tax avoidance.

Strengthening Ethical Standards

Trump’s refusal to divest from his businesses during his presidency violated ethical norms and raised concerns about conflicts of interest. Strengthening ethical standards and enforcement could help prevent future presidents from exploiting their position for personal gain.

Measures could include requiring presidents to fully divest from their businesses or place their assets in a blind trust, as well as implementing stricter conflict-of-interest rules and oversight. These reforms would help maintain the integrity of the presidency and ensure that the public interest takes precedence over personal financial interests.

FAQs

Did Trump break any laws with his tax strategies?

+While Trump’s tax returns showed aggressive tax planning, they did not reveal any illegal activities. However, the ethics of his tax avoidance have been called into question.

Why did Trump pay so little in federal income taxes?

+Trump’s tax records showed a pattern of tax avoidance through business losses, tax credits, and deductions. He took advantage of legal loopholes and complex accounting practices to minimize his tax liability.

What impact did Trump’s tax records have on public perception?

+The revelation that Trump paid little to no federal income taxes despite his immense wealth damaged his credibility and trust with the American people. It raised questions about his commitment to the nation’s well-being and the fairness of the tax system.

How has Trump’s tax controversy influenced policy debates?

+Trump’s tax records sparked debates about tax policy and reform. Democrats and progressives have called for more stringent tax laws to prevent wealthy individuals and corporations from avoiding taxes through loopholes and deductions.

What reforms could improve presidential tax transparency and ethics?

+Reforms could include mandatory disclosure of tax returns, simplifying the tax code to close loopholes, and strengthening ethical standards to prevent conflicts of interest and ensure the public interest takes precedence over personal financial interests.