When Are Virginia State Taxes Due

Virginia, officially known as the Commonwealth of Virginia, is a southeastern state in the United States. With a rich history and a diverse economy, Virginia is home to a range of industries and residents. One important aspect of living and doing business in Virginia is understanding the state's tax system and the deadlines for tax payments.

Understanding Virginia State Taxes

Virginia’s tax system consists of various types of taxes, including income tax, sales and use tax, property tax, and more. These taxes contribute to the state’s revenue and fund essential services, infrastructure, and public programs. Let’s delve into the specifics of Virginia state taxes and explore when they are due.

Income Tax in Virginia

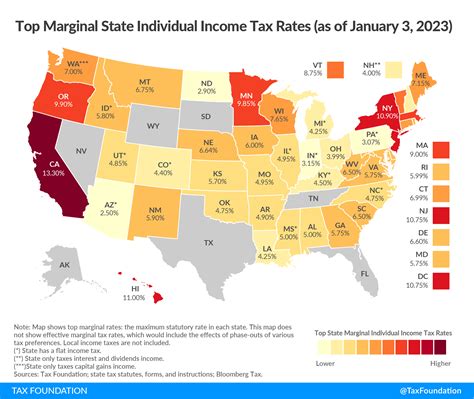

Virginia imposes an income tax on its residents and non-residents who earn income within the state. The income tax rate in Virginia varies depending on the taxpayer’s filing status and income level. As of the 2023 tax year, the income tax rates range from 2% to 5.75%.

Virginia follows a calendar year tax system, which means the tax year runs from January 1st to December 31st. Individual taxpayers are required to file their state income tax returns annually, typically by a specific deadline in April.

The due date for Virginia income tax returns is April 15th for most taxpayers. However, it’s important to note that this deadline may vary based on the day of the week. If April 15th falls on a weekend or a state holiday, the deadline is extended to the next business day.

For instance, in 2023, April 15th falls on a Saturday. Therefore, the due date for Virginia income tax returns is extended to Monday, April 17th. It’s crucial for taxpayers to be aware of these deadline variations to ensure timely filing and avoid any penalties.

Sales and Use Tax

Virginia imposes a sales and use tax on the sale or purchase of tangible personal property and certain services. The sales tax rate in Virginia is 5.3%, which is applied to the purchase price of taxable items. Additionally, localities may impose their own local sales tax rates, which can vary across the state.

When it comes to the due date for sales and use tax payments, businesses and individuals with sales tax obligations in Virginia must remit their sales tax returns and payments monthly, quarterly, or annually, depending on their sales volume and the frequency of their sales.

For monthly filers, the due date for sales tax payments is typically the 20th day of the following month. Quarterly filers have a due date of the last day of the month following the end of the quarter. Annual filers must submit their sales tax returns and payments by January 31st of the following year.

It’s important for businesses to accurately calculate and remit their sales tax obligations to avoid penalties and interest charges.

Property Tax in Virginia

Property tax is another significant source of revenue for Virginia. The state’s property tax system is primarily managed at the local level, with each county or city setting its own tax rates and assessment processes.

The due date for property tax payments varies across localities in Virginia. Generally, property taxes are due in two installments, with the specific dates determined by the locality’s fiscal year and assessment schedule.

For instance, in the city of Alexandria, property taxes are due in June and December of each year. In Fairfax County, the due dates are typically in March and September. It’s crucial for property owners to consult their local tax authorities to determine the exact due dates and payment options available in their specific locality.

Other Virginia State Taxes

In addition to income tax, sales and use tax, and property tax, Virginia imposes various other taxes to generate revenue and support specific initiatives.

For example, Virginia has a Motor Vehicle Tax, which is an annual tax levied on registered vehicles. The due date for this tax typically coincides with the vehicle’s registration renewal date. Additionally, there are fuel taxes, inheritance taxes, and estate taxes, each with their own specific due dates and requirements.

Tax Payment Options and Resources

Virginia offers various options for taxpayers to pay their state taxes, including online payments, direct deposit, credit card payments, and traditional mail-in payments. The Virginia Department of Taxation provides a user-friendly website with detailed information on tax payment options, forms, and due dates.

The department also offers a range of resources and tools to assist taxpayers, such as tax calculators, tax guides, and answers to frequently asked questions. Taxpayers can access these resources to ensure they are well-informed and can meet their tax obligations efficiently.

Conclusion: Stay Informed and Meet Your Tax Obligations

Understanding the due dates for Virginia state taxes is crucial for individuals and businesses operating in the Commonwealth. Whether it’s income tax, sales tax, property tax, or other specific taxes, being aware of the deadlines helps taxpayers avoid late penalties and ensures a smooth tax payment process.

By staying informed and utilizing the resources provided by the Virginia Department of Taxation, taxpayers can navigate the state’s tax system effectively and contribute to the growth and development of the state.

Can I extend the deadline for filing my Virginia income tax return?

+Yes, you can request an extension for filing your Virginia income tax return. To do so, you need to file Form 760-IR Extension of Time to File by the original due date of your return. Keep in mind that an extension to file does not extend the time to pay any taxes owed. Make sure to estimate and pay any taxes due by the original deadline to avoid penalties and interest.

Are there any tax incentives or credits available in Virginia?

+Yes, Virginia offers various tax credits and incentives to support certain industries, promote economic development, and encourage specific behaviors. These include tax credits for research and development, job creation, historic preservation, and more. It’s important to consult the Virginia Department of Taxation’s website or seek professional advice to explore available incentives that may apply to your situation.

What happens if I miss the deadline for paying my property taxes in Virginia?

+Missing the deadline for paying your property taxes in Virginia can result in penalties and interest charges. Each locality may have its own specific late payment policies and penalties. It’s important to contact your local tax authority to understand the consequences and explore potential options for late payment or payment plans.