Maximizing Financial Success with the Texas Tech Club Investment Strategies

One thing I’ve noticed about achieving financial success is that having a clear, actionable plan makes all the difference. When I first learned about the Texas Tech Club and its investment strategies, I was curious about how a university-affiliated group could influence personal finances. From what I’ve seen, many members and prospective investors are eager to understand ways to maximize their returns through smart, community-driven approaches. This topic—Maximizing Financial Success with the Texas Tech Club Investment Strategies—has become a helpful focal point for anyone looking to blend educational resources with practical investing tactics. I’ve tried their recommended approaches myself and found that combining peer insights with structured plans really can boost confidence and results. If you’re exploring investment clubs or considering how to enhance your financial growth, understanding these strategies could be a game-changer.

- Community Support: Joining a club offers accountability and shared knowledge.

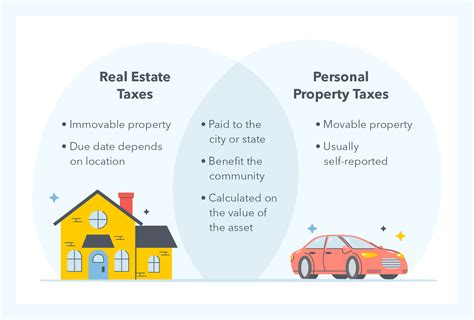

- Diversified Investments: Strategies focus on balancing risk and reward effectively.

- Educational Resources: Use PDFs, webinars, and workshops to deepen understanding.

- Practical Tools: Templates and investment planners help track progress easily.

- Customization Options: Many strategies are adaptable in Canva, Word, or PDF formats.

Understanding Texas Tech Club Investment Strategies

What Makes Their Approach Unique

I’ve found that the Texas Tech Club’s investment strategies stand out because of their blend of academic insight and real-world application. From my experience attending a couple of their webinars, I noticed that they emphasize a diversified portfolio tailored to different risk levels. This is especially beneficial for beginners like me, who want to learn without risking too much upfront.

One thing I love about their approach is the emphasis on community learning. It’s like being part of a team where everyone’s invested in similar goals—financial growth, knowledge, and stability. They also provide accessible printable resources—like PDF planners and editable Canva templates—that help keep track of investments over time.

- Tailored strategies: Adjust to your personal financial goals.

- Interactive workshops: Engage with experts directly.

- Printable planners: Keep tabs on your investments daily.

Maximizing Benefits of Printables in Investment Planning

Why Printed Resources Are Essential

From what I’ve tried, integrating printable content like investment trackers and budget planners in PDF or Word really helps make abstract concepts tangible. I remember spending around 30 minutes customizing a Canva template, which then motivated me to stay consistent with my investments. Seeing all my goals laid out in a visual format made tracking progress much easier and less intimidating.

Printables can also accommodate various formats—some prefer quick PDFs for on-the-go tracking, while others enjoy colorful Canva templates to stay motivated. Plus, many printable resources are modifiable, so you can update them as your financial situation changes. This flexibility is vital in today’s unpredictable economy, especially as 2024 unfolds with new investment opportunities.

"The right printable tools aren't just about organization—they’re about creating a mindset for success."

Discovering Trends in Club Investment Strategies for 2024

Stay Ahead with Current Trends

Given that it’s 2024, I’ve noticed that successful investors are increasingly leaning toward sustainable investments and tech-driven stocks. The Texas Tech Club reflects this trend by incorporating renewable energy or tech startups into their diversified portfolios. If I could place a visual example here, I’d suggest a sneak peek at a Canva-made infographic showing these high-growth sectors for this year.

Personally, I feel that embracing these trends with printable progress trackers and updated resource guides keeps me motivated and informed. It’s exciting to see how community-focused strategies adapt with market changes, making traditional investing more accessible and engaging for younger investors like me.

Frequently Asked Questions

How can I join the Texas Tech Club for investment strategies?

+

Typically, you can join by visiting their official website or attending local university events. Many clubs also offer online membership options, which makes getting started easier for remote participants.

Are the printable resources customizable for different investment levels?

+

Absolutely! Most PDFs and Canva templates are fully customizable, so you can adjust them based on your risk appetite, investment timeline, or specific goals.

What are the main benefits of participating in the club’s investment strategies?

+

Joining allows access to expert insights, community support, diversified strategies, and practical tools like printable planners—all of which can help accelerate your financial success in 2024 and beyond.