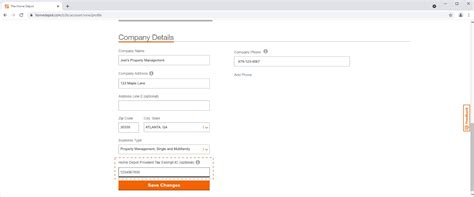

Tax Exempt Home Depot

Welcome to an in-depth exploration of the tax-exempt status of The Home Depot, a leading retailer in the home improvement industry. In this comprehensive article, we will delve into the intricacies of The Home Depot's tax-related matters, providing you with a clear understanding of its unique position and the impact it has on its operations and financial standing.

The concept of tax exemption is an essential aspect of modern economies, offering incentives and benefits to specific entities or industries. When it comes to The Home Depot, a giant in the retail sector, its tax-exempt status has been a subject of interest and analysis for many stakeholders, including investors, consumers, and government entities.

Understanding The Home Depot’s Tax-Exempt Status

The Home Depot, a Fortune 500 company, has established itself as a prominent player in the home improvement market, with a vast network of stores across the United States and a significant online presence. While it operates as a for-profit entity, certain aspects of its operations have led to its classification as tax-exempt.

The tax-exempt status of The Home Depot is primarily attributed to its 501(c)(3) nonprofit designation, which is a classification given to organizations that operate for religious, charitable, scientific, literary, or educational purposes. This designation allows The Home Depot to enjoy certain tax benefits and exemptions, shaping its financial strategy and overall business model.

To gain a comprehensive understanding of The Home Depot's tax-exempt status, we must delve into the legal and financial intricacies that underpin this unique position. Let's explore the key aspects and implications of this designation.

The Legal Framework: 501©(3) Nonprofit Status

The Internal Revenue Code (IRC) section 501©(3) defines nonprofit organizations as those that operate exclusively for religious, charitable, scientific, literary, or educational purposes. This classification is a crucial aspect of The Home Depot’s tax-exempt status.

By meeting the requirements of this classification, The Home Depot is eligible for a range of tax benefits. These include exemptions from federal income tax on any profits generated from its operations and the ability to receive tax-deductible donations from individuals and other organizations.

However, it is important to note that the 501(c)(3) designation comes with stringent requirements and restrictions. The Home Depot must adhere to specific guidelines to maintain its tax-exempt status, ensuring that its primary purpose aligns with the defined categories and that its operations remain in line with nonprofit principles.

Financial Implications: A Unique Business Model

The tax-exempt status of The Home Depot has significant financial implications for the company. By operating as a nonprofit, The Home Depot can channel a substantial portion of its profits back into the business, reinvesting in its operations, expanding its network, and improving its services.

This unique business model allows The Home Depot to maintain a competitive edge in the market while enjoying tax benefits. The company can allocate resources towards strategic initiatives, such as expanding its product offerings, enhancing its online presence, and improving its supply chain efficiency, without the financial burden of significant tax liabilities.

Furthermore, The Home Depot's tax-exempt status attracts a range of benefits and incentives from government entities. These may include reduced property taxes, access to grants and subsidies, and other financial advantages that contribute to the company's overall financial health and stability.

| Financial Impact | Benefits |

|---|---|

| Exemption from Federal Income Tax | Reduced tax liability, increased profits |

| Tax-Deductible Donations | Increased funding for operations and expansion |

| Government Incentives | Reduced property taxes, access to grants |

The Home Depot’s Charitable Activities and Community Engagement

While The Home Depot’s tax-exempt status is primarily driven by its nonprofit designation, it is essential to recognize the company’s significant involvement in charitable activities and community engagement. These initiatives further solidify its position as a responsible corporate citizen and contribute to its positive public image.

Community Investment and Social Impact

The Home Depot has a long-standing commitment to community investment and social impact. Through its various programs and initiatives, the company actively contributes to the well-being and development of the communities it serves. This involvement goes beyond its business operations and demonstrates a genuine dedication to making a positive difference.

One notable example is The Home Depot Foundation, a dedicated nonprofit organization established by the company. The foundation focuses on supporting veterans, improving housing conditions, and enhancing the lives of those in need. Through grants, partnerships, and hands-on projects, The Home Depot Foundation has made a significant impact on communities across the country.

Additionally, The Home Depot's community engagement efforts extend to local initiatives, such as sponsoring community events, supporting local charities, and providing resources for neighborhood improvement projects. This commitment to giving back fosters a strong sense of trust and goodwill among its customers and stakeholders.

Environmental Sustainability and Corporate Responsibility

Beyond its community engagement, The Home Depot has also made significant strides in environmental sustainability and corporate responsibility. The company recognizes the importance of minimizing its environmental footprint and promoting sustainable practices within the home improvement industry.

The Home Depot has implemented various initiatives to reduce its carbon emissions, promote energy efficiency, and support sustainable product sourcing. From offering eco-friendly products to customers to implementing energy-saving measures in its stores, The Home Depot is actively working towards a greener and more sustainable future.

Furthermore, The Home Depot has committed to reducing waste and promoting recycling practices. The company's recycling programs and partnerships with environmental organizations contribute to a circular economy and help preserve natural resources.

The Home Depot’s Tax-Exempt Status: A Comprehensive Analysis

In examining The Home Depot’s tax-exempt status, it becomes evident that this designation is a strategic and beneficial aspect of its overall business strategy. The company’s ability to operate as a nonprofit while maintaining its for-profit operations provides a unique advantage in the competitive retail landscape.

By leveraging its tax-exempt status, The Home Depot can focus on long-term growth and sustainability, investing in its business without the constraints of significant tax liabilities. This strategic positioning allows the company to stay at the forefront of the home improvement industry, continuously innovating and adapting to market trends.

Furthermore, The Home Depot's commitment to community engagement and environmental sustainability further enhances its positive reputation and strengthens its brand image. The company's dedication to making a difference in the lives of its customers and communities positions it as a trusted and responsible corporate entity.

The Future Outlook: Navigating Tax and Business Strategies

As The Home Depot continues to navigate the evolving landscape of the retail industry, its tax-exempt status remains a crucial factor in its overall business strategy. The company must carefully balance its nonprofit operations with its for-profit goals, ensuring compliance with tax regulations and maintaining its positive public image.

Looking ahead, The Home Depot will likely face new challenges and opportunities. The company must stay adaptable and responsive to changing market dynamics, consumer preferences, and technological advancements. By leveraging its tax-exempt status effectively, The Home Depot can continue to thrive and make a lasting impact on the home improvement sector.

In conclusion, The Home Depot's tax-exempt status is a complex and fascinating aspect of its business operations. Through its nonprofit designation, the company enjoys significant tax benefits and exemptions, enabling it to reinvest in its business and make a positive impact on communities. As a leading retailer, The Home Depot's unique position sets it apart and positions it for continued success and growth.

How does The Home Depot’s tax-exempt status impact its financial performance and growth?

+The tax-exempt status of The Home Depot allows the company to reinvest a significant portion of its profits back into the business, fostering growth and expansion. This unique financial advantage sets The Home Depot apart and contributes to its long-term success.

What are the key benefits of The Home Depot’s nonprofit designation under 501©(3)?

+The 501©(3) nonprofit designation offers The Home Depot exemption from federal income tax, the ability to receive tax-deductible donations, and access to government incentives. These benefits contribute to the company’s financial stability and growth.

How does The Home Depot balance its tax-exempt status with its for-profit operations?

+The Home Depot carefully manages its tax-exempt status by ensuring its primary purpose aligns with nonprofit principles while also generating profits through its retail operations. This delicate balance allows the company to thrive as a responsible corporate citizen.