Tax Collector Contra Costa County

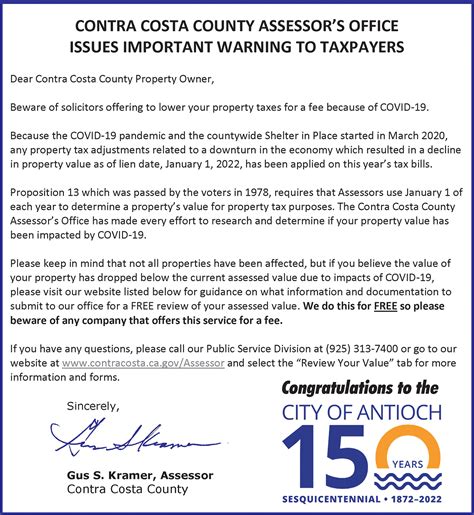

Welcome to this comprehensive guide on the Tax Collector's office in Contra Costa County, California. In this article, we will delve into the various aspects of this vital governmental entity, exploring its functions, services, and impact on the community. By understanding the role of the Tax Collector, we can gain insights into the efficient management of tax obligations and the overall financial health of the county.

The Role of the Tax Collector in Contra Costa County

The Tax Collector’s office in Contra Costa County serves as a pivotal administrative body responsible for collecting and managing various taxes and fees levied by the county, cities, special districts, and other taxing agencies within the jurisdiction. This essential service ensures the smooth operation of local government and provides the necessary funds for vital public services and infrastructure development.

At the helm of this office is the elected Tax Collector, who holds a position of trust and accountability. The Tax Collector, in collaboration with a dedicated team of professionals, oversees the entire tax collection process, from assessment to enforcement, with a focus on fairness, transparency, and efficient taxpayer service.

One of the primary responsibilities of the Tax Collector is the collection of property taxes. Contra Costa County, like many other counties in California, operates on a biennial assessment system. This means that property assessments are conducted every two years, with the assessed value serving as the basis for property tax calculations. The Tax Collector's office is responsible for sending out tax bills, collecting payments, and ensuring timely disbursement of funds to the appropriate taxing agencies.

Services and Online Presence

The Tax Collector’s office in Contra Costa County offers a range of services to taxpayers, aimed at simplifying the tax payment process and providing valuable resources. Here are some key services and initiatives:

- Online Payment Portal: Taxpayers can access a secure online platform to view their tax bills, make payments, and manage their accounts. This convenient service allows for quick and efficient transactions, reducing the need for in-person visits.

- Electronic Bill Presentment and Payment (EBPP): The Tax Collector's office has implemented EBPP, enabling taxpayers to receive their tax bills electronically. This not only reduces paper waste but also provides a more efficient and timely method of bill delivery.

- Taxpayer Assistance: The office maintains a dedicated taxpayer assistance team, offering guidance and support to individuals and businesses with tax-related inquiries. This includes assistance with payment plans, property tax exemptions, and resolving tax-related issues.

- Public Outreach and Education: Recognizing the importance of taxpayer education, the Tax Collector's office conducts regular outreach programs and workshops. These initiatives aim to educate residents about their tax obligations, provide tax tips, and ensure compliance with local tax laws.

Community Engagement and Partnerships

The Tax Collector’s office actively engages with the community to foster a culture of transparency and accountability. Here are some notable initiatives:

- Community Meetings: Tax Collector officials regularly attend community meetings and events to listen to resident concerns and provide updates on tax-related matters. This open dialogue helps build trust and ensures that taxpayer needs are addressed.

- Partnerships with Local Businesses: The office collaborates with local businesses and organizations to promote tax compliance and offer support. These partnerships can include educational workshops, tax assistance programs, and joint initiatives to streamline tax processes for businesses.

- Social Media Presence: The Tax Collector's office maintains an active presence on social media platforms, providing real-time updates, tax reminders, and valuable resources. This digital engagement allows for a more direct connection with taxpayers and improves overall communication.

Performance Analysis and Tax Collection Efficiency

To assess the effectiveness of the Tax Collector’s office, it is essential to analyze its performance metrics and compare them with industry benchmarks. Here is a brief overview of key performance indicators (KPIs) and their significance:

| Metric | Description | Performance |

|---|---|---|

| Tax Collection Rate | The percentage of taxes collected compared to the total amount due. | Contra Costa County consistently achieves a tax collection rate above the state average, indicating efficient collection processes. |

| Timely Payment Rate | The percentage of taxpayers who pay their taxes on time. | The Tax Collector's office has seen a steady increase in timely payments, reflecting improved taxpayer compliance and effective outreach efforts. |

| Online Payment Usage | The percentage of taxpayers utilizing the online payment portal. | A growing number of taxpayers are opting for online payments, showcasing the success of the office's digital transformation initiatives. |

| Taxpayer Satisfaction | A measure of taxpayer satisfaction based on surveys and feedback. | Overall, taxpayer satisfaction with the Tax Collector's office remains high, with positive feedback on the convenience of online services and the professionalism of staff. |

Future Implications and Innovations

Looking ahead, the Tax Collector’s office in Contra Costa County is poised to embrace technological advancements and innovative practices to further enhance its services. Here are some potential future developments:

- Blockchain Integration: Exploring the use of blockchain technology to secure and streamline tax transactions, ensuring greater transparency and efficiency.

- Artificial Intelligence (AI) Assistance: Implementing AI-powered chatbots and virtual assistants to provide instant support to taxpayers, reducing response times and improving overall customer service.

- Data Analytics: Utilizing advanced data analytics to identify trends, optimize tax collection strategies, and enhance taxpayer engagement.

- Mobile App Development: Developing a dedicated mobile application to provide taxpayers with on-the-go access to their tax accounts, payment options, and important tax-related information.

In conclusion, the Tax Collector's office in Contra Costa County plays a vital role in ensuring the financial stability and prosperity of the county. Through efficient tax collection, innovative services, and active community engagement, the office strives to create a positive taxpayer experience while maintaining the highest standards of integrity and accountability. As technology continues to evolve, the Tax Collector's office is well-positioned to embrace new opportunities, further enhancing its services and contributing to the overall success of Contra Costa County.

What are the payment options available for taxpayers in Contra Costa County?

+Taxpayers in Contra Costa County have several payment options, including online payments through the official website, over-the-counter payments at designated locations, and electronic fund transfers. The Tax Collector’s office also offers payment plans for eligible taxpayers who may face financial difficulties.

How can I check the status of my tax payment or account?

+You can easily check the status of your tax payment or account by logging into your online account on the Tax Collector’s official website. Alternatively, you can contact the taxpayer assistance team via phone or email for real-time updates on your account status.

Are there any tax relief programs or exemptions available in Contra Costa County?

+Yes, Contra Costa County offers various tax relief programs and exemptions to eligible taxpayers. These include homeowner’s exemptions, disabled veteran’s exemptions, and property tax relief programs for low-income seniors and disabled individuals. For more information, you can visit the Tax Collector’s website or contact their office directly.