Tax Auction

The world of tax auctions is an intriguing and often overlooked aspect of the real estate market. These auctions present unique opportunities for investors, offering properties at potentially attractive prices. Delving into the intricacies of tax auctions provides a fascinating insight into a specialized sector of the property industry.

Understanding Tax Auctions: A Comprehensive Overview

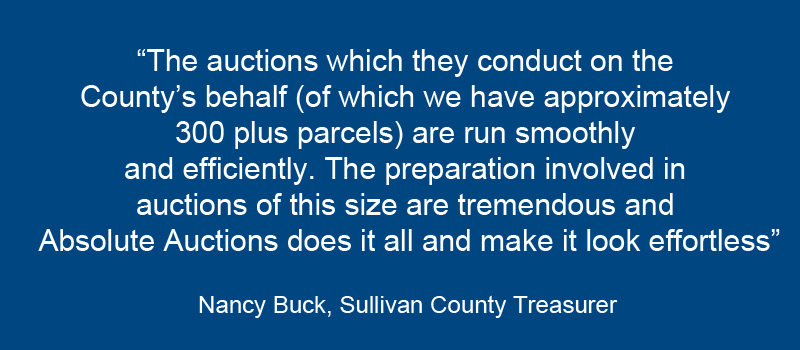

Tax auctions are public sales events where properties are auctioned off due to non-payment of property taxes. These auctions are typically organized by local government authorities or tax collectors to recover outstanding tax debts. The properties up for auction can include residential homes, commercial buildings, vacant land, and even unique assets like vineyards or historical landmarks.

One of the key attractions of tax auctions is the potential for significant discounts. Properties are often sold at a fraction of their market value, presenting an opportunity for investors to acquire assets at a bargain. However, it's important to approach tax auctions with a well-informed strategy, as there are risks and challenges involved.

The Process of Tax Auctions

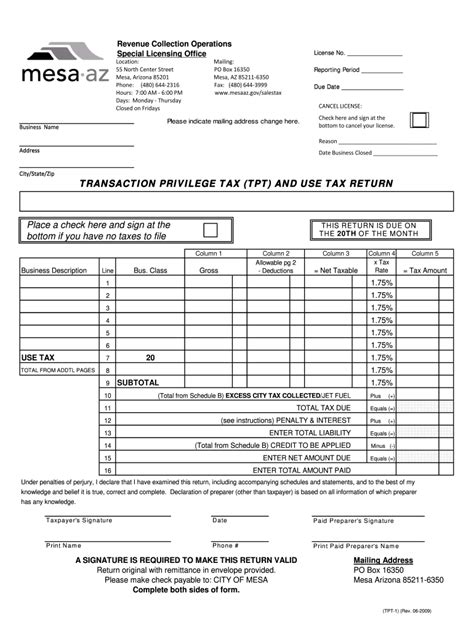

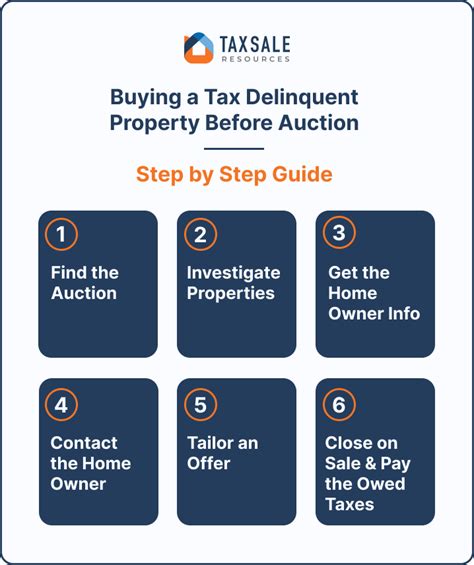

The process begins when a property owner fails to pay their property taxes. After a grace period, which varies by jurisdiction, the local government will initiate the foreclosure process. The property is then scheduled for auction, with details typically published in local newspapers and online platforms.

Prospective bidders must register in advance and provide a deposit to participate. The auction itself follows a standard format, with properties sold to the highest bidder. Bidders can view the properties beforehand, but the inspection process can be limited, so due diligence is crucial.

| Step | Process Description |

|---|---|

| Tax Delinquency | Property owner fails to pay taxes. |

| Foreclosure | Government initiates foreclosure process. |

| Auction Announcement | Details published for public auction. |

| Registration | Bidders register and provide deposits. |

| Auction | Properties sold to highest bidders. |

Exploring the Advantages of Tax Auctions

Tax auctions provide a range of benefits for investors, including:

- Discounted Prices: Properties are often sold at substantial discounts, sometimes as low as 20-50% of their market value.

- Diverse Property Types: Auctions offer a wide range of property types, allowing investors to diversify their portfolios.

- Opportunity for Quick Returns: Tax auctions can lead to rapid investments, especially with properties that are in high demand or require minimal renovations.

- Access to Unique Assets: Auctions sometimes feature one-of-a-kind properties, offering investors a chance to acquire something truly special.

Maximizing Returns: Strategies for Tax Auction Success

To succeed in tax auctions, investors should consider the following strategies:

- Research and Due Diligence: Thoroughly research the properties, their locations, and market trends. Conduct a comprehensive due diligence process, including legal and financial checks.

- Set Clear Investment Goals: Define your investment objectives, whether it's capital growth, income generation, or a combination of both.

- Network and Build Relationships: Attend local auctions to network with experienced bidders and auctioneers. Building relationships can provide valuable insights and opportunities.

- Develop a Bidding Strategy: Determine your maximum bid price and stick to it. Consider the property's value, potential costs, and your desired return on investment.

- Be Prepared for Renovations: Many tax auction properties require renovations. Plan for these costs and ensure they fit within your investment strategy.

Navigating the Risks and Challenges

While tax auctions present exciting opportunities, they also come with risks. Investors should be aware of the following challenges:

- Limited Property Inspection: Bidders often have restricted access to properties before the auction, making it difficult to assess their true condition.

- Unknown Tenants or Squatters: Some properties may have tenants or squatters, which can complicate the process and require additional legal steps.

- Hidden Liens or Encumbrances: Properties might have undisclosed liens or encumbrances, which can impact their value and your ability to sell.

- Title Issues: Title defects or disputes can arise, potentially delaying the transfer of ownership.

Mitigating Risks: A Comprehensive Approach

To mitigate these risks, investors can take the following steps:

- Conduct a Professional Inspection: Engage a professional inspector to assess the property's condition, even if it requires additional fees.

- Check for Tenants or Squatters: Research the property's occupancy status and, if necessary, consult with legal professionals to understand your rights and responsibilities.

- Conduct Title Searches: Perform thorough title searches to identify any potential encumbrances or title defects.

- Consider Professional Advice: Consult with real estate attorneys or experienced investors to gain insights and guidance specific to your jurisdiction.

The Future of Tax Auctions: Trends and Insights

The tax auction landscape is evolving, with several notable trends and insights shaping the future of this market.

Online Auctions and Digital Platforms

The rise of online platforms and digital technologies has transformed the tax auction experience. Many auctions are now conducted entirely online, providing greater accessibility and convenience for bidders. This trend is expected to continue, with a growing number of auctions moving to digital platforms.

Increased Investor Awareness

As awareness of tax auctions grows, more investors are recognizing the potential opportunities. This increased interest can lead to more competitive bidding, but it also highlights the need for a well-informed investment strategy.

Government Initiatives and Reforms

Government authorities are increasingly recognizing the importance of tax auctions as a tool for recovering tax debts and revitalizing communities. Some jurisdictions are implementing reforms to streamline the process, making it more efficient and investor-friendly. These reforms can include improved transparency, better communication, and clearer guidelines for bidders.

How often do tax auctions occur?

+The frequency of tax auctions varies by jurisdiction. Some areas may hold auctions monthly, while others schedule them annually. It’s important to stay updated with local government announcements or subscribe to auction platforms for the latest information.

What happens if there are no bidders at a tax auction?

+If there are no successful bids, the property may be returned to the tax collector’s inventory and relisted for a future auction. In some cases, the government may lower the reserve price or initiate other measures to encourage bidding.

Are tax auctions a good investment option for beginners?

+Tax auctions can be complex and carry higher risks than traditional real estate investments. Beginners should approach them with caution and consider seeking guidance from experienced investors or real estate professionals.