Status Of New York State Tax Refund

As of January 2024, New York State is processing tax refunds for the 2023 tax year. The New York State Department of Taxation and Finance is committed to promptly processing refunds and aims to issue them within 45 days after receiving complete and accurate returns. However, various factors can impact the refund timeline, and it's essential to understand the status and progress of your refund.

Understanding the New York State Tax Refund Process

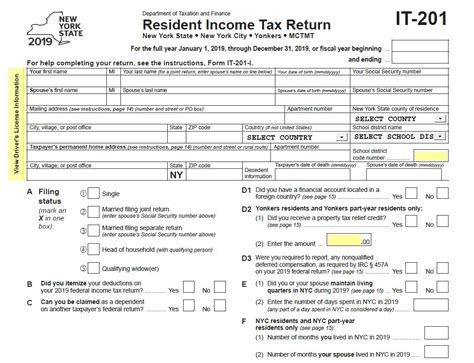

The New York State tax refund process involves several key stages. Once you file your tax return, the Department of Taxation and Finance reviews the information provided and verifies its accuracy. This initial review ensures that the refund calculation is correct and complies with state tax regulations.

After the review, the refund is scheduled for payment. The state aims to issue refunds within the aforementioned 45-day timeframe. However, it's important to note that this timeline is an estimate and can vary based on factors such as the complexity of your return, errors or discrepancies, and the volume of tax returns being processed.

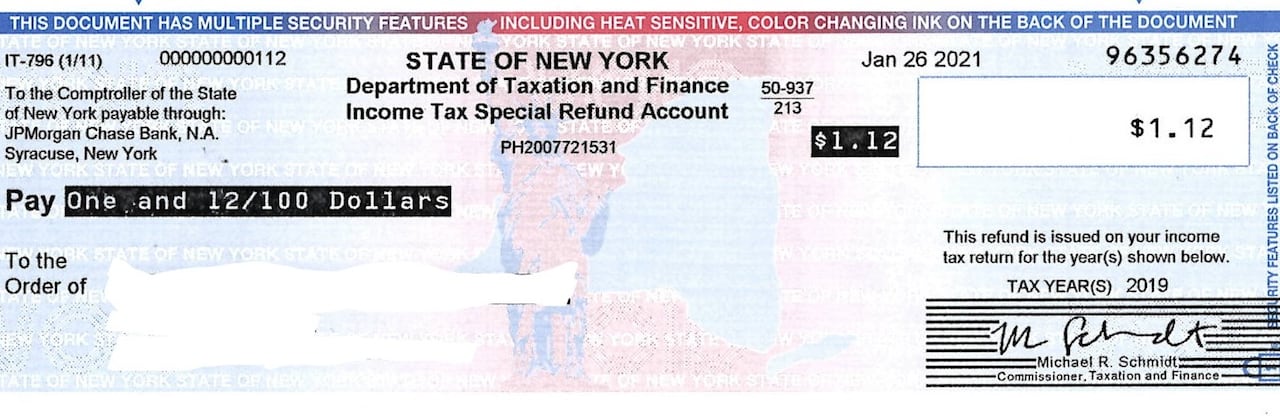

New York State offers various refund options, including direct deposit, check, and debit card. Direct deposit is the fastest and most secure method, with refunds typically appearing in your account within 10 days of the refund issuance date. Checks are mailed to the address provided on your tax return and can take slightly longer to receive.

Checking the Status of Your New York State Tax Refund

The New York State Department of Taxation and Finance provides several convenient ways to check the status of your tax refund. These options allow you to track the progress of your refund and stay informed about any potential delays.

Online Refund Lookup Tool

The online refund lookup tool is a quick and easy way to check your refund status. You can access this tool on the Department’s website by providing your Social Security Number, date of birth, and the exact amount of your refund. This tool provides real-time information about your refund, including its current status and estimated issuance date.

If you have not received your refund within the estimated timeframe, the online lookup tool can help identify potential issues. It may indicate that your return is being reviewed further, that additional information is required, or that there has been a processing delay. This information can help you take appropriate action and stay informed about the status of your refund.

Telephone Refund Hotline

For those who prefer a more personal approach, the Department offers a telephone refund hotline. You can call the hotline at (518) 485-7438 to speak with a representative who can provide an update on your refund status. The hotline is available Monday through Friday from 8:30 a.m. to 4:30 p.m. Eastern Time.

When calling the hotline, be prepared to provide your Social Security Number, date of birth, and the exact amount of your refund. The representative can verify your identity and provide you with the most up-to-date information regarding your refund's progress.

Written Refund Inquiries

If you prefer written communication, you can send a written inquiry to the Department of Taxation and Finance. Include your name, address, Social Security Number, and the tax year for which you are inquiring about your refund. Mail your inquiry to the following address:

New York State Department of Taxation and Finance

W.A. Harriman Campus

Albany, NY 12227

Allow for a processing time of approximately 30 days for written inquiries. The Department will respond to your inquiry with an update on the status of your refund.

Potential Delays and How to Address Them

While the New York State Department of Taxation and Finance strives to process refunds within the 45-day timeframe, there are instances where delays may occur. Understanding the potential causes of delays can help you take appropriate action and potentially expedite the refund process.

Errors and Discrepancies

One of the most common reasons for refund delays is errors or discrepancies on your tax return. If the Department identifies an issue with your return, it may require additional information or documentation to resolve the discrepancy. This can result in a temporary hold on your refund until the issue is resolved.

If you receive a notice from the Department requesting additional information, respond promptly. Provide the requested documents or information as soon as possible to avoid further delays. Ensure that you thoroughly review your tax return for accuracy before filing to minimize the risk of errors.

Identity Verification

In some cases, the Department may require additional identity verification to process your refund. This is a security measure to protect against fraud and ensure that refunds are issued to the rightful taxpayers.

If you are selected for identity verification, you will receive a notice explaining the process and the required steps. Typically, you will need to provide additional documentation, such as a copy of your driver's license or other government-issued ID, to verify your identity. Responding promptly to identity verification requests is crucial to avoid delays in receiving your refund.

Processing Backlogs

During peak tax seasons or in response to significant tax law changes, the Department may experience processing backlogs. These backlogs can result in longer wait times for refunds. While the Department works diligently to address these backlogs, it’s important to be patient and allow for additional time for your refund to be processed.

You can stay informed about processing times and potential delays by checking the Department's website or social media channels for updates. They often provide timely information about any ongoing issues or backlogs that may impact refund processing.

Tips for a Smooth Tax Refund Experience

To ensure a smooth tax refund experience, consider the following tips:

- File Electronically: Electronic filing is the most efficient way to submit your tax return. It reduces the risk of errors and ensures a faster processing time. Additionally, e-filing allows you to track your refund status more easily.

- Direct Deposit: Opt for direct deposit as your refund method. It is the fastest and most secure way to receive your refund, with funds typically available within 10 days of issuance.

- Review Your Return: Before submitting your tax return, carefully review it for accuracy. Ensure that all information, including your personal details, income, deductions, and credits, is correct. This helps minimize the risk of errors and potential delays.

- Stay Informed: Keep yourself updated on tax law changes and refund processing timelines. The Department's website and social media channels are excellent resources for staying informed about any ongoing issues or changes that may impact your refund.

- Respond Promptly: If you receive a notice from the Department requesting additional information or identity verification, respond promptly. Quick responses help expedite the refund process and prevent further delays.

Conclusion

Understanding the status of your New York State tax refund is crucial for financial planning and peace of mind. By utilizing the online lookup tool, telephone hotline, or written inquiries, you can stay informed about the progress of your refund. Remember to be vigilant about accuracy when filing your return and promptly respond to any requests from the Department.

While the Department aims for a timely refund process, delays can occur due to various factors. By staying informed and taking proactive steps, you can help ensure a smooth tax refund experience and receive your refund as promptly as possible.

Frequently Asked Questions

How long does it usually take to receive a New York State tax refund after filing?

+New York State aims to process refunds within 45 days after receiving complete and accurate returns. However, the actual timeframe can vary based on factors such as the complexity of your return and the volume of tax returns being processed.

What should I do if I haven’t received my refund within the estimated timeframe?

+If you haven’t received your refund within the estimated timeframe, check the status of your refund using the online lookup tool or call the telephone refund hotline. This will provide you with an update on the progress of your refund and identify any potential issues.

How can I track the status of my New York State tax refund online?

+To track your refund status online, visit the New York State Department of Taxation and Finance’s website and use the online refund lookup tool. You’ll need to provide your Social Security Number, date of birth, and the exact amount of your refund.

What if I’m selected for identity verification by the Department of Taxation and Finance?

+If you’re selected for identity verification, you’ll receive a notice from the Department explaining the process. Follow the instructions provided and promptly submit the required documentation to verify your identity. This is a security measure to protect against fraud and ensure your refund is issued correctly.

Can I receive my New York State tax refund via direct deposit?

+Yes, you can opt for direct deposit as your refund method. Direct deposit is the fastest and most secure way to receive your refund. Funds are typically available within 10 days of the refund issuance date.