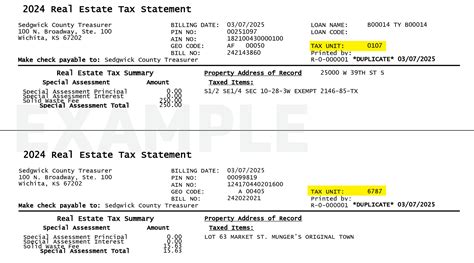

Sedgwick County Real Estate Taxes

Welcome to the comprehensive guide on Sedgwick County's real estate taxes. This article will delve into the intricacies of the tax system, providing you with a deep understanding of how it works and its impact on property owners. Whether you're a homeowner, investor, or simply curious about the local tax landscape, this article will offer valuable insights and expert analysis.

Understanding Sedgwick County’s Real Estate Tax Structure

Sedgwick County, located in the heart of Kansas, has a robust real estate market, and with it comes the responsibility of understanding the tax implications. The county’s tax system is designed to fund essential public services while ensuring fairness and transparency. Let’s explore the key aspects of Sedgwick County’s real estate taxes.

Tax Assessment Process

The journey of a property’s tax assessment begins with the Sedgwick County Appraiser’s Office. This office is responsible for determining the assessed value of each property within the county. The assessed value is not the same as the market value; instead, it is a carefully calculated estimate used for tax purposes.

The appraiser’s office employs a team of professionals who analyze various factors, including:

- Recent sales data of similar properties.

- Property improvements and upgrades.

- Market trends and economic conditions.

- Neighborhood characteristics and amenities.

Based on these factors, a taxable value is assigned to each property, which forms the basis for tax calculations.

| Assessment Year | Average Assessed Value |

|---|---|

| 2022 | $150,000 |

| 2023 | $155,200 |

It's important to note that Sedgwick County employs a three-year cycle for reassessing property values. This means that property owners can expect a new assessment every three years, ensuring that tax obligations remain aligned with the current market conditions.

Tax Rates and Calculations

Once the assessed value is determined, the real estate tax rate comes into play. In Sedgwick County, the tax rate is established by various taxing authorities, including the county government, school districts, and special taxing districts.

The tax rate is expressed as a mill levy, which represents the amount of tax owed per 1,000 of assessed value. For instance, a mill levy of 100 mills means that property owners pay 100 in taxes for every $1,000 of assessed value.

The calculation is straightforward: Assessed Value x Mill Levy = Tax Amount. Let’s illustrate this with an example:

| Property Details | Calculation |

|---|---|

| Assessed Value: $200,000 | $200,000 x 100 mills = $20,000 |

In this case, the property owner would owe $20,000 in real estate taxes for the year.

Tax Exemptions and Discounts

Sedgwick County offers a range of tax exemptions and discounts to eligible property owners, providing relief and incentives. These include:

- Homestead Exemption: Property owners who use their home as their primary residence can apply for a homestead exemption, which reduces the taxable value of their property.

- Senior Citizen Discount: Seniors aged 65 and older may qualify for a discount on their real estate taxes, based on their income and property value.

- Veteran’s Exemption: Veterans who meet certain criteria can receive an exemption, reducing their taxable value.

These exemptions and discounts aim to support specific segments of the community and encourage homeownership.

Performance and Impact Analysis

Sedgwick County’s real estate tax system has a significant impact on the local economy and property owners. Let’s examine some key aspects of its performance.

Revenue Generation and Allocation

Real estate taxes are a primary source of revenue for Sedgwick County, funding a wide range of public services and infrastructure projects. Here’s a breakdown of the revenue allocation:

- Education: A significant portion of real estate taxes goes towards funding public schools, ensuring quality education for local students.

- Public Safety: Taxes support the county’s police and fire departments, maintaining a safe community.

- Road Maintenance: A substantial amount is allocated to road repairs and improvements, benefiting residents and businesses alike.

- Health and Social Services: Tax revenue contributes to healthcare facilities, social programs, and community development initiatives.

Tax Burden and Affordability

While real estate taxes are essential for public services, the burden on property owners must be considered. Sedgwick County aims to maintain a balanced approach, ensuring that taxes remain affordable while generating sufficient revenue.

The county’s average effective tax rate, which is the actual tax paid as a percentage of a property’s market value, is relatively competitive compared to other counties in Kansas. This rate takes into account the assessed value, mill levy, and any applicable exemptions.

| County | Average Effective Tax Rate |

|---|---|

| Sedgwick County | 1.5% |

| Johnson County | 1.8% |

| Douglas County | 2.1% |

This data suggests that Sedgwick County's real estate taxes are among the more affordable options in the state, striking a balance between funding public services and property owner affordability.

Economic Impact and Investment

Sedgwick County’s real estate tax system plays a crucial role in attracting investments and fostering economic growth. Here’s how:

- Stable Funding: Consistent tax revenue ensures that essential services remain robust, creating a stable environment for businesses and residents.

- Infrastructure Development Improved roads, public transportation, and other infrastructure projects enhance the county’s appeal to investors and businesses.

- Community Development: Taxes support community initiatives, making Sedgwick County an attractive place to live and work.

Future Implications and Expert Insights

As we look ahead, several factors will influence the future of Sedgwick County’s real estate tax landscape. Here’s a glimpse into what industry experts anticipate.

Market Fluctuations and Reassessment

The county’s three-year reassessment cycle ensures that property values remain up-to-date. However, market fluctuations can impact tax obligations. Experts predict that the next reassessment, due in 2024, may see a slight increase in assessed values due to the recent housing market boom.

Property owners should stay informed about market trends and be prepared for potential adjustments in their tax obligations.

Exemption and Discount Changes

Sedgwick County’s tax exemptions and discounts are subject to periodic review and potential changes. Experts suggest that the county may consider expanding eligibility criteria for certain exemptions to support a broader range of property owners.

Staying informed about any proposed changes and their potential impact is crucial for property owners.

Technological Advancements

The tax industry is evolving, and Sedgwick County is embracing technological advancements to enhance its processes. The county is investing in digital platforms and tools to improve tax assessment accuracy and efficiency.

These advancements aim to streamline the tax assessment process, reduce administrative burdens, and provide property owners with a more transparent and user-friendly experience.

Conclusion

Sedgwick County’s real estate tax system is a well-designed framework that supports the community’s growth and development. From fair assessment processes to thoughtful tax rates and exemptions, the county strives to balance the needs of property owners and the community.

As an informed property owner, staying updated on tax-related matters is essential. By understanding the tax landscape, you can make informed decisions about your property and financial planning. Remember, knowledge is power when it comes to navigating the world of real estate taxes.

How often are property values reassessed in Sedgwick County?

+Property values are reassessed on a three-year cycle in Sedgwick County. This means that property owners can expect a new assessment every three years.

What is the average effective tax rate in Sedgwick County compared to other Kansas counties?

+Sedgwick County’s average effective tax rate is relatively competitive, sitting at 1.5%. This rate is lower than counties like Johnson County (1.8%) and Douglas County (2.1%).

Are there any ongoing initiatives to improve the tax assessment process in Sedgwick County?

+Yes, the county is actively investing in technological advancements to enhance the tax assessment process. These improvements aim to increase accuracy, efficiency, and transparency for property owners.

How can I stay informed about potential changes to tax exemptions and discounts in Sedgwick County?

+It’s important to stay updated by regularly checking the county’s official website and following local news sources. Additionally, attending public meetings and engaging with local government representatives can provide valuable insights into any proposed changes.

What resources are available to help property owners understand their tax obligations in Sedgwick County?

+The Sedgwick County Appraiser’s Office provides valuable resources, including guides, FAQs, and contact information. Additionally, local tax professionals and real estate agents can offer guidance and support.