San Antonio Sales Tax

When discussing sales tax, it's essential to understand that each jurisdiction has its own unique regulations and rates. In the case of San Antonio, Texas, the sales tax system is a complex yet vital component of the city's economic landscape. This comprehensive guide aims to unravel the intricacies of San Antonio's sales tax, providing a detailed analysis for businesses and consumers alike.

Understanding San Antonio’s Sales Tax Ecosystem

San Antonio, the vibrant city located in Bexar County, Texas, boasts a robust economy and a thriving business environment. The city’s sales tax structure is a key element in funding public services and infrastructure development. With a diverse tax system, San Antonio imposes various tax rates, depending on the type of goods or services being purchased.

The State and Local Sales Tax Rates

In San Antonio, the sales tax is composed of both state and local components. The state sales tax rate stands at 6.25%, which is a uniform rate applicable across the entire state of Texas. This state-level tax contributes to the overall revenue for essential state-wide services and projects.

However, the story doesn't end there. San Antonio, like many other cities in Texas, imposes an additional local sales tax, often referred to as the municipal sales tax or city sales tax. This local tax rate is 1.75%, bringing the total sales tax rate in San Antonio to 8% for most goods and services.

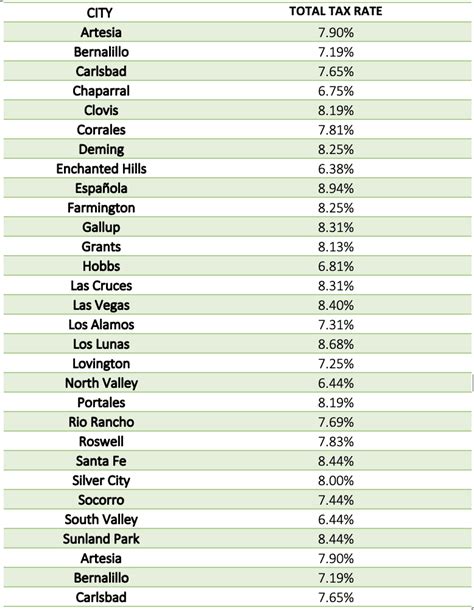

It's important to note that this local sales tax rate can vary across different cities and counties within Texas. For instance, neighboring cities like Austin or Corpus Christi may have slightly different local sales tax rates, leading to variations in the overall sales tax burden.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| San Antonio Local Sales Tax | 1.75% |

| Total Sales Tax in San Antonio | 8% |

Specialty Taxes and Exemptions

Beyond the standard sales tax, San Antonio also imposes specialty taxes on certain goods and services. These taxes are designed to fund specific initiatives or projects within the city. For example, a 0.25% tax is levied on the sale of certain prepared foods, with the proceeds dedicated to the San Antonio River Improvements Project.

Additionally, the city offers sales tax exemptions for certain purchases. This includes tax-exempt status for many essential items like groceries, prescription drugs, and some agricultural products. These exemptions aim to alleviate the tax burden on residents and promote accessibility to basic necessities.

| Specialty Tax | Rate | Purpose |

|---|---|---|

| Prepared Foods Tax | 0.25% | San Antonio River Improvements |

| Other Specialty Taxes | Varies | Various City Projects |

Compliance and Reporting: A Guide for Businesses

For businesses operating in San Antonio, compliance with the city’s sales tax regulations is non-negotiable. The city’s tax authority, in collaboration with the state, has stringent guidelines to ensure proper tax collection and reporting.

Registration and Permits

All businesses selling taxable goods or services in San Antonio are required to obtain a Sales and Use Tax Permit from the Texas Comptroller of Public Accounts. This permit serves as authorization to collect and remit sales tax to the state and local authorities.

The application process involves submitting necessary business documentation, including the completed Form 01-339 (Application for Permit to Collect Sales and Use Tax). Once approved, the business is issued a unique permit number, which must be displayed at the point of sale.

Tax Collection and Remittance

Businesses are responsible for collecting the appropriate sales tax on each taxable transaction. This involves calculating the total sales tax based on the applicable rates and adding it to the sale price. The collected tax is then held in trust by the business until it is remitted to the appropriate tax authorities.

The frequency of tax remittance depends on the business's tax liability. Generally, businesses with higher sales volumes are required to remit taxes more frequently (e.g., monthly or quarterly). Those with lower sales may remit annually. It's crucial for businesses to understand their remittance obligations to avoid penalties for late or incorrect payments.

Record-Keeping and Audits

Maintaining accurate records is a critical aspect of sales tax compliance. Businesses must keep detailed records of all sales transactions, including the tax collected on each sale. These records should be readily available for audit purposes.

The Texas Comptroller's office conducts regular audits to ensure businesses are correctly calculating and remitting sales tax. During an audit, businesses may be required to provide sales records, tax returns, and other financial documents. Failure to produce accurate records can result in penalties and additional tax liabilities.

Online Sales and Remote Sellers

With the rise of e-commerce, the sales tax landscape has evolved. San Antonio, like many cities, has regulations in place for online sales and remote sellers. These businesses are required to collect and remit sales tax based on the destination of the sale, even if they don’t have a physical presence in the city.

To facilitate compliance, the city provides resources and guidance for online businesses, including information on economic nexus and the Marketplace Fairness Act. By understanding these regulations, online businesses can ensure they are meeting their sales tax obligations accurately.

Consumer Perspective: Navigating San Antonio’s Sales Tax

For consumers in San Antonio, understanding the city’s sales tax system is essential for making informed purchasing decisions. The tax rates and exemptions can significantly impact the overall cost of goods and services.

Calculating Sales Tax on Purchases

When making a purchase in San Antonio, it’s important to consider the sales tax that will be added to the final price. The total sales tax rate, which combines the state and local rates, is 8% for most goods and services.

For instance, if you're purchasing a new laptop for $1,000, the sales tax would be calculated as follows: $1,000 x 8% = $80. This means the total cost of the laptop would be $1,080, including the sales tax.

Sales Tax on Specific Items

San Antonio’s sales tax structure varies depending on the type of item being purchased. Certain items, like groceries, prescription drugs, and some agricultural products, are exempt from sales tax, providing a significant savings for consumers.

On the other hand, specialty items like prepared foods may attract an additional tax. For instance, if you purchase a meal at a local restaurant, you may be charged an extra 0.25% tax, which is dedicated to the San Antonio River Improvements Project.

Comparing Prices and Savings

When shopping around San Antonio, it’s beneficial to compare prices across different retailers. The sales tax can significantly impact the final price, especially for higher-value items. By doing thorough research and comparing prices, consumers can make more cost-effective choices.

Additionally, understanding sales tax exemptions can lead to significant savings. For instance, purchasing groceries or essential medications at a tax-exempt retailer can result in substantial savings over time.

Online Shopping Considerations

For online shoppers in San Antonio, it’s important to note that sales tax is still applicable, even for purchases made from out-of-state retailers. The tax is calculated based on the destination of the sale, ensuring that San Antonio residents pay the appropriate tax rate.

Some online retailers provide a clear breakdown of the sales tax on their checkout page, making it easier for consumers to understand the final cost. Others may only display the tax after shipping information is entered, so it's essential to review the total cost before finalizing the purchase.

The Impact of Sales Tax on San Antonio’s Economy

Sales tax plays a pivotal role in shaping San Antonio’s economic landscape. The revenue generated from sales tax is a significant contributor to the city’s overall economic health and development.

Funding Public Services and Infrastructure

A substantial portion of the sales tax revenue in San Antonio is allocated towards funding essential public services. This includes maintaining and improving the city’s infrastructure, such as roads, bridges, and public transportation systems.

The sales tax also supports vital community services like police and fire departments, emergency services, and public health initiatives. By ensuring a stable source of revenue, the sales tax helps maintain the city's overall quality of life and standard of living.

Economic Development and Job Creation

The sales tax revenue in San Antonio also fuels economic development initiatives. The city uses these funds to attract new businesses, promote entrepreneurship, and support local industries. This, in turn, leads to job creation and a more robust local economy.

For instance, the 0.25% tax on prepared foods is dedicated to the San Antonio River Improvements Project, which aims to enhance the city's riverfront and create a vibrant, tourist-friendly destination. This project not only beautifies the city but also stimulates the local economy by attracting visitors and creating new business opportunities.

The Role of Sales Tax in Fiscal Planning

Sales tax revenue is a critical component of San Antonio’s fiscal planning. The city’s budget relies heavily on this revenue stream to fund a wide range of services and projects. By carefully managing and allocating sales tax revenue, the city can ensure a balanced budget and maintain its financial stability.

Additionally, the sales tax system in San Antonio provides a degree of economic stability. Unlike other forms of taxation, sales tax is less susceptible to economic downturns, as people continue to make essential purchases even during difficult economic times.

Future Trends and Potential Changes

As with any tax system, San Antonio’s sales tax structure is subject to potential changes and evolving trends. Staying informed about these developments is crucial for businesses and consumers to adapt and plan accordingly.

Potential Rate Adjustments

While the current sales tax rate in San Antonio stands at 8%, there is always the possibility of future rate adjustments. These changes could be driven by various factors, including economic conditions, budgetary needs, or shifts in political leadership.

For instance, during economic downturns, cities may consider increasing sales tax rates to generate additional revenue and support essential services. Conversely, in times of economic prosperity, cities may reduce rates to stimulate consumer spending and boost the local economy.

Specialty Tax Adjustments

Specialty taxes, like the 0.25% tax on prepared foods, may also be subject to adjustments. The city could decide to increase or decrease these rates based on the success and funding needs of specific projects or initiatives.

For example, if the San Antonio River Improvements Project requires additional funding, the city might consider increasing the specialty tax rate to accelerate the project's progress. Alternatively, if the project is on track and well-funded, the city might reduce the rate to provide some relief to consumers.

Online Sales and Tax Policy

The rise of e-commerce and online sales has presented unique challenges for tax policy. San Antonio, along with many other cities, is actively monitoring and adapting its tax regulations to accommodate this evolving landscape.

One potential trend is the increased focus on economic nexus and the remote seller concept. This means that even out-of-state businesses selling to San Antonio residents may be required to collect and remit sales tax, ensuring a fair and level playing field for local businesses.

Sales Tax Exemptions and Adjustments

Sales tax exemptions are another area that could see potential changes. The city may decide to expand or reduce the list of tax-exempt items based on various factors, including public demand, economic impact, and budgetary considerations.

For instance, if there is a push for environmental sustainability, the city might consider adding certain eco-friendly products to the list of tax-exempt items to encourage their adoption. Conversely, if certain tax-exempt items are found to have a negative impact on the city's budget, they might be removed from the exemption list.

Conclusion: A Comprehensive Guide to San Antonio’s Sales Tax

San Antonio’s sales tax system is a complex yet integral part of the city’s economic ecosystem. From funding essential public services to shaping the local business environment, sales tax plays a vital role in the city’s overall prosperity.

For businesses, understanding and complying with San Antonio's sales tax regulations is crucial for maintaining a healthy relationship with the city and its residents. Accurate tax collection and remittance not only ensure legal compliance but also contribute to the city's overall economic stability.

Consumers, on the other hand, benefit from a clear understanding of sales tax rates and exemptions. This knowledge empowers them to make informed purchasing decisions, maximize savings, and support local businesses and initiatives through their tax contributions.

As San Antonio continues to thrive and evolve, its sales tax system will undoubtedly play a pivotal role in shaping the city's future. By staying informed and engaged with the city's tax landscape, both businesses and consumers can contribute to San Antonio's ongoing success and prosperity.

What is the total sales tax rate in San Antonio, Texas?

+

The total sales tax rate in San Antonio is 8%, which includes the state sales tax rate of 6.25% and the local sales tax rate of 1.75%.

Are there any sales tax exemptions in San Antonio?

+

Yes, San Antonio offers sales tax exemptions for certain items such as groceries, prescription drugs, and some agricultural products. These exemptions aim to reduce the tax burden on essential goods and promote accessibility.

How often do businesses need to remit sales tax in San Antonio?

+

The frequency of sales tax remittance depends on the business’s tax liability. Generally, businesses with higher sales volumes are required to remit taxes more frequently (e.g., monthly or quarterly), while those with lower sales may remit annually.