Sales Tax Louisiana New Orleans

In the vibrant city of New Orleans, nestled within the state of Louisiana, the topic of sales tax can be a complex yet crucial aspect for both residents and businesses alike. Understanding the intricacies of sales tax in this unique city can provide valuable insights into the local economy and the overall financial landscape.

Unraveling the Sales Tax Landscape in New Orleans

Sales tax in New Orleans, much like the city’s diverse cultural offerings, is a multifaceted system that encompasses various layers of taxation. Let’s delve into the specifics to navigate this intricate web effectively.

The Louisiana Sales Tax Structure

Louisiana operates on a unique sales tax system, where both the state and local governments impose taxes on retail sales. This dual taxation system results in a combined sales tax rate that varies across the state, with New Orleans having its own distinct rate.

The state of Louisiana imposes a 4.45% sales tax rate, which serves as the base rate for all transactions. However, it's the local tax rate that adds an extra layer of complexity to the equation.

| Taxing Jurisdiction | Local Sales Tax Rate |

|---|---|

| New Orleans City | 5.00% |

| Orleans Parish | 0.50% |

When combined, the total sales tax rate applicable in New Orleans stands at 10.45%. This rate applies to most retail sales, including tangible personal property and certain services. It's important to note that there are specific exemptions and special tax rates for certain items, such as groceries and prescription drugs.

Understanding the Impact of Sales Tax

The sales tax rate in New Orleans can significantly influence consumer behavior and business strategies. For consumers, it means that the final price of goods and services can be substantially higher than the advertised price, impacting their purchasing power and overall budget planning.

From a business perspective, navigating the sales tax landscape is crucial for accurate pricing, compliance with tax regulations, and maintaining a competitive edge. Businesses in New Orleans must ensure they collect and remit the correct sales tax to avoid penalties and maintain their reputation.

Sales Tax Compliance and Enforcement

The Louisiana Department of Revenue is responsible for enforcing sales tax regulations and ensuring compliance. They have various tools and resources to assist businesses in understanding their obligations and responsibilities. This includes guidance on registration, tax collection, and remittance processes.

Businesses that fail to comply with sales tax regulations may face penalties, interest charges, and even legal consequences. It's essential for businesses to stay informed about their tax obligations and seek professional advice when needed.

Future Trends and Potential Changes

The sales tax landscape in Louisiana, including New Orleans, is subject to potential changes and updates. Factors such as economic conditions, political decisions, and consumer behavior can influence tax rates and policies.

In recent years, there have been discussions and proposals for tax reforms, including the potential for a simplified sales tax system. While these proposals aim to streamline the process and reduce administrative burdens, their implementation and impact remain uncertain.

Staying informed about any proposed changes and their potential effects is crucial for both consumers and businesses. It allows for proactive planning and adaptation to any new tax regulations that may arise.

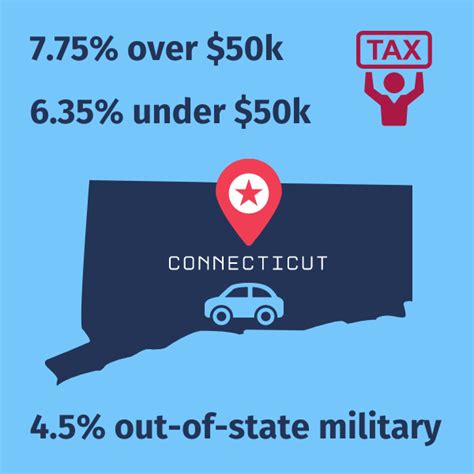

Comparative Analysis: Sales Tax in New Orleans vs. Other Cities

When compared to other major cities in the United States, New Orleans’ sales tax rate stands out as one of the highest. Cities like Chicago, Illinois, have a combined sales tax rate of 10.25%, while Los Angeles, California, has a rate of 9.50%. Even nearby cities like Baton Rouge, Louisiana, have a lower combined rate at 9.85%.

This higher sales tax rate in New Orleans can impact the city's competitiveness in attracting businesses and consumers. It may encourage consumers to make purchases outside the city limits or online, where they can avoid the higher tax rate.

However, it's important to consider the overall economic context and the unique advantages that New Orleans offers. The city's vibrant culture, tourism industry, and diverse business landscape contribute to its resilience and ability to adapt to changing tax environments.

Conclusion

Navigating the sales tax landscape in New Orleans requires a comprehensive understanding of the state and local tax rates, as well as the specific regulations and exemptions that apply. Both consumers and businesses must stay informed and adapt to any changes in the tax system to ensure compliance and maintain financial stability.

By staying abreast of the latest developments and utilizing tools like sales tax software, businesses can effectively manage their tax obligations and contribute to the vibrant economy of New Orleans. Consumers, too, can make informed purchasing decisions by considering the impact of sales tax on their overall expenses.

How often are sales tax rates updated in Louisiana?

+Sales tax rates in Louisiana are typically updated on a quarterly basis. The state and local governments may make adjustments to the tax rates based on various factors, including economic conditions and legislative decisions.

Are there any special tax rates for specific industries in New Orleans?

+Yes, certain industries in New Orleans may be subject to special tax rates or exemptions. For example, the hospitality industry often has specific tax rates for hotel and restaurant sales. It’s essential to consult the Louisiana Department of Revenue for industry-specific tax guidelines.

How can businesses ensure they are compliant with sales tax regulations in New Orleans?

+Businesses should register with the Louisiana Department of Revenue and obtain a sales tax permit. They should also stay informed about any changes in tax rates and regulations. Utilizing sales tax software and seeking professional advice can help ensure compliance and avoid penalties.