Is Car Registration Tax Deductible

When it comes to taxes and car ownership, many vehicle owners wonder whether the costs associated with registering their vehicles can be deducted on their tax returns. This article aims to provide a comprehensive guide to understanding the tax deductibility of car registration fees, exploring the factors that influence their deductibility, and offering insights into maximizing tax benefits for vehicle-related expenses.

Understanding Car Registration Fees

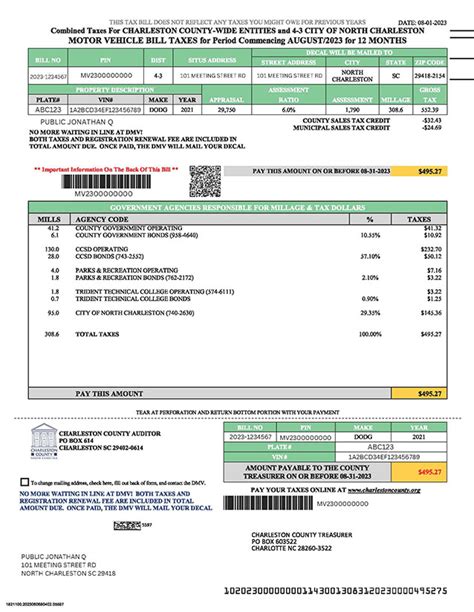

Car registration fees are mandatory expenses incurred by vehicle owners to legally operate their vehicles on public roads. These fees vary depending on several factors, including the type of vehicle, its age, and the jurisdiction in which it is registered. While registration fees are a necessary cost of vehicle ownership, their deductibility on tax returns is a matter of careful consideration and understanding of tax regulations.

Key Factors Influencing Deductibility

The deductibility of car registration fees is largely dependent on the primary use of the vehicle and the taxpayer’s eligibility for specific tax deductions or credits. Here are some key factors that play a role in determining the tax treatment of registration fees:

- Vehicle Usage: The primary purpose for which the vehicle is used is a crucial factor. If the vehicle is used exclusively for business purposes, such as for self-employment or as part of a trade or business, the registration fees may be deductible as a business expense. However, if the vehicle is used primarily for personal purposes, the deductibility of registration fees becomes more complex.

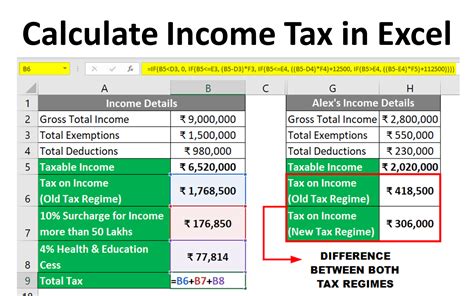

- Taxpayer Status: The taxpayer’s status, whether an individual or a business entity, can impact the deductibility of registration fees. For individuals, the Internal Revenue Service (IRS) has specific guidelines for deducting vehicle-related expenses, including registration fees, under certain circumstances.

- Business Deductions: If the vehicle is used for business purposes, taxpayers may be eligible for various business deductions, including depreciation, mileage, and operating expenses. The deductibility of registration fees may be incorporated into these business deductions, providing a tax benefit for business vehicle owners.

Analyzing Real-World Examples

To illustrate the concept of car registration fee deductibility, let’s consider a few scenarios:

- Business Vehicle: Jane operates a small business and uses her personal vehicle exclusively for business purposes, such as client meetings and deliveries. In this case, Jane can deduct the registration fees for her vehicle as a business expense, as the vehicle is essential to her business operations.

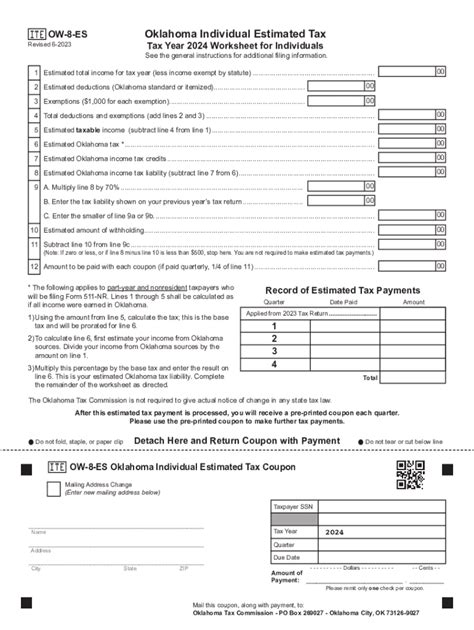

- Personal Vehicle with Business Use: John owns a personal vehicle that he uses partially for business purposes, such as occasional business trips and client meetings. In this scenario, John can deduct a portion of his registration fees based on the percentage of business use. He would need to calculate the business mileage and the corresponding registration fee allocation to claim this deduction.

- Solely Personal Vehicle: Emily owns a vehicle that she uses exclusively for personal purposes, such as commuting to work and running personal errands. In this case, the registration fees for Emily’s vehicle are not deductible as a business expense. However, she may still be able to claim other vehicle-related deductions if she meets certain criteria, such as using her vehicle for charitable purposes or as part of a qualifying medical expense.

Maximizing Tax Benefits for Vehicle Owners

Vehicle owners who wish to maximize their tax benefits should carefully track and document their vehicle-related expenses, including registration fees. Here are some strategies to consider:

- Business Use Records: If you use your vehicle for business purposes, maintain accurate records of your business mileage, including the dates, distances, and purposes of each trip. This documentation is essential for claiming business-related vehicle deductions, including registration fees.

- Deduction Eligibility: Stay informed about the latest tax regulations and guidelines regarding vehicle-related deductions. The IRS periodically updates its guidelines, so it’s crucial to stay up-to-date with any changes that may impact your eligibility for deducting registration fees.

- Consult a Tax Professional: Complex tax situations, especially those involving vehicle-related expenses, may benefit from the expertise of a qualified tax professional. They can provide personalized advice based on your specific circumstances and help maximize your tax benefits while ensuring compliance with tax laws.

Conclusion

The deductibility of car registration fees on tax returns depends on the primary use of the vehicle and the taxpayer’s eligibility for specific deductions or credits. By understanding the factors that influence deductibility and staying informed about tax regulations, vehicle owners can make informed decisions to maximize their tax benefits. Whether it’s claiming business deductions or exploring other eligible expenses, careful record-keeping and professional guidance can help navigate the complexities of tax deductions for vehicle owners.

FAQ

Can I deduct car registration fees if I use my vehicle for both business and personal purposes?

+

Yes, you can deduct a portion of your car registration fees if you use your vehicle for both business and personal purposes. To do this, you need to calculate the percentage of business use and apply that percentage to your registration fees. This allocation allows you to claim a deduction for the business-related portion of your registration costs.

Are there any limitations on the amount I can deduct for car registration fees as a business expense?

+

Yes, there are limitations on the deductibility of car registration fees as a business expense. The IRS sets specific guidelines and thresholds for various vehicle-related deductions. It’s important to stay within these limits and ensure that your deductions are supported by accurate records and documentation. Consulting with a tax professional can help you navigate these limitations and maximize your deductions while remaining compliant with tax regulations.

Can I deduct car registration fees if I use my vehicle for charitable purposes or as a volunteer?

+

Yes, if you use your vehicle for charitable purposes or as a volunteer, you may be eligible to deduct a portion of your car registration fees. The IRS allows taxpayers to claim certain deductions for charitable mileage, including registration fees. However, it’s important to note that specific guidelines and requirements apply to charitable deductions. To claim these deductions accurately, it’s recommended to consult with a tax professional or refer to official IRS guidelines for charitable contributions.