Sales Tax In La County California

Sales tax in Los Angeles County, California, is an essential aspect of the state's economy and revenue system. Understanding the sales tax structure and its implications is crucial for both businesses and consumers. This comprehensive guide aims to provide an in-depth analysis of the sales tax landscape in LA County, offering valuable insights and practical information.

The Complex Web of Sales Tax in LA County

The sales tax system in California, and particularly in Los Angeles County, is intricate and multifaceted. It involves various tax rates, jurisdictions, and regulations that can be challenging to navigate. Here’s a detailed breakdown of the key elements:

Sales Tax Rates

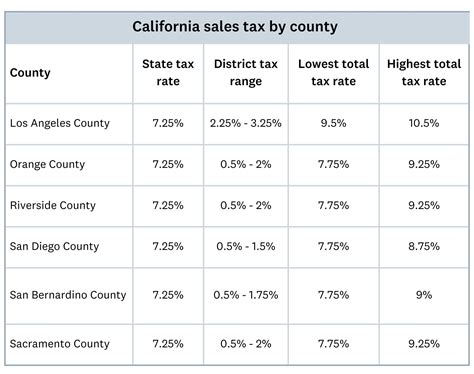

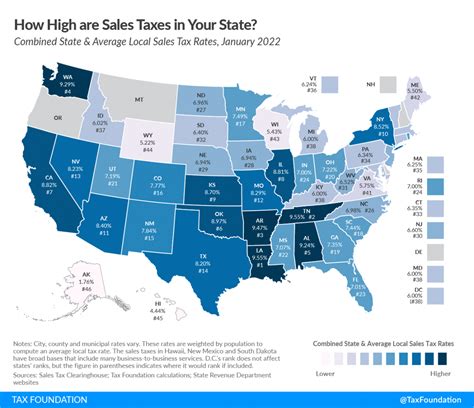

Sales tax rates in LA County are comprised of several components, including state, county, and city taxes. The base state sales tax rate is set at 7.25%, but this is just the beginning. Each county, and sometimes even specific cities within a county, can add their own additional tax rates. For instance, Los Angeles County levies an extra 0.25% sales tax, bringing the total to 7.5% for most transactions within the county.

However, the complexity doesn't end there. Cities within LA County often have their own city sales tax on top of the state and county rates. For example, the city of Los Angeles imposes an additional 1% tax, resulting in a total sales tax rate of 8.5% for goods purchased within city limits. Other cities like Beverly Hills and Santa Monica have their unique tax rates, making the sales tax landscape in LA County highly diverse.

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Los Angeles County | 0.25% |

| Los Angeles City | 1% |

| Beverly Hills | 1.5% |

| Santa Monica | 1% |

Taxable Goods and Services

Not all goods and services are subject to the same sales tax rates. California has a comprehensive list of taxable goods and services, which includes most retail items, rentals, and certain services. However, there are also specific exemptions and zero-rated items, such as groceries, prescription medications, and certain agricultural products.

For instance, the sales tax on prepared food (e.g., restaurant meals) is often higher than the general sales tax rate, while unprepared food items (e.g., groceries) are typically exempt from sales tax. This distinction can lead to variations in pricing and tax calculations, especially for businesses in the food industry.

Sales Tax Collection and Remittance

Businesses operating in LA County have a responsibility to collect and remit sales tax on behalf of the state and local governments. This process involves accurate record-keeping, regular tax filings, and timely payments to the California Department of Tax and Fee Administration (CDTFA). Failure to comply with these obligations can result in penalties and legal consequences.

For out-of-state sellers, the California use tax comes into play. This tax is applicable when goods are purchased from a seller who doesn't collect sales tax, typically online retailers. Buyers are responsible for self-reporting and paying the use tax to the state.

The Impact of Sales Tax on Businesses and Consumers

The sales tax structure in LA County has significant implications for both businesses and consumers. Let’s explore these impacts in detail.

Business Considerations

For businesses operating in LA County, navigating the complex sales tax system is a critical aspect of their financial operations. Here are some key considerations:

- Tax Compliance: Ensuring compliance with sales tax regulations is essential to avoid penalties and legal issues. This involves accurate tax calculation, proper tax collection, and timely remittance to the CDTFA.

- Price Strategy: The varying sales tax rates across different cities and jurisdictions can impact a business's pricing strategy. Companies must carefully consider these rates when setting prices to remain competitive and profitable.

- Tax Software and Services: To simplify the tax compliance process, many businesses utilize specialized sales tax software or engage tax professionals. These tools and services can help streamline tax calculations, filings, and payments.

- Tax Registration: Businesses must obtain the necessary sales tax permits and registrations from the CDTFA. This process involves providing detailed information about the business, its locations, and the goods or services it offers.

Consumer Perspective

Consumers in LA County are also significantly affected by the sales tax system. Here’s how it impacts their daily lives:

- Price Awareness: Understanding the sales tax rates in different areas can help consumers make informed purchasing decisions. For example, a consumer might choose to shop in a city with a lower sales tax rate to save money.

- Budgeting and Planning: Sales tax can significantly impact a consumer's budget, especially for large purchases. Knowing the sales tax rates in advance can aid in financial planning and decision-making.

- Online Shopping: When shopping online, consumers should be aware of the California use tax. They may need to self-report and pay this tax if they purchase goods from out-of-state sellers who don't collect sales tax.

- Sales Tax Holidays: California occasionally offers sales tax holidays, during which certain items are exempt from sales tax for a limited time. These events can provide significant savings for consumers and boost sales for businesses.

Future Implications and Potential Changes

The sales tax landscape in LA County and California as a whole is subject to change and evolution. Several factors can influence future developments, including political decisions, economic trends, and technological advancements.

Potential Sales Tax Reforms

There have been ongoing discussions and proposals for sales tax reforms in California. Some of the potential changes include:

- Simplification of Tax Rates: Simplifying the tax structure by reducing the number of jurisdictions with unique tax rates could make the system more transparent and easier to navigate for businesses and consumers.

- Expansion of Taxable Goods: To increase revenue, the state might consider expanding the list of taxable goods and services. This could include items like digital products or certain services that are currently exempt.

- Online Sales Tax Collection: With the growth of e-commerce, there's a push to ensure that online retailers collect and remit sales tax. This would level the playing field between brick-and-mortar and online businesses.

Technological Advancements

The integration of technology in the sales tax system can bring about significant changes. For instance, the use of blockchain technology could enhance transparency and efficiency in tax collection and remittance processes. Additionally, AI-powered tax software can automate many tax-related tasks, reducing the risk of errors and improving compliance.

Economic Impact

Changes in the sales tax system can have a notable economic impact. For example, increasing the sales tax rate could lead to a shift in consumer behavior, potentially impacting sales and revenue for businesses. On the other hand, simplifying the tax structure might encourage economic growth by reducing administrative burdens on businesses.

Conclusion

The sales tax system in LA County is a complex but essential component of the local economy. Understanding its intricacies is crucial for both businesses and consumers to navigate the market effectively. As the landscape continues to evolve, staying informed about potential changes and their implications will be vital for all stakeholders.

What is the sales tax rate in Los Angeles County, California, for 2023?

+The sales tax rate in Los Angeles County for 2023 is 7.5%. This rate is comprised of the base state sales tax rate of 7.25% and an additional 0.25% county tax. However, it’s important to note that cities within LA County may have their own unique sales tax rates on top of this.

Are there any sales tax holidays in California?

+Yes, California occasionally offers sales tax holidays. These are specific periods when certain items, such as clothing or school supplies, are exempt from sales tax. These holidays can provide significant savings for consumers and boost sales for businesses.

How often do sales tax rates change in LA County?

+Sales tax rates in LA County can change annually, usually effective from July 1st of each year. These changes are typically decided by local government bodies and can vary depending on the specific jurisdiction.

What happens if a business doesn’t collect and remit sales tax correctly in LA County?

+Businesses that fail to collect and remit sales tax correctly in LA County can face penalties and legal consequences. These may include fines, interest charges, and even criminal prosecution in severe cases. It’s crucial for businesses to understand their tax obligations and ensure compliance.

Are there any resources available to help businesses navigate the sales tax system in LA County?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides a wealth of resources to assist businesses in understanding and complying with sales tax regulations. This includes guides, webinars, and a help desk for specific inquiries. Additionally, many tax professionals and software providers offer tailored solutions for businesses navigating the complex sales tax landscape.