How To Get Previous Tax Returns

Tax returns are an essential part of financial record-keeping and often become crucial when applying for loans, claiming deductions, or simply understanding one's financial history. Retrieving previous tax returns can be a straightforward process, but it does require some knowledge of the available methods and the necessary steps to take. This guide will provide an in-depth analysis of the process, offering a comprehensive understanding of how to access and obtain past tax returns.

Understanding the Importance of Tax Returns

Before delving into the retrieval process, it’s essential to grasp the significance of tax returns. These documents serve as a detailed record of an individual’s or business’s financial activities for a specific tax year. They contain information such as income, deductions, credits, and tax liabilities, providing a snapshot of one’s financial situation during that period.

Tax returns are not only essential for tax compliance but also play a vital role in various financial transactions. For instance, when applying for a mortgage or a business loan, lenders often require several years of tax returns to assess an applicant's financial stability and earning capacity. Similarly, when filing an amended return or claiming a refund, having access to previous tax returns is crucial.

Moreover, tax returns can be invaluable for personal financial planning. They can help individuals identify trends in their income, expenses, and deductions, allowing for more informed decision-making regarding investments, retirement planning, and tax strategies. In essence, tax returns are a wealth of financial information that can guide both present and future financial choices.

Methods to Retrieve Previous Tax Returns

Retrieving previous tax returns can be achieved through several methods, each with its own advantages and potential limitations. Understanding these methods is key to a successful retrieval process.

1. Using the IRS Online Tools

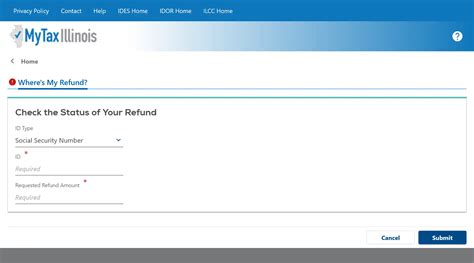

The Internal Revenue Service (IRS) provides several online tools that can be used to retrieve past tax returns. One of the most convenient methods is through the Get Transcript Online service. This service allows taxpayers to access their tax transcripts, which are essentially summaries of their tax returns, for the current tax year and up to the past three years. To access this service, taxpayers need to create an account on the IRS website, which involves providing personal and financial information for verification.

Another online tool offered by the IRS is the Get Transcript by Mail service. This option allows taxpayers to request their tax transcripts by providing their name, address, and other personal details. The transcripts are then mailed to the taxpayer's address on file with the IRS. While this method may take longer than the online option, it can be a more secure way to retrieve sensitive tax information.

Additionally, the IRS offers the Taxpayer Assistance Center (TAC) service, where taxpayers can visit a local IRS office and request their tax transcripts in person. This method may be more convenient for those who prefer face-to-face interactions or have complex tax situations.

2. Requesting Copies from the IRS by Mail

If online methods are not preferred or feasible, taxpayers can request copies of their tax returns directly from the IRS by mail. To do this, taxpayers need to complete and mail Form 4506, Request for Copy of Tax Return, to the appropriate IRS office. This form requires detailed information about the tax return being requested, including the tax year, filing status, and the taxpayer’s personal information.

The IRS processes these requests and mails the requested tax returns to the taxpayer's address on file. It's important to note that there may be a fee associated with this service, and it can take several weeks for the IRS to process the request and deliver the tax returns.

3. Utilizing Tax Preparation Software

Many popular tax preparation software providers offer features that allow taxpayers to retrieve and access their previous tax returns. These software tools often store tax return data securely and allow users to revisit and review their past filings. Some software even provides tools to analyze and compare data across different tax years, offering valuable insights into financial trends.

When using tax preparation software, it's crucial to ensure that the data is securely stored and backed up. Additionally, taxpayers should verify that the software provider they choose is reputable and offers robust security measures to protect their sensitive financial information.

4. Contacting a Tax Professional

For those who find the process of retrieving tax returns complex or time-consuming, engaging a tax professional can be a viable option. Certified Public Accountants (CPAs) and enrolled agents (EAs) have access to specialized software and tools that can simplify the retrieval process. They can also provide guidance and assistance in understanding and utilizing the retrieved tax returns.

Tax professionals can often access and download tax returns directly from the IRS, saving taxpayers the time and effort of navigating the process themselves. They can also offer insights and advice on how to utilize the information in the tax returns for future financial planning and tax strategies.

Performance Analysis and Best Practices

While the methods outlined above provide various avenues to retrieve previous tax returns, certain best practices can enhance the efficiency and security of the process.

1. Maintaining Organized Records

One of the simplest yet most effective ways to facilitate the retrieval of tax returns is to maintain organized records. Taxpayers should consider keeping digital and physical copies of their tax returns in a secure and easily accessible location. This practice can significantly streamline the retrieval process, especially when faced with an urgent need for past tax return data.

Digital storage solutions, such as cloud-based storage platforms or dedicated tax return storage software, can offer added convenience and security. These platforms often provide features like data encryption and backup, ensuring that tax return data is protected and readily available.

2. Understanding the IRS Retrieval Process

Familiarizing oneself with the IRS retrieval process can help taxpayers navigate the system more efficiently. Understanding the requirements, such as the need for accurate personal and financial information, can expedite the process. Additionally, being aware of potential delays, such as those caused by high volume periods or system updates, can help taxpayers plan accordingly.

The IRS website provides detailed information on the various methods of retrieving tax returns, including step-by-step guides and frequently asked questions. Taxpayers are encouraged to review this information to ensure a smooth and timely retrieval process.

3. Regularly Updating Contact Information

Maintaining accurate and up-to-date contact information with the IRS is crucial for several reasons. Firstly, it ensures that taxpayers receive important notices and updates from the IRS, such as those related to tax return processing or potential delays.

Secondly, having accurate contact information on file with the IRS is essential for the successful delivery of tax transcripts or copies of tax returns requested by mail. Inaccurate or outdated contact information can lead to delays or misdelivery, which can be particularly problematic when taxpayers are facing time-sensitive financial decisions.

Future Implications and Potential Challenges

As technology advances and the tax landscape evolves, the process of retrieving tax returns is likely to undergo further changes and improvements. Here are some potential future implications and challenges that taxpayers may encounter.

1. Enhanced Digital Security Measures

With the increasing prevalence of cyber threats, tax authorities and software providers are likely to implement more robust digital security measures. This could include the use of advanced encryption technologies, multi-factor authentication, and biometric verification to protect sensitive tax data.

While these measures will enhance security, they may also introduce additional steps and complexities to the retrieval process. Taxpayers will need to adapt to these new security protocols, ensuring they have the necessary tools and knowledge to navigate the enhanced security landscape.

2. Integration of Blockchain Technology

Blockchain technology, known for its decentralized and secure nature, has the potential to revolutionize the tax return retrieval process. By leveraging blockchain, tax authorities could create a secure and tamper-proof digital ledger of tax returns, providing an immutable record of tax data.

While the integration of blockchain technology could bring significant benefits, it may also present challenges. Taxpayers may need to adapt to new systems and learn how to access and utilize their tax return data within a blockchain-based infrastructure. Additionally, the implementation of blockchain technology may require significant infrastructure updates and investments by tax authorities.

3. Increased Automation and AI Integration

The tax industry is increasingly embracing automation and artificial intelligence (AI) to streamline processes and enhance efficiency. This trend is likely to continue, with AI being integrated into various aspects of tax return retrieval, including data extraction, analysis, and verification.

While AI integration can bring significant improvements in speed and accuracy, it may also present challenges. Taxpayers may need to provide more detailed and structured data to facilitate automated processes, and there may be a learning curve associated with interacting with AI-powered systems.

| Retrieval Method | Advantages | Potential Challenges |

|---|---|---|

| IRS Online Tools | Convenience, accessibility, quick turnaround | Potential for delays during peak periods, need for online access and verification |

| Request by Mail | Simple process, no need for online access | Potential delays, cost associated, need for accurate and complete Form 4506 |

| Tax Preparation Software | Easy access, often includes analysis tools, secure storage | Cost associated, need for reliable software and data backup |

| Tax Professional Assistance | Expert guidance, efficient process, access to specialized tools | Cost associated, need to find a reputable tax professional |

How long does it take to receive tax returns via mail from the IRS?

+

The IRS typically takes 45 to 60 days to process requests for tax returns by mail. However, this timeframe can vary based on factors such as the volume of requests, the completeness of the request form, and any potential issues with the taxpayer’s information.

Can I retrieve tax returns from more than three years ago using the IRS online tools?

+

Yes, while the IRS online tools primarily provide access to tax transcripts for the current tax year and the past three years, taxpayers can also request copies of older tax returns by completing and mailing Form 4506. This form allows taxpayers to request tax returns from any year they were filed.

What if I need to retrieve tax returns for a deceased family member or a business entity that is no longer operational?

+

In such cases, the process can be more complex. For deceased individuals, the IRS requires specific documentation, such as a copy of the death certificate and a signed statement by the executor or personal representative. For business entities, the IRS may require additional documentation, such as a letter of authorization from the business owner or a notice of termination from the state.

Are there any fees associated with retrieving tax returns from the IRS?

+

Yes, there is a fee for requesting copies of tax returns by mail. As of the time of writing, the fee is $43 per return, with a limit of two returns per request. There are no fees for accessing tax transcripts online or through the mail. However, fees are subject to change, so it’s advisable to check the IRS website for the most up-to-date information.

How can I ensure the security of my tax return data when using online tools or tax preparation software?

+

When using online tools or tax preparation software, it’s crucial to choose reputable providers that offer robust security measures. Look for platforms that use encryption, two-factor authentication, and secure data storage practices. Additionally, regularly update your passwords and avoid accessing sensitive tax information on public networks.