Richland County Taxes

Welcome to our comprehensive guide on Richland County Taxes, where we delve into the intricate world of taxation within this vibrant region. As an expert in the field, I aim to provide you with an in-depth analysis, ensuring you understand the nuances of Richland County's tax system and how it impacts residents, businesses, and the local economy.

Understanding Richland County’s Tax Structure

Richland County, known for its diverse economy and thriving communities, has a unique tax structure that plays a vital role in funding essential services and driving economic development. This section will break down the key components of the county’s tax system, providing a clear picture of how taxes are assessed, collected, and utilized.

Property Taxes: A Cornerstone of Revenue

Property taxes are a significant source of revenue for Richland County. The county assesses property values based on various factors, including location, improvements, and market trends. The ad valorem tax system ensures that property owners contribute fairly to the local tax base. Here’s a breakdown of the property tax process:

- Assessment: Properties are evaluated annually by the Richland County Assessor's Office. This involves physical inspections, research, and consideration of recent sales data to determine fair market values.

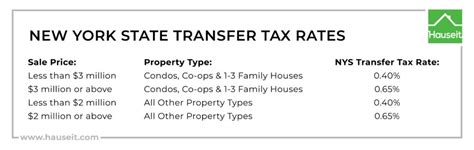

- Tax Rates: The county council sets tax rates, which are applied to the assessed value of properties. These rates vary depending on the property type (residential, commercial, or agricultural) and the specific tax district.

- Collection: Property taxes are typically due in two installments, with deadlines in June and December. Late payments incur penalties and interest, ensuring timely revenue collection.

- Distribution: The collected property tax revenue is distributed to various entities, including the county government, school districts, and special districts. These funds support essential services like education, public safety, infrastructure, and social programs.

| Property Type | Average Tax Rate | Major Tax Recipients |

|---|---|---|

| Residential | 1.5% - 2.0% | County Government, School Districts |

| Commercial | 1.8% - 2.5% | County Government, Economic Development |

| Agricultural | 1.2% - 1.6% | Special Agricultural Districts, County Government |

It's worth noting that Richland County offers tax incentives and exemptions to encourage economic growth and support certain industries. For instance, the county's economic development initiatives may provide tax breaks for new businesses or those investing in specific sectors.

Sales and Use Taxes: Capturing Economic Activity

Sales and use taxes are another crucial component of Richland County’s tax revenue. These taxes are imposed on the sale of goods and services within the county and are collected from both residents and visitors. Here’s an overview of how sales and use taxes function in Richland County:

- Sales Tax: Richland County, like many other counties, levies a sales tax on most retail transactions. The rate is set by the county council and is applied to the purchase price of goods and services. Currently, the sales tax rate in Richland County is 6%.

- Use Tax: The use tax is similar to the sales tax but applies to goods purchased outside the county and brought into Richland County for use. This ensures that all economic activity within the county is taxed fairly.

- Collection and Distribution: Sales and use taxes are collected by businesses at the point of sale and remitted to the South Carolina Department of Revenue. The revenue is then distributed to various state and local entities, with a significant portion allocated to Richland County.

- Economic Impact: Sales and use taxes are a critical source of funding for public services, infrastructure projects, and economic development initiatives. They contribute to the overall financial health of the county and support the community's growth and prosperity.

Other Taxes and Fees: A Diverse Revenue Stream

In addition to property and sales taxes, Richland County relies on a range of other taxes and fees to fund its operations and initiatives. These include:

- Accommodation Tax: A tax levied on hotel and lodging stays, providing revenue for tourism promotion and infrastructure improvements.

- Vehicle Registration Fees: Fees collected when registering vehicles contribute to transportation infrastructure and public safety initiatives.

- Business License Fees: Businesses operating within Richland County are required to obtain licenses and pay associated fees, supporting economic development and regulatory compliance.

- Special Taxes and Assessments: Depending on the location within the county, there may be additional taxes or assessments for specific services or infrastructure projects.

Tax Incentives and Economic Development

Richland County understands the importance of attracting and retaining businesses to drive economic growth. As such, the county offers a range of tax incentives and programs aimed at supporting business development and job creation.

Tax Credits and Incentives

The Richland County Economic Development Office works closely with businesses to offer a variety of tax credits and incentives. These incentives are tailored to the unique needs of each business and can include:

- Job Tax Credits: Businesses creating new jobs may be eligible for tax credits based on the number of full-time employees hired.

- Investment Tax Credits: Companies investing in new equipment, technology, or facilities can receive tax credits to offset the costs.

- Research and Development Tax Credits: Richland County encourages innovation by offering tax credits for research and development activities.

- Enterprise Zones: Certain areas within the county are designated as enterprise zones, offering reduced tax rates and other incentives to businesses operating within these zones.

Economic Development Initiatives

Richland County actively promotes economic growth through various initiatives. These efforts include:

- Business Incubation: The county supports business incubation centers, providing resources and mentorship to startup businesses.

- Workforce Development: Collaboration with educational institutions and training programs ensures a skilled workforce, attracting businesses to the region.

- Infrastructure Improvements: Investing in transportation, communication, and utility infrastructure enhances the county's competitiveness and attracts investment.

- Business Support Services: Richland County offers a range of support services, including business consulting, permitting assistance, and access to financing options.

Case Study: Success Through Tax Incentives

One notable example of Richland County’s successful tax incentive program is the attraction of a major technology company. By offering a combination of tax credits, reduced tax rates, and support for infrastructure development, the county was able to secure a significant investment from the company. This led to the creation of hundreds of high-paying jobs and a substantial boost to the local economy.

Tax Relief and Assistance Programs

Recognizing the financial challenges that some residents and businesses face, Richland County has implemented various tax relief and assistance programs. These initiatives aim to provide support and ensure that taxes remain manageable for all members of the community.

Property Tax Relief Programs

Richland County offers several property tax relief programs to assist eligible homeowners and businesses. These programs include:

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the assessed value of their property for tax purposes.

- Senior Citizen Tax Relief: Richland County provides tax relief to senior citizens based on income and property value, ensuring that older residents can afford to stay in their homes.

- Disability Tax Relief: Individuals with disabilities may be eligible for tax relief, helping them manage the financial burden of property ownership.

- Veteran's Tax Exemption: Veterans and their surviving spouses may qualify for property tax exemptions, as a way to honor their service and support their financial well-being.

Tax Payment Assistance

For residents and businesses facing financial difficulties, Richland County offers assistance with tax payments. This can include:

- Payment Plans: Eligible taxpayers can arrange payment plans to pay their taxes over time, making it more manageable to meet their tax obligations.

- Hardship Waivers: In cases of severe financial hardship, Richland County may offer waivers or reductions on late payment penalties and interest.

- Tax Abatement Programs: Certain programs allow for the reduction or deferral of taxes for specific properties or circumstances, such as renovation or redevelopment projects.

Community Outreach and Education

Richland County is committed to ensuring that all residents understand their tax obligations and are aware of the available relief programs. The county conducts regular outreach and education initiatives, including:

- Tax Workshops: Community events and workshops provide information on tax laws, filing requirements, and available relief programs.

- Online Resources: The Richland County website offers a wealth of information, including tax forms, deadlines, and details on tax relief programs.

- Personalized Assistance: Taxpayers can schedule appointments with county officials to receive one-on-one guidance and assistance with their specific tax situations.

The Future of Taxation in Richland County

As Richland County continues to evolve and grow, the tax system will play a pivotal role in shaping its future. Here, we explore some key considerations and potential developments that may impact the county’s tax landscape.

Technological Advancements in Tax Administration

Richland County is embracing technological advancements to streamline tax administration and improve efficiency. This includes:

- Online Tax Filing: Residents and businesses can now file their taxes online, reducing paperwork and improving accuracy.

- Digital Payment Options: Taxpayers have the convenience of paying their taxes online, through secure payment portals.

- Data Analytics: Richland County is utilizing data analytics to identify trends, detect potential tax fraud, and improve overall tax compliance.

Economic Trends and Tax Revenues

The county’s economic health and growth directly impact tax revenues. As Richland County continues to attract new businesses and industries, the tax base will likely expand. This can lead to:

- Increased Property Values: As the economy thrives, property values may rise, leading to higher property tax revenues.

- Diversification of Tax Revenue: With a growing economy, the county may see an increase in sales tax revenue and a shift in the tax burden away from property owners.

- Economic Development Initiatives: Continued investment in economic development initiatives can attract more businesses, creating a sustainable tax base.

Tax Policy Reforms and Equity

Richland County is committed to maintaining a fair and equitable tax system. As such, the county may explore policy reforms to address any potential disparities or gaps in the current system. This could include:

- Reassessment of Tax Rates: Periodic reviews of tax rates to ensure they remain fair and aligned with the county's economic realities.

- Tax Reform Initiatives: Exploring options such as a shift towards a more progressive tax system or the implementation of new tax policies to promote social and economic equity.

- Community Engagement: Engaging with residents and businesses to gather feedback and ensure that tax policies reflect the needs and values of the community.

Conclusion

Richland County’s tax system is a dynamic and integral part of the local economy, funding essential services and driving economic growth. Through a balanced approach to taxation, the county ensures that residents, businesses, and the community as a whole thrive. As we’ve explored, the county’s commitment to tax incentives, relief programs, and future-oriented initiatives positions it well for continued success.

Whether you're a resident, a business owner, or simply interested in the inner workings of local government, understanding Richland County's tax system is essential. By delving into the intricacies of property taxes, sales taxes, and the various other components, we hope to have provided a comprehensive guide to this complex yet crucial aspect of community life.

What is the average property tax rate in Richland County?

+The average property tax rate in Richland County varies depending on the property type and location. Residential properties typically have a rate of around 1.5% to 2.0%, commercial properties range from 1.8% to 2.5%, and agricultural properties are assessed at 1.2% to 1.6%.

Are there any tax incentives for businesses in Richland County?

+Yes, Richland County offers a range of tax incentives to attract and support businesses. These incentives include job tax credits, investment tax credits, research and development tax credits, and reduced tax rates in designated enterprise zones.

How does Richland County support economic development?

+Richland County promotes economic development through various initiatives, such as business incubation centers, workforce development programs, infrastructure improvements, and business support services. These efforts aim to create a favorable business environment and attract investment.

What tax relief programs are available for residents?

+Richland County offers several tax relief programs for residents, including homestead exemptions, senior citizen tax relief, disability tax relief, and veteran’s tax exemptions. These programs aim to make property taxes more manageable for eligible individuals.

How can residents stay informed about tax deadlines and requirements?

+Residents can stay informed by visiting the Richland County website, which provides detailed information on tax deadlines, forms, and relief programs. The county also conducts outreach events and workshops to educate residents about their tax obligations and available assistance.