Resale Tax Id

The world of reselling and e-commerce is thriving, and with it comes the need for understanding the intricacies of taxation. One crucial aspect that resellers often encounter is the requirement for a Resale Tax ID. This unique identifier plays a pivotal role in the tax landscape, ensuring compliance and smooth operations for businesses engaged in reselling activities. In this comprehensive guide, we'll delve deep into the concept of the Resale Tax ID, its significance, and its implications for resellers across various platforms.

Unveiling the Resale Tax ID: A Crucial Tool for Resellers

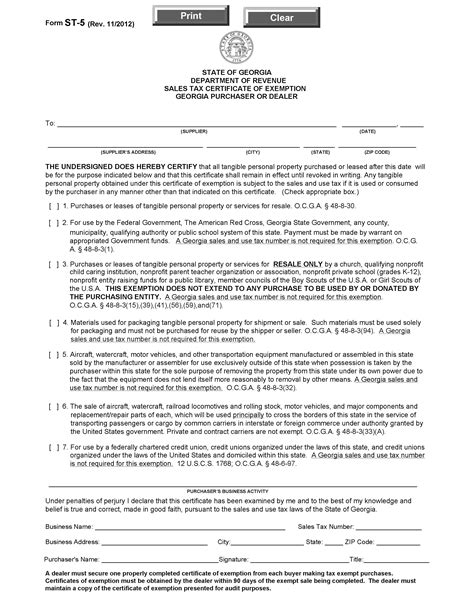

In the dynamic realm of reselling, where goods change hands frequently and transactions occur across multiple platforms, the Resale Tax ID emerges as a critical tool for managing tax obligations. Officially known as the Resale Certificate or Seller’s Permit, this ID is a unique identifier assigned to businesses engaged in reselling goods. It serves as a testament to the business’s legitimacy and its compliance with tax regulations.

The Resale Tax ID is a legal requirement in many jurisdictions, particularly for businesses involved in the buying and selling of tangible goods. It is an essential component of the sales tax system, facilitating the collection and remittance of taxes on behalf of the government. By obtaining this ID, resellers assert their commitment to ethical business practices and ensure a transparent relationship with tax authorities.

Understanding the Scope: Who Needs a Resale Tax ID?

The necessity for a Resale Tax ID arises for a wide range of businesses, from traditional brick-and-mortar stores to modern e-commerce platforms and online marketplaces. Here’s a breakdown of the key entities that typically require this identification:

- Retail Stores: Physical stores that sell tangible goods, such as clothing boutiques, electronics retailers, and specialty shops, often need a Resale Tax ID to operate legally.

- Online Marketplaces: Sellers on popular e-commerce platforms like Amazon, eBay, and Etsy may require a Resale Tax ID, especially if they are based in jurisdictions with stringent tax regulations.

- Wholesale Businesses: Wholesale distributors and suppliers who buy goods from manufacturers and resell them to retailers often operate under a Resale Tax ID to manage their tax liabilities.

- Flea Market Vendors: Individuals or businesses that sell goods at flea markets, craft fairs, or other temporary markets may also need a Resale Tax ID, depending on local regulations.

- Online Resellers: Individuals or businesses that buy and sell items online, whether through their own websites or social media platforms, may be required to obtain a Resale Tax ID.

It's important to note that the specific requirements for obtaining a Resale Tax ID can vary significantly based on the jurisdiction and the nature of the business. Some states or countries may have more lenient regulations, while others may impose stricter guidelines.

The Application Process: How to Obtain a Resale Tax ID

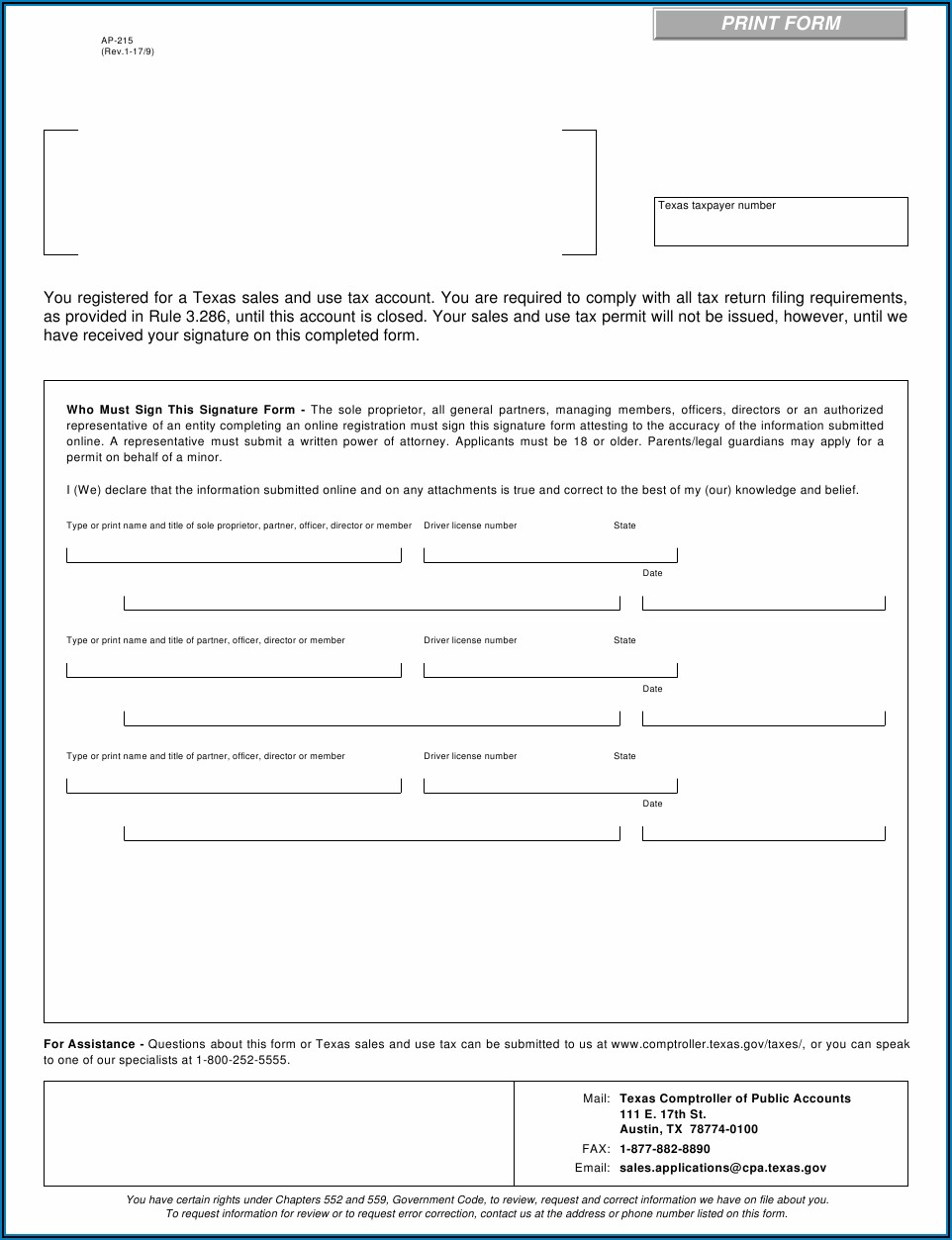

The process of acquiring a Resale Tax ID is typically straightforward but varies depending on the jurisdiction. Here’s a general overview of the steps involved:

- Research Local Regulations: Begin by understanding the tax laws and regulations in your specific jurisdiction. This includes knowing the requirements for obtaining a Resale Tax ID, the associated fees, and any deadlines for registration.

- Determine Eligibility: Assess whether your business activities align with the criteria for requiring a Resale Tax ID. This may involve considering the type of goods sold, the frequency of transactions, and the nature of your business operations.

- Gather Required Documentation: Prepare the necessary documents, which may include business licenses, articles of incorporation, or other business-related paperwork. Some jurisdictions may also require personal identification documents.

- Complete the Application: Fill out the official application form, which can usually be found on the website of the relevant tax authority. Ensure that all information is accurate and complete to avoid delays in processing.

- Submit the Application: Submit your application and supporting documents either online, by mail, or in person, depending on the options provided by the tax authority.

- Await Processing: The processing time for Resale Tax ID applications can vary. While some jurisdictions may provide immediate approval, others may take several weeks. Be patient and ensure you have the necessary documentation ready if additional information is requested.

- Receive Your Resale Tax ID: Once your application is approved, you will receive your Resale Tax ID, which may be in the form of a physical certificate or a unique identification number.

It's crucial to keep your Resale Tax ID up-to-date and renew it as required by your jurisdiction's regulations. Failure to maintain a valid Resale Tax ID can result in penalties and legal consequences.

Implications for Resellers: Navigating Tax Obligations

Obtaining a Resale Tax ID is just the first step in managing tax obligations for resellers. Here’s an overview of how this ID impacts various aspects of your business:

- Sales Tax Collection: With a Resale Tax ID, you are authorized to collect sales tax from your customers. This tax is then remitted to the appropriate tax authority, ensuring compliance with tax laws.

- Purchase Tax Exemption: One of the primary benefits of a Resale Tax ID is the ability to purchase goods tax-free. When making wholesale purchases, you can present your Resale Tax ID to the supplier, allowing you to avoid paying sales tax on the goods you intend to resell.

- Record-Keeping: Maintaining accurate records is crucial when operating with a Resale Tax ID. You must keep track of all sales and purchases, ensuring that tax obligations are calculated correctly and that you have the necessary documentation to support your transactions.

- Reporting and Remittance: Depending on your jurisdiction's regulations, you may be required to file periodic sales tax returns and remit the collected taxes to the tax authority. Staying on top of these deadlines is essential to avoid penalties.

- Audits and Compliance: In the event of an audit, having a Resale Tax ID and accurate records can demonstrate your commitment to tax compliance. It is important to understand the audit process and be prepared to provide the necessary documentation.

Navigating the tax landscape as a reseller can be complex, but with a clear understanding of your obligations and the proper tools like the Resale Tax ID, you can ensure smooth operations and maintain a positive relationship with tax authorities.

The Future of Resale Tax IDs: Adapting to Changing Tax Landscapes

As the world of e-commerce and reselling continues to evolve, so too do the tax regulations that govern these industries. Resale Tax IDs are an essential component of this evolving landscape, and their importance is only expected to grow. Here’s a glimpse into the future implications of Resale Tax IDs:

Expanding E-Commerce Platforms

The rise of e-commerce platforms has revolutionized the way goods are bought and sold. With the increasing popularity of online marketplaces, the need for Resale Tax IDs is likely to expand. As more resellers operate online, tax authorities will need to adapt their regulations to accommodate these platforms and ensure compliance.

For resellers, this means staying informed about any changes to tax laws that may impact their online activities. Keeping abreast of these developments will help ensure that they remain compliant and avoid any unexpected tax liabilities.

International Reselling

With the ease of global shipping and the rise of cross-border e-commerce, many resellers are expanding their operations internationally. This presents a unique challenge when it comes to tax obligations, as different countries have varying tax regulations.

Resellers engaged in international trade will need to navigate the complexities of foreign tax laws and obtain the necessary Resale Tax IDs or equivalent documentation in each country they operate in. This may involve working with local tax advisors or consultants to ensure compliance and avoid any potential legal issues.

Tax Automation and Technology

The tax landscape is increasingly being shaped by technology, with tax authorities and businesses alike adopting innovative solutions to streamline tax processes. This trend is likely to continue, with more tax authorities embracing digital platforms and automation to improve efficiency and compliance.

For resellers, this means leveraging technology to stay organized and compliant. Tax software and automation tools can help with record-keeping, tax calculation, and filing, making it easier to manage tax obligations alongside the day-to-day operations of a thriving resale business.

Collaborative Efforts for Compliance

As the tax landscape becomes more complex, there is a growing recognition of the need for collaboration between tax authorities, businesses, and industry associations. This collaborative approach can help clarify tax regulations, provide guidance to businesses, and ensure a more uniform application of tax laws.

Resellers can benefit from engaging with industry associations and tax professionals who specialize in their specific sector. These experts can provide valuable insights into the latest tax developments and best practices for compliance, helping resellers navigate the ever-changing tax landscape with confidence.

What is the difference between a Resale Tax ID and a Sales Tax Permit?

+While the terms “Resale Tax ID” and “Sales Tax Permit” are often used interchangeably, there can be subtle differences in their usage and purpose. In general, a Resale Tax ID is a broader term that encompasses the identification and authorization required for resellers to operate legally. It includes the right to collect and remit sales tax from customers and to purchase goods tax-free from suppliers. On the other hand, a Sales Tax Permit is a specific type of Resale Tax ID that focuses solely on the collection and remittance of sales tax. It is typically used by businesses that primarily sell goods to end consumers and need to collect sales tax on their transactions.

Are there any alternatives to obtaining a Resale Tax ID?

+The requirement for a Resale Tax ID is generally non-negotiable for businesses engaged in reselling tangible goods. However, there may be alternative options depending on the jurisdiction and the specific nature of your business. For example, some states offer exemptions for small businesses or for certain types of transactions. It’s important to research and understand the specific regulations in your area to determine if any alternatives apply to your situation.

How long does a Resale Tax ID remain valid?

+The validity period of a Resale Tax ID can vary depending on the jurisdiction. Some states or countries may issue Resale Tax IDs with a set expiration date, typically ranging from one to five years. In such cases, it is crucial to renew your Resale Tax ID before it expires to maintain your legal status as a reseller. Other jurisdictions may issue indefinite Resale Tax IDs, which remain valid until you cease business operations or face legal action for non-compliance.

What are the consequences of operating without a Resale Tax ID?

+Operating a resale business without a valid Resale Tax ID can have serious legal and financial consequences. Tax authorities may impose fines, penalties, and even criminal charges for non-compliance. Additionally, you may be liable for unpaid taxes, interest, and penalties on past transactions. In some cases, your business may be subject to audits, which can be time-consuming and costly. To avoid these issues, it is crucial to obtain a Resale Tax ID and maintain compliance with tax regulations.