Sales Tax Suffolk County Ny

In the vibrant state of New York, sales tax regulations play a crucial role in shaping the economic landscape, and understanding these intricacies is essential for businesses and consumers alike. This article delves into the specifics of sales tax in Suffolk County, New York, providing a comprehensive guide to help navigate this complex yet vital aspect of commerce.

Sales Tax Basics in Suffolk County, NY

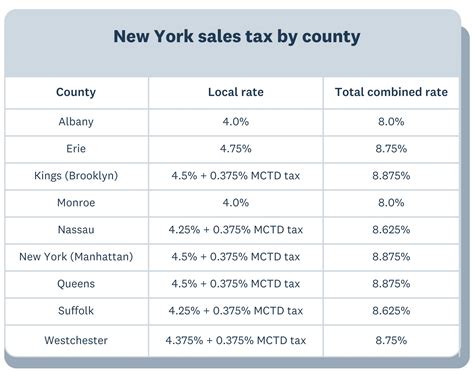

Suffolk County, situated on the eastern end of Long Island, is a dynamic region with a unique sales tax structure. The state of New York imposes a base sales tax rate, but counties and municipalities have the authority to levy additional taxes, leading to varying rates across the state.

As of the latest information available, the current sales tax rate in Suffolk County is 8.625%, which includes both the state and local taxes. This rate is subject to change, and it's essential to stay updated with any modifications to ensure compliance.

Components of Suffolk County Sales Tax

The sales tax rate in Suffolk County is composed of several components, each with its own specific rate:

- State Sales Tax: The state of New York levies a sales tax of 4% on most goods and services.

- Suffolk County Sales Tax: The county adds an additional 4.25% to the state rate, bringing the total to 8.25%.

- Local Municipality Tax: Depending on the specific municipality within Suffolk County, there may be an additional tax ranging from 0.125% to 0.375%. This variation results in the total sales tax rate ranging from 8.375% to 8.625% across the county.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 4% |

| Suffolk County Sales Tax | 4.25% |

| Local Municipality Tax | 0.125% - 0.375% |

| Total Sales Tax | 8.375% - 8.625% |

It's important to note that these rates are subject to change, and businesses operating in Suffolk County should regularly check for updates to ensure accurate tax collection and reporting.

Sales Tax Exemptions and Special Considerations

While the standard sales tax rate applies to most goods and services, there are certain exemptions and special considerations in Suffolk County, NY. These exemptions can significantly impact the tax obligations of businesses and consumers.

Exemptions from Sales Tax

Certain items and transactions are exempt from sales tax in Suffolk County. These exemptions are outlined in the New York State Tax Law and include:

- Prescription Drugs: Medications purchased with a valid prescription are exempt from sales tax.

- Groceries: Most non-prepared food items, including staple foods and beverages, are exempt from sales tax.

- Clothing and Footwear: Items of clothing and footwear priced under $110 are exempt from sales tax, providing a tax break for essential items.

- Educational Materials: Sales tax does not apply to books, maps, and other educational materials used in schools.

- Manufacturing Equipment: Machinery and equipment used directly in manufacturing processes are exempt, encouraging investment in industry.

It's crucial for businesses to stay updated with the specific exemptions applicable to their industry to ensure compliance and avoid overcharging customers.

Special Considerations for Tourism and Entertainment

Suffolk County, with its picturesque beaches and vibrant cultural scene, attracts a significant number of tourists. To accommodate the unique needs of the tourism industry, there are special considerations in sales tax regulations:

- Hotel and Lodging Tax: In addition to the standard sales tax, a hotel occupancy tax is levied on lodging establishments. This tax varies depending on the municipality and can range from 3% to 6% of the room rate.

- Admission Tax: Businesses charging admission fees for entertainment, such as movie theaters, amusement parks, and sporting events, are subject to an additional tax. This tax is typically 4% of the admission price.

These special considerations aim to generate revenue for the county while providing a fair tax structure for the tourism and entertainment industries.

Sales Tax Collection and Reporting for Businesses

For businesses operating in Suffolk County, NY, understanding the sales tax collection and reporting process is crucial. Accurate tax collection ensures compliance with state and local regulations and builds trust with customers.

Sales Tax Registration

All businesses engaged in taxable sales in Suffolk County must register with the New York State Department of Taxation and Finance. This registration process ensures that businesses are authorized to collect and remit sales tax.

Taxable Sales and Transactions

Businesses should identify taxable sales and transactions to ensure proper tax collection. Taxable sales include the sale of tangible personal property, certain services, and admissions. It’s important to understand the specific regulations applicable to each industry to avoid non-compliance.

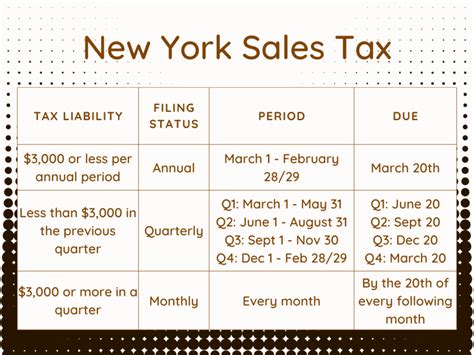

Sales Tax Remittance

Businesses are required to remit the collected sales tax to the state and local authorities on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly filings. Late or inaccurate remittances can result in penalties and interest charges.

Sales Tax Returns

In addition to remitting the collected sales tax, businesses must also file sales tax returns. These returns provide a detailed breakdown of taxable sales, exemptions, and the calculated tax liability. The deadline for filing sales tax returns is typically one month after the end of the reporting period.

Online Sales and Remote Sellers

With the rise of e-commerce, online sales have become a significant part of the retail landscape. Remote sellers, even those located outside New York, may be required to collect and remit sales tax on transactions with Suffolk County residents. This is known as economic nexus, and businesses should stay updated with the latest regulations to avoid potential legal issues.

Consumer Rights and Responsibilities

Consumers in Suffolk County, NY, have rights and responsibilities when it comes to sales tax. Understanding these rights ensures a fair and transparent shopping experience.

Understanding Sales Tax on Receipts

When making a purchase, consumers have the right to know the sales tax amount included in the total price. Retailers are required to clearly indicate the tax amount on the receipt, ensuring transparency and helping consumers understand their total expenditure.

Sales Tax Refunds and Exemptions

Consumers who are exempt from sales tax, such as certain government entities or non-profit organizations, have the right to claim a refund for the tax paid. The process involves providing valid documentation and following the refund procedures outlined by the state and local authorities.

Reporting Sales Tax Violations

Consumers play a crucial role in maintaining compliance with sales tax regulations. If a consumer suspects a retailer of not charging or remitting the correct sales tax, they have the right and responsibility to report the violation to the New York State Department of Taxation and Finance. This helps ensure fair competition and protects honest businesses.

Conclusion: Navigating Sales Tax in Suffolk County, NY

Understanding the sales tax regulations in Suffolk County, NY, is a vital aspect of doing business in this vibrant region. From the varying tax rates to the specific exemptions and special considerations, businesses and consumers alike must stay informed to ensure compliance and fairness.

By staying updated with the latest regulations, utilizing sales tax automation tools, and being mindful of consumer rights, businesses can navigate the complex world of sales tax with confidence. Consumers, too, can make informed choices and understand their rights when it comes to sales tax.

As Suffolk County continues to thrive economically, a solid understanding of sales tax regulations will contribute to the overall success and sustainability of the local businesses and the community.

What is the current sales tax rate in Suffolk County, NY?

+The current sales tax rate in Suffolk County, NY, is 8.625%, including both state and local taxes. This rate is subject to change, and businesses and consumers should stay updated with any modifications.

Are there any sales tax exemptions in Suffolk County, NY?

+Yes, there are several sales tax exemptions in Suffolk County. These include prescription drugs, groceries, clothing and footwear under $110, educational materials, and manufacturing equipment. Understanding these exemptions is crucial for businesses to ensure compliance.

How often do businesses need to remit sales tax in Suffolk County, NY?

+The frequency of sales tax remittance depends on the business’s sales volume. Businesses with higher sales volumes may be required to remit sales tax on a monthly basis, while others may remit quarterly. Late or inaccurate remittances can result in penalties.

What are the consequences of not collecting or remitting sales tax in Suffolk County, NY?

+Failure to collect or remit sales tax in Suffolk County, NY, can result in significant penalties and interest charges. Additionally, it may lead to legal consequences and damage the business’s reputation. It’s crucial for businesses to stay compliant with sales tax regulations.

How can consumers in Suffolk County, NY, ensure they are not overcharged for sales tax?

+Consumers in Suffolk County, NY, can ensure they are not overcharged for sales tax by checking their receipts for the correct tax amount. If they suspect overcharging, they have the right to report the issue to the New York State Department of Taxation and Finance.