Pw County Property Tax

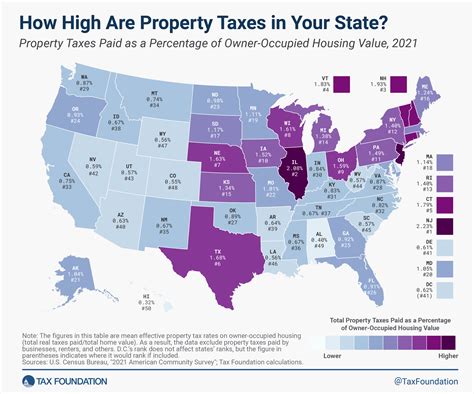

Property taxes are an essential component of local government revenue, playing a crucial role in funding public services and infrastructure. In Prince William County, Virginia, property taxes are a significant source of funding for schools, public safety, and various community initiatives. This article aims to delve into the intricacies of Pw County property taxes, providing an in-depth analysis of the assessment process, tax rates, and the overall impact on homeowners and the community.

Understanding the Property Tax Assessment Process in Pw County

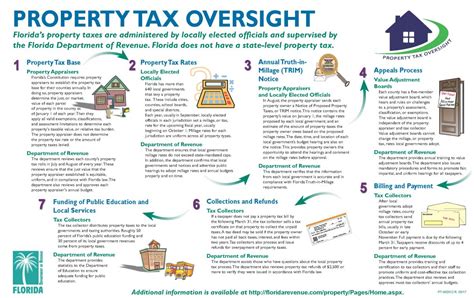

The assessment process is a vital aspect of property taxation, ensuring that the tax burden is distributed fairly among property owners. In Pw County, the Department of Finance and Real Estate Assessments is responsible for conducting assessments to determine the value of each property within the county.

The assessment process typically occurs once every five years, with the most recent reassessment taking place in 2021. During this process, assessors visit each property to evaluate its physical characteristics, including size, condition, and any improvements made since the last assessment. This data is then used to calculate the property's assessed value, which forms the basis for tax calculations.

To maintain transparency and fairness, Pw County provides an online tool where property owners can access detailed information about their assessment, including the assessed value, previous assessments, and any changes made during the current assessment cycle. This allows homeowners to understand the factors influencing their property tax bill and facilitates a more informed appeal process if necessary.

Factors Influencing Property Assessments

Several factors come into play when determining the assessed value of a property in Pw County. These include:

- Market Value: The primary consideration is the property's market value, which reflects the price it would likely fetch in an open market transaction.

- Physical Characteristics: Assessors consider the property's size, number of rooms, age, and overall condition. Upgrades or improvements, such as additions or renovations, can impact the assessed value.

- Location: The property's location within the county, including its proximity to amenities, schools, and transportation hubs, can significantly influence its value.

- Sales Data: The county regularly analyzes sales data to ensure assessments align with market trends. This data helps assessors identify any disparities and make necessary adjustments.

By considering these factors, the assessment process aims to provide an accurate and fair valuation of each property, ensuring that property taxes are distributed equitably among homeowners.

Pw County Property Tax Rates and Calculations

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the property tax bill. In Pw County, property taxes are levied by multiple taxing authorities, including the county government, local school districts, and special districts.

The overall tax rate is a combination of these various rates, which can vary based on the location of the property within the county. As of the 2022-2023 fiscal year, the combined tax rate for Prince William County is $1.32 per $100 of assessed value. This rate consists of:

| Taxing Authority | Tax Rate |

|---|---|

| Prince William County | $0.75 per $100 |

| Prince William County Schools | $0.51 per $100 |

| Special Districts (e.g., Fire & Rescue, Water & Sewer) | Varies based on location |

For example, a property with an assessed value of $300,000 in Prince William County would have a tax bill of approximately $3,960 for the year, calculated as follows:

Assessed Value: $300,000 Combined Tax Rate: $1.32 per $100 Property Tax = ($300,000 / 100) * $1.32 = $3,960

It's important to note that the tax rates and calculations can change annually, influenced by factors such as budgetary needs and economic conditions. Homeowners can refer to the official tax rate pages provided by Pw County for the most up-to-date information.

Property Tax Relief Programs

Pw County offers several property tax relief programs to assist eligible homeowners. These programs aim to reduce the tax burden for specific categories of homeowners, including seniors, disabled individuals, and veterans.

- Homestead Exemption: This program provides a $250 reduction in the taxable value of a primary residence for eligible homeowners. To qualify, individuals must meet certain income and residency requirements.

- Senior Citizen Real Estate Tax Relief: Seniors aged 65 and above who meet specific income and residency criteria may be eligible for a partial or full exemption from property taxes. This program aims to ease the financial burden on older homeowners.

- Veteran Exemption: Qualifying veterans may be entitled to a partial or full exemption from property taxes. The level of exemption depends on the veteran's disability status and other factors.

These relief programs demonstrate Pw County's commitment to supporting its residents and ensuring that property taxes remain manageable for those facing financial challenges.

Impact of Property Taxes on the Pw County Community

Property taxes are a vital source of revenue for Pw County, funding essential services and infrastructure that benefit the entire community. The revenue generated from property taxes supports:

- Education: A significant portion of property tax revenue is allocated to local schools, ensuring that students have access to quality education and necessary resources.

- Public Safety: Property taxes fund police, fire, and emergency services, ensuring the safety and well-being of residents.

- Infrastructure Development: The county uses property tax revenue to maintain and improve roads, bridges, and other public infrastructure, enhancing the quality of life for residents.

- Community Initiatives: Property taxes contribute to various community programs, such as parks and recreation, cultural events, and social services, fostering a vibrant and cohesive community.

By investing in these areas, Pw County creates a thriving environment that attracts residents and businesses, leading to economic growth and a high quality of life.

Frequently Asked Questions

When are property tax bills mailed out in Pw County?

+

Property tax bills are typically mailed out in late August or early September. Homeowners are encouraged to pay their taxes by November 15 to avoid any penalties or interest charges.

How can I appeal my property assessment in Pw County?

+

If you disagree with your property assessment, you have the right to appeal. The process involves submitting an application to the Board of Equalization, providing evidence to support your claim, and attending a hearing. It’s advisable to consult the Pw County website for detailed instructions and deadlines.

Are there any online resources to estimate my property taxes in Pw County?

+

Yes, Pw County provides an online property tax estimator tool. This tool allows homeowners to input their property details and receive an estimated tax bill based on the current tax rates.

Can I pay my property taxes online in Pw County?

+

Absolutely! Pw County offers convenient online payment options through its official website. Homeowners can pay their taxes using a credit card, debit card, or electronic check.