Property Tax New Jersey

Welcome to the comprehensive guide on Property Tax in New Jersey, a topic that affects every homeowner and real estate investor in the Garden State. In this expert-level article, we will delve into the intricacies of property taxation, exploring the unique aspects of New Jersey's system, its impact on residents, and the strategies to navigate this essential aspect of homeownership.

Understanding Property Tax in New Jersey

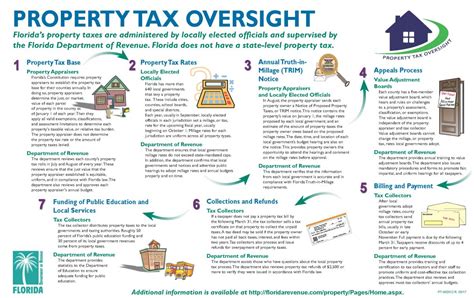

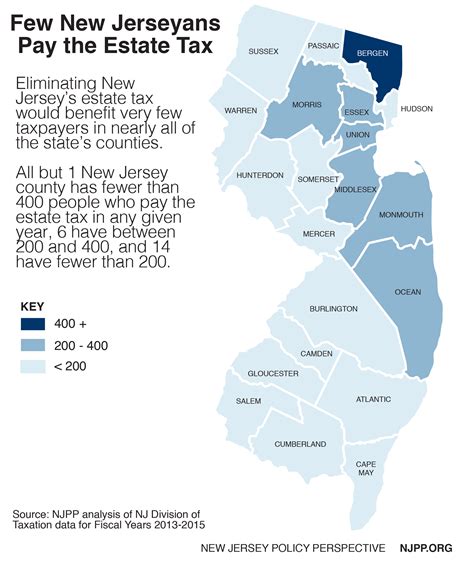

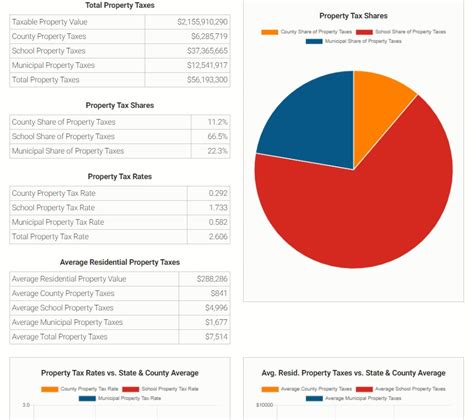

Property tax is a significant component of the tax system in New Jersey, contributing to the state’s revenue and funding various public services. The state’s property tax system is known for its complexity, with assessments, rates, and exemptions varying across counties and municipalities. Understanding this system is crucial for homeowners and investors alike.

The Role of Assessments

Property assessments play a pivotal role in determining the tax liability for each property. In New Jersey, the assessment process involves evaluating the property’s market value and assigning a taxable value. This assessment is typically conducted by local assessors, who consider factors such as location, size, condition, and recent sales data. The assessed value forms the basis for calculating the property tax.

To illustrate, let's consider a hypothetical scenario. Imagine a single-family home in Monmouth County. The assessor evaluates the property's features and recent sales of similar homes in the area. Based on this data, they determine an assessed value of $400,000. This assessed value will be crucial in calculating the property tax liability.

Tax Rates and Variations

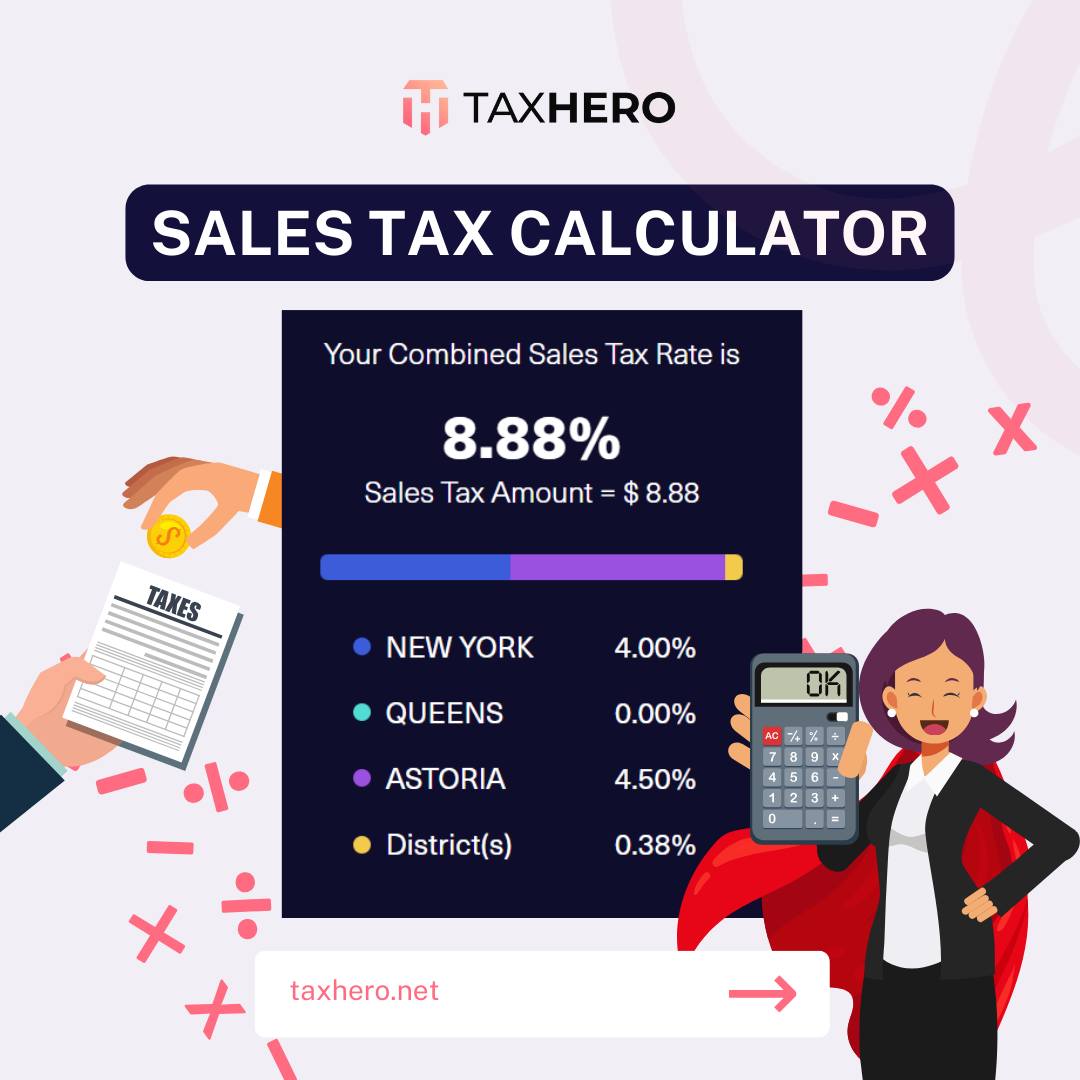

New Jersey is renowned for its diverse tax rates, which can vary significantly between counties and even within municipalities. These rates are expressed as millage rates, where one mill represents 1 of tax for every 1,000 of assessed property value. For instance, a millage rate of 3.5 implies a tax of 3.50 for every 1,000 of assessed value.

| County | Average Millage Rate |

|---|---|

| Monmouth | 3.10 |

| Ocean | 2.85 |

| Atlantic | 2.60 |

As shown in the table, Monmouth County has a higher average millage rate compared to Ocean and Atlantic Counties. This means homeowners in Monmouth County can expect to pay more in property taxes, all else being equal.

The Impact on Homeowners

Property tax in New Jersey can have a substantial impact on homeowners’ finances. It is a recurring expense, typically paid annually, and can significantly affect a household’s budget. The tax burden can influence decisions such as home buying, renovations, and long-term financial planning.

Let's consider a practical example. A homeowner in Ocean County with an assessed property value of $300,000 and a millage rate of 2.85 would owe approximately $8,550 in property taxes annually. This expense should be factored into their financial considerations, alongside mortgage payments and other costs of homeownership.

Navigating Property Tax in New Jersey

Understanding the property tax system is the first step; the next is learning how to navigate it effectively. Homeowners and investors can employ various strategies to optimize their tax liability and ensure they are not overburdened by property taxes.

Assessment Appeals

One powerful tool at the disposal of homeowners is the right to appeal their property assessment. If a homeowner believes their property’s assessed value is inaccurate or too high, they can initiate an assessment appeal process. This allows them to challenge the assessment and potentially reduce their taxable value, resulting in lower property taxes.

The assessment appeal process typically involves gathering evidence, such as recent sales data and comparable property values, to support the claim that the assessed value is excessive. It is a formal process that requires careful preparation and adherence to the local guidelines.

Exemptions and Credits

New Jersey offers a range of exemptions and credits to certain homeowners, helping to alleviate the tax burden. These exemptions and credits can reduce the taxable value of a property or provide direct tax relief.

- Senior Citizen Deduction: Eligible senior citizens can receive a deduction on their property taxes, reducing their tax liability.

- Veteran Exemption: Certain veterans and their spouses may be entitled to an exemption from a portion of their property taxes.

- Farmland Assessment: Properties dedicated to agricultural use may be assessed based on their agricultural value rather than market value, providing a significant tax advantage.

Strategies for Homeowners

Homeowners can employ various strategies to manage their property taxes effectively. Here are some recommendations:

- Stay Informed: Keep up-to-date with local tax rates and assessment practices. Understanding the local tax landscape can help you anticipate changes and plan accordingly.

- Appeal Assessments: If you believe your property's assessment is too high, consider appealing. It can be a complex process, so seeking professional guidance is advisable.

- Explore Exemptions: Research and apply for any exemptions or credits you may be eligible for. These can provide substantial tax savings.

- Long-Term Planning: Consider property taxes as a factor in your long-term financial planning. Factor in the tax burden when making decisions such as home buying or remodeling.

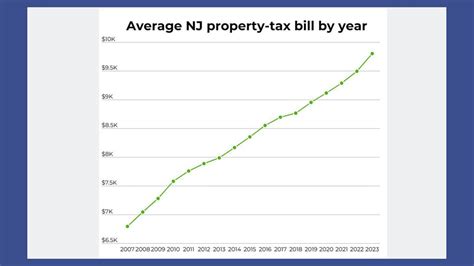

Future Implications and Trends

The property tax landscape in New Jersey is constantly evolving, influenced by economic factors, legislative changes, and local initiatives. Understanding these trends is essential for homeowners and investors to stay informed and make strategic decisions.

Economic Factors

Economic conditions, such as inflation and interest rates, can impact property values and, consequently, property taxes. During periods of economic growth, property values may increase, leading to higher assessments and tax liabilities. Conversely, economic downturns can result in lower property values and potentially lower taxes.

Legislative Changes

New Jersey’s property tax system is subject to legislative changes, which can introduce new exemptions, credits, or reforms. Staying informed about these changes is crucial for homeowners to take advantage of any benefits or prepare for potential impacts.

Local Initiatives

Individual counties and municipalities may implement unique initiatives or programs to address property taxes. These can include tax relief programs, assessment reforms, or incentives for certain types of development. Monitoring local initiatives can provide opportunities for tax savings or improved property tax management.

Conclusion: Empowering Homeowners

Property tax is an integral part of homeownership in New Jersey, but it need not be a source of confusion or financial strain. By understanding the system, exploring available resources, and employing strategic planning, homeowners can navigate the complexities of property taxation with confidence.

This guide has provided an in-depth look at property tax in New Jersey, offering practical insights and strategies. Remember, knowledge is power, and by staying informed, you can make informed decisions to optimize your property tax obligations and ensure your financial well-being.

FAQ

How often are property assessments conducted in New Jersey?

+

Property assessments in New Jersey are typically conducted every year. However, some counties may reassess properties less frequently, such as every two or three years.

Can I appeal my property assessment if I disagree with it?

+

Absolutely! Homeowners have the right to appeal their property assessments if they believe the assessed value is inaccurate or excessive. The appeal process varies by county, so it’s important to understand the specific procedures and timelines in your area.

What are some common exemptions and credits available in New Jersey for property taxes?

+

New Jersey offers various exemptions and credits, including the Senior Citizen Deduction, Veteran Exemption, and Farmland Assessment. These can significantly reduce tax liabilities for eligible homeowners.

How can I stay updated on changes to property tax laws and regulations in New Jersey?

+

To stay informed, it’s recommended to follow local news sources, subscribe to newsletters from government agencies, and connect with property tax professionals or organizations that provide updates on tax-related matters.