Phila Real Estate Taxes

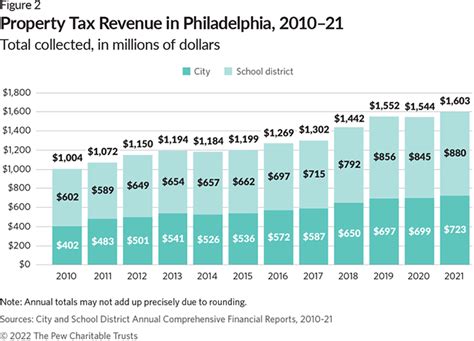

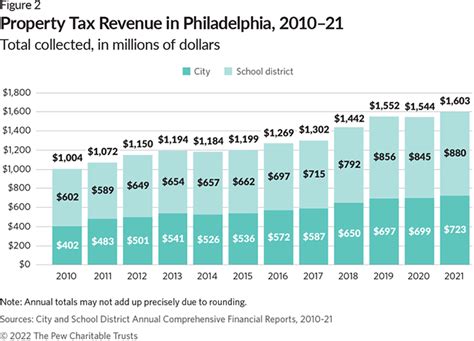

In Philadelphia, the real estate tax is an essential component of the city's revenue stream, contributing significantly to the overall budget and funding vital services and infrastructure projects. Understanding how these taxes work and their impact on property owners is crucial for both residents and potential investors.

The Basics of Philadelphia Real Estate Taxes

Philadelphia’s real estate tax is levied annually on the assessed value of properties within the city limits. The tax is a critical revenue source for the city, aiding in the maintenance and development of essential services such as schools, public safety, transportation, and other public works.

The Philadelphia City Charter empowers the Philadelphia City Council to determine the real estate tax rate, which is then applied uniformly across the city. This rate is expressed as millage, where one mill represents $1 of tax for every $1,000 of assessed property value.

The Office of Property Assessment (OPA), a division of the Philadelphia Department of Revenue, is responsible for assessing property values. These assessments are conducted every eight years, with a reassessment cycle that ensures property values remain current and fair.

Property owners receive a tax bill, known as the Notice of Property Value, which details their property's assessed value and the calculated tax amount. The bill is typically mailed out in late summer, with a payment deadline set for the following spring.

| Assessment Cycle | Next Assessment Year |

|---|---|

| Every 8 years | 2024 |

The Impact of Real Estate Taxes on Property Owners

For property owners, real estate taxes are a significant financial commitment. The tax bill can vary widely based on the property’s assessed value, which is influenced by factors such as location, size, condition, and recent sales of comparable properties.

While the tax burden can be substantial, there are mechanisms in place to offer relief. Philadelphia provides several tax abatement programs and tax credits to eligible property owners. These incentives aim to encourage property improvements, promote economic development, and assist low-income homeowners.

One notable program is the 10-Year Tax Abatement, which exempts new construction and substantial renovations from real estate taxes for the first ten years. This incentive has played a pivotal role in Philadelphia's recent real estate boom, attracting developers and revitalizing neighborhoods.

Additionally, the city offers a Homeowner's Rebate Program, providing eligible homeowners with a rebate of up to $400 on their real estate taxes. This program aims to ease the tax burden on long-term residents and promote homeownership.

Navigating the Real Estate Tax Landscape in Philadelphia

Understanding and managing real estate taxes is crucial for property owners in Philadelphia. It’s essential to stay informed about the assessment process, tax rates, and available incentives to make informed decisions about property ownership and investment.

The city's real estate tax structure is designed to be fair and transparent, with regular reassessments ensuring property values remain accurate. However, property owners have the right to appeal their assessments if they believe the value is incorrect.

Appeals can be made to the Board of Revision of Taxes, which reviews and adjusts assessments based on evidence provided by the property owner. This process ensures property owners have a voice in the assessment process and can challenge values they deem unfair.

The Role of Real Estate Taxes in Philadelphia’s Economy

Real estate taxes play a pivotal role in Philadelphia’s economic landscape. They provide a stable and significant revenue stream for the city, enabling it to invest in critical infrastructure, education, and public services.

The real estate tax system also encourages development and reinvestment in the city. The 10-Year Tax Abatement, for instance, has been a catalyst for new construction and renovations, bringing economic activity and improved housing stock to various neighborhoods.

Furthermore, the availability of tax relief programs ensures that Philadelphia remains an attractive place to own property, whether for personal residence or investment. These incentives help maintain a balanced real estate market and support the city's long-term economic growth.

Conclusion

Philadelphia’s real estate tax system is a complex yet essential aspect of the city’s financial and economic framework. It is designed to support the city’s development while offering incentives to property owners. By understanding this system and utilizing available resources, property owners can navigate the real estate tax landscape effectively.

For more information on Philadelphia's real estate taxes, property assessments, and available incentives, visit the official websites of the Office of Property Assessment and the Philadelphia Department of Revenue. These resources provide detailed guidelines, application processes, and contact information for further assistance.

How often are real estate taxes assessed in Philadelphia?

+Real estate taxes are assessed every eight years in Philadelphia, with the next assessment cycle scheduled for 2024. This process ensures property values remain current and fair.

What is the 10-Year Tax Abatement, and how does it work?

+The 10-Year Tax Abatement is a program that exempts new construction and substantial renovations from real estate taxes for the first ten years. It encourages development and reinvestment in the city by providing a tax incentive for these projects.

Who is eligible for the Homeowner’s Rebate Program, and how much can they receive?

+The Homeowner’s Rebate Program is available to eligible homeowners in Philadelphia. It provides a rebate of up to $400 on their real estate taxes, helping to ease the tax burden and promote homeownership.