Palm Beach Tax

Palm Beach, located in the heart of Florida's Gold Coast, is renowned for its luxurious lifestyle, breathtaking beaches, and vibrant community. However, beneath its glamorous exterior lies a complex system of taxes that residents and businesses must navigate. Understanding the intricacies of Palm Beach tax laws is crucial for anyone residing or operating a business in this prestigious region.

This comprehensive guide aims to shed light on the various aspects of Palm Beach taxes, providing an in-depth analysis of the types of taxes, their rates, and the unique considerations specific to this locale. By exploring real-world examples and offering expert insights, we aim to empower individuals and businesses with the knowledge needed to effectively manage their tax obligations while thriving in this prosperous environment.

Unraveling the Palm Beach Tax Landscape

The tax landscape in Palm Beach is multifaceted, encompassing a range of taxes that contribute to the overall fiscal health of the region. From property taxes to sales taxes and income taxes, each component plays a vital role in funding essential services and infrastructure development. Let’s delve into the specifics of these tax categories and understand their implications.

Property Taxes: A Cornerstone of Palm Beach’s Fiscal Structure

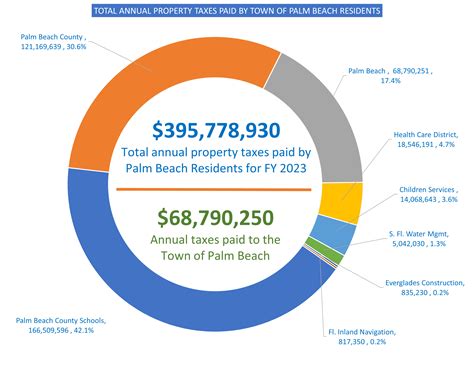

Property taxes are a significant source of revenue for Palm Beach County, with rates varying across different municipalities. These taxes are primarily based on the assessed value of real estate properties, including residential homes, commercial buildings, and vacant land. The assessed value is determined by the Palm Beach County Property Appraiser’s Office, taking into account factors such as property size, location, and recent sales data.

To illustrate, let's consider a hypothetical scenario: Ms. Smith, a resident of Palm Beach, owns a single-family home with an assessed value of $1 million. The current property tax rate in her municipality is 1.5%. By applying this rate, Ms. Smith's annual property tax obligation amounts to $15,000. This calculation showcases the direct impact of property taxes on individuals' financial planning and underscores the importance of understanding these rates.

| Municipality | Property Tax Rate |

|---|---|

| West Palm Beach | 1.35% |

| Palm Beach Gardens | 1.45% |

| Boca Raton | 1.60% |

Sales and Use Taxes: Navigating Palm Beach’s Retail Landscape

Sales and use taxes are an integral part of the Palm Beach tax system, impacting both consumers and businesses alike. These taxes are applied to the sale of goods and certain services, with rates determined by both the state and local governments.

Currently, the combined sales tax rate in Palm Beach County is 6.95%, consisting of a 6% state sales tax and an additional 0.95% local option tax. This rate applies to a wide range of goods, from clothing and electronics to restaurant meals and entertainment services. Businesses operating in Palm Beach must collect and remit these taxes to the Florida Department of Revenue, ensuring compliance with the state's tax laws.

For individuals, understanding the sales tax rate is crucial when budgeting for purchases. Take, for instance, a resident planning to buy a new laptop. With a laptop priced at $1,000, the applicable sales tax would amount to approximately $69.50, bringing the total cost to $1,069.50. This example highlights the tangible impact of sales taxes on consumers' spending decisions.

Income Taxes: A Snapshot of Palm Beach’s Earnings

Income taxes in Palm Beach follow the guidelines set by the federal and state governments. At the federal level, the Internal Revenue Service (IRS) imposes income taxes on individuals and businesses based on their earnings. Similarly, the State of Florida levies income taxes, although it is important to note that Florida does not have a personal income tax for residents.

However, Florida does impose an income tax on certain types of business entities, such as corporations and limited liability companies (LLCs). The state corporate income tax rate is 5.5%, which applies to the taxable income of these entities. This rate is relatively competitive compared to other states, making Florida an attractive destination for businesses considering relocation.

Unique Considerations in Palm Beach’s Tax System

The tax landscape in Palm Beach presents some unique considerations that are worth exploring. From homestead exemptions to tax incentives for businesses, understanding these nuances can provide significant advantages to residents and entrepreneurs alike.

Homestead Exemption: Protecting Palm Beach Residents’ Equity

Palm Beach County offers a homestead exemption, which provides significant property tax savings for eligible homeowners. This exemption applies to the primary residence of an individual or family, and it reduces the assessed value of the property for tax purposes. The maximum homestead exemption in Palm Beach County is $50,000, which can result in substantial savings over time.

To qualify for the homestead exemption, residents must meet certain criteria. They must be legal residents of Florida, own and occupy the property as their primary residence, and file an application with the Palm Beach County Property Appraiser's Office. This exemption not only reduces the tax burden on homeowners but also encourages long-term residency and community stability.

Tax Incentives for Businesses: Attracting Economic Growth

Palm Beach County is committed to fostering a business-friendly environment, and as such, it offers a range of tax incentives to attract and support businesses. These incentives are designed to encourage investment, job creation, and economic development within the region.

One notable incentive is the Enterprise Zone Program, which provides tax breaks and grants to businesses that locate or expand within designated enterprise zones. These zones are typically in areas targeted for economic revitalization, and businesses operating within them can benefit from reduced tax rates, tax credits, and other financial incentives. This program aims to stimulate economic growth and create opportunities for local residents.

Additionally, Palm Beach County offers a range of tax credits and exemptions for specific industries, such as manufacturing, renewable energy, and film production. These incentives aim to attract businesses in these sectors, further diversifying the local economy and creating a dynamic business landscape.

Navigating the Tax Landscape: Expert Insights and Strategies

Understanding the intricacies of Palm Beach’s tax system is the first step towards effective tax management. However, it is equally important to seek expert guidance and explore strategies to optimize one’s tax obligations.

Engaging Tax Professionals: A Wise Investment

For individuals and businesses alike, consulting with tax professionals can provide invaluable insights and guidance. Tax advisors, accountants, and attorneys with expertise in Palm Beach’s tax laws can help navigate the complexities of tax planning, ensuring compliance and optimizing tax strategies.

These professionals can assist with tasks such as preparing tax returns, identifying potential tax deductions and credits, and staying abreast of any changes in tax regulations. By leveraging their expertise, individuals and businesses can make informed decisions, minimize tax liabilities, and maximize their financial resources.

Tax Planning Strategies: Maximizing Savings and Compliance

Effective tax planning is a proactive approach that involves strategic decision-making throughout the year. Here are some key strategies to consider when navigating Palm Beach’s tax landscape:

- Utilize Available Deductions and Credits: Take advantage of the various deductions and credits offered by the federal and state governments. This includes deductions for mortgage interest, charitable contributions, and certain business expenses. Additionally, explore state-specific credits, such as those for renewable energy investments or job creation.

- Optimize Retirement Savings: Contributing to tax-advantaged retirement accounts, such as IRAs or 401(k)s, can provide significant tax benefits. These accounts allow individuals to save for retirement while reducing their taxable income, leading to potential tax savings.

- Consider Business Entity Structure: The choice of business entity can have tax implications. Consulting with a tax professional can help businesses understand the tax advantages and obligations associated with different entity types, such as sole proprietorships, partnerships, or corporations.

- Take Advantage of Tax Incentive Programs: Explore the various tax incentive programs offered by Palm Beach County and the State of Florida. These programs can provide substantial savings and support for businesses, especially those in targeted industries or located in designated enterprise zones.

The Future of Palm Beach’s Tax Landscape

As Palm Beach continues to thrive and evolve, its tax landscape is also subject to change. Understanding the potential future implications of tax policies is crucial for long-term financial planning and decision-making.

Potential Tax Reforms and Their Impact

Tax policies are dynamic and can be influenced by various factors, including economic conditions, political landscapes, and public sentiment. While it is challenging to predict future tax reforms with absolute certainty, staying informed about potential changes is essential.

One area of potential reform is property taxes. As Palm Beach County experiences continued growth and development, there may be discussions around adjusting property tax rates or implementing new assessment methodologies. These changes could impact the tax obligations of residents and businesses, making it crucial to stay engaged with local tax authorities and community discussions.

Additionally, the state of Florida has periodically considered implementing a personal income tax. While such a reform would have significant implications for residents, it could also attract additional revenue for the state, potentially impacting the allocation of resources and services within Palm Beach County.

The Role of Technology in Tax Administration

The advancement of technology is transforming the way taxes are administered and managed. Palm Beach County, like many other jurisdictions, is leveraging technology to streamline tax processes, enhance compliance, and improve taxpayer services.

For instance, the Palm Beach County Property Appraiser's Office has implemented an online portal where residents can access their property tax information, view assessment details, and even dispute valuations. This digital transformation not only improves transparency but also facilitates efficient communication between taxpayers and tax authorities.

Furthermore, the Florida Department of Revenue is continually enhancing its online services, allowing businesses and individuals to file tax returns, make payments, and access tax-related resources electronically. These technological advancements aim to simplify tax administration, reduce errors, and provide a more convenient experience for taxpayers.

Conclusion: Empowering Residents and Businesses

Navigating the complex world of taxes is an essential aspect of financial management, especially in a vibrant community like Palm Beach. By understanding the various taxes, their rates, and the unique considerations specific to this region, individuals and businesses can make informed decisions and effectively manage their tax obligations.

This comprehensive guide has aimed to provide an in-depth analysis of Palm Beach's tax landscape, offering real-world examples and expert insights. By staying informed, engaging with tax professionals, and exploring strategic tax planning, residents and businesses can thrive while contributing to the fiscal health and prosperity of Palm Beach County.

How often do property tax rates change in Palm Beach County?

+

Property tax rates in Palm Beach County can change annually, based on decisions made by local governments and the County Commission. These changes are typically announced before the start of the fiscal year, allowing residents and businesses to plan accordingly.

Are there any special tax considerations for senior citizens in Palm Beach County?

+

Yes, Palm Beach County offers a Senior Exemption Program, which provides a partial exemption from property taxes for eligible senior citizens. To qualify, individuals must be at least 65 years old, meet certain income requirements, and have owned and occupied their property for at least three years. This program can significantly reduce the tax burden for seniors, making it an attractive incentive for retirement.

What are the consequences of not paying taxes in Palm Beach County?

+

Failure to pay taxes in Palm Beach County can result in severe consequences. Unpaid taxes can lead to tax liens being placed on properties, which can impact credit scores and make it difficult to sell or refinance. Additionally, the County may initiate legal actions to collect unpaid taxes, including wage garnishments or seizures of assets. It is crucial to stay current with tax obligations to avoid these potential pitfalls.