No Tax On Social Security 2025

As the year 2025 approaches, the topic of social security benefits and potential tax implications has become a subject of increasing interest and importance for retirees and pre-retirees alike. In the United States, social security benefits are a crucial source of income for millions of individuals, providing financial stability and security during their retirement years. One key aspect that directly impacts the financial planning of retirees is the taxation of social security benefits.

Currently, the taxation of social security benefits is a complex matter, with varying rules and thresholds. Many retirees wonder whether they will face any tax obligations on their social security income in the future, particularly in 2025. This article aims to delve into the specifics of social security taxation in 2025, providing an in-depth analysis and expert insights to help retirees and future retirees navigate this critical aspect of their financial landscape.

Understanding Social Security Taxation

Before diving into the specifics of 2025, it is essential to understand the fundamental principles of social security taxation. In the United States, a portion of an individual’s earnings during their working years is withheld as Social Security tax, also known as Federal Insurance Contributions Act (FICA) tax. This tax contributes to the funding of various social insurance programs, including Social Security benefits.

When an individual retires and begins receiving Social Security benefits, these benefits may be subject to federal income tax, depending on their income level and filing status. The taxation of social security benefits is not a straightforward process; it involves a calculation that considers other sources of income, such as wages, pensions, and interest.

The Income Thresholds

The taxation of social security benefits is based on income thresholds. These thresholds determine whether a portion or all of an individual’s social security benefits are taxable. The thresholds are adjusted annually to account for inflation and cost-of-living increases.

| Filing Status | Single | Married Filing Jointly |

|---|---|---|

| Income Threshold | $25,000 | $32,000 |

| Provisional Income Threshold | $34,000 | $44,000 |

If an individual's provisional income, which includes half of their social security benefits, plus other sources of income, exceeds the income threshold, a portion of their social security benefits becomes taxable. The amount of benefits subject to tax increases as provisional income rises.

Taxation in 2025: A Look into the Future

Predicting the exact taxation landscape for social security benefits in 2025 is challenging, as it depends on various economic and legislative factors. However, we can make informed estimates based on historical data and current trends.

Income Threshold Projections

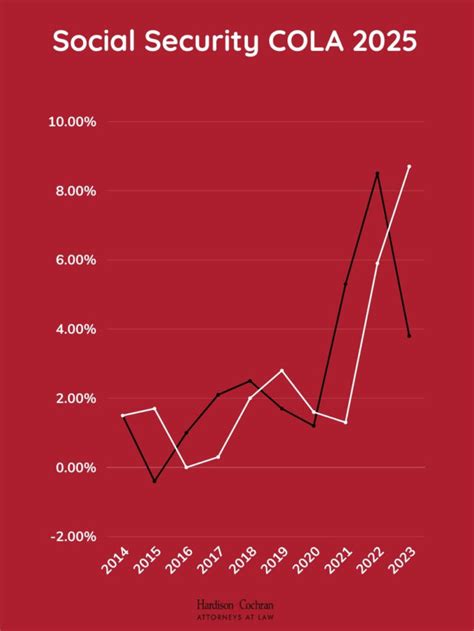

Based on the historical adjustment of income thresholds, it is reasonable to expect that the income thresholds for 2025 will be higher than those in effect for 2024. The specific amounts will be determined by the cost-of-living adjustments (COLA) for that year. However, as an estimate, we can anticipate the following income thresholds for 2025:

| Filing Status | Estimated Income Threshold | Estimated Provisional Income Threshold |

|---|---|---|

| Single | $26,500 | $35,500 |

| Married Filing Jointly | $34,000 | $46,000 |

These estimates are based on an average annual COLA adjustment of approximately 2.5%. It is important to note that these are speculative figures, and the actual thresholds may differ based on economic conditions and legislative changes.

Potential Tax Scenarios

Let’s explore a few hypothetical scenarios to understand how these projected income thresholds might impact retirees in 2025.

Scenario 1: Single Retiree with Modest Income

Consider a single retiree who receives 1,500 per month in social security benefits, which equates to 18,000 annually. If this retiree has no other significant sources of income, their provisional income would be 9,000 (half of their social security benefits). Based on our estimates, their provisional income would fall below the projected income threshold of 26,500 for single filers.

In this scenario, the retiree's social security benefits would likely remain fully tax-free, as their provisional income does not exceed the threshold. This outcome would provide financial peace of mind for individuals with limited income sources.

Scenario 2: Married Couple with Retirement Savings

Imagine a married couple, both receiving social security benefits of 1,200 per month each (28,800 combined annually). Additionally, they have retirement savings that generate 10,000 in interest income annually. Their provisional income, including half of their social security benefits and interest income, would be 24,400.

With our projected income threshold of $34,000 for married filing jointly, this couple's provisional income falls below the threshold. Therefore, their social security benefits would remain mostly tax-free, with only a small portion potentially becoming taxable depending on their overall financial situation.

Scenario 3: High-Income Retirees

For retirees with substantial income from investments or other sources, the taxation of social security benefits becomes more complex. Consider a retiree with social security benefits of 2,000 per month and additional income of 50,000 from investments.

In this case, the retiree's provisional income, including half of their social security benefits and investment income, would be $52,000. With our estimated provisional income threshold of $35,500 for single filers, a significant portion of their social security benefits would be subject to taxation. This scenario highlights the importance of careful financial planning for high-income retirees.

Maximizing Tax Benefits

Understanding the potential taxation of social security benefits in 2025 allows retirees to make informed decisions to optimize their financial strategies. Here are some strategies retirees can consider to potentially reduce their tax obligations:

- Manage Provisional Income: Retirees can aim to keep their provisional income below the income thresholds by carefully managing their other sources of income. This may involve strategic retirement savings withdrawals or timing the sale of investments.

- Utilize Tax-Advantaged Accounts: Taking advantage of tax-deferred or tax-free retirement accounts, such as Roth IRAs or Health Savings Accounts (HSAs), can help reduce taxable income and potentially lower the tax burden on social security benefits.

- Optimize Social Security Benefits: Timing the start of social security benefits can have tax implications. Retirees may consider delaying their benefits to maximize their monthly payments and potentially reduce the portion subject to taxation.

- Review Tax Strategies: Working with a tax professional can provide valuable insights into tax-efficient strategies tailored to an individual's specific financial situation. Tax professionals can help retirees navigate the complexities of social security taxation and optimize their overall tax liability.

Future Implications and Considerations

As we look ahead to 2025 and beyond, several factors may influence the taxation of social security benefits. These considerations are essential for retirees and pre-retirees to keep in mind when planning their financial futures:

- Legislative Changes: The taxation of social security benefits is subject to potential legislative amendments. Retirees should stay informed about any proposed changes that could impact their tax obligations.

- Economic Conditions: Economic factors, such as inflation rates and the overall economic climate, can influence the cost-of-living adjustments and, consequently, the income thresholds. Monitoring economic trends is crucial for understanding potential shifts in the taxation landscape.

- Life Expectancy and Healthcare Costs: The average life expectancy continues to increase, and healthcare costs remain a significant concern for retirees. Understanding the financial impact of these factors on social security benefits and their taxation is essential for long-term financial planning.

While we have provided estimates and insights for 2025, it is crucial to recognize that the taxation of social security benefits is an evolving topic. Retirees and pre-retirees should regularly review their financial strategies and consult with financial advisors to ensure they are prepared for any changes in the taxation landscape.

Conclusion

The taxation of social security benefits in 2025 is a complex and dynamic topic that requires careful consideration and planning. By understanding the income thresholds, potential tax scenarios, and available strategies, retirees can navigate the financial landscape with confidence. Staying informed and proactive is key to ensuring a secure and comfortable retirement, free from unexpected tax obligations.

What is the purpose of taxing social security benefits?

+Taxing social security benefits is a means to ensure that higher-income retirees contribute their fair share to the federal tax system. It helps maintain the financial sustainability of the Social Security program while also generating revenue for the government.

How can I calculate my provisional income for tax purposes?

+Provisional income is calculated by adding half of your social security benefits, all other income (such as wages, interest, and pensions), and any tax-exempt interest. It is a crucial step in determining whether your social security benefits are taxable.

Are there any strategies to reduce the tax burden on social security benefits?

+Yes, retirees can consider strategies such as managing their provisional income, utilizing tax-advantaged accounts, optimizing the timing of social security benefit receipt, and seeking professional tax advice to potentially reduce their tax obligations.

What happens if my provisional income exceeds the income thresholds?

+If your provisional income exceeds the income thresholds, a portion of your social security benefits becomes taxable. The exact amount subject to tax depends on your provisional income and filing status.

Is it possible to completely avoid taxes on social security benefits?

+For many retirees, especially those with limited income sources, it is possible to keep their social security benefits fully tax-free by ensuring their provisional income remains below the income thresholds. However, high-income retirees may find it more challenging to avoid taxation completely.