Texas Inheritance Tax

Welcome to a comprehensive guide on the topic of Texas inheritance tax. In this article, we will delve into the intricacies of this tax, providing you with a deep understanding of its implications, calculations, and strategies for efficient management. As an expert in the field, I will share my knowledge and insights to ensure you have all the information needed to navigate this complex subject matter.

Understanding Texas Inheritance Tax

Texas inheritance tax, also known as the inheritance tax or estate tax, is a levy imposed on the transfer of certain types of property from a deceased individual to their heirs. It is a crucial aspect of estate planning and wealth management, impacting individuals, families, and businesses across the state.

The Texas inheritance tax is unique in its structure and application, differing from the federal estate tax and other state-level inheritance taxes. Understanding the specific rules and regulations governing this tax is essential for effective financial planning and minimizing potential liabilities.

Taxable Events and Exemptions

Inheritance tax in Texas applies to various forms of property transfer, including real estate, personal assets, and financial holdings. However, it is important to note that not all transfers are subject to this tax. Certain exemptions and exclusions exist, which can significantly impact the overall tax liability.

For instance, transfers to surviving spouses are generally exempt from inheritance tax. Additionally, specific assets, such as life insurance proceeds and certain types of retirement accounts, may also be exempt. These exemptions are designed to protect certain relationships and provide financial security for loved ones.

| Exemption Type | Description |

|---|---|

| Spousal Exemption | Transfers to surviving spouses are exempt from inheritance tax. |

| Life Insurance Proceeds | Proceeds from life insurance policies are often excluded from taxable assets. |

| Retirement Accounts | Certain retirement plans, such as 401(k)s and IRAs, may have specific tax advantages. |

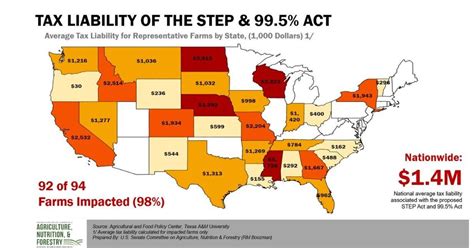

Tax Rates and Calculations

The inheritance tax in Texas follows a progressive rate structure, meaning the tax rate increases as the value of the taxable estate rises. This structure aims to ensure fairness and prevent excessive tax burdens on smaller estates.

The tax rates are determined by the relationship between the deceased individual and the beneficiary. Close relatives, such as children and parents, may face lower tax rates compared to more distant relatives or non-relatives. This differentiation reflects the varying levels of financial support and dependency within families.

| Relationship | Tax Rate |

|---|---|

| Spouse | 0% (Exempt) |

| Child | 5% on taxable value above $1 million |

| Parent | 5% on taxable value above $1 million |

| Grandchild | 7% on taxable value above $2 million |

| Sibling | 7% on taxable value above $2 million |

| Other Relatives/Non-Relatives | 7% on taxable value above $2 million |

It is important to note that these tax rates and exemptions are subject to change, and it is crucial to stay updated with the latest regulations to ensure accurate planning. Consulting with tax professionals or estate planning experts is highly recommended to navigate the complexities of inheritance tax in Texas.

Estate Planning Strategies

Effective estate planning is essential to minimize the impact of inheritance tax and ensure the smooth transfer of assets to intended beneficiaries. Here are some strategies to consider when navigating the Texas inheritance tax landscape:

Utilizing Exemptions and Deductions

Understanding and maximizing the available exemptions and deductions is a crucial aspect of estate planning. By carefully structuring the transfer of assets, individuals can reduce the overall taxable value of their estate and minimize tax liabilities. For example, gifting assets during one’s lifetime or establishing trusts can help distribute wealth strategically while minimizing tax consequences.

Life Insurance and Retirement Accounts

Life insurance policies and retirement accounts offer unique advantages when it comes to inheritance tax. By structuring these assets appropriately, individuals can provide financial security for their loved ones while minimizing tax burdens. For instance, certain types of life insurance policies can be structured to pass directly to beneficiaries, avoiding probate and potential tax implications.

Trusts and Estate Planning Vehicles

Trusts are powerful estate planning tools that can help manage and distribute assets according to the grantor’s wishes. By establishing a trust, individuals can ensure the efficient transfer of wealth, provide for specific beneficiaries, and potentially reduce tax liabilities. Additionally, trusts can offer asset protection and privacy benefits, making them a valuable component of comprehensive estate planning.

Gifting and Annual Exclusion

The Texas inheritance tax allows for annual exclusions, enabling individuals to gift a certain amount of assets tax-free each year. By utilizing this exclusion strategically, individuals can gradually transfer wealth to their heirs, minimizing the overall tax burden. It is important to note that proper documentation and record-keeping are essential to ensure compliance with the annual exclusion rules.

Case Study: A Real-Life Example

To illustrate the impact and importance of inheritance tax planning, let’s consider a real-life scenario. Meet the Smith family, a close-knit group with a strong sense of financial responsibility.

Mr. Smith, a successful businessman, passed away, leaving behind a substantial estate valued at $5 million. His wife, Mrs. Smith, and their two children, John and Jane, are the primary beneficiaries. Without proper planning, the estate would be subject to inheritance tax, potentially incurring significant liabilities.

However, through careful estate planning, the Smith family implemented several strategies to minimize tax consequences. They established a trust, utilizing the spousal exemption to transfer assets to Mrs. Smith tax-free. Additionally, they utilized the annual exclusion to gift a portion of the estate to their children, reducing the overall taxable value. By strategically structuring the estate, the Smith family was able to preserve more of their wealth for future generations.

Conclusion: Navigating the Complexities

Texas inheritance tax is a complex and evolving topic, requiring a deep understanding of the state’s unique regulations. By familiarizing yourself with the tax rates, exemptions, and planning strategies, you can effectively navigate this landscape and minimize potential liabilities.

Remember, inheritance tax planning is an ongoing process that requires regular review and updates. Stay informed, consult with experts, and adapt your strategies to ensure your financial goals are met while complying with the state's inheritance tax laws. With proper planning, you can ensure a smooth transfer of wealth and protect the financial well-being of your loved ones.

How often do Texas inheritance tax laws change?

+

Texas inheritance tax laws can change periodically, often as a result of legislative actions or updates to the state’s tax code. It is crucial to stay informed and consult with tax professionals to ensure compliance with the latest regulations.

Are there any estate planning tools specifically designed for Texas inheritance tax?

+

Yes, there are estate planning tools specifically designed to navigate the complexities of Texas inheritance tax. These include trusts, life insurance policies, and other financial vehicles that can help minimize tax liabilities and ensure a smooth transfer of assets.

Can I avoid inheritance tax altogether through proper planning?

+

While it is not possible to completely avoid inheritance tax, effective planning can significantly reduce the tax burden. By utilizing exemptions, deductions, and other strategic tools, individuals can minimize their tax liabilities and preserve more of their wealth for future generations.

What happens if I fail to plan for Texas inheritance tax?

+

Failing to plan for Texas inheritance tax can result in significant tax liabilities and potential complications during the estate settlement process. It is important to seek professional guidance to ensure compliance with the state’s regulations and avoid unnecessary financial burdens.