Wisconsin State Taxes

Wisconsin, known for its rich dairy heritage and vibrant cities, boasts a unique tax system that impacts both residents and businesses. The state's tax structure, including income, sales, and property taxes, plays a significant role in shaping its economic landscape. In this comprehensive article, we delve into the intricacies of Wisconsin state taxes, exploring the various tax categories, rates, exemptions, and their impact on individuals and businesses. From understanding the state's progressive income tax brackets to navigating the sales tax system, we aim to provide a thorough guide for anyone seeking insights into Wisconsin's tax environment.

Understanding Wisconsin’s Tax Landscape

Wisconsin’s tax system is designed to generate revenue for state operations, infrastructure development, and social services. The state collects taxes from various sources, including income, sales, and property taxes. These taxes contribute to the overall economic health and stability of the state, influencing the cost of living and business operations.

Income Tax in Wisconsin

Wisconsin employs a progressive income tax system, which means that higher incomes are taxed at higher rates. This approach aims to ensure a fair distribution of tax burden among residents. The state’s income tax brackets are divided into four categories, with each bracket having its own tax rate. As of the latest available information, the income tax rates in Wisconsin are as follows:

| Income Bracket | Tax Rate |

|---|---|

| First $12,450 | 3.57% |

| $12,451 - $29,500 | 4.85% |

| $29,501 - $225,000 | 6.27% |

| Over $225,000 | 7.65% |

These tax rates are applicable to both single filers and married couples filing jointly. However, it's important to note that Wisconsin also offers various tax credits and deductions that can reduce the overall tax liability. Some common tax credits include the Earned Income Tax Credit, Child and Dependent Care Credit, and the Property Tax Credit.

Sales and Use Tax

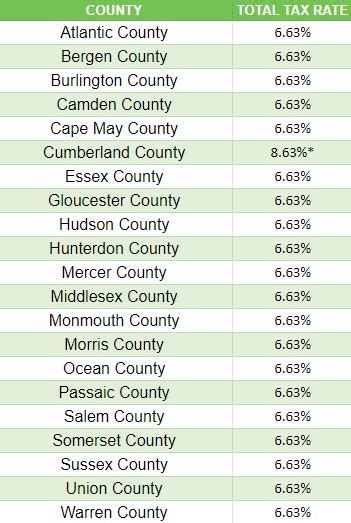

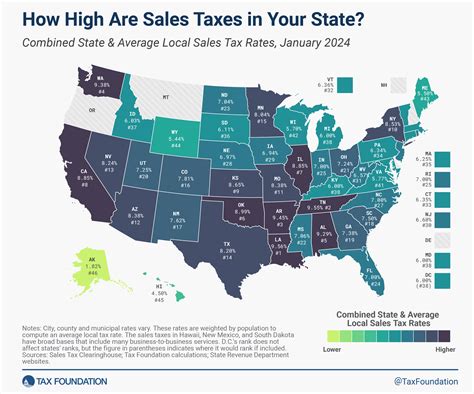

Wisconsin imposes a sales and use tax on the sale of tangible personal property and certain services. The standard sales tax rate in the state is 5%, which is applicable to most goods and some services. However, there are certain exceptions and additional taxes that may apply depending on the nature of the transaction and the location of the sale.

For instance, Wisconsin has a combined rate system, which means that certain municipalities and counties can add their own sales tax rates on top of the state's base rate. This results in varying sales tax rates across the state. Additionally, there are specific taxes for certain industries, such as the 5.5% tax on telecommunications services and the 7% tax on alcoholic beverages.

Property Taxes

Property taxes are a significant source of revenue for local governments in Wisconsin. These taxes are levied on real estate, including land and buildings, as well as personal property. The property tax rates vary across the state and are determined by local taxing authorities, such as counties and municipalities.

The property tax system in Wisconsin is complex and involves multiple factors. The taxable value of a property is determined through a process called assessment, which considers factors like the property's market value, location, and improvements. This assessed value is then multiplied by the tax rate, which is set by the local government. The resulting amount is the property tax liability for the owner.

Tax Exemptions and Incentives

Wisconsin offers various tax exemptions and incentives to promote economic growth and support specific industries. These exemptions and incentives can significantly impact the tax liability of individuals and businesses.

Individual Tax Exemptions

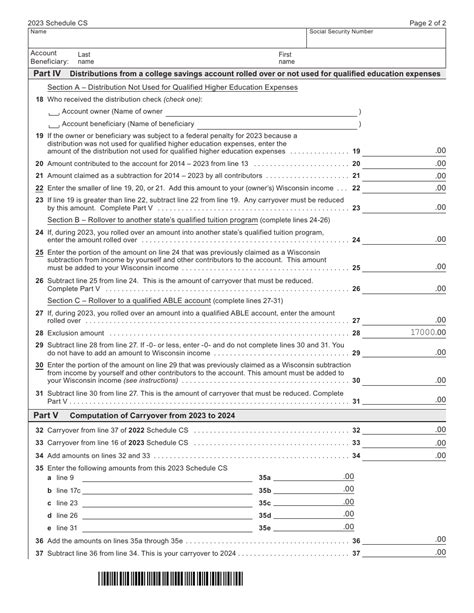

Wisconsin provides several tax exemptions for individuals, including exemptions for certain types of income. For example, Social Security benefits, certain retirement plan distributions, and military combat pay are exempt from state income tax. Additionally, there are deductions available for medical expenses, charitable contributions, and certain education-related expenses.

Moreover, Wisconsin offers a Homestead Credit, which provides a tax credit for homeowners and renters based on their income and property taxes paid. This credit aims to reduce the property tax burden for low- and middle-income individuals.

Business Tax Incentives

The state of Wisconsin actively promotes business development and job creation through a range of tax incentives. These incentives are designed to attract new businesses and support existing ones. Some notable business tax incentives in Wisconsin include:

- Enterprise Zone Tax Credits: Businesses operating in designated Enterprise Zones can qualify for tax credits based on their investment and job creation.

- Manufacturing and Agriculture Credits: Manufacturers and agricultural businesses may be eligible for tax credits based on their sales and production.

- Research and Development Tax Credits: Wisconsin offers tax credits for businesses engaged in research and development activities.

- Job Tax Credits: Businesses that create new jobs or retain existing jobs may be eligible for tax credits.

The Impact of Wisconsin’s Tax System

Wisconsin’s tax system has a profound impact on the state’s economy and its residents. The progressive income tax structure ensures that higher-income earners contribute a larger share of their income towards state revenue. This approach can help reduce income inequality and support social programs.

The sales tax system, with its varying rates across the state, influences consumer behavior and business operations. Businesses must navigate the complex sales tax regulations to ensure compliance and minimize tax liabilities. On the other hand, consumers may face higher prices in certain areas due to the combined rate system.

Property taxes, while a significant source of revenue for local governments, can also pose challenges for homeowners and businesses. The assessment process and varying tax rates can result in discrepancies in tax burdens across different regions. However, the availability of tax exemptions and credits can provide some relief for property owners.

Economic Growth and Business Environment

Wisconsin’s tax system, coupled with its business incentives, plays a crucial role in attracting and retaining businesses. The state’s competitive tax rates and targeted incentives create an environment conducive to business growth. This, in turn, leads to job creation and economic development.

Additionally, Wisconsin's tax structure encourages investment in certain industries, such as manufacturing and agriculture, which are vital to the state's economy. The tax incentives for research and development further promote innovation and technological advancements.

Future Implications and Considerations

As Wisconsin’s economy continues to evolve, the state’s tax system may face new challenges and opportunities. The ongoing debate surrounding tax reform and simplification is a key consideration for the future. Simplifying the tax code and reducing the complexity of tax regulations could enhance compliance and improve the overall business environment.

Furthermore, the state's tax system may need to adapt to changing economic conditions and technological advancements. For instance, the rise of e-commerce and remote work may require updates to sales tax regulations to ensure fairness and compliance.

Another critical aspect is the potential impact of tax policy on the state's population. While Wisconsin's tax system aims to be progressive and fair, ensuring that the tax burden is distributed equitably across different income groups is essential for maintaining a healthy economy and society.

What is the average property tax rate in Wisconsin?

+The average property tax rate in Wisconsin varies by county and municipality. As of recent data, the average effective property tax rate across the state is approximately 1.83% of the property’s assessed value.

Are there any sales tax holidays in Wisconsin?

+Yes, Wisconsin occasionally holds sales tax holidays, typically focused on specific items like school supplies or energy-efficient appliances. These holidays offer temporary sales tax exemptions, encouraging consumer spending.

How often are Wisconsin tax rates updated?

+Wisconsin tax rates are generally updated annually to account for inflation and other economic factors. The state’s budget process often includes adjustments to tax rates and brackets to maintain revenue stability.

Can non-residents of Wisconsin be subject to Wisconsin taxes?

+Yes, non-residents of Wisconsin may be subject to certain taxes if they earn income within the state or own property in Wisconsin. Income taxes may apply to non-resident earnings, and property taxes are levied on property ownership regardless of residency.

How can businesses stay compliant with Wisconsin’s sales tax regulations?

+Businesses can stay compliant by registering for a sales tax permit, collecting the appropriate sales tax on transactions, and filing regular sales tax returns. It’s crucial to stay updated on any changes to sales tax rates and regulations.