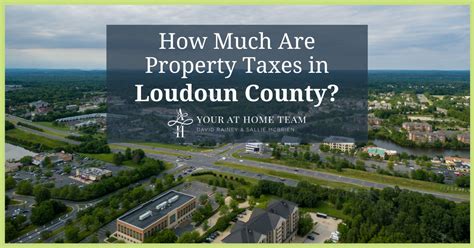

Loudoun County Taxes

Welcome to an in-depth exploration of Loudoun County's tax landscape. This comprehensive guide aims to shed light on the various tax components, rates, and their implications for residents and businesses within the county. With a focus on specificity and accuracy, we will delve into the intricate details of Loudoun County's tax structure, offering a valuable resource for anyone seeking to understand and navigate this essential aspect of local governance.

Understanding Loudoun County’s Tax System

Loudoun County, known for its vibrant communities and thriving economy, has a well-structured tax system that plays a pivotal role in funding essential services and initiatives. The county’s tax revenue is a vital component of its financial ecosystem, contributing to infrastructure development, education, public safety, and numerous other public services.

The tax system in Loudoun County is governed by a set of regulations and policies that ensure fairness and transparency. These guidelines are designed to distribute the tax burden equitably among residents and businesses, taking into account various factors such as property value, income, and the nature of economic activities.

Property Taxes: A Significant Component

Property taxes form a substantial part of Loudoun County’s tax revenue. Every property owner within the county is subject to this tax, which is calculated based on the assessed value of their property. The assessment process involves evaluating the fair market value of the property, taking into consideration factors like location, size, condition, and recent sales of similar properties.

| Property Type | Assessment Rate |

|---|---|

| Residential | 78.64% |

| Commercial | 88.54% |

| Agricultural | 50.00% |

Loudoun County employs a real estate tax rate of $1.24 per $100 of assessed value for the 2023-2024 fiscal year. This rate is applied to the assessed value of the property to calculate the annual property tax liability. For instance, a residential property with an assessed value of $500,000 would have an annual property tax of $6,232.

Income Taxes: Individual and Business Perspectives

In addition to property taxes, Loudoun County also levies income taxes on individuals and businesses operating within its boundaries. The county follows the state’s income tax structure, which consists of a flat rate for all taxpayers, regardless of income level.

| Income Tax Rate | Taxable Income Range |

|---|---|

| 4.0% | $0 and above |

For the tax year 2023, Loudoun County residents are required to file their income tax returns by April 17, 2024. The county offers online filing options through its official website, providing a convenient and efficient way for taxpayers to submit their returns.

Sales and Use Taxes: Impact on Daily Life

Loudoun County, like many other jurisdictions, imposes sales and use taxes on the sale of goods and services. These taxes are collected at the point of sale and are an essential source of revenue for the county, contributing to its overall financial stability.

| Sales and Use Tax Rate |

|---|

| 5.3% |

The sales tax in Loudoun County is applicable to a wide range of goods and services, including groceries, clothing, electronics, and entertainment. However, certain essential items, such as prescription medications and non-prepared food items, are exempt from sales tax. This exemption ensures that basic necessities remain accessible to all residents without an additional tax burden.

The Impact of Loudoun County Taxes

Loudoun County’s tax system has a profound impact on the local economy and the overall well-being of its residents. The revenue generated through various taxes funds essential services and infrastructure development, shaping the county’s present and future.

Funding Essential Services

Tax revenue is the lifeblood of Loudoun County’s public services. It supports a wide range of critical functions, including education, healthcare, public safety, transportation, and environmental initiatives. For instance, property taxes play a significant role in funding the county’s renowned school system, ensuring that students receive quality education.

Infrastructure Development

Loudoun County’s tax revenue also fuels infrastructure development projects. These projects include road and bridge maintenance, expansion of public transportation networks, and the construction of community facilities such as libraries, recreational centers, and parks. By investing in infrastructure, the county enhances the quality of life for its residents and creates a more sustainable and resilient community.

Economic Growth and Business Climate

The county’s tax policies have a direct impact on its economic growth and business climate. A well-structured tax system can attract businesses and investors, fostering economic development. Loudoun County’s competitive tax rates and incentives make it an attractive destination for businesses, leading to job creation and a thriving local economy.

Equity and Social Justice

The tax system in Loudoun County also plays a role in promoting equity and social justice. The county strives to ensure that tax policies do not disproportionately burden low-income households or marginalized communities. Through targeted initiatives and tax relief programs, the county aims to provide support and resources to those who need it most.

Navigating Loudoun County Taxes

Understanding and navigating Loudoun County’s tax system can be a complex task, but it is essential for residents and businesses to ensure compliance and take advantage of available benefits and incentives.

Tax Filing and Compliance

For individuals and businesses, tax filing is a critical aspect of compliance. Loudoun County provides comprehensive guidelines and resources to assist taxpayers in understanding their obligations and filing accurately. The county’s website offers a wealth of information, including tax forms, deadlines, and step-by-step guides to simplify the filing process.

Tax Relief and Assistance Programs

Loudoun County recognizes the financial challenges faced by some residents and offers a range of tax relief and assistance programs. These programs aim to provide support to low-income households, senior citizens, and individuals with disabilities. Examples include property tax relief programs, tax deferral options, and income-based tax credits.

Tax Incentives for Businesses

To attract and support businesses, Loudoun County provides a variety of tax incentives. These incentives are designed to encourage investment, job creation, and economic growth. Businesses can benefit from tax credits, tax abatement programs, and targeted tax relief measures, making Loudoun County an attractive location for entrepreneurship and innovation.

Future Implications and Opportunities

As Loudoun County continues to evolve and grow, its tax system will play a pivotal role in shaping its future. The county’s commitment to fiscal responsibility and innovative tax policies positions it well for future challenges and opportunities.

Economic Development and Innovation

Loudoun County’s tax policies can continue to foster economic development and innovation. By strategically leveraging tax incentives and promoting a business-friendly environment, the county can attract high-tech industries, startups, and diverse businesses. This, in turn, can lead to increased job opportunities, a more diversified economy, and a higher quality of life for residents.

Sustainable Financing for Public Services

With a focus on sustainable financing, Loudoun County can ensure the long-term viability of its public services. By carefully managing tax revenue and exploring innovative funding models, the county can maintain its commitment to high-quality education, healthcare, and public safety services. This approach ensures that residents continue to receive essential services without undue burden on taxpayers.

Addressing Social and Economic Disparities

Loudoun County’s tax system can also be a tool for addressing social and economic disparities. By targeting tax policies and initiatives towards specific communities or sectors, the county can promote equity and inclusivity. This may involve tax incentives for affordable housing development, support for small businesses in underserved areas, or initiatives to bridge the digital divide.

Conclusion

Loudoun County’s tax system is a dynamic and essential component of its governance and community well-being. By understanding the various tax components, rates, and their implications, residents and businesses can actively participate in shaping the county’s future. This comprehensive guide serves as a valuable resource, offering insights into the intricacies of Loudoun County’s tax landscape and its impact on the community.

What is the real estate tax rate in Loudoun County for the current fiscal year?

+The real estate tax rate in Loudoun County for the 2023-2024 fiscal year is 1.24 per 100 of assessed value.

When is the deadline for filing income taxes in Loudoun County for the 2023 tax year?

+The deadline for filing income taxes in Loudoun County for the 2023 tax year is April 17, 2024.

Are there any sales tax exemptions in Loudoun County?

+Yes, Loudoun County exempts certain essential items from sales tax, including prescription medications and non-prepared food items. This exemption ensures that basic necessities remain affordable for residents.

How does Loudoun County use tax revenue to support education?

+Property taxes, a significant source of revenue for Loudoun County, are allocated towards education, constituting over 50% of the county’s annual budget. These funds are used to support the county’s school system, ensuring quality education for students.

What tax incentives are available for businesses in Loudoun County?

+Loudoun County offers a range of tax incentives for businesses, including tax credits, tax abatement programs, and targeted tax relief measures. These incentives are designed to attract and support businesses, fostering economic growth and innovation.