Nj Sales Tax On A Car

When purchasing a car in the state of New Jersey, understanding the sales tax implications is crucial. The sales tax on a car can significantly impact the overall cost, so it's essential to be well-informed about the applicable rates and regulations. In this comprehensive guide, we will delve into the specifics of New Jersey's sales tax on car purchases, providing you with valuable insights and practical information.

Understanding New Jersey’s Sales Tax Structure

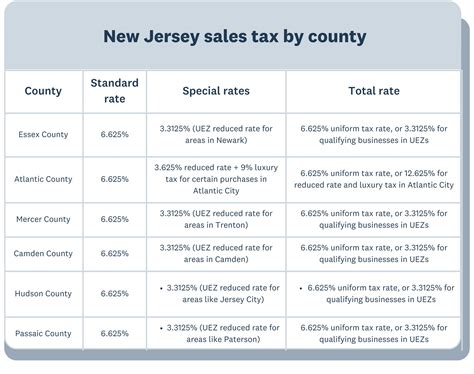

New Jersey has a progressive sales tax system, which means the tax rate can vary depending on the type of transaction and the specific goods or services being purchased. The state imposes a general sales tax rate, which is applicable to most retail sales, including vehicles. However, there are additional factors to consider when it comes to taxing cars.

The general sales tax rate in New Jersey is currently set at 6.625%. This rate is subject to change, so it's advisable to check for any updates before finalizing a car purchase. The state tax is consistent across all counties, ensuring uniformity in taxation.

Additional Local Taxes

In addition to the state sales tax, New Jersey allows local municipalities to impose their own additional taxes on vehicle purchases. These local taxes, often referred to as municipal sales tax or local option tax, can vary from one municipality to another. It’s crucial to research and understand the specific local tax rates applicable to the location where the car is being purchased.

| Local Municipality | Sales Tax Rate |

|---|---|

| Atlantic City | 3.5% |

| Cape May | 3% |

| Jersey City | 3% |

| Hoboken | 2% |

| Princeton | 1% |

These rates are subject to change, and some municipalities may have additional requirements or exemptions. It's always best to consult the local tax authorities or a trusted tax advisor to ensure accuracy.

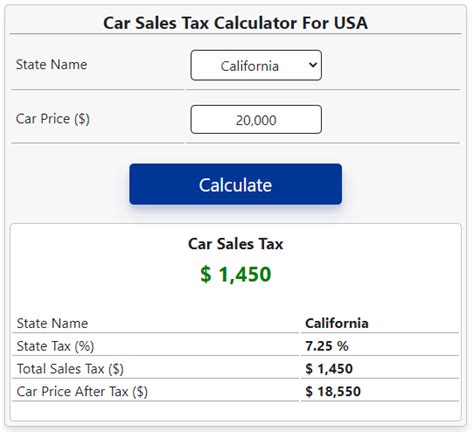

Calculating Sales Tax on a Car Purchase

To calculate the sales tax on a car purchase in New Jersey, you need to consider both the state sales tax and any applicable local taxes. Here’s a step-by-step guide to help you determine the tax amount accurately:

- Determine the Purchase Price: Start by knowing the total purchase price of the vehicle, including any additional fees or charges.

- Apply State Sales Tax: Multiply the purchase price by the state sales tax rate of 6.625%. This will give you the state tax amount.

- Consider Local Taxes: Research and identify the local tax rate applicable to the purchase location. Multiply the purchase price by the local tax rate to calculate the local tax amount.

- Add State and Local Taxes: Sum up the state tax amount and the local tax amount to find the total sales tax liability.

- Rounding and Final Payment: In most cases, the sales tax is rounded to the nearest cent. The total sales tax should be added to the purchase price to arrive at the final cost of the vehicle.

Sales Tax Exemptions and Special Considerations

New Jersey offers certain exemptions and special considerations when it comes to sales tax on car purchases. These exemptions are designed to benefit specific groups or promote specific initiatives. Here are some notable exemptions and considerations:

Vehicle Trade-Ins

When trading in a vehicle as part of a new car purchase, the trade-in value is generally not subject to sales tax in New Jersey. This means you won’t pay sales tax on the trade-in amount. However, it’s essential to understand that the sales tax is still applicable to the difference between the trade-in value and the new vehicle’s purchase price.

Sales Tax Exemption for Military Personnel

Active-duty military personnel stationed in New Jersey are eligible for a sales tax exemption when purchasing a vehicle. To qualify, the military member must provide valid military identification and meet specific residency requirements. This exemption can significantly reduce the overall cost of a car purchase for service members.

Sales Tax for Out-of-State Purchases

If you purchase a car from another state and plan to register it in New Jersey, you may be required to pay use tax. Use tax is similar to sales tax and is applied to ensure that all vehicles registered in New Jersey are taxed appropriately. The use tax rate aligns with the state’s sales tax rate, ensuring fairness.

Sales Tax for Electric Vehicles

New Jersey offers an incentive program to promote the adoption of electric vehicles (EVs). The state provides a sales tax exemption for the purchase of qualified EVs. This exemption applies to both new and used electric vehicles, encouraging environmentally friendly transportation choices.

Future Implications and Tax Policy Updates

New Jersey’s sales tax policies are subject to change over time, reflecting the state’s economic priorities and legislative decisions. Staying informed about potential changes is essential for car buyers and dealers alike. Here are some key considerations regarding future implications:

- Legislative Changes: The New Jersey legislature periodically reviews and adjusts tax policies. Any proposed changes to sales tax rates or exemptions should be monitored to ensure compliance.

- Environmental Initiatives: With a focus on sustainability, New Jersey may continue to promote and expand tax incentives for electric and hybrid vehicles. Keeping an eye on these initiatives can benefit environmentally conscious car buyers.

- Economic Factors: Economic conditions and budgetary needs can influence tax policies. Understanding the broader economic context can provide insights into potential shifts in sales tax rates or exemptions.

- Municipal Tax Updates: Local municipalities may periodically adjust their local sales tax rates. Regularly checking for updates ensures accurate calculations and compliance with local regulations.

Conclusion

Understanding the sales tax implications when purchasing a car in New Jersey is crucial for making informed decisions. From the state’s general sales tax rate to local tax variations, each aspect impacts the overall cost. By following the calculations, staying aware of exemptions, and keeping up with potential policy changes, you can navigate the sales tax landscape with confidence. Remember to consult official sources and tax professionals for the most accurate and up-to-date information.

FAQ

What is the current state sales tax rate in New Jersey for car purchases?

+As of my last update in January 2023, the state sales tax rate in New Jersey for car purchases is 6.625%.

Are there any additional taxes I should consider when buying a car in New Jersey?

+Yes, in addition to the state sales tax, local municipalities may impose their own sales tax rates. These local taxes can vary, so it’s important to research the specific tax rate applicable to the purchase location.

Are there any sales tax exemptions for car purchases in New Jersey?

+Yes, New Jersey offers sales tax exemptions for specific groups and initiatives. Active-duty military personnel, electric vehicle purchases, and certain vehicle trade-ins may qualify for exemptions.

How is sales tax calculated on a car purchase in New Jersey?

+Sales tax is calculated by multiplying the purchase price of the vehicle by the applicable sales tax rate, which includes both the state and local tax rates. The tax amount is then added to the purchase price to determine the final cost.

Are there any online resources or tools to help calculate sales tax on a car purchase in New Jersey?

+Yes, the New Jersey Division of Taxation provides online resources and tools to assist with calculating sales tax. These resources can help you estimate the tax amount based on the purchase price and applicable tax rates.