Montgomery County Property Tax

Montgomery County, located in the heart of Texas, is renowned for its vibrant communities, diverse landscapes, and thriving economic environment. As a homeowner or prospective buyer in this dynamic region, understanding the intricacies of property taxes is essential. In this comprehensive guide, we will delve into the Montgomery County property tax system, exploring its assessment processes, payment options, and the factors that influence tax rates.

Unraveling the Montgomery County Property Tax System

Montgomery County operates under a robust property tax system, overseen by the Montgomery Central Appraisal District (MCAD). This district plays a pivotal role in determining the property values that serve as the foundation for tax assessments.

Property Assessment and Appraisal

The MCAD employs a meticulous process to evaluate properties within the county. Each year, the district conducts field reviews and utilizes market data to establish accurate property values. This ensures that tax assessments are fair and reflective of the current real estate market.

For homeowners, the notice of appraised value is a critical document. Sent out annually, it details the MCAD's assessment of your property's value. If you disagree with the appraised value, you have the right to file a protest with the Appraisal Review Board (ARB), which provides an impartial hearing process.

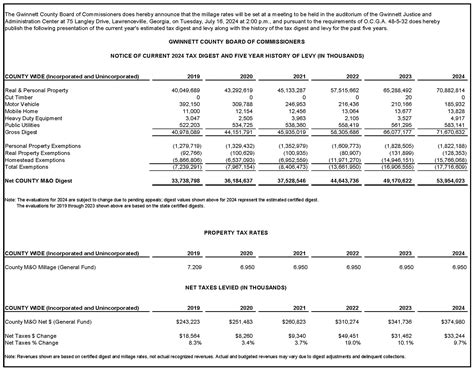

Tax Rates and Calculations

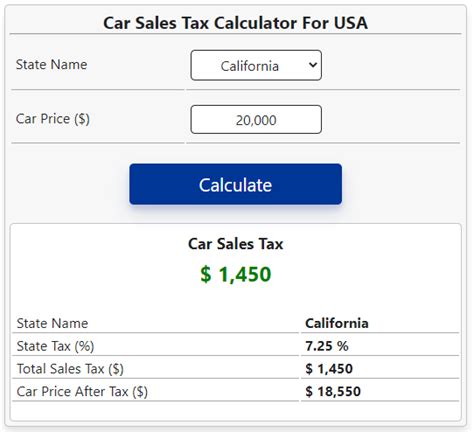

The property tax rate in Montgomery County is determined through a collaborative effort by various taxing entities, including the county government, school districts, and municipalities. These entities set their tax rates, which are then combined to calculate the overall tax rate for the county.

The tax rate is typically expressed as dollars per $100 of assessed value. For instance, a tax rate of $0.45 per $100 means that for every $100 of your property's assessed value, you will owe $0.45 in taxes. This calculation results in your total tax bill for the year.

| Taxing Entity | Tax Rate ($/100) |

|---|---|

| Montgomery County | $0.35 |

| Conroe ISD | $1.25 |

| City of Conroe | $0.40 |

| Total Tax Rate | $2.00 |

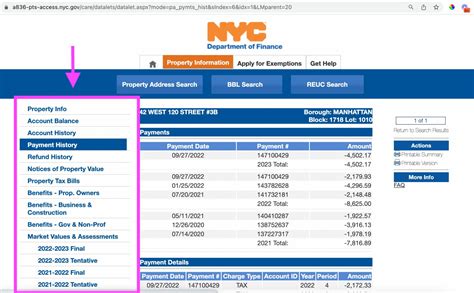

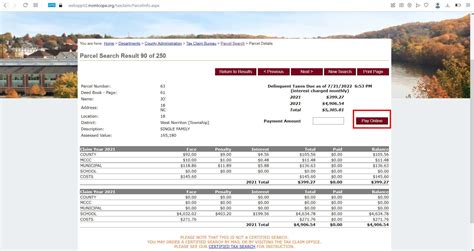

Property Tax Payments

Property tax payments in Montgomery County are due twice a year. The first installment is typically due in October, and the second installment is due in January of the following year. Late payments incur penalties and interest, so it’s essential to stay informed about due dates.

The county offers a range of payment methods, including online payment portals, mail-in payments, and in-person payments at designated locations. Some taxpayers may also be eligible for deferral programs or hardship exemptions to ease the financial burden of property taxes.

Factors Influencing Property Tax Rates

Property tax rates in Montgomery County are influenced by a variety of factors, each playing a unique role in the overall tax assessment.

Property Value

The assessed value of your property is a primary determinant of your tax bill. Higher property values generally result in higher tax obligations. Regular maintenance and improvements to your property can impact its value and, consequently, your tax liability.

Taxing Entity Budgets

The budgets of taxing entities, such as school districts and municipalities, significantly impact tax rates. When these entities require additional funding for projects or services, they may propose tax rate increases to generate the necessary revenue. This is a common occurrence during periods of economic growth or when there is a need for infrastructure development.

State Laws and Regulations

The state of Texas has implemented various laws and regulations to ensure fairness and transparency in the property tax system. For instance, the Texas Property Tax Code sets guidelines for appraisal districts and provides protections for taxpayers, such as the limitation on annual value increases for homesteads.

Economic Conditions

The overall economic climate of Montgomery County influences property tax rates. During periods of economic prosperity, property values tend to rise, leading to higher tax assessments. Conversely, economic downturns may result in tax rate adjustments to account for reduced property values.

Strategies for Navigating Property Taxes

Understanding the Montgomery County property tax system empowers homeowners to make informed decisions and potentially reduce their tax burden. Here are some strategies to consider:

- Stay Informed: Keep abreast of tax rate changes, assessment notices, and due dates. This knowledge can help you plan your finances effectively.

- Review Assessments: Carefully examine your property's assessed value and compare it to recent sales of similar properties in your area. If you believe the assessment is inaccurate, consider filing a protest with the ARB.

- Utilize Exemptions: Montgomery County offers various exemptions, such as the homestead exemption, which can reduce your taxable value. Ensure you are aware of the eligibility criteria and apply for the exemptions that apply to your situation.

- Explore Payment Options: The county provides flexible payment options, including payment plans and online payment portals. Choose the method that suits your financial situation and ensures timely payments to avoid penalties.

- Engage with Taxing Entities: Attend public meetings and engage with your local government and school district representatives. Understanding their budget processes and providing input can influence tax rates and ensure that your tax dollars are allocated efficiently.

Conclusion

Navigating the Montgomery County property tax system requires a combination of knowledge, vigilance, and strategic planning. By understanding the assessment process, staying informed about tax rates, and exploring available exemptions and payment options, homeowners can effectively manage their property tax obligations. Remember, the MCAD and local taxing entities are resources you can utilize to clarify any doubts or concerns you may have.

Frequently Asked Questions

What is the deadline for paying property taxes in Montgomery County?

+The deadline for paying property taxes in Montgomery County is typically January 31st of the following year. However, it’s crucial to verify the exact due date for your specific property, as it may vary slightly depending on the taxing entity.

How can I protest my property’s appraised value?

+To protest your property’s appraised value, you must file a protest application with the Appraisal Review Board (ARB) by the deadline specified on your notice of appraised value. The ARB will then schedule a hearing, where you can present your case and supporting evidence.

Are there any exemptions available to reduce my property taxes?

+Yes, Montgomery County offers several exemptions, including the homestead exemption, over-65 exemption, and disability exemption. These exemptions can reduce your taxable value, resulting in lower property taxes. To apply, you must meet specific eligibility criteria and submit the required documentation to the Montgomery Central Appraisal District (MCAD) by the deadline.

Can I pay my property taxes online?

+Absolutely! Montgomery County provides an online payment portal where you can conveniently make your property tax payments. You can also choose to set up automatic payments to ensure timely payments and avoid penalties.

How can I stay updated on tax rate changes and important deadlines?

+Montgomery County offers a taxpayer notification service that sends alerts and reminders about tax rate changes, assessment notices, and important deadlines. You can sign up for this service through the Montgomery Central Appraisal District (MCAD) website. Additionally, you can follow local news outlets and attend public meetings to stay informed about tax-related matters.