State Of Iowa Sales Tax

Welcome to a comprehensive guide on the State of Iowa's sales tax system, designed to offer a deep dive into the intricacies of this crucial revenue stream for the Hawkeye State. This article aims to provide an expert-level analysis, exploring the various facets of Iowa's sales tax policy, its impact on businesses and consumers, and its role in shaping the state's economic landscape.

The State of Iowa's Sales Tax Policy: An In-Depth Exploration

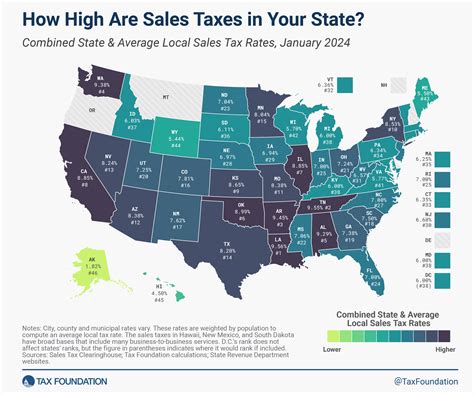

Iowa's sales tax, a key component of the state's revenue generation, operates under a robust framework that has evolved over the years to adapt to the dynamic needs of the economy. With a foundational rate of 6%, Iowa's sales tax is a significant contributor to the state's fiscal health, providing essential funding for vital public services and infrastructure development.

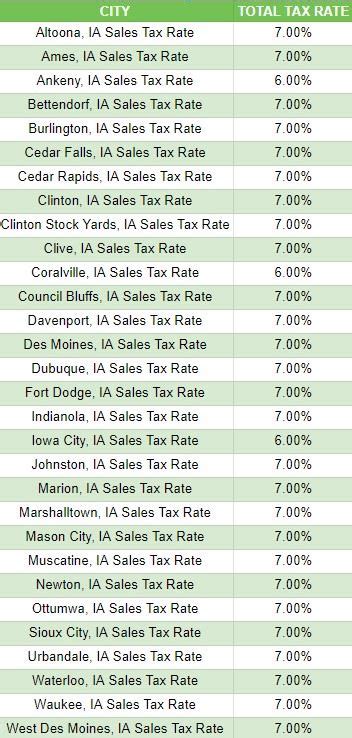

One unique aspect of Iowa's sales tax is its transparency and simplicity. The state imposes a uniform sales tax rate across all counties and cities, with no additional local sales taxes, making it easier for businesses to navigate and for consumers to understand. This uniformity also simplifies the tax collection and remittance process, reducing administrative burdens.

Key Components of Iowa's Sales Tax Structure

Iowa's sales tax system is characterized by a few key features that set it apart from many other states:

- Streamlined Tax System: Iowa has implemented a streamlined sales tax system, which aims to simplify and modernize sales tax administration. This system has been designed to reduce the burden on businesses by standardizing tax rates and rules across the state.

- Taxable Items: Iowa imposes sales tax on a wide range of goods and services, including tangible personal property, certain digital products, and many services. However, there are some notable exemptions, such as most food items for home consumption and prescription drugs.

- Taxable Jurisdiction: As mentioned earlier, Iowa has a statewide uniform sales tax rate, which means the same tax rate applies regardless of the location of the sale within the state. This uniformity makes it easier for businesses to comply with tax regulations.

- Tax Collection and Remittance: Businesses are responsible for collecting sales tax from customers at the point of sale. These funds are then remitted to the Iowa Department of Revenue on a regular basis, typically on a monthly or quarterly basis, depending on the business's tax liability.

The Iowa Department of Revenue provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations. This includes guidelines on tax registration, tax rate determination, tax collection, and remittance processes.

Sales Tax Exemptions and Special Considerations

While Iowa's sales tax is generally applicable to a broad range of goods and services, there are certain exemptions and special considerations in place. These include:

- Exemptions: As mentioned, Iowa exempts certain items from sales tax, such as food for home consumption, prescription drugs, and some agricultural equipment. These exemptions are designed to reduce the tax burden on essential items and support specific industries.

- Use Tax: Iowa also has a use tax, which is complementary to the sales tax. Use tax is applicable to purchases made outside of Iowa that are brought into the state for use, storage, or consumption. This tax ensures that out-of-state purchases are taxed similarly to in-state purchases, preventing tax avoidance.

- Special Tax Rates: In some specific cases, Iowa may impose special tax rates or additional taxes on certain goods or services. For instance, there is a 9% tax rate on prepared food and beverages served on-premises, and a 10% tax rate on lodging and short-term rentals.

Impact on Businesses and Consumers

Iowa's sales tax policy has a significant impact on both businesses and consumers within the state. For businesses, the sales tax is a critical consideration in their financial planning and pricing strategies. Businesses must ensure they are compliant with tax regulations to avoid penalties and maintain their reputation.

From a consumer perspective, the sales tax is a visible component of their purchasing decisions. While the tax may increase the cost of goods and services, it is a necessary contribution to the state's revenue stream, which in turn funds essential public services that benefit all Iowans.

Furthermore, the uniformity of Iowa's sales tax rate provides a level of predictability for both businesses and consumers, simplifying the tax landscape and reducing potential confusion.

| Metric | Value |

|---|---|

| Statewide Sales Tax Rate | 6% |

| Prepared Food Tax Rate | 9% |

| Lodging Tax Rate | 10% |

Future Outlook and Potential Reforms

As with any tax system, Iowa's sales tax is subject to ongoing review and potential reforms. The state's policymakers continuously evaluate the tax structure to ensure it remains fair, efficient, and aligned with the state's economic goals.

In recent years, there have been discussions and proposals for sales tax reforms in Iowa. These include considerations to:

- Modernize the tax system further to keep pace with the digital economy and the increasing prevalence of online sales.

- Explore the potential for tax incentives or exemptions to support specific industries or promote economic development in targeted areas.

- Review the tax rates and structure to ensure they remain competitive and do not create a burden on businesses or consumers.

Additionally, Iowa's policymakers often engage in inter-state discussions and collaborations to ensure the state's tax policies remain in line with regional and national trends, especially given the interconnected nature of the economy.

Conclusion

Iowa's sales tax policy is a crucial component of the state's fiscal framework, contributing significantly to the funding of essential public services and infrastructure. With its streamlined system and uniform tax rate, Iowa's sales tax is designed to be fair, transparent, and easy to administer and understand.

As the state continues to evolve and adapt to economic changes, the sales tax policy will remain a key focus for policymakers, businesses, and consumers alike. The future of Iowa's sales tax will be shaped by these ongoing discussions and the state's commitment to a robust and sustainable economy.

What is the current sales tax rate in Iowa for general goods and services?

+

The current sales tax rate in Iowa for general goods and services is 6%.

Are there any sales tax holidays in Iowa?

+

No, Iowa does not currently have sales tax holidays. However, certain items like school supplies and clothing may be exempt from sales tax during specific periods.

How often do businesses need to remit sales tax to the Iowa Department of Revenue?

+

The frequency of sales tax remittance depends on the business’s tax liability. Generally, businesses with higher tax liabilities remit sales tax on a monthly basis, while those with lower liabilities remit quarterly. Some businesses with very low tax liabilities may remit annually.