When Can We Start Filing Taxes

Tax season is an annual event that impacts millions of individuals and businesses across the country. Filing taxes is a crucial process that allows individuals to report their income, claim deductions, and either pay their tax liabilities or receive refunds. The Internal Revenue Service (IRS) sets specific timelines and guidelines for when taxpayers can start filing their returns. Understanding these deadlines is essential to ensure compliance and take advantage of any potential tax benefits.

The exact date when taxpayers can begin filing their taxes varies from year to year, often falling within the first quarter of the calendar year. This date is determined by the IRS and can be influenced by various factors, including the day of the week on which tax deadlines fall and any changes to tax laws or regulations. Staying informed about the official start date for tax filing is vital to avoid penalties and ensure a smooth process.

The IRS Tax Filing Calendar

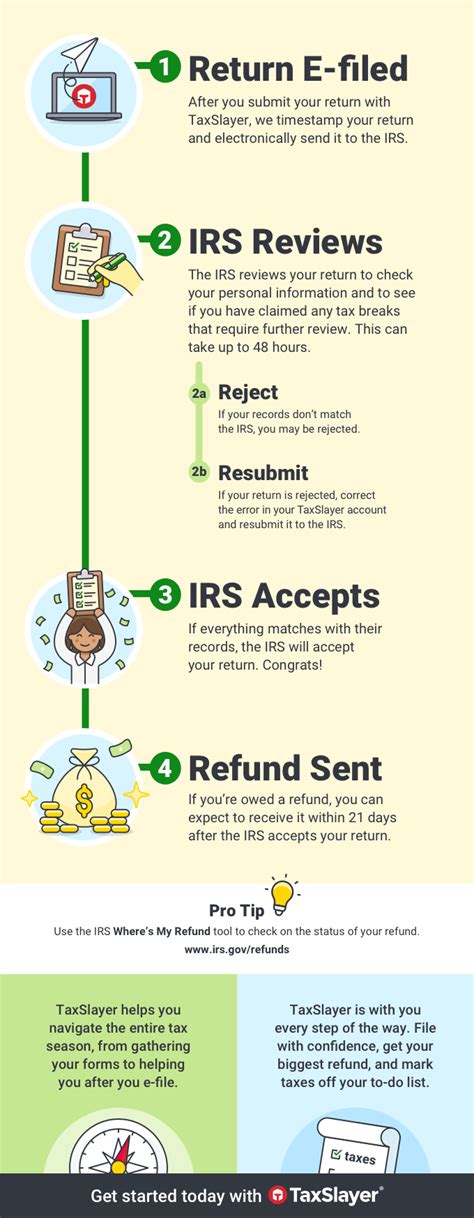

The IRS typically announces the official start date for tax filing several months in advance, allowing taxpayers ample time to prepare. This date serves as a guide for when taxpayers can begin submitting their returns, but it is not the only deadline to keep in mind. The tax calendar also includes other crucial dates, such as the due date for filing tax returns and paying any taxes owed.

For the current tax year, the IRS has set January 23, 2024 as the official start date for tax filing. This date marks the earliest taxpayers can begin submitting their returns for the 2023 tax year. It's important to note that while the IRS accepts returns starting on this date, not all taxpayers will need to file immediately. The start date serves as a general guideline, and taxpayers can choose to file their returns at their convenience within the designated timeframe.

The due date for filing tax returns and paying any taxes owed is typically April 15th of the following year. However, this deadline can be extended under certain circumstances, such as filing for an extension or encountering specific challenges that prevent timely filing. It's crucial to stay informed about these extensions and their requirements to ensure compliance with tax laws.

Extension Deadlines and Requirements

Taxpayers who cannot meet the standard filing deadline can request an extension from the IRS. This extension provides additional time to file tax returns but does not grant an extension for paying any taxes owed. To request an extension, taxpayers must complete and submit Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return", before the original filing deadline.

By filing for an extension, taxpayers can secure an additional six months to file their tax returns. This means that the new deadline for filing tax returns would be October 15th of the same year. However, it's essential to note that an extension for filing does not relieve taxpayers from their obligation to pay any taxes owed by the original deadline. Failure to pay taxes by the due date may result in penalties and interest charges.

| Start Date for Filing Taxes | Due Date for Filing Returns and Paying Taxes |

|---|---|

| January 23, 2024 | April 15, 2024 |

Preparing for Tax Season

With the start date for tax filing approaching, it's essential to begin preparing your tax documents and understanding your financial situation. Gather all relevant paperwork, including W-2 forms, 1099 forms, receipts, and any other documentation related to your income, deductions, and credits. Organize your records to make the filing process more efficient and accurate.

Consider seeking professional assistance if you have complex tax situations or are unsure about specific deductions or credits. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide valuable guidance and ensure compliance with tax laws. They can also help identify potential tax-saving opportunities and strategies tailored to your financial circumstances.

Common Tax Preparation Documents

- W-2 Forms: Wage and tax statements from employers, reporting your income and tax withholdings.

- 1099 Forms: Various versions of this form report different types of income, such as interest, dividends, or independent contracting earnings.

- Receipts: Keep records of expenses related to deductions, such as medical expenses, charitable donations, or business-related costs.

- Tax Software or Services: Explore user-friendly tax preparation software or consider hiring a tax professional for complex situations.

By staying informed about the official start date for tax filing and understanding the key deadlines, taxpayers can approach the process with confidence and efficiency. Remember to gather your tax documents, seek professional guidance when needed, and take advantage of any tax-saving opportunities available to you. Filing taxes accurately and on time ensures compliance with tax laws and can lead to potential refunds or tax benefits.

FAQs

Can I file my taxes before the official start date announced by the IRS?

+

While the IRS sets an official start date for tax filing, taxpayers are not required to wait until that exact date to begin filing their returns. You can start filing your taxes as soon as you have all the necessary information and documentation, even if it’s before the official start date.

What happens if I miss the tax filing deadline without requesting an extension?

+

Missing the tax filing deadline without a valid extension can result in penalties and interest charges. The IRS may impose a late filing penalty, which is typically 5% of the unpaid tax amount for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid taxes from the original due date until the tax is paid in full.

Can I pay my taxes after the due date and avoid penalties?

+

While paying your taxes after the due date will likely result in penalties and interest charges, you can take steps to minimize these consequences. If you owe taxes and cannot pay the full amount by the due date, consider requesting a payment plan or installment agreement with the IRS. This can help spread out the payment over time and potentially reduce or waive certain penalties.

Are there any circumstances where I don’t need to file taxes even if I have income?

+

Yes, there are certain circumstances where you may not be required to file a tax return even if you have income. This typically applies to individuals with very low income or specific exemptions. The IRS provides guidelines on who is required to file a tax return based on factors such as age, filing status, and income level. It’s important to review these guidelines to determine if you fall into an exempt category.

What should I do if I’m unsure about my tax filing obligations or have complex tax situations?

+

If you’re unsure about your tax filing obligations or have complex tax situations, it’s recommended to seek professional guidance. Tax professionals, such as CPAs or enrolled agents, can provide expert advice tailored to your specific circumstances. They can help you navigate the tax laws, identify potential deductions and credits, and ensure compliance with tax regulations.