Milwaukee County Tax

Welcome to an in-depth exploration of the Milwaukee County Tax system, an essential aspect of understanding the economic landscape of the region. Milwaukee County, located in Wisconsin, USA, has a unique tax structure that influences the financial operations of businesses and individuals alike. This article aims to demystify the intricacies of Milwaukee County's tax system, providing a comprehensive guide for taxpayers, investors, and anyone interested in the local economy.

Understanding the Milwaukee County Tax Landscape

Milwaukee County operates under a comprehensive tax system that includes a variety of taxes to support local government operations and services. The tax structure is designed to ensure fair and equitable contributions from residents and businesses, playing a pivotal role in the county’s fiscal health and economic development.

Property Taxes: A Cornerstone of County Revenue

Property taxes are a significant source of revenue for Milwaukee County. These taxes are levied on both real estate and personal property, with rates varying based on the assessed value of the property. The county’s property tax system is designed to provide stable and predictable revenue streams, which are crucial for funding essential services like education, public safety, and infrastructure maintenance.

| Tax Type | Description |

|---|---|

| Real Estate Tax | Levied on land and buildings, with rates determined by the county's assessed value system. |

| Personal Property Tax | Applies to tangible assets like vehicles, machinery, and equipment. Rates are set by the county and can vary based on the type of property. |

To ensure fairness, Milwaukee County utilizes an assessment process that considers factors like location, property type, and market value. Property owners are provided with assessment notices, detailing the assessed value of their property and the corresponding tax liability. This transparency helps build trust and understanding among taxpayers.

Income and Business Taxes: Supporting Economic Growth

In addition to property taxes, Milwaukee County imposes income and business taxes to generate revenue and support economic development initiatives. These taxes contribute to the county’s ability to invest in infrastructure, attract new businesses, and foster a thriving business environment.

| Tax Type | Description |

|---|---|

| Individual Income Tax | Based on a progressive tax rate structure, residents of Milwaukee County pay income tax on their earnings. The rates vary depending on income brackets, ensuring that higher earners contribute a larger share. |

| Business Income Tax | Businesses operating within Milwaukee County are subject to a business income tax. The tax is calculated based on the net income of the business, with provisions for deductions and credits. |

| Sales and Use Tax | A sales tax is levied on retail sales within the county, while a use tax is imposed on goods purchased from outside the county and used within Milwaukee County. |

Tax Incentives and Relief Programs

Recognizing the importance of attracting and retaining businesses, Milwaukee County offers a range of tax incentives and relief programs. These initiatives aim to stimulate economic growth, create jobs, and support community development.

- Tax Incremental Financing (TIF): TIF districts are established to encourage private investment in targeted areas. Property tax revenues from these districts are used to fund public improvements, making the area more attractive for development.

- Enterprise Zones: Certain areas within the county are designated as Enterprise Zones, offering tax benefits and incentives to businesses that locate or expand within these zones.

- Tax Abatement Programs: Milwaukee County provides tax abatement programs to encourage investment in specific industries or to support businesses impacted by economic downturns.

The Impact of Milwaukee County Taxes on the Local Economy

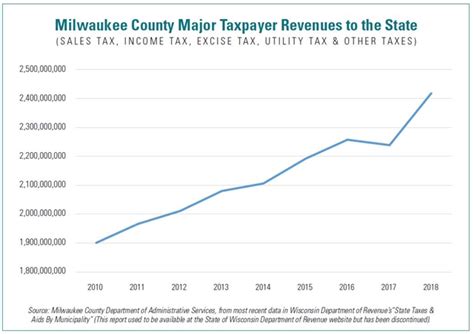

The tax system in Milwaukee County plays a crucial role in shaping the local economy. By providing stable funding for essential services, the county creates an environment conducive to business growth and community development. Let’s explore some key impacts of the tax system on the local economy.

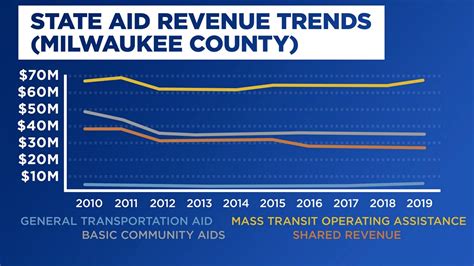

Funding Essential Services

Revenue generated from taxes is primarily used to fund vital services that benefit the entire community. This includes public education, which is a significant recipient of tax dollars. The county’s commitment to education ensures that students have access to quality learning environments, fostering a skilled workforce for the future.

Additionally, tax revenue supports public safety initiatives, including police and fire departments, ensuring the safety and well-being of residents. The county's investment in infrastructure maintenance and development also contributes to a higher quality of life for residents and a more attractive environment for businesses.

Economic Development and Job Creation

The tax system in Milwaukee County is designed to encourage economic growth and job creation. By offering tax incentives and relief programs, the county attracts new businesses and supports existing ones, leading to increased employment opportunities. This, in turn, boosts the local economy and enhances the county’s tax base.

For instance, the Enterprise Zone program has been instrumental in revitalizing specific areas within the county. By offering tax benefits to businesses operating in these zones, the county has successfully encouraged investment and development, creating jobs and improving the overall economic outlook.

Promoting Community Development

Milwaukee County’s tax system goes beyond revenue generation; it actively promotes community development and social equity. The county’s commitment to providing affordable housing and supporting community-based initiatives is evident in its tax policies.

Through dedicated tax funds, the county invests in affordable housing programs, ensuring that low-income families have access to suitable and affordable housing options. Additionally, community development initiatives, such as neighborhood revitalization projects, receive funding support, enhancing the overall quality of life for residents.

Future Outlook and Innovations in Tax Policy

As Milwaukee County continues to evolve, its tax system is expected to adapt and innovate to meet the changing needs of the community. Here’s a glimpse into the future of Milwaukee County taxes and some potential developments.

Technological Advancements in Tax Administration

The county is exploring ways to leverage technology to streamline tax administration processes. Online tax filing and payment systems are being enhanced to provide taxpayers with convenient and secure options for managing their tax obligations. This not only improves efficiency but also reduces the administrative burden on taxpayers.

Furthermore, the county is investing in data analytics to optimize tax assessment processes. By utilizing advanced technologies, Milwaukee County aims to ensure fair and accurate assessments, fostering transparency and trust among taxpayers.

Sustainable Funding Models

In an effort to promote sustainability and long-term fiscal health, Milwaukee County is considering the implementation of green initiatives and sustainable funding models. This may involve exploring taxes or fees related to environmental initiatives, such as a carbon tax or a waste disposal fee, to encourage environmentally conscious practices and generate revenue for sustainable projects.

Community Engagement and Tax Policy Reform

Milwaukee County recognizes the importance of community engagement in shaping tax policies. The county is committed to fostering open dialogue and seeking input from residents and businesses to ensure that tax policies reflect the needs and values of the community. Regular town hall meetings and online engagement platforms provide opportunities for citizens to voice their opinions and contribute to tax policy discussions.

Addressing Equity and Inclusion

As part of its commitment to social equity, Milwaukee County is actively working to address tax-related disparities. The county is exploring ways to ensure that the tax system is fair and accessible to all residents, regardless of their socioeconomic status. This includes initiatives to simplify tax processes, provide assistance to low-income taxpayers, and promote financial literacy.

Conclusion: Milwaukee County’s Tax System – A Catalyst for Progress

Milwaukee County’s tax system is more than just a means of revenue generation; it is a catalyst for progress and economic development. By providing stable funding for essential services, supporting business growth, and promoting community development, the county’s tax policies contribute to a thriving and resilient local economy.

As Milwaukee County continues to innovate and adapt, its tax system will play a crucial role in shaping the future of the region. Through a commitment to fairness, transparency, and community engagement, the county is poised to create a tax environment that fosters economic prosperity and enhances the quality of life for all its residents.

How often do property taxes change in Milwaukee County?

+Property taxes in Milwaukee County are assessed annually. The assessed value of properties is reviewed and adjusted based on market conditions and other factors. This ensures that property taxes reflect the current value of properties and contribute fairly to the county’s revenue.

What are the tax rates for businesses operating in Milwaukee County?

+Business tax rates in Milwaukee County vary depending on the type of business and its location within the county. Generally, businesses pay a percentage of their net income as a business tax. However, specific rates can be determined by consulting the Milwaukee County Treasurer’s office or the Department of Revenue.

Are there any tax relief programs for senior citizens or veterans in Milwaukee County?

+Yes, Milwaukee County offers tax relief programs for senior citizens and veterans. These programs provide property tax credits or exemptions based on certain eligibility criteria. To learn more about these programs and their requirements, individuals can contact the Milwaukee County Department of Aging or the Veterans Service Office.