Marriage Tax Benefits

Marriage is an important milestone in many people's lives, and it can bring about various legal, social, and financial changes. One often-discussed aspect of married life is the impact on taxes. The concept of "marriage tax benefits" has been a topic of interest and sometimes controversy, as it can significantly affect a couple's financial planning and overall tax liability. In this comprehensive guide, we delve into the world of marriage tax benefits, exploring the advantages, considerations, and strategies to optimize your financial situation as a married couple.

Understanding Marriage Tax Benefits

When two individuals tie the knot, their financial lives become intertwined, and this includes their tax obligations. The Internal Revenue Service (IRS) recognizes married couples as a single tax unit, offering a range of benefits and considerations unique to this status. These benefits can result in tax savings and better financial planning opportunities for married couples.

Joint Tax Filing and Reduced Tax Rates

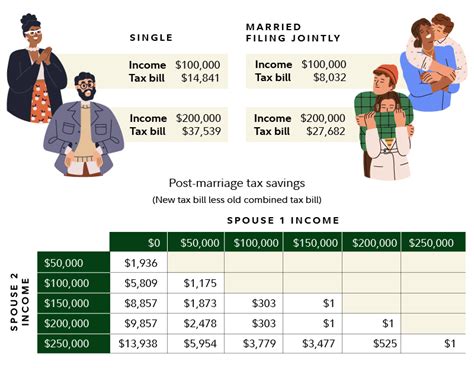

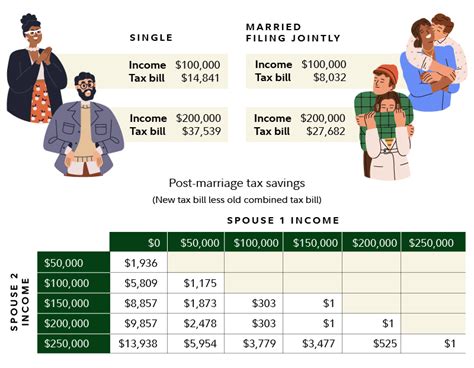

One of the most significant advantages of marriage is the option to file taxes jointly. Joint filing allows couples to combine their incomes and deductions, which can lead to a lower overall tax rate. The tax brackets for married filing jointly are more favorable than those for single filers, especially for higher-income earners. For instance, the IRS tax rate schedule for 2023 shows that a married couple filing jointly can earn up to 183,550 before reaching the 24% tax bracket, whereas a single filer reaches this bracket at 91,775.

| Filing Status | 2023 Tax Bracket Thresholds |

|---|---|

| Married Filing Jointly | $183,550 (for 24% tax bracket) |

| Single | $91,775 (for 24% tax bracket) |

Additionally, joint filing can provide a larger standard deduction and more opportunities for tax credits and deductions, such as the Child Tax Credit or the Earned Income Tax Credit, which can further reduce the couple's tax burden.

Tax Credits and Deductions

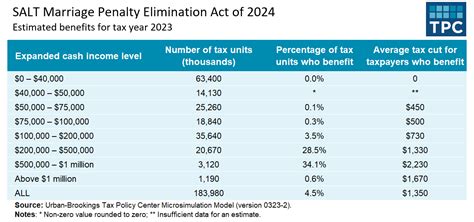

Marriage can unlock a range of tax credits and deductions that are specifically designed for married couples. For example, the Marriage Penalty Relief tax credit is available to married couples whose combined income is below a certain threshold. This credit aims to reduce the tax burden for couples who may face a higher tax liability due to their marital status.

Moreover, married couples can take advantage of the Child and Dependent Care Credit, which provides a tax credit for expenses related to childcare or the care of elderly or disabled dependents. This credit can be particularly beneficial for dual-income households, where both spouses work and require childcare services.

Social Security and Retirement Benefits

Marriage can also impact a couple’s retirement planning and Social Security benefits. Spouses can receive spousal benefits based on their partner’s work history, which can supplement their own retirement income. This is especially beneficial for couples where one spouse has a higher earning potential or a more extensive work history.

Additionally, married couples can benefit from the Survivor Benefits program, which provides financial support to the surviving spouse in the event of the other spouse's death. This can be a crucial safety net, ensuring financial stability during a difficult time.

Maximizing Marriage Tax Benefits

Understanding the potential benefits is the first step, but to truly optimize your financial situation, there are several strategies you can employ.

Effective Tax Planning

Engaging in proactive tax planning can help you make the most of your marriage tax benefits. This includes regularly reviewing your tax situation, especially after significant life events such as a job change, the birth of a child, or a move to a new state. Adjusting your tax withholdings throughout the year can ensure that you’re not overpaying or underpaying taxes, which can lead to penalties or missed opportunities for refunds.

Utilizing Tax Credits and Deductions

Stay informed about the tax credits and deductions available to married couples. For instance, if you have dependent children, understanding the Child Tax Credit and Child and Dependent Care Credit can help you reduce your tax liability. Additionally, consider contributions to tax-advantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which can provide tax savings for eligible medical expenses.

Retirement Planning and Social Security Optimization

Marriage provides an opportunity to optimize your retirement planning and Social Security benefits. Couples can coordinate their retirement savings strategies, such as contributing to a spouse’s IRA or 401(k) if they have a lower income or have not maximized their own contributions. This can help balance retirement savings and potentially reduce the tax burden for the higher-earning spouse.

Furthermore, understanding the Social Security claiming strategies for married couples can be beneficial. For instance, one spouse might choose to delay claiming their benefits until a later age, allowing for a higher monthly benefit. The other spouse can then claim spousal benefits based on the higher-earning spouse's work record, ensuring a more secure retirement income.

Considerations and Potential Challenges

While marriage tax benefits can be advantageous, there are also considerations and potential challenges to be aware of.

The “Marriage Penalty”

The term “marriage penalty” refers to the situation where a married couple’s tax liability is higher than it would be if they were single. This can occur when both spouses have similar incomes and file jointly, pushing them into a higher tax bracket. To mitigate this, some couples choose to file separately, but this option has its own set of complexities and may not always be beneficial.

Impact on Healthcare and Insurance

Marriage can also impact healthcare and insurance coverage. For instance, married couples often have the option to enroll in a family healthcare plan, which can provide comprehensive coverage for both spouses and any dependent children. However, this can also result in higher premiums compared to individual plans.

Additionally, marriage can impact life insurance and estate planning. Spouses are often named as beneficiaries on each other's policies, and marriage can simplify the process of transferring assets upon death. However, it's essential to review and update these policies regularly to ensure they align with your current financial goals and family situation.

Conclusion: Navigating the Complexities

Marriage tax benefits offer a range of advantages and opportunities for financial optimization. From reduced tax rates to access to specific credits and deductions, married couples have a unique set of tools to manage their financial lives. However, navigating these benefits and considerations requires careful planning and an understanding of the potential complexities.

By staying informed, engaging in proactive tax planning, and optimizing your retirement and healthcare strategies, you can make the most of your marriage tax benefits. Remember, every couple's situation is unique, so consulting with a tax professional or financial advisor can provide personalized guidance to help you make the best decisions for your financial future.

What is the difference between filing jointly and separately as a married couple?

+

Filing jointly as a married couple combines your incomes and deductions, often resulting in a lower overall tax rate. On the other hand, filing separately maintains individual tax liabilities and may be beneficial in certain situations, such as when there is a significant income disparity between spouses.

Are there any tax benefits specifically for married couples with children?

+

Yes, married couples with children can benefit from tax credits like the Child Tax Credit and the Child and Dependent Care Credit. These credits can provide significant savings on your tax liability, especially if you have dependent children or require childcare services.

How does marriage impact Social Security benefits?

+

Marriage can provide several Social Security benefits, including spousal benefits and survivor benefits. Spouses can receive benefits based on their partner’s work history, and in the event of a spouse’s death, the surviving spouse can receive financial support through the Survivor Benefits program.