Las Vegas Nv Sales Tax Rate

Las Vegas, the vibrant city of lights and entertainment, has a robust economy that extends beyond its famous casinos and resorts. One crucial aspect of doing business in Las Vegas is understanding the city's sales tax structure. In this comprehensive guide, we will delve into the intricacies of the Las Vegas, NV sales tax rate, exploring its current rate, historical context, and how it impacts various industries and consumers.

Understanding the Las Vegas Sales Tax Rate

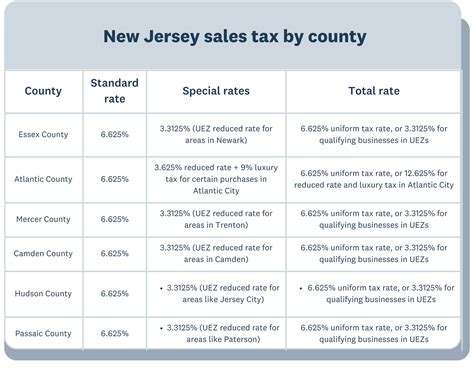

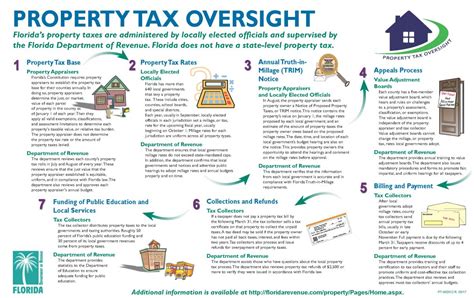

The sales tax in Las Vegas, like many other U.S. cities, is a consumption tax levied on the sale of goods and certain services. It is an essential revenue stream for the city and the state, funding essential public services and infrastructure projects. The sales tax rate in Las Vegas consists of several components, including state, county, and city taxes, each with its own purpose and rate.

Current Sales Tax Rate in Las Vegas

As of [insert current year], the combined sales tax rate in Las Vegas is 8.25%. This rate is composed of the following components:

- Nevada State Sales Tax: 4.6%

- Clark County Sales Tax: 2.25%

- Las Vegas City Sales Tax: 1.4%

It’s important to note that these rates are subject to change, and it’s advisable to check for any updates before conducting business transactions or planning large purchases.

Historical Perspective

The sales tax rate in Las Vegas has undergone several adjustments over the years. In the early 2000s, the combined rate was lower, at around 6.5%, but it has since increased to support the city’s growth and infrastructure development. The most recent increase in the sales tax rate occurred in [insert year], primarily to fund specific projects and maintain essential services.

Impact on Businesses and Consumers

The sales tax rate in Las Vegas affects both businesses and consumers in various ways:

- Businesses: Retailers and service providers are responsible for collecting and remitting sales tax to the appropriate authorities. This process requires accurate record-keeping and compliance with tax regulations. Additionally, businesses may need to consider the sales tax rate when setting their pricing strategies and competitive offerings.

- Consumers: Shoppers and customers in Las Vegas encounter the sales tax rate at the point of purchase. It is important for consumers to be aware of the tax rate to understand the true cost of their purchases. The sales tax can significantly impact the affordability of goods and services, especially for large or frequent purchases.

Sales Tax Distribution and Usage

The revenue generated from the sales tax in Las Vegas is distributed among different government entities and is utilized for a variety of purposes. Here’s a breakdown of how the sales tax funds are allocated:

| Government Entity | Tax Rate | Usage |

|---|---|---|

| Nevada State Government | 4.6% | The state's general fund supports various public services, including education, healthcare, public safety, and infrastructure development. |

| Clark County | 2.25% | County funds are used for local government operations, including law enforcement, road maintenance, and community development projects. |

| City of Las Vegas | 1.4% | The city's portion of the sales tax goes towards urban planning, city infrastructure, cultural programs, and public amenities. |

This distribution ensures that the sales tax revenue benefits the community at large, contributing to the overall well-being and development of Las Vegas.

Industries and Sales Tax

The sales tax rate in Las Vegas affects different industries in unique ways. Here’s a closer look at how specific sectors are influenced by the tax structure:

Retail and E-commerce

Retail businesses in Las Vegas, whether brick-and-mortar stores or online platforms, play a crucial role in the city’s economy. The sales tax directly impacts their pricing strategies and competitive advantage. Retailers must ensure compliance with tax regulations to avoid legal issues and maintain consumer trust. Additionally, e-commerce businesses need to navigate the complexities of sales tax laws, especially when selling to customers outside Nevada.

Hospitality and Tourism

Las Vegas is renowned for its vibrant tourism industry, and the sales tax rate directly affects the cost of travel and leisure experiences. Hotels, resorts, and entertainment venues must factor in the sales tax when setting their rates and packages. Additionally, the tax rate can influence the affordability of attractions and impact the overall perception of value for tourists.

Construction and Real Estate

The construction and real estate sectors in Las Vegas are significant contributors to the city’s economic growth. The sales tax rate applies to various construction materials and services, impacting the overall cost of building projects. Additionally, the tax structure influences the affordability of housing and commercial properties, which can have long-term implications for the local real estate market.

Future Implications and Potential Changes

The sales tax rate in Las Vegas is subject to ongoing evaluation and potential adjustments. As the city’s needs evolve, so might the tax structure. Here are some potential future implications and considerations:

- Infrastructure Development: Las Vegas continues to invest in its infrastructure, including transportation networks and sustainable initiatives. Future sales tax adjustments could be aimed at funding these critical projects.

- Economic Growth and Stability: A stable and competitive sales tax rate can attract businesses and investors, contributing to the city's economic growth. However, significant rate changes could impact the business landscape and consumer spending patterns.

- Equitable Tax Structure: Ensuring that the sales tax is distributed equitably across different industries and income levels is essential for maintaining social and economic balance in the city.

Staying informed about potential changes in the sales tax rate is crucial for businesses and consumers alike, as it can significantly impact financial planning and decision-making.

FAQ

What is the current sales tax rate in Las Vegas, NV?

+

The current combined sales tax rate in Las Vegas is 8.25%, effective [insert current year]. This rate includes state, county, and city taxes.

How often are sales tax rates adjusted in Las Vegas?

+

Sales tax rates in Las Vegas can be adjusted periodically, typically to fund specific projects or maintain essential services. It’s advisable to check for updates annually.

Do tourists and visitors pay the same sales tax rate as locals in Las Vegas?

+

Yes, both tourists and locals pay the same sales tax rate when making purchases in Las Vegas. The tax applies to all consumers equally.

Are there any sales tax exemptions or special rates for specific industries in Las Vegas?

+

While the sales tax rate is generally consistent across industries, there may be specific exemptions or special rates for certain sectors, such as manufacturing or agriculture. It’s advisable to consult with tax professionals or the Nevada Department of Taxation for industry-specific guidance.

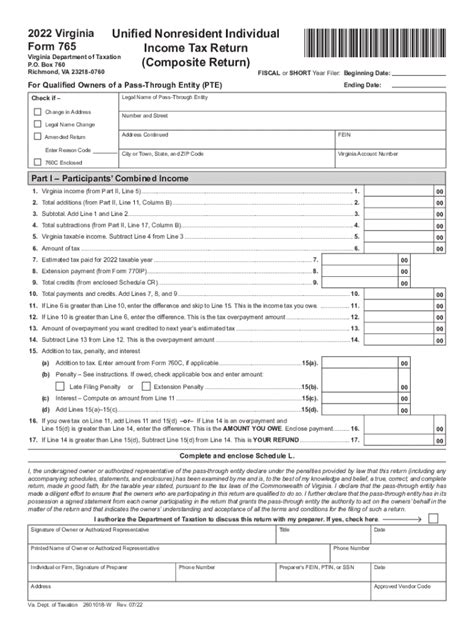

How can businesses stay compliant with sales tax regulations in Las Vegas?

+

Businesses in Las Vegas should ensure they are registered with the Nevada Department of Taxation and collect and remit sales tax accurately. Regular tax training and staying updated with tax law changes are essential for compliance.

Understanding the Las Vegas, NV sales tax rate is a crucial aspect of doing business and making informed consumer choices in this dynamic city. By staying informed about the current rate, its historical context, and its impact on various industries, stakeholders can navigate the city’s economy with confidence.