Iowa State Sales Tax

In the heart of the United States, the state of Iowa stands as a vibrant economic hub with a unique sales tax landscape. Iowa's sales tax system is an essential component of its fiscal policy, contributing significantly to the state's revenue and shaping the economic environment for both residents and businesses.

Understanding Iowa’s Sales Tax: An Overview

Iowa’s sales tax is a statewide tax applied to the retail sale or lease of tangible personal property and some services. It is a cumulative tax, meaning that local jurisdictions can levy additional taxes on top of the state’s base rate, creating a unique tax structure across the state.

The state sales tax rate in Iowa is currently set at 6%, one of the more competitive rates in the Midwest. This rate is applied uniformly across the state, providing a consistent tax environment for businesses and consumers alike. However, the story doesn't end there, as Iowa's tax system is far more nuanced.

The Complexity of Iowa’s Local Sales Tax

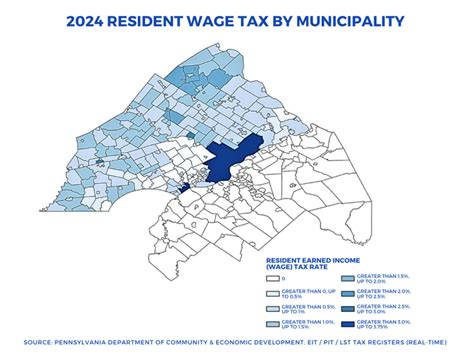

While the state rate is consistent, Iowa’s local jurisdictions, including cities and counties, are authorized to impose their own local option sales taxes. These additional taxes can vary significantly, resulting in a patchwork of sales tax rates across the state.

For instance, while the city of Des Moines levies a local option sales tax of 1.5%, bringing the total sales tax rate to 7.5%, the nearby city of West Des Moines has a 0.5% local tax, resulting in a 6.5% total rate. This variation can be a challenge for businesses operating in multiple jurisdictions and for consumers shopping across different areas.

The Impact on Businesses and Consumers

The complex local tax landscape in Iowa can lead to uncertainty and administrative burdens for businesses, especially those with operations in multiple counties or cities. They must navigate different tax rates and ensure compliance with various tax authorities. For consumers, it means varying prices for the same goods depending on the location of the purchase.

Sales Tax Exemptions and Special Considerations

Iowa’s sales tax system is not without its exemptions and special considerations. Certain items, such as prescription drugs, most food items, and residential energy, are exempt from sales tax. This is designed to ease the tax burden on essential goods and services, making them more affordable for residents.

The Role of Remote Sellers

With the rise of e-commerce, Iowa, like many other states, has had to address the issue of remote sellers and their tax obligations. Iowa’s Marketplace Facilitator Law requires out-of-state sellers who meet certain thresholds to collect and remit sales tax on behalf of the state. This law aims to level the playing field for in-state and out-of-state businesses, ensuring fair competition.

Iowa’s Sales Tax Administration and Compliance

The Iowa Department of Revenue is responsible for the administration and enforcement of sales tax in the state. It provides resources and guidance to help businesses understand their tax obligations and ensure compliance. This includes detailed information on tax rates, exemptions, and filing requirements.

Businesses in Iowa are required to register for a sales tax permit and collect the appropriate tax rate based on the location of the sale. They must then file periodic tax returns and remit the collected taxes to the Department of Revenue. Non-compliance can result in penalties and interest, making it crucial for businesses to stay informed and up-to-date with their tax obligations.

The Role of Technology in Sales Tax Compliance

To ease the compliance burden, many businesses in Iowa are turning to sales tax automation software. These tools can help businesses manage the complexities of Iowa’s sales tax system by automatically calculating taxes based on the destination of the sale, ensuring accurate tax collection and filing.

The Economic Impact of Iowa’s Sales Tax

Iowa’s sales tax system plays a critical role in the state’s economy. It is a significant source of revenue for the state and local governments, funding essential services and infrastructure projects. In 2022, Iowa’s sales tax revenue accounted for approximately 38.4% of the state’s general fund, a substantial contribution to the state’s fiscal health.

| Year | Total Sales Tax Revenue (in millions) |

|---|---|

| 2022 | $2,663.5 |

| 2021 | $2,509.7 |

| 2020 | $2,345.1 |

However, the sales tax also influences consumer behavior. High sales tax rates can discourage spending, potentially leading to a decrease in retail sales. Conversely, lower rates can stimulate economic activity. As such, Iowa's sales tax rates are a delicate balance between revenue generation and consumer incentives.

The Future of Iowa’s Sales Tax

Looking ahead, Iowa’s sales tax system is likely to evolve in response to changing economic conditions and technological advancements. The continued growth of e-commerce and the increasing complexity of the tax landscape will present new challenges and opportunities for the state.

As Iowa navigates these changes, the focus will remain on fairness, simplicity, and revenue adequacy. This means ensuring that the tax system is easy to understand and comply with for businesses, provides sufficient revenue for the state and local governments, and treats all taxpayers equitably.

Frequently Asked Questions

What is the current state sales tax rate in Iowa?

+

The current state sales tax rate in Iowa is 6%.

Can local jurisdictions in Iowa impose additional sales taxes?

+

Yes, Iowa allows local jurisdictions like cities and counties to impose local option sales taxes on top of the state rate, resulting in varying total sales tax rates across the state.

Are there any sales tax exemptions in Iowa?

+

Yes, Iowa has several sales tax exemptions, including for prescription drugs, most food items, and residential energy.

How does Iowa address the tax obligations of remote sellers?

+

Iowa’s Marketplace Facilitator Law requires out-of-state sellers who meet certain thresholds to collect and remit sales tax on behalf of the state, ensuring fair competition with in-state businesses.

What is the role of the Iowa Department of Revenue in sales tax administration?

+

The Iowa Department of Revenue is responsible for administering and enforcing sales tax in the state, providing resources and guidance to businesses, and collecting tax revenues.