Idaho State Income Tax Rate

The Idaho State Income Tax is an important consideration for residents and businesses alike. Understanding the tax structure and its implications is crucial for effective financial planning. This comprehensive guide delves into the intricacies of Idaho's income tax system, offering a detailed analysis and expert insights.

Understanding Idaho’s Income Tax Landscape

Idaho, like many other states, imposes an income tax on its residents and businesses. This tax is a significant source of revenue for the state government, contributing to the funding of essential services and infrastructure. The income tax system in Idaho is designed to be progressive, meaning that higher income earners pay a larger proportion of their income in taxes compared to lower-income individuals.

The state's income tax is calculated based on a set of tax brackets, each with its own tax rate. As income increases, it moves into higher tax brackets, resulting in a higher overall tax liability. This system aims to ensure that the tax burden is distributed fairly across different income levels.

Current Tax Rates and Brackets

As of the latest tax year, Idaho’s income tax rates range from 1.6% to 7.4%. These rates are applied to different income levels, creating a series of tax brackets that cater to various income ranges. The table below provides an overview of the current tax brackets and their corresponding rates:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,143 | 1.6% |

| $2,144 - $4,286 | 2.4% |

| $4,287 - $6,429 | 4.2% |

| $6,430 - $9,643 | 5.9% |

| $9,644 and above | 7.4% |

These tax brackets are designed to ensure that individuals and businesses pay a fair and progressive tax. The lowest tax bracket, with a rate of 1.6%, applies to the lowest income earners, while the highest bracket, with a rate of 7.4%, captures the highest income levels.

Taxable Income and Deductions

When calculating taxable income, Idaho residents and businesses can take advantage of various deductions and credits. These deductions can significantly reduce the amount of income subject to tax, thereby lowering the overall tax liability. Common deductions include:

- Standard Deduction: A fixed amount that can be deducted from taxable income. The standard deduction amount varies based on filing status.

- Itemized Deductions: These include expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Business Deductions: Businesses can deduct expenses related to their operations, such as equipment costs, office rent, and employee salaries.

Additionally, Idaho offers specific tax credits for various purposes, such as the Low-Income Tax Credit and the Research and Development Tax Credit, which further reduce the tax burden for eligible individuals and businesses.

Idaho’s Income Tax System in Practice

To illustrate how Idaho’s income tax system works in real-world scenarios, let’s consider a few examples.

Case Study 1: Single Individual with Moderate Income

John, a single individual living in Idaho, has an annual income of $45,000. Based on Idaho’s tax brackets, his income would fall into the following categories:

- $2,143 falls into the 1.6% bracket, resulting in a tax of $34.28.

- $2,143 falls into the 2.4% bracket, resulting in a tax of $51.43.

- $40,714 falls into the 4.2% bracket, resulting in a tax of $1,710.10.

In total, John would owe $1,795.81 in Idaho state income tax for the year.

Case Study 2: Married Couple with High Income

Sarah and Robert, a married couple filing jointly, have a combined annual income of $250,000. Their income would be taxed as follows:

- $2,143 falls into the 1.6% bracket, resulting in a tax of $34.28.

- $2,143 falls into the 2.4% bracket, resulting in a tax of $51.43.

- $6,429 falls into the 4.2% bracket, resulting in a tax of $273.66.

- $9,643 falls into the 5.9% bracket, resulting in a tax of $569.79.

- $231,682 falls into the 7.4% bracket, resulting in a tax of $17,144.96.

In total, Sarah and Robert would owe $17,974.02 in Idaho state income tax for the year.

The Impact of Tax Planning

These case studies highlight the importance of tax planning. By understanding the tax brackets and utilizing available deductions and credits, individuals and businesses can optimize their tax liabilities. Effective tax planning can result in significant savings, especially for higher-income earners.

Future Outlook and Potential Changes

The Idaho state income tax system is subject to ongoing review and potential changes. As economic conditions evolve and new policies are proposed, the tax landscape may shift. Here are some key considerations for the future:

Economic Growth and Tax Revenue

Idaho’s economic growth plays a significant role in shaping its tax policy. A thriving economy often leads to increased tax revenue, which can influence decisions about tax rates and brackets. As the state’s economy expands, it may consider adjusting tax rates to optimize revenue collection while maintaining a competitive business environment.

Legislative Initiatives and Tax Reform

Idaho’s state legislature periodically reviews tax laws and may propose reforms to address various economic and social goals. This could involve modifying tax brackets, introducing new tax credits or deductions, or even considering a flat tax rate. Staying informed about legislative initiatives is crucial for understanding potential changes to the income tax system.

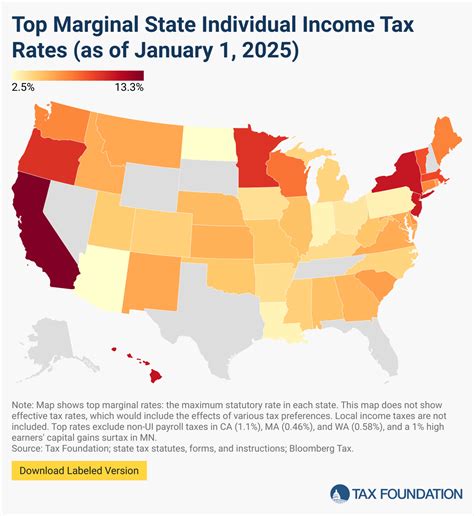

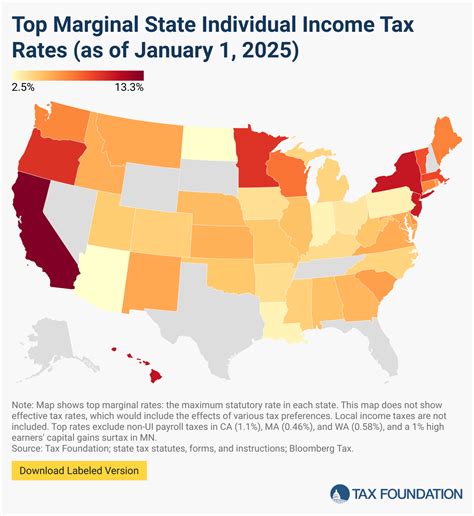

Comparison with Neighboring States

Idaho’s tax policies are often compared to those of neighboring states, particularly in terms of competitiveness. States with lower tax rates may attract businesses and individuals, leading to potential revenue losses for Idaho. On the other hand, Idaho’s tax system may offer advantages in other areas, such as tax credits or a more favorable business environment.

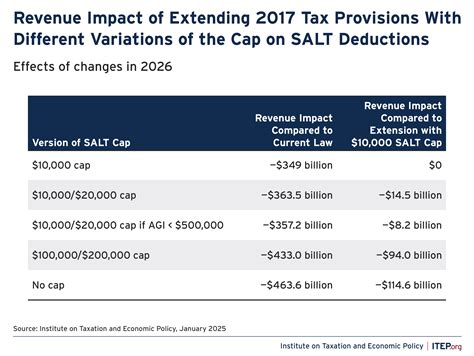

Impact of Federal Tax Policies

Federal tax policies can indirectly influence state tax systems. Changes in federal tax laws, such as tax rate adjustments or the introduction of new deductions, can impact state-level tax calculations and strategies. Staying abreast of federal tax reforms is essential for understanding their potential ripple effects on Idaho’s income tax system.

Conclusion: A Dynamic Tax Environment

Idaho’s state income tax system is a dynamic and evolving entity, influenced by economic trends, legislative decisions, and federal policies. Understanding this landscape is crucial for individuals and businesses operating within the state. By staying informed and engaging in effective tax planning, taxpayers can optimize their financial strategies and navigate the complexities of Idaho’s tax environment.

What are the key benefits of understanding Idaho’s income tax system for businesses?

+Understanding Idaho’s income tax system allows businesses to make informed financial decisions. They can strategically plan their operations, maximize deductions, and optimize their tax liabilities. This knowledge can lead to cost savings and a more competitive business environment.

How often are Idaho’s income tax rates and brackets reviewed and updated?

+Idaho’s income tax rates and brackets are typically reviewed annually or as needed to align with economic trends and legislative changes. The state’s tax code is subject to continuous evaluation to ensure fairness and competitiveness.

Are there any special tax considerations for Idaho’s unique industries, such as agriculture or technology?

+Yes, Idaho offers specific tax incentives and credits for certain industries. For instance, the state provides tax credits for agricultural research and development, as well as tax incentives for technology startups. These measures aim to support the growth of these key sectors.

How does Idaho’s income tax system compare to other states in the region?

+Idaho’s income tax system is generally considered competitive within the region. While some neighboring states have lower tax rates, Idaho offers a range of tax incentives and a business-friendly environment that can offset these differences. The state’s overall tax structure aims to strike a balance between revenue generation and economic growth.

What resources are available for taxpayers seeking more detailed information on Idaho’s income tax system?

+Idaho State Tax Commission provides comprehensive resources, including tax guides, forms, and online tools. Additionally, taxpayers can consult with tax professionals or utilize online tax preparation services for personalized guidance.