Goose Creek Cisd Tax Office

The Goose Creek Consolidated Independent School District (GCISD) is a public school district located in Baytown, Texas, and it plays a vital role in the community, providing education and support to thousands of students. As a key administrative office within the district, the GCISD Tax Office handles a range of essential financial and administrative tasks, ensuring the smooth operation of the school system. This article aims to delve into the various aspects of the Goose Creek Cisd Tax Office, exploring its functions, services, and significance within the district.

Understanding the Goose Creek Cisd Tax Office

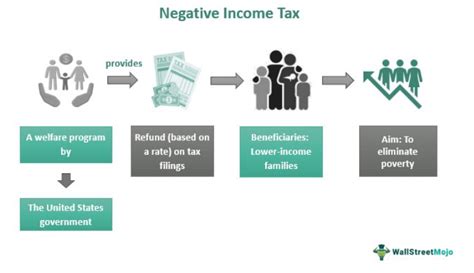

The GCISD Tax Office is responsible for managing the financial aspects related to property taxes, which are a significant source of funding for public schools in Texas. This office acts as a vital link between the district, property owners, and tax authorities, ensuring that the school district receives the necessary financial support to provide quality education.

Key Functions and Services

The Goose Creek Cisd Tax Office undertakes a range of critical tasks to fulfill its responsibilities effectively. These include:

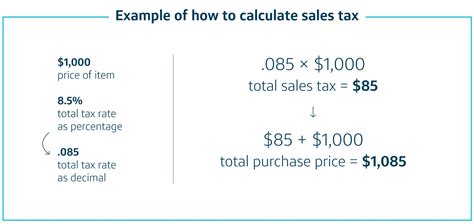

- Property Appraisal: The tax office works closely with the district’s property appraisers to determine the fair market value of properties within the district. This valuation process is crucial for assessing the amount of taxes to be paid by property owners.

- Tax Collection: One of the primary functions of the tax office is to collect property taxes from residents and businesses within the district. They send out tax statements, manage payment plans, and handle any issues related to tax payments.

- Delinquent Tax Management: When property owners fail to pay their taxes on time, the tax office takes on the role of managing delinquent accounts. This involves sending out notices, offering payment arrangements, and, if necessary, initiating legal proceedings to collect outstanding taxes.

- Tax Research and Assistance: The office provides valuable assistance to taxpayers by offering information and guidance on tax-related matters. This includes answering queries about tax rates, exemptions, and other relevant topics.

- Financial Reporting: The tax office prepares and submits financial reports to various authorities, including the state and federal governments. These reports ensure transparency and accountability in the district’s financial operations.

The Impact on GCISD’s Education System

The Goose Creek Cisd Tax Office plays a pivotal role in shaping the educational landscape within the district. The funds generated through property taxes directly impact the resources available for schools, teachers, and students. Here’s how the tax office’s work benefits the district:

- Funding for Schools: Property taxes are a primary source of revenue for GCISD, allowing the district to allocate funds towards maintaining and improving school facilities, purchasing educational resources, and supporting various school programs.

- Teacher Support: Adequate funding ensures that teachers receive competitive salaries and have access to professional development opportunities. This, in turn, attracts and retains highly qualified educators, benefiting students’ educational experiences.

- Curriculum Development: With sufficient financial backing, the district can invest in developing innovative curricula, integrating technology, and offering specialized programs to meet the diverse needs of students.

- Extracurricular Activities: Sports teams, clubs, and other extracurricular activities are often supported by tax revenue. These activities contribute to a well-rounded education, fostering teamwork, leadership skills, and a sense of community.

- Special Education Services: Property taxes also fund special education programs, ensuring that students with unique needs receive the necessary support and accommodations to thrive academically.

Efficient Tax Management and Community Engagement

The Goose Creek Cisd Tax Office employs a range of strategies to streamline tax management processes and engage with the community effectively.

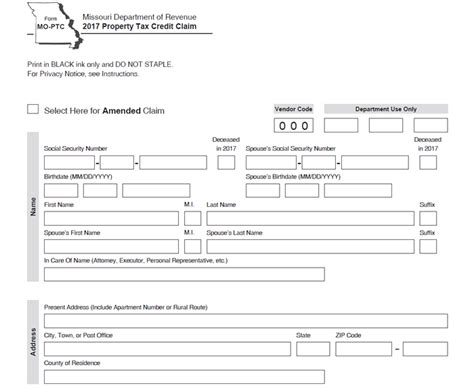

Online Services and Payment Options

Recognizing the importance of technological advancements, the tax office offers online services to enhance convenience and efficiency. Taxpayers can access their accounts, view tax statements, and make payments online through the district’s secure website. This not only saves time for taxpayers but also reduces the administrative burden on the tax office.

Community Outreach and Education

The tax office actively engages with the community to foster understanding and cooperation. They host informational sessions, workshops, and open houses to educate residents about property taxes, exemptions, and payment options. By demystifying the tax process, the office aims to build trust and ensure that taxpayers feel empowered to manage their obligations effectively.

Partnerships and Collaboration

Collaboration is key to the success of the Goose Creek Cisd Tax Office. They work closely with other district departments, such as the Finance Office and the Superintendent’s Office, to align tax collection efforts with the overall financial goals of the district. Additionally, the tax office collaborates with external organizations, including local government entities and community groups, to advocate for the district’s interests and secure additional funding opportunities.

Performance Analysis and Future Outlook

The Goose Creek Cisd Tax Office’s performance is a critical indicator of the district’s financial health and stability. By analyzing key metrics and trends, the office can identify areas for improvement and develop strategies to optimize tax collection processes.

Key Performance Indicators (KPIs)

The tax office tracks several KPIs to assess its performance, including:

- Tax Collection Rate: The percentage of taxes collected against the total amount due provides an insight into the office’s efficiency in managing tax payments.

- Delinquent Account Resolution: Tracking the resolution rate of delinquent accounts helps identify any potential issues with tax enforcement and allows for timely interventions.

- Timeliness of Financial Reports: Ensuring that financial reports are submitted on time demonstrates the office’s commitment to transparency and accountability.

Performance Analysis and Improvements

Regular performance analyses allow the Goose Creek Cisd Tax Office to identify areas where improvements can be made. For instance, if the tax collection rate is lower than expected, the office might implement targeted outreach campaigns or explore alternative payment options to encourage timely payments. Additionally, analyzing delinquent account data can help identify trends and develop strategies to prevent future non-payment issues.

Future Outlook and Innovations

Looking ahead, the tax office is committed to staying at the forefront of technological advancements to enhance its operations. This includes exploring blockchain technology for secure and transparent tax record-keeping, implementing artificial intelligence for more efficient data analysis, and utilizing mobile apps to provide taxpayers with real-time updates and payment options.

Community Feedback and Continuous Improvement

The Goose Creek Cisd Tax Office values community feedback and actively seeks input from taxpayers and stakeholders. By conducting surveys and focus groups, the office can understand taxpayer concerns and make data-driven decisions to improve its services. This commitment to continuous improvement ensures that the tax office remains responsive to the needs of the community it serves.

The Goose Creek Cisd Tax Office: A Vital Pillar of Education

In conclusion, the Goose Creek Cisd Tax Office is an indispensable component of the district’s administrative framework. Its efficient management of property taxes directly contributes to the quality of education provided to students within the district. By effectively collecting taxes, providing valuable assistance to taxpayers, and collaborating with various stakeholders, the tax office ensures that GCISD has the financial resources needed to thrive and provide an exceptional educational experience.

How can I contact the Goose Creek Cisd Tax Office?

+You can reach the tax office by calling (281) 420-4800 during their business hours. For more information, visit their official website at https://www.gccisd.net/Page/438.

What is the tax rate for properties within the GCISD?

+The tax rate varies based on the type of property and its location within the district. For accurate and up-to-date information on tax rates, it is recommended to contact the tax office directly or refer to their official website.

Are there any tax exemptions available for homeowners in GCISD?

+Yes, GCISD offers several tax exemptions, including the homestead exemption and the over-65 exemption. To learn more about eligibility criteria and application processes, you can visit the tax office’s website or reach out to their team for assistance.

How does the tax office handle delinquent tax accounts?

+The tax office follows a comprehensive process to manage delinquent accounts. This includes sending out notices, offering payment arrangements, and, if necessary, pursuing legal action to collect outstanding taxes. For more details on this process, you can contact the tax office or refer to their official guidelines.

Can I pay my property taxes online?

+Yes, the Goose Creek Cisd Tax Office provides an online payment portal for taxpayers’ convenience. You can access the portal through their official website and make secure payments using various methods. For step-by-step instructions, visit their website or contact their support team.