Real Estate Taxes Greene County Mo

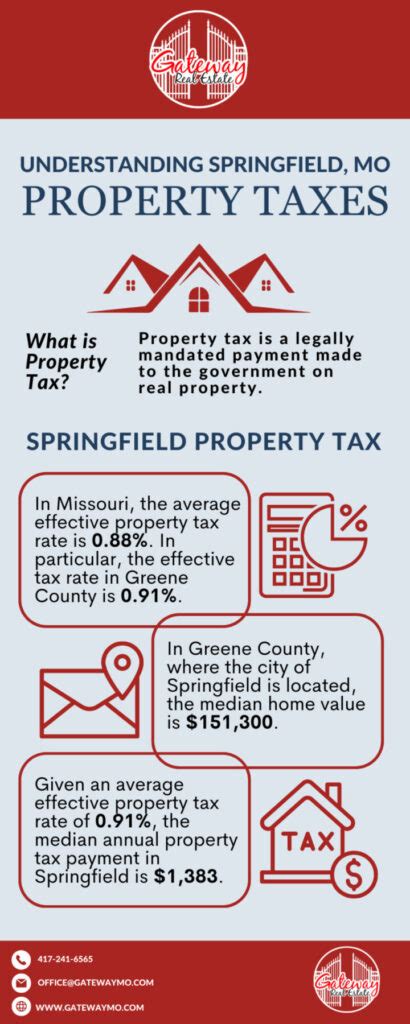

When it comes to real estate ownership, understanding the intricacies of property taxes is essential. Greene County, located in the heart of Missouri, is home to a diverse range of properties, from picturesque rural landscapes to bustling urban centers. In this comprehensive guide, we will delve into the world of Real Estate Taxes in Greene County, MO, exploring the assessment process, tax rates, exemptions, and strategies to manage your property tax obligations effectively.

Understanding Property Tax Assessment in Greene County

Property taxes are a vital source of revenue for local governments, funding essential services such as education, public safety, and infrastructure development. In Greene County, the property tax assessment process is a meticulous endeavor aimed at ensuring fair and equitable taxation for all property owners.

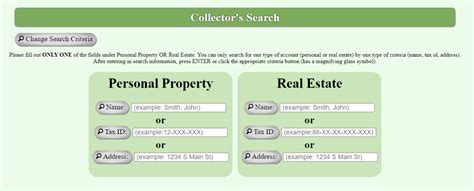

The Greene County Assessor's Office is responsible for evaluating the value of real estate properties within the county. This assessment determines the taxable value of your property, which serves as the basis for calculating your property tax liability. The assessment process involves several key steps:

- Data Collection: Assessor's office gathers information about your property, including its physical characteristics, such as size, location, improvements, and any recent renovations.

- Market Analysis: Real estate market trends, comparable property sales, and rental rates are analyzed to determine the fair market value of properties in the county.

- Assessment Ratio: A specific ratio, often set by state law, is applied to the determined market value to arrive at the assessed value. This ratio ensures uniformity across different types of properties.

- Notices and Appeals: Property owners receive assessment notices, detailing the assessed value of their property. If you believe the assessment is inaccurate, you have the right to appeal and provide supporting evidence.

The assessment process aims to ensure that property owners pay their fair share of taxes based on the value of their real estate holdings. It is important to note that assessments are conducted periodically, typically every few years, to account for changes in property values over time.

Greene County Property Tax Rates and Calculations

Once your property’s assessed value is determined, the next step is to understand how the property tax rate is applied to calculate your tax liability. Greene County, like many other jurisdictions, employs a millage rate system to determine property taxes.

A millage rate is expressed in mills, with one mill representing one-tenth of a cent. The millage rate is determined by the various taxing authorities within Greene County, including the county government, school districts, and special taxing districts. These entities decide on the rate needed to fund their respective budgets and services.

To calculate your property tax liability, you multiply the assessed value of your property by the applicable millage rate. This calculation provides you with the total tax due for the year. For example, if your property's assessed value is $200,000 and the combined millage rate is 50 mills, your property tax liability would be $1,000 ($200,000 x 0.050). This amount is then divided into installments, typically due twice a year.

| Taxing Authority | Millage Rate |

|---|---|

| Greene County Government | 25.50 mills |

| Springfield Public Schools | 37.25 mills |

| Greene County Fire Protection | 5.00 mills |

| Total Combined Millage Rate | 67.75 mills |

It's important to note that the millage rates can vary from year to year as taxing authorities adjust their budgets and needs. Staying informed about these changes is crucial for effective property tax planning.

Property Tax Exemptions and Relief Programs in Greene County

Greene County recognizes the diverse needs of its residents and offers a range of property tax exemptions and relief programs to ease the financial burden on certain property owners. These programs are designed to provide support to eligible individuals and organizations.

Homestead Exemption

One of the most common property tax exemptions is the homestead exemption. This exemption reduces the taxable value of your primary residence, resulting in lower property taxes. In Greene County, eligible homeowners can receive a reduction of up to $7,500 on their property’s assessed value.

To qualify for the homestead exemption, you must meet the following criteria:

- Own and occupy the property as your primary residence.

- Be a Missouri resident for at least six months prior to the assessment date.

- Have a combined household income below a certain threshold (varies annually).

The homestead exemption is a valuable tool for homeowners looking to reduce their property tax burden. It provides financial relief and encourages homeownership within the community.

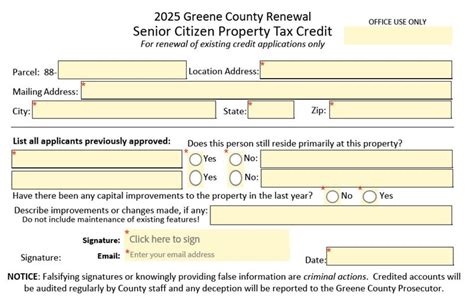

Veterans and Senior Citizen Exemptions

Greene County extends special consideration to its veteran and senior citizen populations through dedicated property tax exemptions. These exemptions aim to honor the service of veterans and support the financial well-being of senior citizens.

Veteran Exemption: Qualified veterans can receive a property tax exemption based on their level of disability. The exemption reduces the taxable value of their primary residence, providing much-needed financial relief. To qualify, veterans must meet specific criteria, including having a service-connected disability and meeting income requirements.

Senior Citizen Exemption: Greene County offers a property tax freeze program for eligible senior citizens. This program freezes the assessed value of their primary residence, ensuring that their property taxes remain stable even as property values increase over time. To be eligible, senior citizens must be at least 65 years old, meet income guidelines, and have owned their home for a minimum period.

Other Relief Programs

In addition to the exemptions mentioned above, Greene County provides other relief programs to assist property owners in managing their tax obligations. These programs include:

- Agricultural Land Assessment: Properties designated as agricultural land are assessed based on their agricultural use value, often resulting in lower property taxes.

- Disabled Citizen Exemption: Individuals with disabilities may qualify for a property tax exemption, reducing the taxable value of their primary residence.

- Low-Income Tax Relief: Greene County offers a tax relief program for low-income homeowners, providing a reduction in their property taxes.

These relief programs demonstrate Greene County's commitment to supporting its residents and ensuring that property taxes remain manageable for all property owners.

Strategies for Managing Your Property Taxes in Greene County

Understanding the assessment process, tax rates, and exemptions is just the first step in effectively managing your property taxes. Here are some strategies to consider when navigating the world of real estate taxes in Greene County:

Stay Informed and Engage with Local Government

Keep yourself updated on any changes to property tax rates, assessment processes, and available exemptions. Attend local government meetings, read official notices, and engage with your elected representatives to voice your concerns and stay informed about tax-related matters.

Appeal Your Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal. Gather evidence, such as recent property sales data or appraisals, to support your case. Consult with a tax professional or attorney to guide you through the appeals process and increase your chances of a successful outcome.

Take Advantage of Exemptions and Relief Programs

Review the various exemptions and relief programs available in Greene County and determine if you are eligible for any of them. Apply for these programs to reduce your property tax burden and ensure you receive the financial support you deserve.

Consider Tax-Efficient Property Improvements

When making improvements to your property, consider the potential impact on your property taxes. Some improvements, such as energy-efficient upgrades or landscape enhancements, may be eligible for tax incentives or exemptions. Research local programs and consult with tax professionals to make informed decisions.

Explore Tax Deferral Options

If you are facing financial difficulties or unexpected circumstances, explore tax deferral options. Greene County may offer programs that allow eligible property owners to defer their property taxes until a later date, providing temporary relief during challenging times.

Conclusion

Understanding the intricacies of Real Estate Taxes in Greene County, MO is essential for property owners looking to navigate the local tax landscape effectively. From the assessment process to tax rates and exemptions, this guide has provided a comprehensive overview of the key aspects of property taxation in Greene County. By staying informed, engaging with local government, and utilizing available resources, you can manage your property taxes with confidence and ensure that your real estate investments thrive in this vibrant community.

How often are property assessments conducted in Greene County, MO?

+

Property assessments in Greene County are typically conducted every odd-numbered year, aligning with the state’s assessment cycle. This means assessments occur approximately every two years.

Can I appeal my property’s assessed value if I disagree with it?

+

Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves submitting documentation and evidence to support your case. It is advisable to consult with a tax professional or attorney for guidance.

Are there any tax incentives for energy-efficient improvements in Greene County?

+

Yes, Greene County offers tax incentives for property owners who make energy-efficient improvements to their homes. These incentives can include tax credits or exemptions, reducing the taxable value of the property. Check with the local government or a tax advisor for specific details.

How can I stay updated on changes to property tax rates and exemptions in Greene County?

+

To stay informed, you can subscribe to official newsletters or follow local government websites and social media accounts. Attending public meetings and engaging with your elected representatives can also provide valuable insights into tax-related matters.

What happens if I fail to pay my property taxes in Greene County?

+

Unpaid property taxes can lead to serious consequences, including late fees, penalties, and potential tax liens on your property. It is crucial to stay current with your tax payments to avoid these issues. If you are facing financial difficulties, consider exploring tax deferral options or seeking assistance from local support programs.