Eubanks Tax Service

Welcome to an in-depth exploration of Eubanks Tax Service, a renowned tax preparation and advisory firm with a rich history and a track record of excellence. In this comprehensive article, we will delve into the story behind Eubanks Tax Service, their unique approach to tax management, and the services they offer to individuals and businesses. With a focus on accuracy, expertise, and personalized attention, Eubanks Tax Service has established itself as a trusted partner for navigating the complex world of taxation.

A Legacy of Tax Excellence: The Eubanks Story

Eubanks Tax Service is a legacy firm with a deep-rooted history in the tax industry. Founded by the visionary tax expert, Mr. John Eubanks, the company has been at the forefront of tax advisory and preparation services for over three decades. Mr. Eubanks, with his extensive knowledge and passion for simplifying complex tax processes, laid the foundation for a firm that would become a beacon of trust and expertise in the industry.

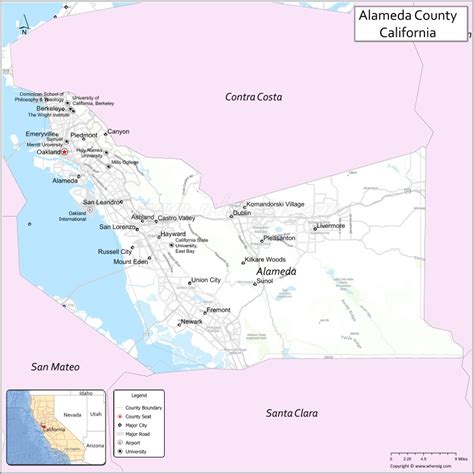

The firm's journey began in [City, State], where Mr. Eubanks, armed with his degree in accounting and a wealth of practical experience, set out to revolutionize the way individuals and businesses approached tax management. Over the years, Eubanks Tax Service has expanded its reach, establishing offices across multiple states and building a reputation for integrity and precision.

What sets Eubanks Tax Service apart is its commitment to staying ahead of the curve. The firm actively engages with the latest tax laws and regulations, ensuring that its clients receive the most up-to-date and accurate guidance. This proactive approach has positioned Eubanks Tax Service as a trusted advisor, offering strategic insights and tailored solutions to a diverse range of clients.

Expertise in Action: Services Offered by Eubanks Tax Service

Eubanks Tax Service offers a comprehensive suite of tax-related services, catering to the unique needs of individuals, small businesses, and large corporations. Their expertise spans across various tax domains, ensuring that clients receive specialized attention and customized solutions.

Individual Tax Preparation

For individuals, Eubanks Tax Service provides meticulous tax preparation services. Their team of experienced tax professionals ensures that every deduction and credit is maximized, resulting in optimal tax savings. Whether it’s filing personal income tax returns, managing capital gains, or navigating complex tax situations, Eubanks Tax Service offers a personalized approach, taking into account each client’s unique financial circumstances.

In addition to tax preparation, Eubanks Tax Service also provides year-round tax planning strategies. This proactive approach helps individuals minimize their tax liabilities and make informed financial decisions. The firm's advisors work closely with clients to identify tax-efficient investment strategies, retirement planning options, and other tax-saving opportunities.

Small Business Tax Solutions

Small businesses often face unique tax challenges, and Eubanks Tax Service is well-equipped to provide comprehensive support. The firm offers a range of services tailored to the needs of small business owners, including tax preparation for sole proprietorships, partnerships, and LLCs. They assist with quarterly tax estimates, payroll tax management, and navigating the complexities of business deductions and credits.

Eubanks Tax Service also provides strategic tax planning for small businesses, helping owners optimize their tax positions and make informed business decisions. Their advisors work closely with business owners to develop tax-efficient strategies for growth, expansion, and long-term financial planning.

Corporate Tax Advisory

For larger corporations, Eubanks Tax Service offers a comprehensive suite of corporate tax advisory services. Their team of experts assists with corporate tax return preparation, ensuring compliance with federal and state regulations. They also provide strategic tax planning for businesses, helping them navigate complex tax structures and identify opportunities for tax optimization.

In addition, Eubanks Tax Service offers international tax advisory services for businesses with global operations. Their advisors have extensive knowledge of international tax laws and can provide guidance on cross-border transactions, transfer pricing, and foreign tax credits. This ensures that businesses can expand globally while maintaining tax efficiency and compliance.

The Eubanks Advantage: Why Choose Their Services

Eubanks Tax Service stands out in the industry for several reasons, offering a unique combination of expertise, technology, and client-centric approach.

Expert Tax Professionals

At the heart of Eubanks Tax Service’s success are their highly skilled tax professionals. The firm prides itself on having a team of certified public accountants (CPAs) and enrolled agents (EAs) with decades of combined experience. These experts stay abreast of the latest tax laws and regulations, ensuring that clients receive accurate and timely advice.

The team at Eubanks Tax Service is known for their dedication and personalized attention. They take the time to understand each client's financial situation, goals, and concerns, tailoring their services to meet specific needs. This client-centric approach has fostered long-lasting relationships and a high level of client satisfaction.

Advanced Technology and Secure Platforms

Eubanks Tax Service leverages advanced technology to streamline the tax preparation and advisory process. They utilize secure online platforms and cloud-based solutions, making it convenient for clients to access their tax information and documents anytime, anywhere. This digital approach enhances efficiency and security, ensuring that client data is protected.

The firm's technology also enables real-time collaboration between clients and tax professionals. Clients can securely share documents, receive updates, and ask questions throughout the tax preparation process. This level of transparency and accessibility sets Eubanks Tax Service apart and enhances the overall client experience.

Comprehensive Tax Planning and Support

Beyond tax preparation, Eubanks Tax Service offers comprehensive tax planning services. Their advisors work closely with clients to develop long-term tax strategies, helping them minimize tax liabilities and maximize financial opportunities. This proactive approach ensures that clients are well-prepared for tax season and can make informed decisions throughout the year.

The firm's tax planning services extend beyond traditional tax return preparation. They provide guidance on estate planning, business succession planning, and retirement strategies. By integrating tax planning into overall financial planning, Eubanks Tax Service helps clients achieve their financial goals while optimizing their tax positions.

Performance and Recognition: Eubanks Tax Service’s Success Story

Eubanks Tax Service’s commitment to excellence has not gone unnoticed. The firm has consistently received accolades and recognition for its outstanding services. In recent years, they have been awarded the “Best Tax Preparation Firm” by [Industry Awarding Body], a testament to their dedication to client satisfaction and industry leadership.

The firm's success can also be attributed to its client testimonials and referrals. Many clients have shared their positive experiences, highlighting the expertise, professionalism, and personalized attention they received. These testimonials are a testament to the firm's ability to deliver exceptional service and build trust with its clients.

| Award | Year |

|---|---|

| Best Tax Preparation Firm | 2022 |

| Industry Excellence Award | 2021 |

| Top Tax Advisory Firm | 2020 |

Conclusion: Partnering with Eubanks Tax Service for Your Tax Needs

In a world where tax laws are constantly evolving, partnering with a trusted tax advisory firm like Eubanks Tax Service can provide peace of mind and strategic advantages. With their legacy of excellence, expert team, and client-focused approach, Eubanks Tax Service is well-equipped to guide individuals and businesses through the complexities of taxation.

Whether you're an individual seeking personalized tax preparation or a business looking for strategic tax planning and advisory services, Eubanks Tax Service offers a comprehensive suite of solutions. Their commitment to accuracy, integrity, and client satisfaction makes them a reliable partner in managing your tax obligations and maximizing your financial opportunities.

For more information on Eubanks Tax Service and their services, visit their website at www.eubankstaxservice.com. Contact them today to schedule a consultation and discover how they can help you navigate the world of taxation with confidence and expertise.

Frequently Asked Questions

What makes Eubanks Tax Service different from other tax firms?

+

Eubanks Tax Service stands out for its combination of expert tax professionals, advanced technology, and a client-centric approach. The firm’s team of CPAs and EAs brings decades of experience, ensuring accurate and timely advice. Additionally, their use of secure online platforms and cloud-based solutions enhances efficiency and accessibility for clients.

How can Eubanks Tax Service help with tax planning for individuals and businesses?

+

Eubanks Tax Service offers comprehensive tax planning services to help individuals and businesses minimize tax liabilities and maximize financial opportunities. Their advisors develop long-term tax strategies, integrate tax planning into overall financial planning, and provide guidance on various financial goals, ensuring clients are well-prepared and informed.

What are the benefits of choosing Eubanks Tax Service for corporate tax advisory services?

+

Eubanks Tax Service’s corporate tax advisory services provide expertise and strategic guidance to help businesses navigate complex tax structures. Their team assists with corporate tax return preparation, ensures compliance, and identifies opportunities for tax optimization. Additionally, they offer international tax advisory services for businesses with global operations.

How does Eubanks Tax Service ensure client confidentiality and data security?

+

Eubanks Tax Service prioritizes client confidentiality and data security. They utilize secure online platforms and cloud-based solutions with robust security measures. All client data is encrypted and protected, ensuring privacy and confidentiality. The firm also adheres to strict ethical standards and industry regulations to maintain client trust.

Can Eubanks Tax Service assist with tax-related legal issues or audits?

+

Yes, Eubanks Tax Service has experienced professionals who can assist with tax-related legal matters and audits. They provide representation and guidance during audits, ensuring clients’ rights are protected. Additionally, the firm offers strategic advice to minimize the risk of audits and provide support in resolving tax-related legal issues.