Ellis County Property Tax

Welcome to our comprehensive guide on the Ellis County Property Tax system. In this article, we will delve into the intricacies of property taxes in Ellis County, Texas, providing you with an in-depth understanding of the process, rates, exemptions, and more. As an expert in the field, I aim to offer valuable insights and practical information to help you navigate the property tax landscape effectively.

Understanding the Ellis County Property Tax System

Ellis County, located in the vibrant region of North Texas, is renowned for its thriving communities, diverse landscapes, and a robust property market. With a population of approximately 197,000 residents (as of the 2020 census), the county boasts a vibrant mix of urban and rural areas, making it an attractive destination for homeowners and investors alike. However, with the perks of property ownership come the responsibilities, and one of the most significant considerations is the property tax system.

In Ellis County, like many other regions in Texas, property taxes play a crucial role in funding essential public services and infrastructure. These taxes are levied on real estate properties, including land, buildings, and improvements, and contribute to the maintenance of schools, roads, emergency services, and other vital community resources.

Property Tax Rates in Ellis County

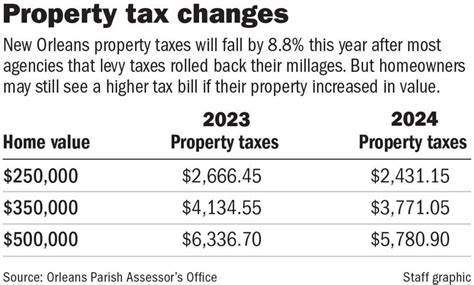

The property tax rates in Ellis County are determined by a combination of factors, including the jurisdiction in which the property is located and the specific tax rate adopted by each taxing entity. In Texas, property taxes are primarily levied by local governments, including cities, counties, and school districts.

To illustrate, let's consider the effective property tax rate for the city of Waxahachie, the county seat of Ellis County. As of the 2022 tax year, the effective tax rate for Waxahachie is 1.68%, which translates to approximately $1.68 for every $100 of a property's assessed value. This rate is composed of the combined tax rates set by the city of Waxahachie, Ellis County, and the Waxahachie Independent School District.

| Taxing Entity | Effective Tax Rate |

|---|---|

| Waxahachie City | 0.470000 |

| Ellis County | 0.436700 |

| Waxahachie ISD | 0.773300 |

It's important to note that effective tax rates can vary across different areas within Ellis County due to the presence of multiple taxing entities and the unique needs of each community. For instance, the city of Ennis, another prominent municipality in Ellis County, had an effective tax rate of 1.67% for the 2022 tax year, with a breakdown as follows:

| Taxing Entity | Effective Tax Rate |

|---|---|

| Ennis City | 0.470000 |

| Ellis County | 0.436700 |

| Ennis ISD | 0.763300 |

These tax rates reflect the combined efforts of local governments to provide essential services to their communities. Property taxes in Ellis County are calculated based on the appraised value of the property, determined by the Ellis Central Appraisal District (ECAD). The ECAD conducts an annual appraisal process, assessing the market value of each property, which forms the basis for calculating the tax liability.

Property Tax Appraisal and Assessment

The property tax system in Ellis County relies on a systematic appraisal and assessment process to ensure fair and accurate taxation. The Ellis Central Appraisal District (ECAD) plays a pivotal role in this process, serving as the independent body responsible for determining the market value of each property within the county.

The ECAD employs a team of trained professionals who conduct thorough evaluations of properties, considering factors such as location, size, improvements, and recent sales data. This comprehensive approach ensures that the appraised value accurately reflects the property's worth in the current real estate market.

Once the appraisal process is complete, property owners receive a Notice of Appraised Value, which outlines the ECAD's assessment of their property's value. This notice serves as a critical tool for property owners to understand their potential tax liability and provides an opportunity for review and appeal if they believe the appraised value is inaccurate.

Property owners in Ellis County have the right to protest their appraised value if they disagree with the ECAD's assessment. The protest process is designed to be accessible and transparent, allowing homeowners and businesses to voice their concerns and provide evidence to support their case. Protests can be filed online, by mail, or in person, and the ECAD provides clear guidelines and resources to assist property owners throughout the process.

Property Tax Exemptions and Discounts

Ellis County offers a range of property tax exemptions and discounts to eligible homeowners, providing financial relief and promoting homeownership. These exemptions are designed to assist specific groups, such as senior citizens, disabled individuals, and veterans, by reducing their tax burden.

One of the most well-known exemptions is the Homestead Exemption, which provides a reduction in the taxable value of a property for homeowners who use it as their primary residence. In Ellis County, the Homestead Exemption can reduce the taxable value of a home by up to $25,000, resulting in significant savings on property taxes.

Additionally, Ellis County offers exemptions for disabled veterans, surviving spouses of veterans, and individuals with disabilities. These exemptions can provide a substantial reduction in property taxes, making homeownership more affordable and accessible for those who qualify. For instance, a disabled veteran who meets the eligibility criteria may be exempt from paying property taxes on their primary residence, further supporting their financial well-being.

Furthermore, Ellis County provides various discounts and incentives for early payment of property taxes. Property owners who pay their taxes before the due date may be eligible for a discount, reducing their overall tax liability. These incentives encourage timely payment and help streamline the tax collection process.

Navigating the Property Tax Payment Process

Understanding the property tax payment process is crucial for homeowners in Ellis County. The tax year in Texas runs from January 1 to December 31, and property taxes are typically due by January 31 of the following year. However, it’s important to note that the specific payment deadlines and options may vary based on the taxing entity and the method of payment chosen.

To facilitate convenient tax payment, Ellis County offers a range of options, including online payment portals, mail-in payments, and in-person payments at designated locations. Property owners can choose the method that best suits their preferences and circumstances, ensuring a seamless and efficient tax payment experience.

Online payment portals provide a user-friendly interface, allowing taxpayers to securely access their account information, view their tax bill, and make payments using credit cards, debit cards, or electronic checks. This method offers convenience and flexibility, especially for busy individuals who may not have the time to visit physical payment locations.

For those who prefer traditional methods, mail-in payments are also an option. Property owners can receive their tax bill by mail, which includes detailed instructions on how to make the payment. By following the provided guidelines, taxpayers can ensure their payment is processed accurately and on time.

In-person payments are available at designated locations, such as the county tax office or authorized payment centers. This option provides an opportunity for taxpayers to interact directly with tax officials, seek assistance, and resolve any queries they may have regarding their tax liability or payment process.

To ensure timely payment and avoid penalties, it is essential for property owners to stay informed about the payment deadlines and options available to them. The Ellis County Tax Office provides comprehensive resources and updates on its website, including due dates, payment methods, and frequently asked questions. By staying informed and proactive, homeowners can manage their property tax obligations effectively.

Property Tax Payment Options and Due Dates

Ellis County offers a variety of payment options to accommodate the diverse needs of its taxpayers. These options include online payments, which provide a convenient and secure way to make tax payments from the comfort of one’s home. The county’s official website features a user-friendly online payment portal, where taxpayers can register, view their tax bills, and make payments using various methods, such as credit cards, debit cards, or electronic checks.

For those who prefer traditional methods, mail-in payments are also accepted. Property owners can receive their tax bills by mail, which includes detailed instructions on how to remit their payments. By following the provided guidelines, taxpayers can ensure that their payments are processed accurately and on time.

In addition to online and mail-in payments, Ellis County also offers in-person payment options at designated locations. Taxpayers can visit the county tax office or authorized payment centers to make their payments. This option provides an opportunity for taxpayers to interact directly with tax officials, seek assistance, and address any concerns they may have regarding their tax obligations.

To facilitate timely payment, it is crucial for property owners to be aware of the due dates for their property taxes. In Ellis County, the tax year runs from January 1 to December 31, and the payment deadlines are typically set for January 31 of the following year. However, it is essential to note that specific due dates may vary depending on the taxing entity and the method of payment chosen.

To avoid penalties and late fees, property owners are encouraged to pay their taxes promptly. Late payments may incur additional charges, and in some cases, failure to pay taxes can result in enforcement actions, such as tax liens or property foreclosure. Therefore, it is in the best interest of taxpayers to stay informed about the payment deadlines and take advantage of the available payment options to ensure a smooth and timely tax payment process.

Property Tax Penalties and Late Payment Consequences

While the property tax system in Ellis County aims to provide a fair and transparent process, it is essential for property owners to understand the potential consequences of late payments and non-compliance. Failing to pay property taxes on time can result in various penalties and legal repercussions, which can significantly impact a homeowner’s financial stability and overall well-being.

When property taxes are not paid by the established deadline, Ellis County imposes a penalty on the outstanding amount. The penalty is calculated as a percentage of the unpaid tax and is typically applied on a monthly basis until the taxes are paid in full. This penalty serves as an incentive for taxpayers to meet their obligations promptly and avoid accumulating additional financial burdens.

In addition to penalties, late payments can also lead to the accrual of interest on the unpaid balance. The interest rate is set by the Texas Tax Code and is calculated based on the number of days the taxes remain unpaid. This interest further compounds the financial burden on the taxpayer and emphasizes the importance of timely payment.

If a property owner continues to neglect their tax obligations, the situation can escalate, and more severe consequences may arise. Ellis County, in collaboration with the Texas Comptroller's Office, has the authority to enforce tax collection through various means, including tax liens and property foreclosure. A tax lien is a legal claim against the property, which can prevent the owner from selling or transferring the property until the taxes are paid.

In extreme cases, if a property owner fails to rectify their tax delinquency, the county may initiate foreclosure proceedings. This process involves the forced sale of the property to recover the unpaid taxes and associated costs. Foreclosure can have significant implications for homeowners, including the loss of their primary residence and potential damage to their credit rating.

To avoid such dire consequences, it is imperative for property owners to prioritize their tax obligations and stay informed about the payment deadlines and options available to them. By understanding the potential penalties and repercussions, homeowners can take proactive measures to ensure timely payment and maintain their financial stability.

Appealing Property Tax Assessments in Ellis County

The property tax system in Ellis County, like many other jurisdictions, recognizes the importance of fairness and transparency. As such, property owners have the right to appeal their property tax assessments if they believe the appraised value is inaccurate or unfair. This process, known as a property tax protest, provides an opportunity for homeowners and businesses to challenge the assessed value of their property and potentially secure a reduction in their tax liability.

The property tax protest process in Ellis County is designed to be accessible and impartial. Property owners have the option to file a protest on their own or engage the services of a professional property tax consultant or attorney. The latter can provide valuable expertise and guidance throughout the protest process, increasing the chances of a successful appeal.

When filing a property tax protest, it is essential to gather supporting evidence to strengthen the case. This evidence may include recent sales data of comparable properties, professional appraisals, and documentation of any improvements or damages that could impact the property's value. By presenting a well-documented case, property owners can demonstrate that the assessed value is excessive or inaccurate, increasing the likelihood of a favorable outcome.

The protest process in Ellis County typically involves a hearing before an independent appraisal review board (ARB). The ARB is comprised of local citizens who are appointed to serve in this capacity. During the hearing, both the property owner and the ECAD have the opportunity to present their arguments and evidence. The ARB then makes a decision based on the information provided, aiming to reach a fair and equitable resolution.

If the property owner is dissatisfied with the ARB's decision, they have the right to appeal further. The next step is to file a petition with the district court, where a judge will review the case and make a final determination. This option provides an additional layer of protection for property owners who believe their rights have not been adequately addressed in the initial protest process.

It is important to note that the property tax protest process requires careful preparation and a thorough understanding of the applicable laws and procedures. Property owners should familiarize themselves with the protest guidelines and timelines, as well as seek professional advice if needed. By navigating the process effectively, homeowners can protect their financial interests and ensure a fair assessment of their property's value.

The Property Tax Protest Process in Ellis County

The property tax protest process in Ellis County is a formal procedure that allows property owners to challenge the appraised value of their property if they believe it is excessive or inaccurate. This process is overseen by the Ellis Central Appraisal District (ECAD) and is designed to provide a fair and impartial platform for taxpayers to voice their concerns.

To initiate a property tax protest, property owners must first file a written notice of protest with the ECAD. This notice should clearly state the reasons for the protest, including any supporting evidence or documentation. The ECAD provides specific guidelines and forms for filing a protest, ensuring that taxpayers understand the requirements and can navigate the process effectively.

Once the notice of protest is received, the ECAD schedules a hearing before an independent Appraisal Review Board (ARB). The ARB is composed of local citizens who are appointed to serve in this capacity, ensuring a neutral and unbiased decision-making process. During the hearing, both the property owner and the ECAD have the opportunity to present their arguments and evidence to support their respective positions.

The ARB carefully considers the information presented by both parties and may request additional documentation or expert testimony if necessary. After a thorough review, the ARB makes a decision regarding the protest, which is typically based on the evidence presented and the applicable laws and regulations. The ARB's decision is final and binding, unless the property owner chooses to appeal further.

If a property owner is dissatisfied with the ARB's decision, they have the right to appeal to the district court. This option provides an additional layer of protection for taxpayers who believe their rights have been infringed upon or that the ARB's decision was unfair. The appeal process involves filing a petition with the district court, which will then review the case and make a final determination.

It is crucial for property owners to carefully consider their options and gather all relevant evidence before initiating a property tax protest. The process requires thorough preparation and a strong understanding of the applicable laws and procedures. Seeking professional advice or representation can be beneficial, as property tax consultants or attorneys can provide valuable expertise and guidance throughout the protest process.

Tips for a Successful Property Tax Protest

Successfully protesting a property tax assessment in Ellis County requires careful preparation and a strategic approach. Here are some valuable tips to enhance your chances of a favorable outcome:

- Gather Comprehensive Evidence: Collect all relevant documents and evidence to support your case. This may include recent sales data of similar properties, professional appraisals, photographs, and records of any improvements or damages to your property.

- Understand the Assessment Process: Familiarize yourself with the appraisal methods and guidelines used by the Ellis Central Appraisal District (ECAD). Understanding their evaluation criteria can help you identify potential discrepancies or inaccuracies in your property’s assessment.

- Seek Professional Assistance: Consider engaging the services of a qualified property tax consultant or attorney. These professionals have extensive knowledge of the protest process and can provide valuable guidance, increasing your chances of a successful appeal.

- File Your Protest on Time: Pay close attention to the protest deadlines set by the ECAD. Missing the filing deadline can result in your protest being dismissed