Do Illegal Immigrants Pay Taxes

The question of whether illegal immigrants pay taxes is a complex and often contentious issue, with varying perspectives and implications. In this article, we will delve into the facts and figures surrounding this topic, exploring the legal framework, economic impact, and societal considerations. By examining the tax contributions of undocumented immigrants, we can gain a deeper understanding of their role within the broader tax system and its potential consequences.

The Legal Landscape and Tax Obligations

To understand the tax obligations of illegal immigrants, it is crucial to examine the legal framework surrounding their presence and residency status. In many countries, including the United States, the laws regarding immigration and taxation are intricate and subject to ongoing debates.

While undocumented immigrants are not eligible for legal employment due to their lack of proper immigration status, they are often employed in various sectors, including agriculture, construction, hospitality, and domestic services. Despite their undocumented status, they are still subject to certain tax obligations, primarily related to income tax and social security contributions.

The Internal Revenue Service (IRS) in the United States has established guidelines for tax compliance by undocumented immigrants. According to the IRS, individuals, regardless of their immigration status, are required to pay taxes on income earned within the country. This means that even illegal immigrants who work and earn income are liable for federal income tax.

Income Tax and Social Security Contributions

Illegal immigrants who work in the formal economy and receive wages are generally subject to federal income tax. They must report their income and file tax returns annually, just like any other taxpayer. However, due to their undocumented status, they often face challenges when it comes to obtaining a valid tax identification number, such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

To address this issue, the IRS provides alternative tax identification numbers for individuals who are not eligible for a SSN. The ITIN, for example, allows undocumented immigrants to file tax returns and claim refunds for any taxes withheld from their income. This ensures that they meet their tax obligations and can potentially receive tax benefits or refunds.

In addition to income tax, illegal immigrants may also contribute to social security programs through payroll taxes. While they may not be eligible to receive social security benefits directly, their contributions support the overall social security system and help fund various social programs.

Withholding and Reporting

Employers who hire illegal immigrants are required to withhold and report taxes just as they would for any other employee. This includes withholding federal income tax, Social Security, and Medicare taxes from the employee’s wages. The employer must then remit these taxes to the appropriate tax authorities.

However, it is worth noting that some employers may choose to avoid these obligations by paying employees in cash or failing to report their income accurately. This not only undermines the tax system but also puts the undocumented workers at risk of exploitation and unfair labor practices.

Economic Impact and Tax Contributions

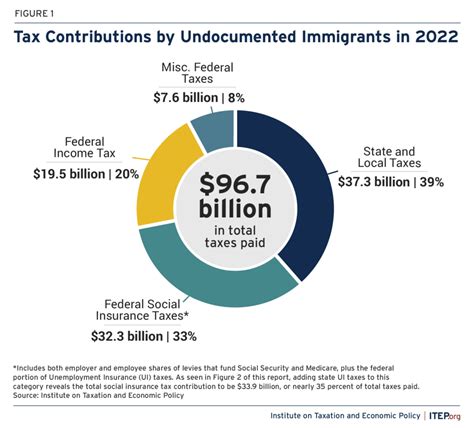

The tax contributions of illegal immigrants have a significant economic impact, both locally and nationally. These contributions affect government revenues, social programs, and the overall fiscal health of a country.

Government Revenue and Budget

Undocumented immigrants make substantial contributions to government revenue through their tax payments. According to a study by the Institute on Taxation and Economic Policy (ITEP), undocumented immigrants in the United States paid an estimated $11.74 billion in state and local taxes in 2017. This includes income taxes, sales taxes, property taxes, and other taxes imposed at the state and local levels.

These tax contributions play a crucial role in funding public services and infrastructure. They help support education, healthcare, transportation, and other essential government functions. By paying taxes, illegal immigrants contribute to the overall economic stability and development of their host communities.

| Year | Estimated State and Local Tax Contributions (USD) |

|---|---|

| 2017 | $11.74 billion |

| 2015 | $11.26 billion |

| 2013 | $11.16 billion |

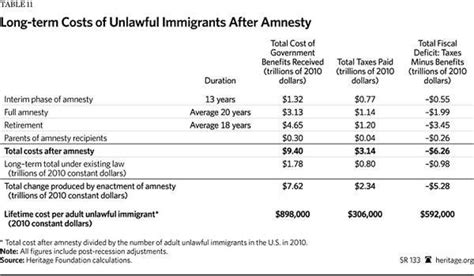

Social Programs and Benefits

While illegal immigrants are generally not eligible for federal social programs and benefits, such as welfare or unemployment insurance, their tax contributions indirectly support these programs. The taxes they pay fund various social safety nets, including healthcare programs, public education, and infrastructure development.

Additionally, some undocumented immigrants may qualify for certain state-level social programs, such as emergency Medicaid or in-state tuition for higher education. These programs, funded by tax revenue, provide essential support to vulnerable populations and promote social equity.

Economic Growth and Employment

The presence of illegal immigrants in the workforce can have both positive and negative effects on the economy. On the one hand, they often fill labor gaps in industries with high demand for low-skilled workers, contributing to economic growth and productivity. Their labor contributions support various sectors, including agriculture, manufacturing, and service industries.

On the other hand, the presence of undocumented workers may also impact employment opportunities for legal residents and citizens. This can lead to debates over labor market competition and wage dynamics. However, it is important to note that illegal immigrants often take on jobs that are less desirable or require specific skills, thus complementing rather than displacing the domestic workforce.

Social and Policy Considerations

The tax contributions of illegal immigrants are not only a legal and economic matter but also raise important social and policy considerations. These contributions highlight the complex relationship between immigration, tax policy, and societal well-being.

Social Equity and Access to Services

The tax contributions of illegal immigrants raise questions about social equity and access to public services. While they contribute to the tax system, they may face barriers when it comes to accessing healthcare, education, and other social services. This disparity can lead to social and economic disparities within communities.

Policy reforms that recognize the contributions of undocumented immigrants and provide them with access to essential services can promote social cohesion and ensure that their tax contributions are equitably reciprocated.

Immigration Reform and Tax Policy

The issue of illegal immigration and tax contributions is often intertwined with broader immigration reform debates. Proponents of comprehensive immigration reform argue that providing a pathway to legal status for undocumented immigrants would not only strengthen the tax system but also enhance social stability and economic growth.

By legalizing the status of undocumented immigrants, their tax contributions could be further maximized, and they could become eligible for social benefits, leading to a more inclusive and equitable society. This approach, however, requires careful consideration of various factors, including border security, workforce needs, and social integration.

Ethical and Moral Perspectives

The tax contributions of illegal immigrants also spark ethical and moral discussions. Some argue that undocumented immigrants, by paying taxes, demonstrate a sense of responsibility and contribute to the common good. Their tax payments can be seen as a form of social contract, acknowledging the benefits they receive from living within a society.

Others, however, question the fairness of allowing individuals who are in the country illegally to benefit from public services and social programs funded by tax revenue. This perspective raises complex moral dilemmas and requires thoughtful consideration of societal values and principles.

Conclusion

The question of whether illegal immigrants pay taxes is a multifaceted issue that intersects with legal, economic, and social considerations. While illegal immigrants face legal barriers and challenges in meeting their tax obligations, they nonetheless contribute significantly to the tax system and the overall economic well-being of their host countries.

The tax contributions of undocumented immigrants play a crucial role in funding public services, supporting social programs, and driving economic growth. These contributions, however, are often overshadowed by the complexities of immigration policy and the societal implications they entail. As societies grapple with immigration reform and tax policy, it is essential to recognize the value of these contributions and strive for inclusive and equitable solutions.

Do all illegal immigrants pay taxes?

+Not all illegal immigrants pay taxes. While many undocumented immigrants work and contribute to the tax system, some may be employed in the informal economy or have limited access to legal employment. Additionally, certain tax obligations, such as federal income tax, may be more challenging for undocumented immigrants due to their lack of valid tax identification numbers.

How do illegal immigrants obtain tax identification numbers?

+Illegal immigrants who require tax identification numbers for filing tax returns can obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. The ITIN is issued to individuals who are not eligible for a Social Security Number (SSN) but still need to comply with tax obligations. The process involves completing an application form and providing supporting documentation.

What happens if an illegal immigrant doesn’t pay taxes?

+If an illegal immigrant fails to meet their tax obligations, they may face penalties and legal consequences. The IRS has the authority to audit, assess penalties, and pursue enforcement actions against individuals who fail to report and pay taxes. However, it is important to note that the IRS generally focuses on employers and businesses that engage in tax evasion rather than targeting individual undocumented workers.