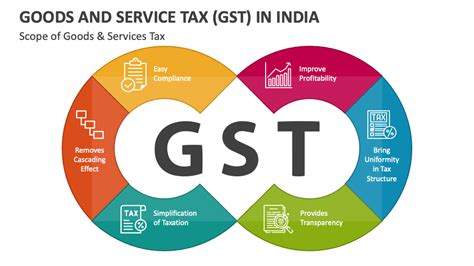

Define Goods And Services Tax

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that has revolutionized the taxation system in various countries, including India. Implemented with the aim of simplifying and unifying indirect taxes, GST has had a profound impact on businesses, consumers, and the overall economy. In this article, we will delve into the intricacies of GST, exploring its definition, purpose, benefits, and its role in shaping modern tax systems.

Understanding the Concept of GST

GST is a broad-based consumption tax levied on the supply of goods and services. It is a value-added tax, meaning that it is collected at each stage of the production and distribution process, with the tax burden ultimately falling on the final consumer. This tax system is designed to be neutral, efficient, and transparent, ensuring that businesses and consumers are not unduly burdened by multiple layers of taxation.

The key principle behind GST is that it is a destination-based tax. This means that the tax is levied on the place where the goods or services are consumed, rather than where they are produced. This concept is particularly relevant in an era of global trade and supply chains, where goods often cross multiple borders and jurisdictions before reaching their final destination.

For instance, consider a manufacturer in one state who sells goods to a distributor in another state. Under a traditional tax system, the manufacturer might pay a tax on the production of the goods, and the distributor might pay a tax on the sale. However, with GST, the tax is levied only on the value addition at each stage, and the final consumer bears the tax burden. This ensures that there is no double taxation and that the tax revenue is directed to the state where the consumption takes place.

The Benefits and Impact of GST

The implementation of GST has brought about numerous advantages and transformed the tax landscape in several ways.

Simplification of Tax Structure

One of the primary objectives of GST was to streamline and simplify the complex web of indirect taxes that existed previously. By replacing multiple taxes such as excise duty, service tax, value-added tax (VAT), and more, GST has created a unified tax system. This has reduced compliance costs for businesses, as they no longer need to navigate a myriad of tax laws and regulations for each tax type.

For example, prior to GST, a business might have had to deal with separate tax authorities for central excise, state VAT, and service tax. Each authority would have its own set of rules, forms, and compliance requirements. With GST, businesses interact with a single tax administration, making tax compliance more manageable and less time-consuming.

Elimination of Cascading Effect

GST has successfully eliminated the cascading effect of taxes, which occurs when taxes are levied on taxes. In the pre-GST era, taxes were often charged on the final price of a product, including the taxes paid at previous stages. This resulted in a tax on tax, leading to higher prices for consumers and an inefficient tax system.

With GST, the tax is calculated only on the value addition at each stage. This means that taxes paid at one stage can be set off against taxes due at the next stage. This input tax credit mechanism ensures that taxes are not compounded, leading to more competitive pricing and a fairer tax burden for consumers.

Boost to Economic Growth

The introduction of GST has had a positive impact on the economy. By reducing compliance costs and eliminating tax barriers, GST has facilitated the free flow of goods and services across the country. This has encouraged businesses to expand their operations, create more jobs, and invest in new technologies, thereby contributing to economic growth and development.

Moreover, GST has also made Indian products more competitive in the global market. With a simplified tax structure, Indian businesses can now focus on their core operations rather than spending excessive time and resources on tax compliance. This has enhanced the country's attractiveness as a business destination and boosted its exports.

Improved Tax Compliance and Revenue

GST has led to improved tax compliance and a more robust tax administration system. The introduction of an online GST portal and the use of technology have made it easier for businesses to register, file returns, and pay taxes. This transparency and ease of compliance have encouraged more businesses to come into the tax net, leading to increased tax revenues for the government.

GST Rates and Classification

GST is levied at various rates depending on the type of goods and services. In India, the GST Council has classified goods and services into different tax slabs: 5%, 12%, 18%, and 28%, with certain items exempt from GST. This classification aims to strike a balance between revenue generation and the affordability of essential goods and services.

| Tax Slab | Items Included |

|---|---|

| 5% | Essential goods such as food items, medicines, and certain household items. |

| 12% | Commonly used items like footwear, textiles, and processed foods. |

| 18% | Electronics, appliances, and certain services like hotels and restaurants. |

| 28% | Luxury items, automobiles, and certain high-value services. |

The classification of goods and services under different tax slabs is a delicate balance, taking into consideration the revenue needs of the government and the affordability of goods for consumers. This classification is subject to periodic reviews and revisions to ensure that the tax system remains fair and equitable.

Challenges and Future Outlook

While GST has brought about significant benefits, it has also faced certain challenges and teething problems. The initial rollout of GST in India, for instance, witnessed some teething issues such as technical glitches on the GST portal and a learning curve for businesses and taxpayers. However, these issues were gradually resolved, and the system has stabilized over time.

Looking ahead, the future of GST holds great promise. With its implementation in various countries, GST has emerged as a global tax model, influencing tax reforms around the world. As more countries adopt GST, the harmonization of tax systems and the ease of cross-border trade will continue to improve. This will have a positive impact on global trade and economic integration.

Moreover, with the increasing adoption of technology and digital solutions, GST administration is likely to become even more efficient and transparent. The use of blockchain, artificial intelligence, and data analytics can further streamline tax compliance, reduce tax evasion, and enhance the overall effectiveness of the GST system.

Frequently Asked Questions

How does GST differ from traditional sales tax systems?

+

GST differs from traditional sales tax systems in that it is a destination-based tax, meaning it is levied on the place of consumption rather than the place of production. This ensures that taxes are not compounded and that the final consumer bears the tax burden. Additionally, GST is a value-added tax, allowing for input tax credits, which traditional sales tax systems often lack.

What are the advantages of a simplified tax structure like GST?

+

A simplified tax structure like GST offers several advantages, including reduced compliance costs for businesses, elimination of cascading taxes, improved tax compliance, and enhanced economic growth. It streamlines the tax system, making it more efficient and transparent, and encourages businesses to expand and invest.

How has GST impacted the Indian economy since its implementation?

+

GST has had a positive impact on the Indian economy. It has facilitated the free flow of goods and services, encouraged businesses to expand, and made Indian products more competitive globally. It has also led to improved tax compliance and increased tax revenues for the government.

Are there any challenges associated with the implementation of GST?

+

Yes, the implementation of GST can face challenges such as initial technical glitches, a learning curve for taxpayers and businesses, and the need for periodic revisions to tax slabs and classifications. However, these challenges are often overcome with time and continuous improvement efforts.