City Of El Paso Tax Office

Welcome to a comprehensive guide on the City of El Paso Tax Office, a crucial department that plays a vital role in the financial administration of the city. This article aims to provide an in-depth understanding of the Tax Office's operations, services, and its significance within the community. By delving into specific details and real-world examples, we will explore how this department contributes to the economic well-being of El Paso and its residents.

Understanding the City of El Paso Tax Office

The City of El Paso Tax Office is a dedicated governmental entity responsible for the efficient and effective management of tax-related affairs within the city limits. With a team of experienced professionals, the Tax Office ensures that the city’s revenue streams are properly assessed, collected, and allocated, contributing to the overall financial stability and development of El Paso.

Located at [Address], the Tax Office serves as a central hub for taxpayers and businesses, offering a range of services and resources to ensure compliance with local tax regulations. From property tax assessments to business license renewals, the office provides essential support to the community, fostering a culture of financial responsibility and transparency.

Key Services Offered by the Tax Office

The City of El Paso Tax Office provides a comprehensive suite of services tailored to meet the diverse needs of its residents and businesses. Here’s an overview of some of the key services offered:

- Property Tax Assessments: The Tax Office is responsible for evaluating and determining the taxable value of properties within El Paso. This process ensures fair and accurate assessments, contributing to a robust property tax system.

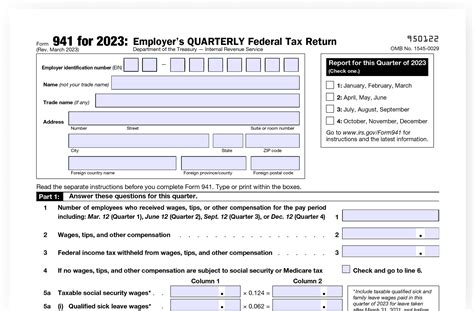

- Tax Payment Options: Taxpayers have access to a variety of convenient payment methods, including online payments, in-person transactions, and automatic payment plans. The Tax Office strives to make tax payments as seamless as possible.

- Business License Renewals: For businesses operating within the city, the Tax Office facilitates the renewal process for licenses and permits. This includes timely reminders, streamlined application procedures, and guidance on compliance requirements.

- Tax Exemptions and Benefits: The Tax Office provides information and support for taxpayers eligible for various tax exemptions and benefits. This includes senior citizen discounts, disability exemptions, and other incentives designed to support the community.

- Tax Appeal Process: In cases where taxpayers disagree with their assessed tax values or other tax-related decisions, the Tax Office offers a fair and transparent appeal process. This ensures that taxpayers have the opportunity to present their case and have their concerns addressed.

| Service | Description |

|---|---|

| Property Tax Lookup | An online tool that allows taxpayers to search and view their property tax information, including assessment details and payment history. |

| Tax Payment Portal | A secure online platform where taxpayers can make payments, view their account status, and manage their tax obligations. |

| Business Tax Resources | A dedicated section on the Tax Office website providing resources, guides, and forms specifically tailored for businesses, ensuring compliance and ease of operations. |

The Impact of the Tax Office on El Paso’s Economy

The role of the City of El Paso Tax Office extends beyond mere revenue collection. It plays a critical part in shaping the city’s economic landscape, influencing various sectors and contributing to sustainable growth.

Fostering Economic Development

By efficiently managing tax revenue, the Tax Office ensures that funds are directed towards essential city services and infrastructure development. This includes investments in education, healthcare, public safety, and transportation, all of which are vital for attracting businesses and creating a thriving community.

The Tax Office also plays a pivotal role in supporting local businesses. Through its services and resources, it helps entrepreneurs navigate the complex world of taxes, providing clarity and guidance on compliance. This support encourages business growth and job creation, ultimately boosting the local economy.

Promoting Financial Stability and Equity

The Tax Office’s commitment to fair and transparent tax assessments ensures that the tax burden is distributed equitably among residents and businesses. This approach fosters a sense of fairness and trust in the community, contributing to overall financial stability.

Furthermore, the Tax Office's focus on tax exemptions and benefits aims to reduce the tax burden on vulnerable populations, such as seniors and individuals with disabilities. By offering these incentives, the office promotes social equity and ensures that all residents can contribute to and benefit from the city's economic growth.

Ensuring Compliance and Preventing Fraud

A critical function of the Tax Office is to enforce tax regulations and prevent fraudulent activities. Through rigorous compliance measures and audit processes, the office ensures that taxpayers and businesses adhere to the law, maintaining the integrity of the tax system.

By deterring tax evasion and fraud, the Tax Office protects the city's revenue stream, ensuring that funds are not diverted or misused. This, in turn, strengthens the city's financial health and its ability to provide essential services to residents.

The Future of the City of El Paso Tax Office

As El Paso continues to grow and evolve, the Tax Office remains dedicated to adapting and improving its services to meet the changing needs of the community. With a focus on technological advancements and innovative solutions, the office aims to enhance efficiency and accessibility for taxpayers.

Digital Transformation

The Tax Office recognizes the importance of digital transformation in modern tax administration. Ongoing efforts are being made to enhance the online platform, making it more user-friendly and accessible. This includes improvements to the tax payment portal, online filing systems, and the integration of secure digital communication channels.

Community Engagement and Education

Building trust and fostering understanding among taxpayers is a key priority for the Tax Office. To achieve this, the office actively engages with the community through educational initiatives, workshops, and outreach programs. These efforts aim to demystify the tax process, promote financial literacy, and encourage voluntary compliance.

Collaborative Partnerships

Recognizing the interconnected nature of tax administration, the Tax Office strives to establish collaborative partnerships with other governmental agencies and community organizations. By working together, these entities can streamline processes, share resources, and provide a more cohesive and efficient support system for taxpayers.

Conclusion

The City of El Paso Tax Office stands as a cornerstone of the city’s financial administration, playing a vital role in the economic well-being of its residents and businesses. Through its dedicated services, commitment to fairness, and focus on community engagement, the Tax Office contributes to a stable and prosperous El Paso.

As the city continues to thrive, the Tax Office will undoubtedly remain a key player, adapting to the changing needs of the community and ensuring that El Paso's financial future remains bright.

How can I pay my property taxes in El Paso?

+The City of El Paso offers various payment options for property taxes, including online payments through the Tax Office website, in-person payments at the Tax Office, and automatic payment plans. You can also mail your payment to the Tax Office with the provided remittance slip.

What are the business license renewal requirements in El Paso?

+Business license renewal requirements may vary based on the type of business and industry. Generally, businesses are required to renew their licenses annually and provide updated information on their operations. The Tax Office provides a user-friendly online portal for business license renewals, making the process convenient and efficient.

Are there any tax exemptions available for senior citizens in El Paso?

+Yes, El Paso offers tax exemptions and benefits specifically designed for senior citizens. These exemptions can reduce the tax burden for eligible individuals. To learn more about these exemptions and determine your eligibility, you can visit the Tax Office website or contact the office directly for assistance.